Electric Vehicle Supply Equipment Market Size 2024-2028

The electric vehicle supply equipment (EVSE) market size is forecast to increase by USD 92.31 billion at a CAGR of 30.8% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. Favorable government policies and subsidies are driving the adoption of electric vehicles (EVs) and, consequently, the demand for EVSE. The deployment of smart grids for EV charging is another trend that is gaining momentum, as it enables efficient energy management and reduces the strain on the power grid. However, the lack of standardization in EV charging station remains a challenge, as it hinders interoperability and increases complexity for consumers. Overall, these trends and challenges are shaping the future of the EVSE market and are expected to influence its growth trajectory In the coming years.

What will be the Size of the Electric Vehicle Supply Equipment (EVSE) Market During the Forecast Period?

- The market encompasses charging infrastructure for Electric Vehicles (EVs), including charging stations and docks. This market is driven by the increasing adoption of EVs and the need to support their growing population. EVSE systems facilitate the transfer of electric power from the grid to the vehicle's batteries, utilizing various electrical conductors and related equipment. Key sectors for EVSE installation include bus depots, hotels, parks, highways, corporate offices, homes, and various other establishments. Incentives such as tax benefits and charging infrastructure subsidies continue to fuel market growth. Supercharging and inductive charging technologies are emerging trends, offering faster charging times and greater convenience.

- Furthermore, installation types include fixed chargers for stationary applications and portable chargers for on-the-go charging. The EVSE market is also influenced by the novel coronavirus pandemic, with a shift towards remote work and e-commerce leading to increased demand for home charging solutions. Despite challenges in import-export and workforce availability, the market is expected to continue expanding, driven by the global transition towards sustainable transportation.

How is this Electric Vehicle Supply Equipment (EVSE) Industry segmented and which is the largest segment?

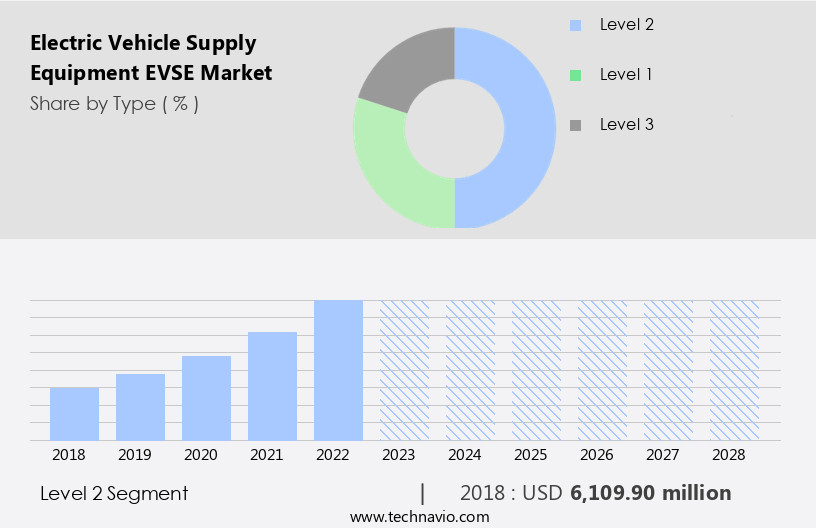

The electric vehicle supply equipment (EVSE) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Level 2

- Level 1

- Level 3

- Application

- Residential

- Commercial

- Geography

- APAC

- China

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Type Insights

- The level 2 segment is estimated to witness significant growth during the forecast period.

The market encompasses level 2 charging infrastructure delivering faster and more efficient charging for electric vehicles (EVs) through higher voltage (240 volts, AC) and amperage. This segment caters to residential and commercial applications, enhancing the convenience and reliability of EV ownership. Level 2 charging stations, such as those installed in parking garages, offer EV owners the ability to charge their vehicles while they park, making electric vehicle usage more accessible. Commercial entities, including parking garages, recognize the growing demand for EV charging and are installing these stations to meet customer needs. EVSE systems include electrical conductors, related equipment, communications protocols, and various charging dock types, such as DC Fast Chargers. Charging station finance, charging station type (normal, supercharging, inductive), installation type (fixed, portable), and the impact of the novel coronavirus on import-export and non-essential items, workforce, factories, and testing of systems, contribute to the supply-demand gap and electric car sales. Future estimations indicate continued growth In the EV market, driven by the shift away from Internal Combustion Engine (ICE) vehicles and the development of smart cities.

Get a glance at the Electric Vehicle Supply Equipment (EVSE) Industry report of share of various segments Request Free Sample

The Level 2 segment was valued at USD 6.11 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia is experiencing significant growth due to the increasing sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) in China, Singapore, Japan, and South Korea. China, the largest global seller of EVs, is leading this growth. Stricter emission norms In these emerging markets are compelling automobile manufacturers to expand their BEV and PHEV offerings, consequently increasing the demand for EV charging infrastructure. Major stakeholders In the EVSE market include auto manufacturers, electric utilities, commercial fleets, public transit, retail establishments, seaports, airports, bus depots, hotels, parks, highways, corporate offices, and homes. EVSE systems consist of electrical conductors, related equipment, communications protocols, and DC Fast Chargers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electric Vehicle Supply Equipment (EVSE) Industry?

Favorable government policies and subsidies is the key driver of the market.

- The market is experiencing significant growth due to increasing government incentives and subsidies for the development and expansion of EV charging infrastructure. These initiatives include programs like e-AMRIT in India and various policies In the US, such as vehicle fuel economy standards, consumer tax credits, and research and development support. The promotion of electric vehicles (EVs) is crucial for reducing environmental pollution and decreasing reliance on non-renewable sources of energy, including crude oil and fossil fuels like petrol and diesel. EVSE systems, including charging stations, docks, and related equipment, employ electrical conductors and communications protocols to charge the vehicle's batteries.

- Furthermore, key stakeholders in this market include auto manufacturers, electric utilities, contractors, installers, and training programs. The EVSE infrastructure includes various charging station types, such as DC Fast Chargers, Normal Charging, Supercharging, Inductive Charging, Fixed Charger, and Portable Charger. The market dynamics are influenced by factors like the shutdown of ICE vehicle operations, carbon emission concerns, and the availability of incentives, tax benefits, and subsidies. The IEA's future estimations indicate a substantial increase in electric car sales, which will further boost the demand for EVSE. The market also faces challenges such as the supply-demand gap, testing of systems, and the impact of the Novel Coronavirus on import-export and non-essential items. Despite these challenges, the market holds significant investment pockets for companies looking to capitalize on the transition to electric vehicles.

What are the market trends shaping the Electric Vehicle Supply Equipment (EVSE) Industry?

Deployment of smart grids for EVs is the upcoming market trend.

- The market encompasses charging stations, docks, and related equipment that facilitate the transfer of electric power from the electrical grid to the vehicle's batteries. EVSE systems consist of electrical conductors, communications protocols, and various components necessary for a seamless charging experience. Major stakeholders in this market include auto manufacturers, electric utilities, commercial fleets, public transit, retail establishments, seaports, airports, bus depots, hotels, parks, highways, corporate offices, and homes. The EVSE infrastructure is witnessing significant growth due to the increasing sales of electric vehicles (EVs), which is driven by incentives such as tax benefits, subsidies, and the need to reduce carbon emissions.

- Moreover, incentives for EV sales include car sales tax exemptions, purchase tax credits, and registration fee waivers. The shift from Internal Combustion Engine (ICE) vehicles to EVs is also influenced by the shutdown of operations In the oil industry and the rising cost of crude oil, which contributes to CO2 emission and road tax. Smart grids are a crucial component of advanced EV charging infrastructure. They provide real-time information on load requirements and power quality to the operators, enabling the integration of renewable energy sources and serving as a base for Vehicle-to-Grid (V2G) infrastructure. The deployment of smart grids is increasing globally, with major countries such as China, the US, India, Spain, Germany, and France leading the way.

What challenges does the Electric Vehicle Supply Equipment (EVSE) Industry face during its growth?

Lack of standardization of EV charging is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing adoption of electric vehicles (EVs) worldwide. Charging stations, charging docks, and related equipment are essential components of the EVSE infrastructure. The electrical conductors and communications protocols used in EVSE systems play a crucial role in the efficient charging of the vehicle's batteries. Major stakeholders In the EVSE market include auto manufacturers, electric utilities, and contractors/installers. Standardization of EV charging infrastructure is a major challenge, as each country or market has its unique codes, rating systems, and standards. For instance, Japan uses the CHAdeMO standard, Europe and the US follow the CCS standard, and China has the GB/T 20234 standard.

- In addition, codes and rating systems are essential for ensuring the safety and interoperability of EVSE systems. Training programs for installers and contractors are necessary to ensure proper installation and maintenance of EV charging stations. Incentives such as tax benefits, subsidies, and incentives from organizations like the IEA, auto manufacturers, and governments are driving the growth of the EVSE market. The market dynamics include the shutdown of operations in some industries due to the novel coronavirus pandemic, which has affected the supply-demand gap for EVs and charging stations. Commercial fleets, public transit, retail establishments, seaports, airports, bus depots, hotels, parks, highways, corporate offices, and homes are major sectors for EVSE installations.

Exclusive Customer Landscape

The electric vehicle supply equipment (EVSE) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric vehicle supply equipment (EVSE) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric vehicle supply equipment (EVSE) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Alfen NV

- Blink Charging Co.

- BP Plc

- ChargePoint Holdings Inc.

- Chroma ATE Inc.

- Comeca Group

- Delta Electronics Inc.

- Eaton Corp. Plc

- Efacec Power Solutions SGPS SA

- Enphase Energy Inc.

- E.ON SE

- Leviton Manufacturing Co. Inc.

- LS Power Development LLC

- Phihong USA Corp.

- Schneider Electric SE

- Shell plc

- Siemens AG

- Webasto SE

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies and infrastructure that enable the charging of electric vehicles (EVs). These systems facilitate the transfer of electrical energy from the power grid to the vehicle's batteries, ensuring their continued operation. EVSE systems consist of various components, including electrical conductors, related equipment, and communications protocols. DC fast chargers represent a significant segment of this market, offering quicker charging times compared to normal charging methods. The NEMAs membership comprises a substantial portion of the industry, contributing to the development and implementation of EVSE infrastructure. Codes and rating systems serve as essential guidelines for the design, installation, and maintenance of EVSE systems.

In addition, contractors and installers play a crucial role in ensuring the proper implementation of these systems, with training programs in place to ensure their expertise. Major stakeholders In the EVSE market include auto manufacturers, electric utilities, and various industries such as commercial fleets, public transit, multi-retail establishments, seaports, airports, bus depots, hotels, parks, highways, corporate offices, and homes. Batteries represent a critical component of the EV ecosystem, with their capacity and efficiency influencing the overall performance of the vehicle and the charging infrastructure. Incentives, tax benefits, and subsidies serve to encourage the adoption of EVs and the expansion of EVSE infrastructure.

Moreover, the IEA reports that the global EV market has seen significant growth in recent years, with passenger car sales increasingly favoring electric vehicles. The shift towards electric mobility has been driven by various factors, including the reduction of carbon emissions, the phasing out of internal combustion engine vehicles, and the increasing availability of charging infrastructure. The EVSE market dynamics are influenced by several factors, including the availability and affordability of electric power, the evolution of charging technologies, and the development of smart cities. The transition away from non-renewable sources of energy, such as crude oil, and the reduction of CO2 emissions are key drivers for the growth of the EVSE market.

Furthermore, government policies, including road tax, purchase tax, and registration fees, have played a significant role In the adoption of electric vehicles. For instance, in August 2021, Singapore Power launched a vehicle-to-grid pilot project to test the usage of EVs as small energy storage systems to address renewables' intermittency. Charging station finance and the availability of various charging station types, including normal charging, supercharging, and inductive charging, also impact market growth. The ongoing COVID-19 pandemic has introduced new challenges to the EVSE market, with import-export restrictions and the shutdown of operations affecting the supply chain. The workforce has been impacted by the pandemic, with factories and testing facilities experiencing disruptions. Despite these challenges, the EVSE market is expected to continue growing as the world moves towards a more sustainable and electric future.

In addition, the supply-demand gap In the electric vehicle market is expected to narrow as charging infrastructure expands, making electric vehicles a more viable alternative to traditional internal combustion engine vehicles. Therefore, the market plays a crucial role In the transition towards sustainable transportation. The market is influenced by various factors, including the availability and affordability of electric power, the evolution of charging technologies, and government policies. The growth of the EVSE market is driven by the shift towards electric mobility and the reduction of carbon emissions. Despite the challenges posed by the ongoing pandemic, the market is expected to continue growing as the world moves towards a more sustainable future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 30.8% |

|

Market growth 2024-2028 |

USD 92.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.01 |

|

Key countries |

China, US, France, Germany, and The Netherlands |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Vehicle Supply Equipment (EVSE) Market Research and Growth Report?

- CAGR of the Electric Vehicle Supply Equipment (EVSE) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric vehicle supply equipment (EVSE) market growth of industry companies

We can help! Our analysts can customize this electric vehicle supply equipment (EVSE) market research report to meet your requirements.

_market_size_abstract_2024_v1.jpg)

_market_regions_abstract_2023_geo_v2.jpg)

_market_customer_landscape_abstract_2023_geo_v1.jpg)