Information and Communications Technology Services in Education Market Size 2024-2028

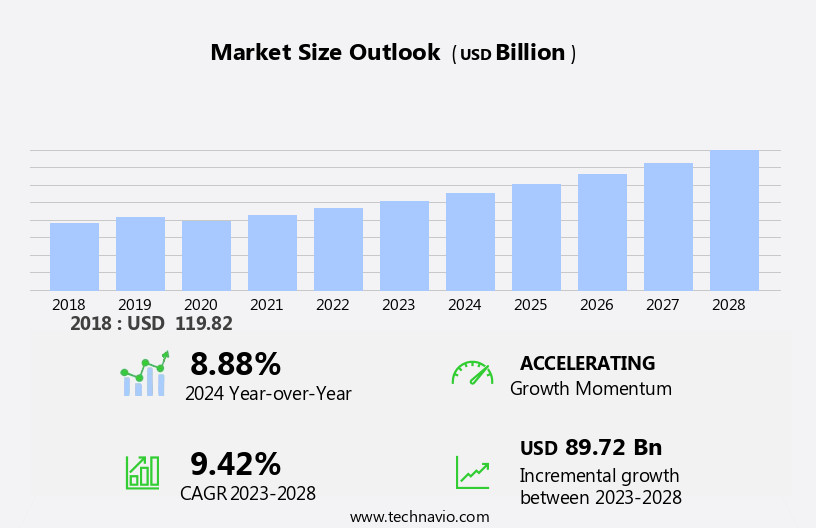

The information and communications technology services in education market size is forecast to increase by USD 89.72 billion at a CAGR of 9.42% between 2023 and 2028.

- The burgeoning emphasis on cloud computing, coupled with rising investments in developing information and communications technology (ICT) infrastructure, is driving a rise in demand for ICT outsourcing services. As businesses increasingly migrate to cloud-based solutions to enhance flexibility and scalability, there is a parallel need to bolster ICT infrastructure to support these advancements. This entails substantial investments in upgrading networks, data centers, and related technologies to accommodate the evolving demands of cloud computing. Concurrently, the growing reliance on ICT outsourcing services stems from organizations seeking specialized expertise and cost efficiencies in managing their IT functions.

- Edtech innovations, such as gamification, augmented reality, and virtual reality, engage students and enhance learning outcomes. By outsourcing tasks such as software development, maintenance, and support, businesses can leverage external resources to streamline operations and drive innovation. This trend underscores the critical role of ICT outsourcing in enabling organizations to stay competitive in a rapidly evolving digital landscape. Consequently, the confluence of these factors is reshaping the ICT industry, with opportunities for service providers to capitalize on the growing demand for cloud-centric solutions and outsourcing services.

What will be the Size of the Information and Communications Technology Services in Education Market during the forecast period?

- The Information and Communications Technology (ICT) services market in education is experiencing growth, driven by the increasing adoption of cloud computing, e-learning, online assessment, and digital classroom solutions. These technologies enable flexible, accessible, and personalized learning experiences, transforming traditional educational models. E-learning and distance learning are key trends, with mobile learning and interactive whiteboards extending educational reach beyond the classroom. Artificial intelligence, big data analytics, and personalized learning offer tailored educational experiences, while cybersecurity and data privacy ensure student protection.

- Educational apps, webinars, collaborative tools, and video conferencing facilitate remote collaboration and communication. The Internet of Things and smart schools are emerging trends, integrating technology into infrastructure for optimized learning environments. Digital literacy is a critical skill for students, driving demand for ICT services in education.

How is this Information and Communications Technology Services in Education Industry segmented?

The information and communications technology services in education industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pre K-12

- Higher education

- Component

- Hardware

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By End-user Insights

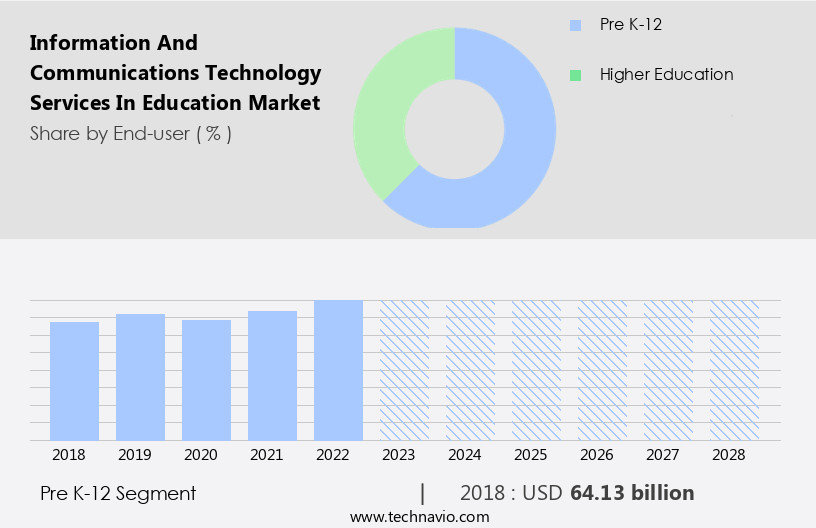

The pre K-12 segment is estimated to witness significant growth during the forecast period.

The Pre K-12 education sector's adoption of information and communication technology services is experiencing consistent growth. Schools integrate various tools to facilitate communication, content creation, distribution, storage, and management. Advanced technologies like adaptive learning and learning analytics, along with support solutions such as learning management systems (LMS) and content management systems (CMS), have encouraged schools to adopt cloud computing. The shift towards cloud computing, including Software as a Service (SaaS), is a significant market driver. Other technologies, including educational apps, online assessment, video conferencing, webinars, collaborative tools, digital curriculum, blended learning, and remote proctoring, are also transforming education.

Additionally, emerging technologies like artificial intelligence, big data analytics, personalized learning, augmented reality, virtual reality, and robotics in education are gaining traction. ICT infrastructure, network security, digital literacy, cybersecurity, data privacy, and digital citizenship are essential considerations in this digital transformation.

Get a glance at the market report of share of various segments Request Free Sample

The pre K-12 segment was valued at USD 64.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

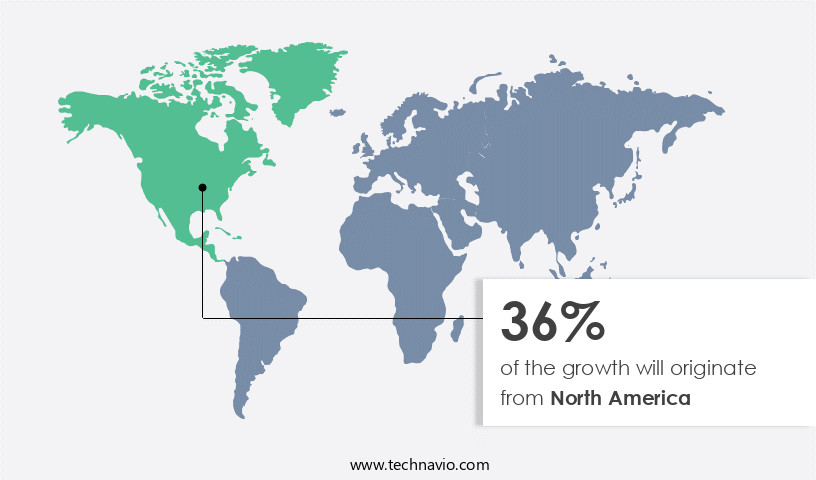

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Information and Communications Technology (ICT) services market in education is experiencing substantial expansion, particularly In the Pre K-12 sector, due to escalating investments in educational institutions' ICT infrastructure. In North America, the US is a significant contributor to this growth. The adoption of cloud computing in schools and universities for hosting ICT services is a primary driver, enabling flexibility, cost savings, and accessibility. Additionally, the increasing trend towards outsourcing ICT services further propels market expansion. Key technologies, such as e-learning, virtual learning environments, learning management systems, online education, and digital classrooms, are transforming the education landscape. Furthermore, emerging technologies like gamification, augmented reality, virtual reality, artificial intelligence, big data analytics, personalized learning, adaptive learning, and the Internet of Things are revolutionizing education.

ICT integration, cybersecurity, data privacy, and digital literacy are essential considerations in this digital transformation. The market encompasses various solutions, including educational apps, online assessment, video conferencing, webinars, collaborative tools, digital curriculum, blended learning, synchronous and asynchronous learning, cloud storage, remote proctoring, blockchain in education, learning analytics, ICT infrastructure, network security, digital citizenship, mobile devices, robotics in education, coding education, internet safety, and ICT support services.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Information and Communications Technology Services in Education Industry?

- Increasing emphasis on cloud computing is the key driver of the market. Governments of developed and developing countries have tremendously increased their information and communications technology spending across schools and universities due to the rise in technological advances across the education sector and the growing competition among students. In addition, the rising number of government initiatives and various schemes contribute to the growth of the market.

- For example, the Rashtriya Madhyamik Shiksha Abhiyan (RMSA) scheme offered by the Ministry of Human Resource Development (MHRD), India, was launched in 2004 and revised in 2010. In addition, it deals with the establishment of smart schools and focuses on providing the opportunity to secondary stage students to mainly build their capacity on information and communications technology skills. Hence, such factors are positively impacting the ICT services in education market. Therefore, it is expected to drive the market growth during the forecast period.

What are the market trends shaping the Information and Communications Technology Services in Education Industry?

- Growing demand for software-defined infrastructure is the upcoming market trend. DevOps comprises the generation of small, agile teams and the creation of a new collaborative culture that enables process collaboration, transparency, and accountability. In addition, there has been a significant rise in the number of institutions outsourcing their information and communications technology services to information and communications technology companies because of the increase in /the information and communications technology skill gap in the educational sector. Therefore, there is an increased demand for DevOps in the outsourced service sector.

- Moreover, the adoption of DevOps makes change management automated and increases the power delegated to development teams, thereby enabling process improvements as any impending risks related to change management can be corrected and reversed quickly. In addition, DevOps requires an infrastructure that is complemented by an involved, adaptable, and skilled workforce to function and is expensive. Furthermore, the growing awareness and the expected increase in the adoption of DevOps will likely have a positive impact on the growth of the market. Therefore, it is expected to drive the market growth during the forecast period.

What challenges does the Information and Communications Technology Services in Education Industry face during its growth?

- Rising data privacy and security risks associated with outsourced information and communications technology services is a key challenge affecting the industry growth. Factors such as the lack of digital literacy and inappropriate risk assessments impede the growth of the market. In addition, the lack in the number of skilled cybersecurity professionals hampers the growth of the market.

- Moreover, the shortage of skilled IT professionals increases the workload on the existing cybersecurity staff. In addition, this challenge is more prominent in rural areas that comprise tier 2 and tier 3 schools. Furthermore, most educational institutes in these areas lack computer-literate teachers and information and communications technology experts who support and manage Internet connectivity. Hence, such factors are negatively impacting the ICT services in education market. Therefore, it is expected to hinder the market growth during the forecast period.

Exclusive Customer Landscape

The information and communications technology services in education market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the information and communications technology services in education market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, information and communications technology services in education market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AdEPT Technology Group plc - The company provides K-12 and higher education sectors with essential information and communications technology solutions, including Adobe Creative Cloud. These tools equip students with the necessary skills for both academic success and professional growth in today's digital world.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdEPT Technology Group plc

- Adobe Inc.

- Apple Inc.

- Blackboard Inc.

- Cisco Systems Inc.

- D2L Corp.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Gaia Technologies Plc

- Hewlett Packard Enterprise Co.

- Infosys Ltd.

- International Business Machines Corp.

- Larsen and Toubro Ltd.

- Lenovo Group Ltd.

- Microsoft Corp.

- Oracle Corp.

- Promethean World Ltd.

- Tata Consultancy Services Ltd.

- Zunesis Inc.

- Bell Techlogix Inc.

- Joskos Solutions Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Information and Communications Technology (ICT) services have become an integral part of modern education systems, transforming the way knowledge is imparted and learned. This sector encompasses various solutions such as cloud computing, e-learning, virtual learning environments, learning management systems, online education, and digital classrooms. These technologies enable flexible, accessible, and interactive learning experiences, catering to diverse student needs and preferences. E-learning and virtual learning environments have gained significant traction, allowing students to access educational content from anywhere, anytime. Learning management systems facilitate the organization, delivery, and tracking of educational content, ensuring a streamlined learning process. Online education and digital classrooms offer engaging, interactive experiences, enhancing student engagement and facilitating real-time collaboration.

Educational technology continues to evolve, with emerging trends such as gamification, augmented reality, and virtual reality revolutionizing the learning landscape. Gamification adds an element of fun and competition to learning, while augmented and virtual reality technologies create interactive experiences that can help students better understand complex concepts. Artificial intelligence (AI) and big data analytics are also transforming education, enabling personalized and adaptive learning experiences. AI-driven systems can analyze student performance data to identify strengths and weaknesses, providing tailored learning paths and recommendations. Big data analytics can help educators gain insights into student learning patterns, enabling them to optimize curriculum and instructional strategies.

The Internet of Things (IoT) is another emerging trend in educational technology, with smart schools leveraging IoT devices to create connected learning environments. Digital literacy, cybersecurity, and data privacy are crucial aspects of ICT services in education, ensuring students are equipped with the necessary skills to navigate the digital world safely and responsibly. Educational apps, online assessment tools, and video conferencing are essential components of ICT services in education, providing students and teachers with flexible, efficient, and cost-effective solutions for learning and collaboration. Collaborative tools, digital curriculum, and online resources enable students to work together on projects and access a wealth of knowledge at their fingertips.

Blended learning, which combines traditional classroom instruction with online learning, is becoming increasingly popular. Synchronous and asynchronous learning models offer flexibility, allowing students to learn at their own pace and convenience. Cloud storage and remote proctoring solutions ensure secure access to educational content and assessments from anywhere. Blockchain technology is also making its way into education, offering secure, decentralized solutions for storing and sharing educational records and credentials. Learning analytics, ICT infrastructure, network security, digital citizenship, mobile devices, robotics in education, coding education, internet safety, ICT integration, and online collaboration are other essential aspects of ICT services in education.

In summary, ICT services have revolutionized education, offering flexible, accessible, and interactive learning experiences. From cloud computing and e-learning to gamification and AI, these technologies are transforming the way knowledge is imparted and learned. As the education landscape continues to evolve, ICT services will play a crucial role in enabling personalized, efficient, and cost-effective learning solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.42% |

|

Market growth 2024-2028 |

USD 89.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, Canada, China, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Information and Communications Technology Services in Education Market Research and Growth Report?

- CAGR of the Information and Communications Technology Services in Education industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the information and communications technology services in education market growth of industry companies

We can help! Our analysts can customize this information and communications technology services in education market research report to meet your requirements.