Content Management Software Market Size 2025-2029

The content management software market size is forecast to increase by USD 7.08 billion at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing focus on digital content and the rise of headless content management systems (CMS). The availability of open-source CMS solutions is also contributing to market expansion. As businesses prioritize digital transformation, the demand for efficient and flexible content management solutions is increasing. Headless CMS, which decouples content from presentation, offers greater flexibility and allows for seamless integration with various digital channels. Machine learning and deep learning technologies facilitate content personalization, accessibility, and optimization services. Open-source CMS options provide cost-effective solutions for businesses, enabling them to manage their content in-house and customize the software to their specific needs. These trends are shaping the market and are expected to continue driving growth In the coming years.

What will be the Size of the Content Management Software Market During the Forecast Period?

- The market is experiencing significant growth as businesses prioritize digital transformation and optimize customer experience. This market encompasses various solutions, including business intelligence tools, automated content generation, and AI-driven insights. AI technology plays a pivotal role, powering customer service, marketing, and content creation with natural language understanding and predictive analytics. Conversational AI and multi-channel marketing enable personalized customer engagement, while data analytics fuels data-driven decision-making.

- Content marketing platforms offer calendar features, quality assurance tools, and integration capabilities, streamlining content creation, organization, and ROI measurement. Content lifecycle management, governance, and storage solutions ensure content remains accessible and compliant throughout its lifecycle. Software integration and content automation further enhance operational efficiency. Overall, the market continues to evolve, driven by the need for AI-powered marketing, customer satisfaction, and digital strategy.

How is this Content Management Software Industry segmented and which is the largest segment?

The content management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large enterprises

- Small and medium enterprises (SMEs)

- Content Type

- Text-based content

- Images and graphics

- Video content

- Audio content

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

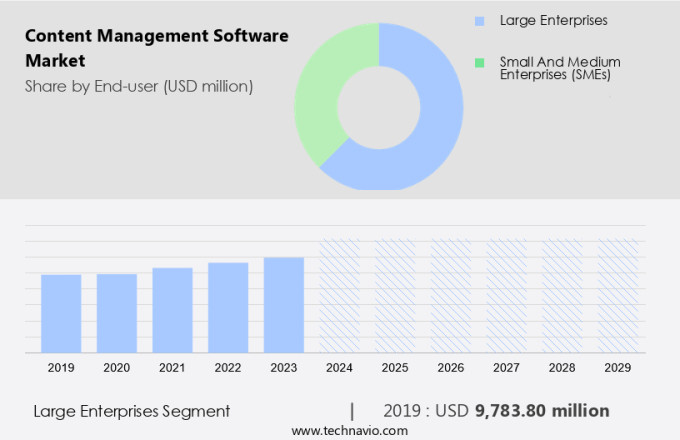

- The large enterprises segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the increasing demands of large enterprises for scalable and secure solutions to manage their extensive content needs. These investments underscore the importance of advanced content management software in supporting global operations and managing vast amounts of data and content across multiple locations. Data-driven personalization, application data workflows, and omnichannel consumer engagement are key features driving the market. Natural language processing (NLP) and voice-enabled technologies, such as voice recognition and encryption protocols, add value to these solutions.

Furthermore, business applications, including sales automation software, require content management systems for efficiency and regulatory compliance. Voice-activated content management, personalized experiences, and digital communication channels are essential components of modern content strategies. Generative AI models and advanced attribution modeling enable tailored content and personalized experiences. Security, regulatory requirements, and conversion funnel optimization are critical considerations for businesses adopting content management software. Mobile devices, the Internet of Things, and smart speakers are integral to digital transformation. Intelligent chatbots and voice-enabled content strategies enhance user engagement and streamline processes. Overall, the market continues to evolve, providing businesses with innovative solutions to manage and leverage their content effectively.

Get a glance at the Content Management Software Industry report of share of various segments Request Free Sample

The large enterprises segment was valued at USD 9.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

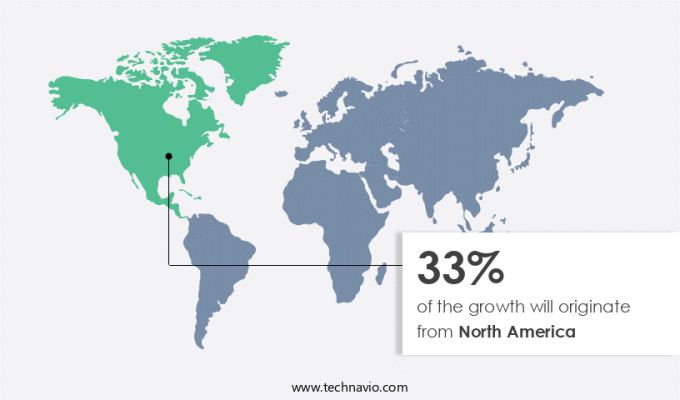

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In 2024, the North American market witnessed notable expansion due to near-ubiquitous internet access at 97%. Businesses prioritized enhancing customer experiences, leading to substantial investments in advanced technologies. These strategies underscore the market's shift towards voice-enabled technologies, data-driven personalization, application data workflows, and omnichannel consumer engagement.

Additionally, security, regulatory compliances, and tailored content remain crucial considerations. The integration of voice recognition, encryption protocols, and intelligent chatbots further streamlines business processes and enhances efficiency. The digital transformation continues to prioritize personalized experiences, visibility, and advanced attribution modeling across various business applications.

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Content Management Software Industry?

The growth of digital content is the key driver of the market.

- The market is experiencing significant growth due to the increasing volume of digital content across various channels. With approximately 5.5 billion Internet users worldwide in 2024, representing a five-fold increase since 2005, the need for efficient content management solutions has become crucial. Individuals spend an average of 2 hours and 24 minutes daily on social media platforms, contributing to the vast generation and consumption of digital content. To manage, store, and distribute content effectively, businesses require advanced CMS tools. These solutions enable data-driven personalization, application data workflows, and voice-enabled technologies to create tailored content and enhance omnichannel consumer engagement.

- The integration of natural language processing (NLP) and generative AI models further improves the efficiency of content management. Security is a primary concern for businesses, and CMS platforms offer encryption protocols, voice recognition, and intelligent chatbots to ensure data protection. Regulatory compliances and voice-activated content management are essential features for businesses operating in heavily regulated industries. Business applications, such as sales automation software, benefit from CMS solutions by improving visibility and conversion funnel performance. The Internet of Things (IoT) and mobile devices have expanded digital communication channels, necessitating CMS tools that can adapt to these platforms.

What are the market trends shaping the Content Management Software Industry?

Focus on headless content management systems is the upcoming market trend.

- The market is experiencing a transformation, with a growing emphasis on headless content management systems. These systems decouple content management and presentation layers, providing a backend-only solution that offers greater flexibility and scalability. Key features include API-driven architecture, omnichannel delivery capabilities, and separation of concerns. Headless CMS allows businesses to manage and store content centrally while delivering it through various channels, including mobile devices, digital communication channels, and IoT devices. Natural language processing (NLP) and voice-enabled technologies are also gaining traction, enabling voice-activated content management and personalized experiences. Data-driven personalization and application data workflows are essential components of modern business applications.

- Headless CMS supports these requirements by providing easy integration with sales automation software, advanced attribution modeling, and intelligent chatbots. Security remains a top priority, with encryption protocols and voice recognition ensuring data privacy and regulatory compliances. The shift towards headless content management systems is driven by the need for efficient, tailored content delivery across multiple channels. Omnichannel consumer engagement is crucial in today's digital transformation landscape, and headless CMS offers a flexible and scalable solution to meet these demands.

What challenges does the Content Management Software Industry face during its growth?

Availability of open-source content management software is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the integration of advanced technologies and data-driven personalization strategies. Natural language processing (NLP) is a key technology driving this market, enabling voice-enabled technologies and intelligent chatbots to provide tailored content and personalized experiences. Application data workflows and omnichannel consumer engagement are also crucial factors, ensuring business applications remain efficient and effective across digital communication channels. Security is a top priority, with encryption protocols and voice recognition ensuring data protection. Regulatory compliances are also essential, with voice-activated content management and regulatory requirements playing a significant role In the market's development. The Internet of Things (IoT) and mobile devices are expanding the market's reach, allowing for advanced attribution modeling and conversion funnel optimization.

- Generative AI models are being adopted to create personalized content, enhancing consumer engagement and conversion rates. Businesses are leveraging these technologies to streamline workflows, improve efficiency, and deliver personalized experiences across various digital channels. The market's future growth is expected to be fueled by the increasing adoption of IoT and mobile devices, as well as the integration of AI and machine learning models to create more personalized and efficient business applications.

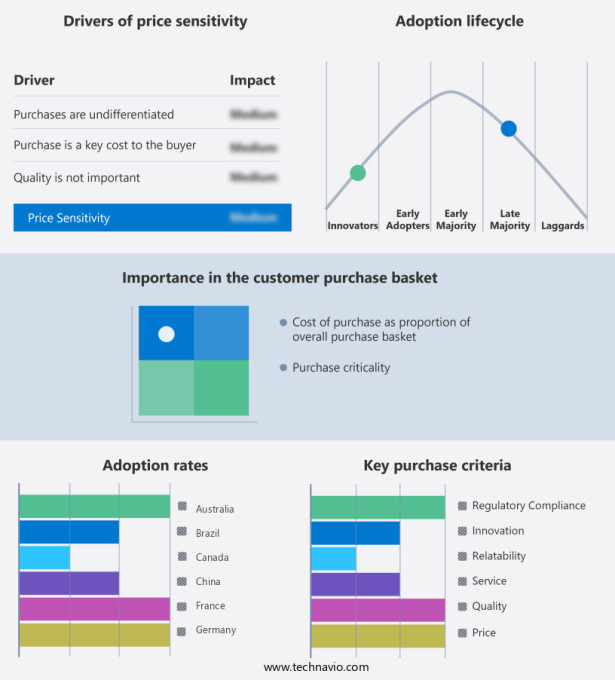

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Automattic Inc.

- Blue Ray for Web Solutions

- Brightspot

- CELUM GmbH

- ClickUp

- Contentful GmbH

- Innoraft Solutions Pvt Ltd.

- Magnolia International Ltd.

- Progress Software Corp.

- Questudio

- Sitecore Holding II AS

- Soft System Solution

- Squarespace Inc.

- Strapi

- The Kentico Group Co.

- Webflow Inc.

- Wix.com Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth as businesses continue to prioritize digital transformation and the delivery of personalized experiences to consumers. This market encompasses a range of solutions designed to manage, organize, and deliver various types of digital content across multiple channels. CMS platforms are essential tools for businesses seeking to streamline their content workflows and improve operational efficiency. They offer features such as data-driven personalization, application data workflows, and voice-enabled technologies to create tailored content and enhance omnichannel consumer engagement. Data security is a critical concern for businesses in today's digital landscape.

Moreover, CMS solutions incorporate advanced encryption protocols and voice recognition technologies to ensure the protection of sensitive business information. Regulatory compliances are also addressed, providing peace of mind for organizations operating in heavily regulated industries. The integration of Natural Language Processing (NLP) and Generative AI models in CMS platforms enables the creation of voice-activated content management systems. These systems offer businesses the ability to automate content creation and delivery, providing a more efficient content strategy. The increasing use of mobile devices and the Internet of Things (IoT) has led to a shift towards digital communication channels. CMS platforms are essential in managing and delivering content across these channels, ensuring visibility and consistency in brand messaging.

Furthermore, business applications of CMS extend beyond marketing and communication. They are also used for sales automation, regulatory requirements, and advanced attribution modeling. Intelligent chatbots are integrated into CMS platforms to provide personalized experiences and improve customer engagement. The CMS market is expected to continue growing as businesses recognize the importance of digital transformation and the need to deliver personalized experiences to consumers across multiple channels. The integration of voice-enabled technologies and advanced AI models is expected to further drive market growth, providing businesses with new opportunities to streamline content workflows and enhance consumer engagement.

|

Content Management Software Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market Growth 2025-2029 |

USD 7.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, Canada, UK, Germany, China, India, Japan, France, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Content Management Software Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the software market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.