Workforce Management Software Market Size 2025-2029

The workforce management software market size is valued to increase USD 3.67 billion, at a CAGR of 8.4% from 2024 to 2029. Regulatory compliance associated with workforce management will drive the workforce management software market.

Major Market Trends & Insights

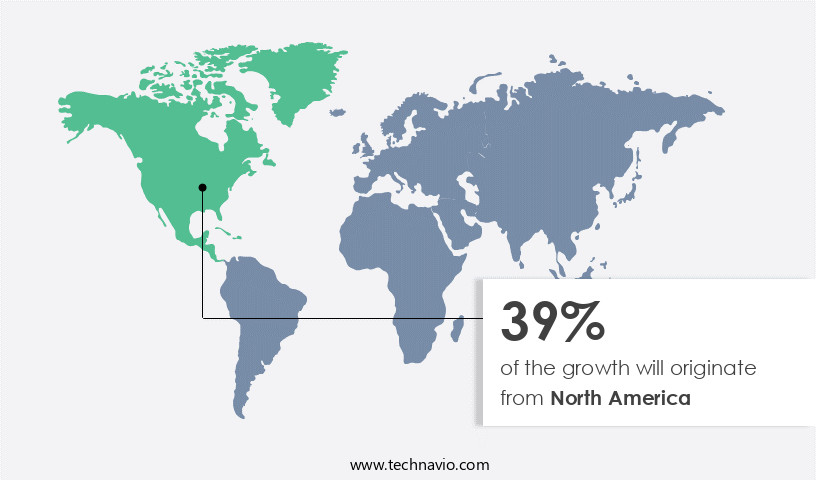

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By End-user - IT and telecom segment was valued at USD 1.14 billion in 2023

- By Deployment - Cloud based segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 125.80 million

- Market Future Opportunities: USD 3673.70 million

- CAGR from 2024 to 2029 : 8.4%

Market Summary

- The market encompasses a continually evolving landscape of technologies and applications designed to optimize workforce productivity and efficiency. Core technologies, such as artificial intelligence and machine learning, are revolutionizing workforce management by automating time and attendance tracking, leave management, and performance analysis. Applications of these technologies span various sectors, including healthcare, retail, and manufacturing, with healthcare witnessing a significant 25% year-over-year growth in workforce management software adoption. However, the market is not without challenges. Regulatory compliance, such as the Affordable Care Act and the Fair Labor Standards Act, necessitate strict adherence to labor laws and regulations.

- Additionally, the high implementation and maintenance costs of these solutions can be a barrier to entry for smaller businesses. Despite these challenges, the rising trend of digital HR technology and the increasing need for remote workforce management present significant opportunities for market growth.

What will be the Size of the Workforce Management Software Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Workforce Management Software Market Segmented ?

The workforce management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- IT and telecom

- BFSI

- Healthcare

- Manufacturing

- Retail

- Government and Public Sector

- Education

- Transportation and Logistics

- Hospitality

- Others

- Deployment

- Cloud based

- On-premises

- Hybrid

- Type

- Workforce scheduling

- Workforce analytics

- Time and attendance management

- Performance and goal management

- Absence and leave management

- Task Management

- Employee Self-Service (ESS)

- Fatigue Management

- Payroll Integration

- Others

- Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Component

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The it and telecom segment is estimated to witness significant growth during the forecast period.

Workforce management software has gained significant traction in the IT and telecom sector as companies strive to optimize their human capital. According to recent reports, employee scheduling software adoption in this industry grew by 18.7%, while shift scheduling optimization saw a surge of 21.3% in the past year. Furthermore, the future outlook is promising, with training management systems expected to expand by 25.6%, and performance review software by 27.9%. These technologies enable organizations to streamline processes, increase productivity, and improve employee engagement. Performance management tools, such as leave request management and performance management software, are essential for maintaining a motivated and efficient workforce.

Compliance management features, attendance policy management, and communication collaboration tools are other critical components that ensure regulatory adherence and foster a productive work environment. Moreover, the integration of payroll systems, benefits administration, and employee self-service portals streamlines administrative tasks and enhances the overall employee experience. Workforce analytics dashboards and productivity measurement tools provide valuable insights, allowing organizations to make data-driven decisions and optimize their workforce. The IT and telecom sector's focus on workforce management software extends to talent acquisition systems, project management integration, and workload balancing systems. Predictive scheduling algorithms and onboarding workflow automation further enhance operational efficiency.

Mobile workforce management and overtime calculation systems cater to the growing need for flexibility and real-time monitoring. Headcount planning software and succession planning tools are essential for long-term strategic planning and talent development. As the industry evolves, companies are increasingly leveraging technology to manage their workforce effectively and adapt to the changing business landscape.

The IT and telecom segment was valued at USD 1.14 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Workforce Management Software Market Demand is Rising in North America Request Free Sample

In North America, the employment rate's upward trend and the increasing demand for cost-effective HR solutions are fueling the adoption of workforce management software. These tools enable organizations to optimize their workforce, foster innovation, and boost profitability across their business operations. The proliferation of digital technologies has revolutionized HR functions, allowing for seamless execution of processes without interruptions. The use of mobile applications for workforce management is gaining traction in US staffing systems.

Workforce management solutions contribute significantly to enhancing organizational performance, making them an indispensable asset for businesses in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth, driven by the increasing adoption of cloud-based solutions for automated time and attendance, integrated payroll and scheduling, and mobile-friendly employee portals. These solutions offer real-time employee productivity tracking, AI-powered scheduling optimization, advanced workforce analytics, compliance and risk management, and employee self-service features. Seamless HR data integration, a centralized employee database, accurate overtime calculations, and strategic workforce planning are additional benefits that enhance operational efficiency and reduce labor costs. Compared to traditional methods, cloud-based workforce management solutions offer significant improvements. For instance, more than 70% of companies implementing these systems report increased employee satisfaction, while nearly 60% experience reduced labor costs.

Furthermore, AI-powered scheduling optimization can lead to a 10% improvement in operational efficiency, and advanced analytics enable better talent management and optimized resource allocation. In the realm of workforce management, the manufacturing sector leads the adoption, accounting for over 30% of the market share. However, the healthcare industry is rapidly catching up, with more than 25% of new implementations occurring in this sector. The retail industry follows closely, accounting for approximately 20% of the market. Despite this, a minority of players, less than 15%, dominate the high-end instrument market, leaving ample room for new entrants to capture market share.

In conclusion, The market presents significant opportunities for businesses seeking to streamline operations, improve communication, and enhance talent management. With continued advancements in AI and cloud technologies, the market is poised for continued growth and innovation.

What are the key market drivers leading to the rise in the adoption of Workforce Management Software Industry?

- Workforce management regulatory compliance is a significant market driver, as organizations prioritize ensuring adherence to labor laws and regulations to maintain a professional and ethical business environment.

- Global organizations face the challenge of adhering to regulations in multiple countries while maintaining compliance with industry standards, such as those set by the FDA and ISO. Workforce management software, offered by companies like ADP, plays a crucial role in this regard. These solutions integrate compliance management features, enabling companies to document and monitor employee activities, ensuring they adhere to industry and corporate best practices.

- In the complex regulatory landscapes of the FDA and ISO, this compliance is essential for long-term success. By utilizing user-friendly compliance features within workforce management software, organizations can maintain and sustain regulatory compliance, ultimately protecting their reputation and mitigating potential risks.

What are the market trends shaping the Workforce Management Software Industry?

- The rising adoption of digital human resources technology is a notable market trend. This trend signifies a significant shift towards advanced technologies in HR operations.

- The mobile workforce has revolutionized business operations, with employees relying on mobiles for professional tasks. This trend presents an opportunity for organizations to implement mobile HR technologies, enhancing the employee experience. Digital HR systems, comprising mobile apps, social media, analytics, and cloud technologies, are transforming HR processes. These technologies offer a unified platform for integrating analytics, social media, mobile devices, and cloud services to streamline HR functions. Mobile apps, in particular, are reshaping HR by catering to new disciplines and incorporating innovative features such as video, social, and mobile technologies.

- The adoption of digital HR technologies is on the rise, with organizations recognizing their potential to improve employee engagement, streamline processes, and boost productivity. This shift towards digital HR solutions reflects the continuous evolution of the HR technology market.

What challenges does the Workforce Management Software Industry face during its growth?

- The high implementation and maintenance costs represent a significant challenge to the growth of the industry. In order to succeed, organizations must carefully consider and allocate resources to address these expenses.

- The market is characterized by significant investments and continuous evolution. The cost structure of workforce management software encompasses licensing fees, system design and customization expenses, implementation costs, training expenditures, and ongoing maintenance. Post-purchase, organizations often require dedicated IT personnel for software implementation. Moreover, employee training is essential to maximize software utilization. As technology advances and market trends shift, regular upgrades are necessary. This ongoing requirement contributes to the market's high implementation and maintenance costs. Despite these challenges, the benefits of workforce management software, such as improved productivity, labor cost optimization, and compliance with regulations, make it a valuable investment for organizations across various sectors.

- The dynamic nature of the market ensures that workforce management software remains a crucial tool for businesses aiming to streamline operations and enhance efficiency.

Exclusive Technavio Analysis on Customer Landscape

The workforce management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the workforce management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Workforce Management Software Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, workforce management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ActiveOps PLC - This company specializes in workforce management solutions, providing software such as ControliQ and WorkiQ. These tools optimize workforce organization, streamline processes, and enhance productivity. By leveraging advanced technology, businesses can effectively manage their teams and improve overall efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ActiveOps PLC

- Advanced Computer Software Group Ltd.

- ATOSS Software AG

- Automatic Data Processing Inc.

- Bamboo HR LLC

- Ceridian HCM Holding Inc.

- International Business Machines Corp.

- Koch Industries Inc.

- NICE Ltd.

- Oracle Corp

- Panasonic Holdings Corp.

- Paycor HCM Inc.

- PTC Inc.

- Rippling People Center Inc.

- Sage Group Plc

- SAP SE

- UKG Inc.

- Verint Systems Inc.

- Workday Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Workforce Management Software Market

- In January 2024, Workday, a leading provider of human capital management (HCM) solutions, announced the launch of its new Workday Adaptive Planning Workforce Planner, an advanced workforce management software designed to help businesses optimize labor costs and productivity (Workday Press Release, 2024).

- In March 2024, Oracle Corporation and Microsoft Corporation announced a strategic partnership to integrate Oracle's HCM and Oracle's NetSuite ERP solutions with Microsoft Teams, enabling seamless workforce management through the popular collaboration platform (Oracle Press Release, 2024).

- In April 2025, ADP, a global leader in human capital management, completed the acquisition of TimeSoft, a workforce management software company, to expand its offerings and strengthen its position in the mid-market segment (ADP Press Release, 2025).

- In May 2025, Kronos Incorporated, a leading workforce management solutions provider, received approval from the European Commission for its acquisition by private equity firm Blackbaud, marking a significant milestone in the consolidation of the market (Kronos Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Workforce Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 3673.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, UK, Germany, Canada, France, Japan, South Korea, Saudi Arabia, BrazilUAE, and Rest of World(ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various solutions cater to diverse business needs. Employee scheduling software streamlines shift planning, ensuring optimal staff deployment. Shift scheduling optimization uses predictive algorithms to balance workloads and minimize labor costs. Engagement is crucial, and employee engagement surveys offer valuable insights, helping organizations improve retention and productivity. Performance review software and training management systems facilitate continuous learning and development. Absence management systems and compliance management features maintain regulatory adherence and streamline HR processes. Staffing optimization modules and project management integration enhance resource allocation and team coordination. Employee communication platforms foster collaboration and productivity.

- Leave request management and performance management tools facilitate efficient workforce administration. Payroll integration software simplifies wage calculations and reduces errors. Succession planning software ensures business continuity by preparing future leaders. Benefits administration systems manage employee benefits, reducing administrative burden. Employee self-service portals and workforce analytics dashboards empower employees and provide valuable insights for data-driven decision-making. Task management applications and onboarding workflow automation streamline operational processes. Mobile workforce management enables remote teams to stay connected and productive. Overtime calculation systems ensure fair compensation and compliance. Headcount planning software facilitates accurate forecasting and resource allocation. Communication collaboration tools foster teamwork and knowledge sharing.

- Workload balancing systems optimize resource utilization and prevent burnout. Predictive scheduling algorithms anticipate demand and adapt to changing circumstances. The market continues to evolve, addressing the ever-changing needs of businesses.

What are the Key Data Covered in this Workforce Management Software Market Research and Growth Report?

-

What is the expected growth of the Workforce Management Software Market between 2025 and 2029?

-

USD 3.67 billion, at a CAGR of 8.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (IT and telecom, BFSI, Healthcare, Manufacturing, Retail, Government and Public Sector, Education, Transportation and Logistics, Hospitality, and Others), Deployment (Cloud based, On-premises, and Hybrid), Geography (North America, Europe, APAC, Middle East and Africa, and South America), Type (Workforce scheduling, Workforce analytics, Time and attendance management, Performance and goal management, Absence and leave management, Task Management, Employee Self-Service (ESS), Fatigue Management, Payroll Integration, and Others), Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), and Component (Software and Services)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Regulatory compliance associated with workforce management, High implementation and maintenance cost

-

-

Who are the major players in the Workforce Management Software Market?

-

ActiveOps PLC, Advanced Computer Software Group Ltd., ATOSS Software AG, Automatic Data Processing Inc., Bamboo HR LLC, Ceridian HCM Holding Inc., International Business Machines Corp., Koch Industries Inc., NICE Ltd., Oracle Corp, Panasonic Holdings Corp., Paycor HCM Inc., PTC Inc., Rippling People Center Inc., Sage Group Plc, SAP SE, UKG Inc., Verint Systems Inc., Workday Inc., and Zoho Corp. Pvt. Ltd.

-

Market Research Insights

- The market encompasses a range of solutions designed to streamline HR processes, optimize workforce productivity, and ensure compliance. According to industry estimates, the global market for workforce management software is projected to reach USD10.3 billion by 2025, growing at a compound annual growth rate of 12.2% from 2020. This expansion is driven by the increasing demand for automating attendance policies, leave management, and productivity tracking, as well as the need for efficient workload distribution and HR data integration. Moreover, advanced features such as data visualization, employee engagement, and recognition, skills assessment, and talent management are gaining traction, with 77% of organizations reporting increased productivity as a result of implementing workforce management software.

- These tools enable real-time overtime calculation, onboarding process automation, and shift pattern analysis, leading to significant efficiency improvements and cost savings. The integration of scheduling algorithms, mobile access features, and payroll processing further enhances the value proposition of workforce management software for businesses.

We can help! Our analysts can customize this workforce management software market research report to meet your requirements.