Data Integration Market Size 2024-2028

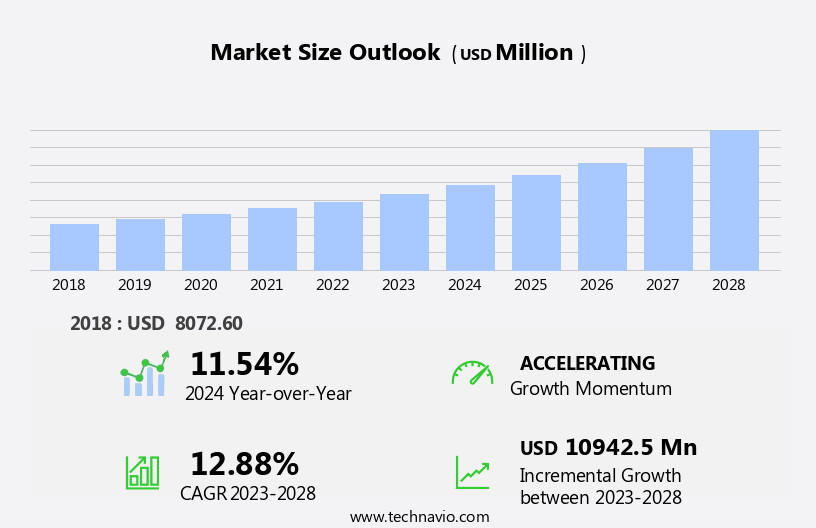

The data integration market size is forecast to increase by USD 10.94 billion, at a CAGR of 12.88% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing need for seamless data flow between various systems and applications. This requirement is driven by the digital transformation initiatives undertaken by businesses to enhance operational efficiency and gain competitive advantage. A notable trend in the market is the increasing adoption of cloud-based integration solutions, which offer flexibility, scalability, and cost savings. However, despite these benefits, many organizations face challenges in implementing effective data integration strategies. One of the primary obstacles is the complexity involved in integrating diverse data sources and ensuring data accuracy and security.

- Additionally, the lack of a comprehensive integration strategy can hinder the successful implementation of data integration projects. To capitalize on the market opportunities and navigate these challenges effectively, companies need to invest in robust integration platforms and adopt best practices for data management and security. By doing so, they can streamline their business processes, improve data quality, and gain valuable insights from their data to drive growth and innovation.

What will be the Size of the Data Integration Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing volume, velocity, and variety of data. Seamless integration of entities such as data profiling, synchronization, quality rules, monitoring, and storytelling are essential for effective business intelligence and data warehousing. Embedded analytics and cloud data integration have gained significant traction, enabling real-time insights. Data governance, artificial intelligence, security, observability, and fabric are integral components of the data integration landscape.

How is this Data Integration Industry segmented?

The data integration industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- IT and telecom

- Healthcare

- BFSI

- Government and defense

- Others

- Component

- Tools

- Services

- Application Type

- Data Warehousing

- Business Intelligence

- Cloud Migration

- Real-Time Analytics

- Solution Type

- ETL (Extract, Transform, Load)

- ELT

- Data Replication

- Data Virtualization

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

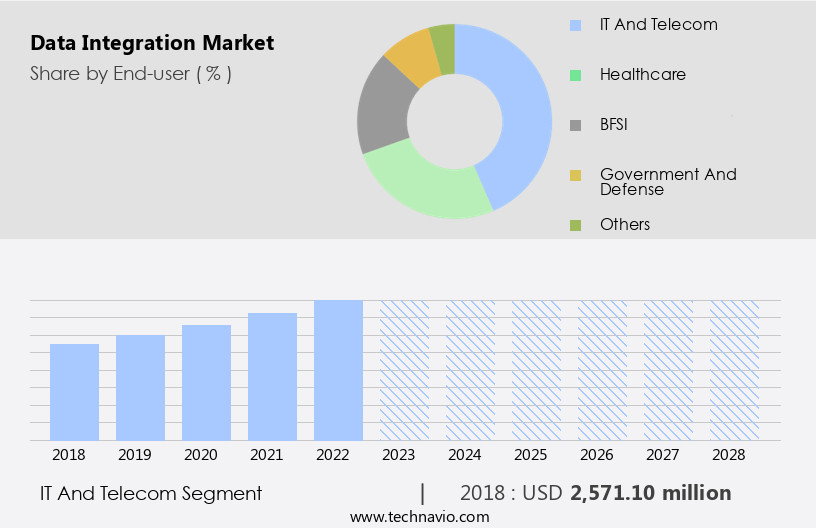

The it and telecom segment is estimated to witness significant growth during the forecast period.

In today's data-driven business landscape, organizations are increasingly relying on integrated data management solutions to optimize operations and gain competitive advantages. The data mesh architecture facilitates the decentralization of data ownership and management, enabling real-time, interconnected data access. Data profiling and monitoring ensure data quality and accuracy, while data synchronization and transformation processes maintain consistency across various systems. Business intelligence, data warehousing, and embedded analytics provide valuable insights for informed decision-making. Cloud data integration and data virtualization enable seamless data access and sharing, while data governance ensures data security and compliance. Artificial intelligence and machine learning algorithms enhance data analytics capabilities, enabling predictive and prescriptive insights.

Data security, observability, and anonymization are crucial components of data management, ensuring data privacy and protection. Schema mapping and metadata management facilitate data interoperability and standardization. Data enrichment, deduplication, and data mart creation optimize data utilization. Real-time data integration, ETL processes, and batch data integration cater to various data processing requirements. Data migration and data cleansing ensure data accuracy and consistency. Data cataloging, data lineage, and data discovery enable efficient data management and access. Hybrid data integration, data federation, and on-premise data integration cater to diverse data infrastructure needs. Data alerting and data validation ensure data accuracy and reliability.

Change data capture and data masking maintain data security and privacy. API integration and self-service analytics empower users to access and analyze data independently. Predictive analytics and data visualization provide actionable insights. Data ingestion, data lakes, and data modeling enable scalable data storage and processing. Data integration platforms and data orchestration streamline data management and workflow automation. Data standardization and data transformation ensure data consistency and compatibility. Data replication and data enrichment optimize data utilization and availability. In conclusion, the market is witnessing significant growth, driven by the increasing adoption of advanced technologies and the need for seamless data management and communication across various systems and devices.

The IT and telecom segment was valued at USD 2.57 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth in North America, driven by enterprises seeking to enhance operational efficiency and remain competitive. The increasing preference for cloud computing, enabling seamless integration of various IT infrastructures and platforms such as HP Enterprise and OneNeck IT Solutions, is a major factor fueling market expansion. Moreover, the widespread adoption of cloud CRM solutions among North American organizations has led to the popularity of the hybrid model, which combines on-premises and cloud systems, to cater to diverse business requirements. Data mesh architectures are gaining traction, allowing organizations to manage and integrate data in a decentralized manner.

Data profiling and quality rules ensure accurate data synchronization and monitoring, while data storytelling and business intelligence provide valuable insights. Data warehousing and data lakes facilitate data storage and retrieval, and data transformation and enrichment enhance data utility. Data integration platforms support real-time and batch data integration, machine learning, and predictive analytics. Data security, observability, and governance are crucial components, ensuring data privacy and compliance. Data validation, change data capture, and data lineage maintain data accuracy and consistency. Data anonymization, deduplication, and master data management optimize data usage and reduce redundancy. Data orchestration, data virtualization, and API integration streamline data access and sharing.

Data cataloging, metadata management, and schema mapping facilitate data discovery and understanding. Data migration and data cleansing ensure data consistency and reliability. Data enrichment, data modeling, and data analytics provide actionable insights. Data fabric, data discovery, and self-service analytics empower users to access and analyze data easily. Data masking, data alerting, and data fabric ensure data security and compliance. Data deduplication, data transformation, and data replication optimize data management and reduce costs. Overall, the market in North America is dynamic, with various entities collaborating to address the evolving data management needs of businesses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global data integration market size and forecast projects growth, driven by data integration market trends 2024-2028. B2B data integration solutions leverage cloud-based integration platforms for efficiency. Data integration market growth opportunities 2025 include data integration for enterprises and real-time data integration, supporting analytics. Data integration software optimizes operations, while data integration market competitive analysis highlights key providers. Sustainable data integration practices align with eco-friendly IT trends. Data integration regulations 2024-2028 shapes data integration demand in North America 2025. AI-driven integration solutions and premium data integration insights boost adoption. Data integration for SMEs and customized integration tools target niches. Data integration market challenges and solutions address complexity, with direct procurement strategies for integration tools and data integration pricing optimization enhancing profitability. Data-driven integration market analytics and hybrid integration trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Data Integration Industry?

- The market is significantly driven by the high demand for data integration solutions.

- In today's business landscape, the influx of vast amounts of data from various sources necessitates effective data integration solutions. Enterprise Application Integration (EAI) systems are increasingly being adopted to address the complexities arising from diverse IT infrastructure. These systems enable the transformation of heterogeneous applications into a unified platform, fostering seamless communication between different business operations. Moreover, with businesses expanding their reach globally, there is a growing requirement to connect customers, suppliers, and stakeholders in real-time. Integration platforms play a crucial role in linking multiple enterprise systems with web and wireless applications, ensuring smooth data flow and enhanced operational efficiency.

- Data integration goes beyond simple data synchronization. It encompasses data profiling, data quality rules, and data monitoring to ensure data accuracy and consistency. Business intelligence, data warehousing, embedded analytics, and cloud data integration are integral components of a comprehensive data integration strategy. Advancements in technology, such as artificial intelligence and data observability, are further enhancing data integration capabilities. Data governance ensures data security and compliance, while data storytelling facilitates effective communication of insights derived from data analysis. In summary, data integration is a critical aspect of modern business operations, enabling seamless data flow, improved operational efficiency, and enhanced decision-making capabilities.

- Integration platforms, with their advanced features, are essential tools in achieving these objectives.

What are the market trends shaping the Data Integration Industry?

- The trend in the market is shifting towards the wider adoption of cloud-based integration solutions. This technological advancement offers numerous benefits, including increased efficiency, scalability, and cost savings.

- Cloud computing solutions have become increasingly popular among organizations for modernizing their IT infrastructure, with data integration being a significant area of adoption. Cloud-based data integration enables enterprises to exchange data within and outside their organizations for various commercial applications. Two primary forms of cloud-based integration services are integration platform-as-a-service (iPaaS) and data platform-as-a-service (dPaaS). IPaaS offers a set of cloud-based integration solutions that allow enterprises to integrate their back-office systems without installing physical IT infrastructure. The availability of faster connectivity features and the flexibility offered by cloud computing have contributed to the increasing popularity of cloud-based data integration.

- IPaaS solutions facilitate schema mapping, data transformation, data orchestration, data standardization, data anonymization, and data migration. They also support elt processes, data cataloging, metadata management, data cleansing, data replication, and data visualization. These capabilities enable organizations to streamline their data analytics and improve overall data quality. Cloud-based data integration solutions are essential for businesses looking to optimize their operations, reduce costs, and gain a competitive edge. They provide a harmonious and immersive experience for users, emphasizing ease of use and seamless integration with various applications. Recent research indicates a growing demand for these solutions as more organizations recognize the benefits of cloud computing and the importance of data management in today's digital economy.

What challenges does the Data Integration Industry face during its growth?

- The absence of comprehensive integration strategies poses a significant challenge to the industry's growth trajectory. Effective implementation of such strategies is essential to streamline operations, enhance collaboration, and foster innovation within the sector.

- In today's intricate IT landscape, organizations require an effective integration strategy to ensure seamless operations. A holistic approach is essential to identify and manage various touchpoints between operational systems. Service-oriented architecture (SOA) plays a crucial role in managing application and service delivery within an organization. Enterprises typically allocate over 8% of their revenue towards IT budgets, encompassing application integration, mobile data integration, and on-premises cloud application integration. However, without a comprehensive integration strategy, CIOs may create customized solutions for each new business challenge, resulting in a heterogeneous environment that is not only challenging to manage but also costly to maintain.

- Data integration is a vital component of this strategy, with solutions offering features like data enrichment, hybrid data integration, data deduplication, master data management, and data quality ensuring accurate and consistent data across the organization. Advanced capabilities such as data validation, change data capture, prescriptive analytics, data discovery, data masking, API integration, and self-service analytics further enhance the value of these solutions. Additionally, data lineage and data fabric enable organizations to gain insights into data origin, movement, and usage, ensuring regulatory compliance and data security.

Exclusive Customer Landscape

The data integration market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data integration market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data integration market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adeptia Inc. - This company specializes in data integration solutions, enabling users to locate and access data from within their organization and external ecosystems, enhancing data visibility and streamlining business operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adeptia Inc.

- Alphabet Inc.

- Cisco Systems Inc.

- Denodo Technologies Inc.

- HCL Technologies Ltd.

- Hevo Data Inc.

- Hitachi Ltd.

- Informatica Inc.

- International Business Machines Corp.

- Jitterbit Inc.

- Microsoft Corp.

- Oracle Corp.

- Precisely

- QlikTech international AB

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Software AG

- Talend Inc

- TIBCO Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Integration Market

- In January 2024, Informatica, a leading data integration solutions provider, announced the launch of its new Intelligent Cloud Services platform, which includes advanced data integration capabilities and AI-driven data management tools (Informatica Press Release). This expansion aimed to cater to the growing demand for cloud-based data integration solutions.

- In March 2024, IBM and Microsoft entered into a strategic partnership to integrate IBM's Watson AI capabilities with Microsoft's Power Platform, enhancing data integration and analytics offerings for businesses (IBM Press Release). This collaboration aimed to provide more robust and intelligent data integration solutions to the market.

- In April 2025, Talend, a data integration and management company, raised USD120 million in a Series D funding round, led by new investor TPG Growth and existing investor Sapphire Ventures (Talend Press Release). This significant investment was intended to accelerate Talend's product development, expand its market reach, and strengthen its competitive position.

- In May 2025, the European Union's General Data Protection Regulation (GDPR) entered its second year of enforcement, leading to increased demand for data integration solutions that help organizations comply with the stringent data privacy regulations (European Commission Press Release). This regulatory milestone highlighted the importance of robust data integration capabilities for businesses operating in the EU.

Research Analyst Overview

- In the dynamic the market, organizations seek efficient methods to manage and optimize their data architectures. Data integration support plays a crucial role in connecting various data sources, enabling seamless data flow between systems. Data profiling tools assist in understanding data quality and identifying potential issues before integration. The emergence of data mesh architecture and data lakehouse architecture challenges traditional data integration solutions. Data management lifecycle requires continuous integration, maintenance, and monitoring to ensure data quality and security. Cloud data warehouses have gained popularity, necessitating data integration deployment in the cloud. Data privacy management and security policies are essential considerations, with data privacy regulations mandating strict adherence to privacy policies.

- Data discovery tools aid in locating and understanding data assets, while ETL tools facilitate data extraction, transformation, and loading. Data modeling techniques and data integration patterns optimize data integration strategies. Data quality reporting and monitoring ensure data accuracy and consistency. Data security protocols and data integration services protect sensitive data during transfer. Data governance frameworks and policies establish guidelines for data usage and access. Data lineage tracking and integration testing ensure data accuracy and reliability. Data cataloging tools provide a centralized repository for metadata management. Data integration challenges persist, necessitating ongoing innovation and improvement in data integration technologies and methodologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Integration Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.88% |

|

Market growth 2024-2028 |

USD 10942.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.54 |

|

Key countries |

US, China, India, Germany, Japan, UK, South Korea, Canada, Brazil, France, UAE, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Integration Market Research and Growth Report?

- CAGR of the Data Integration industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data integration market growth of industry companies

We can help! Our analysts can customize this data integration market research report to meet your requirements.