Private Equity Market Size 2025-2029

The private equity market size is forecast to increase by USD 885.7 billion at a CAGR of 9.5% between 2024 and 2029.

- The private equity and venture capital investment landscape is experiencing significant growth, driven by an increase in deal volumes and the rising number of high-net-worth individuals (HNWIs) worldwide. This trend is fueled by the attractive returns offered by private equity and venture capital investments, which have become a popular asset class for wealth management portfolios. However, this market is not without challenges. Transaction risks, such as regulatory changes and foreign exchange fluctuations, can pose significant hurdles for investors. Additionally, there is a growing demand for impact investing, particularly in sectors like renewable energy, as investors seek to align their financial goals with social and environmental objectives.

- Navigating these trends and challenges requires a deep understanding of market dynamics and a strategic approach to investment opportunities. This market trends and analysis report delves deeper into these topics, providing valuable insights for professionals seeking to maximize their private equity investments.

What will be the Size of the Private Equity Market during the forecast period?

- The markets continue to evolve, with investment strategies becoming increasingly data-driven and sophisticated. Investor returns remain a key focus, with growth stage investing and innovation hubs driving value creation. Risk management is crucial in this industry, with deal origination and fundraising strategies carefully considered. Management fees and capital calls are essential components of the fund lifecycle, while deal closing and post-investment management ensure optimal portfolio performance. Cryptocurrency investments represent an emerging trend, with digital assets joining traditional assets in investment portfolios. Impact measurement and regulatory compliance are also critical, as private equity firms strive for transparency and customer experience.

- ESG integration and industry consolidation are shaping the venture capital ecosystem, with secondary market sales providing liquidity for investors. Fund size and investment strategies vary, with some focusing on start-ups and emerging technologies. Technology adoption is a significant factor in fund performance, with customer acquisition and retention key to long-term success. Fund returns are closely monitored, with performance fees incentivizing top-performing funds. In the global private equity landscape, fundraising strategies and industry trends continue to evolve. Regulatory compliance and customer experience are paramount, with digital assets investment and ESG integration shaping the future of the industry.

- Private equity sales and industry consolidation are ongoing, with post-investment management and portfolio optimization crucial to maximizing returns.

How is this Private Equity Industry segmented?

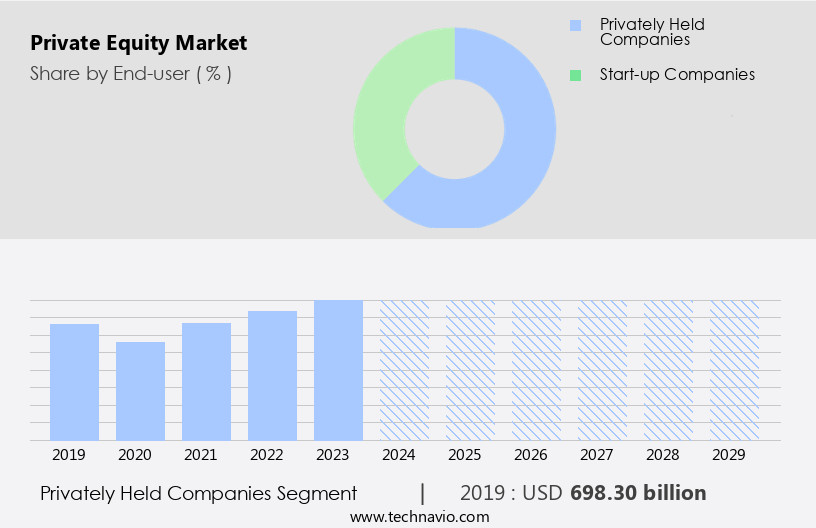

The private equity industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Privately held companies

- Start-up companies

- Application

- Leveraged buyouts

- Venture capital

- Equity investment

- Enterpreneurship

- Investments

- Large Cap

- Upper Middle Market

- Lower Middle Market

- Real Estate

- Large Cap

- Upper Middle Market

- Lower Middle Market

- Real Estate

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The privately held companies segment is estimated to witness significant growth during the forecast period.

In the realm of investment, private equity portfolios play a significant role in the additive manufacturing market. These portfolios encompass various investment vehicles, such as buyout funds, growth equity funds, strategic investments, and late-stage funding. Each type caters to different growth stages of companies in the sector. Buyout funds focus on acquiring controlling stakes in mature companies, often facilitating digital transformation and operational improvements. Growth equity funds, on the other hand, invest in companies with proven business models, aiming to fuel their expansion through capital infusion and industry expertise. Strategic investments are made by firms seeking to gain a foothold in a new market or expand their existing presence.

Legal frameworks and regulatory landscapes play a crucial role in shaping the market dynamics. Alternative investments, such as distressed debt funds and private debt, provide opportunities for investors to generate returns in less conventional ways. Limited partners (LPs) contribute capital to these funds, while general partners (GPs) manage the investments. ESG investing, impact investing, and hedge funds are increasingly popular investment strategies. Series A and B funding are essential for early-stage companies, while venture capital funds provide growth capital and industry specialization. Fund management, financial modeling, and performance measurement are integral components of successful investment strategies. M&A advisory, capital allocation, and corporate restructuring are key services offered by investment banking firms.

Seed funding, venture debt, and series A funding are crucial for startups, while exit strategies, such as IPOs and trade sales, provide investors with potential returns. Machine learning, data analytics, artificial intelligence, and blockchain technology are transforming the investment landscape. Private equity consulting, leveraged buyouts, and growth capital are integral components of private equity investment. Due diligence, industry expertise, financial advisory, and deal sourcing are essential elements of successful investment strategies. Tax implications, deal flow, and portfolio management are critical considerations for investors. In the additive manufacturing market, private equity investment continues to evolve, driven by technological advancements, regulatory changes, and shifting market trends.

Get a glance at the market report of share of various segments Request Free Sample

The Privately held companies segment was valued at USD 698.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the North American the market, the US holds a significant share due to its large equity market presence and continuous trading activities. With over 40% of the global equity market share as of August 2021, the US offers investors tax efficiency, transparency, and access to a centralized stock exchange platform. Cost-sensitive investors on the stock exchange seek low-cost brokerage options, making private equity trading an attractive security choice. Private equity funds, such as buyout, growth equity, strategic, and late-stage, are integral components of this market. These funds rely on various investment strategies, including industry specialization, deal sourcing, and performance measurement, to secure deals and generate returns.

Legal frameworks, tax implications, and regulatory landscape are crucial considerations in private equity investment. Limited partners (LPs) play a vital role in the private equity ecosystem, providing capital and expertise. They may include high net worth individuals, family offices, endowments, foundations, pension funds, and sovereign wealth funds. ESG investing, impact investing, and venture debt are alternative investment strategies gaining popularity. General partners (GPs) manage the funds and make investment decisions. They may be investment banking firms, private equity consulting firms, or financial advisory firms. Due diligence, financial modeling, and deal flow are essential components of the GP's role. The market also encompasses distressed debt funds, private debt, and venture capital funds.

Digital transformation, M&A advisory, and capital allocation are critical areas of focus for private equity firms. Technology-enabled investing, artificial intelligence, and machine learning are increasingly influencing investment strategies. Exit strategies, including IPOs, trade sales, and financial buyouts, are essential for realizing returns on private equity investments. Blockchain technology and leveraged buyouts are emerging trends in the private equity landscape. Private equity consulting, private equity investment, growth capital, and sector expertise are integral to the private equity industry's success. Fund management, fund raising, and portfolio management are essential functions in the private equity value chain.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Private Equity Industry?

- Increase in private equity deals is the key driver of the market.

- The market is experiencing a significant increase in deal activity due to various factors influencing the investment and acquisition landscape. One of the primary drivers is the substantial amount of uninvested capital, or dry powder, held by private equity (PE) firms. This financial cushion enables PE firms to explore diverse investment opportunities, ranging from traditional buyouts to emerging sectors. Another significant factor fueling the rise in private equity deals is the growing interest in niche industries. As sectors such as technology, healthcare, and renewable energy continue to expand, PE firms are actively seeking investments in these high-growth areas.

- The technology sector, in particular, has witnessed considerable attention due to its potential for innovation and disruption. The healthcare sector is another attractive area due to its resilience and potential for long-term growth. The renewable energy sector, driven by the global push towards sustainability, is also a popular choice for PE firms. Overall, the market is undergoing a transformative phase, shaped by these dynamic market trends.

What are the market trends shaping the Private Equity Industry?

- Rising number of high-net-worth individuals (HNWIs) globally is the upcoming market trend.

- The market has witnessed significant growth in recent years due to the increasing number of high net worth individuals (HNWIs) worldwide. HNWIs, defined as individuals with a net worth of over USD1 million in liquid assets, seek specialized services such as investment in private equity and hedge funds, as well as pre-IPO placements and pre-ICO sales. With expanding wealth portfolios, HNWIs demand experienced and strategic financial management. They often turn to wealth managers or wealth advisors for assistance with portfolio management, estate planning, asset protection, and tax planning.

- These professionals utilize their expertise to help HNWIs allocate their finances effectively and make informed investment decisions. The market continues to evolve, offering HNWIs unique opportunities to grow their wealth and secure their financial future.

What challenges does the Private Equity Industry face during its growth?

- Transaction risks is a key challenge affecting the industry growth.

- Transaction risks refer to the challenges faced by corporations when engaging in financial transactions or maintaining financial records in currencies other than their home base. For instance, a Canadian corporation conducting business in China encounters foreign exchange risks due to accepting transactions in the Chinese yuan and reporting financial statements in Canadian dollars. The primary risk involves the currency rate fluctuation before the completion of a transaction. The time gap between a transaction and its settlement serves as the root cause of these risks.

- It is essential for businesses to understand and manage these risks to mitigate potential financial losses. Currency volatility can significantly impact a corporation's financial performance and strategic planning. Effective risk management strategies, such as hedging, forward contracts, and currency options, can help mitigate transaction risks and ensure financial stability.

Exclusive Customer Landscape

The private equity market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the private equity market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, private equity market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advent International Corp. - The company specializes in collaborating with strategically positioned businesses, offering tailored solutions to optimize operations and drive revenue growth. By partnering with management teams, we create long-term value through strategic improvements and earnings enhancements. Our approach focuses on sustainable growth, ensuring the continued success of our invested companies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advent International Corp.

- AHAM Asset Management Berhad

- Allens

- Apollo Asset Management Inc.

- Bain and Co. Inc.

- Bank of America Corp.

- BDO Australia

- Blackstone Inc

- Ernst and Young Global Ltd.

- HSBC Holdings Plc

- JPMorgan Chase and Co.

- Morgan Stanley

- MorganFranklin Consulting

- Navy Federal Credit Union

- Onex Corp.

- The Carlyle Group Inc.

- The Goldman Sachs Group Inc.

- THE PNC FINANCIAL SERVICES GROUP INC.

- U.S. Bancorp

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The markets continue to evolve, with various types of funds playing crucial roles in the investment landscape. Buyout funds and growth equity funds are two distinct categories within this sphere. Buyout funds focus on acquiring controlling stakes in established companies, often with the intention of implementing operational improvements and financial restructuring. In contrast, growth equity funds invest in companies that are already demonstrating strong growth potential, providing them with additional capital to expand their operations and reach new markets. Strategic investments represent another avenue for private equity firms, enabling them to acquire minority stakes in companies and leverage their industry expertise to drive growth.

The legal framework governing private equity investments varies across jurisdictions, necessitating a thorough understanding of the regulatory landscape. Late-stage funding, an alternative investment strategy, involves providing capital to mature companies that are close to reaching profitability or going public. This stage of funding is crucial for companies seeking to scale their operations and solidify their market position. Private debt funds, a subset of private equity, focus on lending to private companies, offering an attractive yield for investors seeking income-generating opportunities. Limited partners (LPs) play a vital role in the private equity ecosystem, providing capital to funds and relying on fund managers to deliver strong returns.

Environmental, social, and governance (ESG) investing is gaining traction within private equity, as investors increasingly prioritize sustainable and socially responsible investments. Series A and B funding rounds mark significant milestones for startups, with venture capital funds and angel investors often providing the initial capital. Fund management, a critical aspect of private equity, encompasses deal sourcing, due diligence, investment thesis development, and performance measurement. Fund raising, a continuous process for private equity firms, requires effective communication of investment strategies and track records to potential LPs. Venture debt and venture capital funds provide crucial financing to early-stage companies, with venture debt offering a lower-risk alternative to equity financing.

Financial modeling, data analytics, and machine learning play essential roles in the decision-making process for private equity investments. Digital transformation and technology-enabled investing are shaping the future of private equity, with firms increasingly focusing on sectors with high growth potential and leveraging data analytics to identify investment opportunities. Mergers and acquisitions (M&A) advisory and corporate restructuring are common exit strategies for private equity firms seeking to realize their investments. Private equity consulting, financial advisory, and investment banking services are integral to the private equity ecosystem, offering expertise in various aspects of deal making and fund management. Impact investing, hedge funds, and infrastructure funds represent additional investment categories within the private equity universe.

Capital allocation, a key responsibility for private equity firms, requires a deep understanding of market dynamics and the ability to identify opportunities that align with their investment thesis. Seed funding, series A and B funding, and late-stage funding each play a unique role in the growth trajectory of startups and emerging companies. Portfolio management, a critical function for private equity firms, involves monitoring and optimizing the performance of their investment portfolios, ensuring that they are aligned with their investment objectives and risk tolerance. Industry specialization and sector expertise are essential for private equity firms seeking to maximize returns and minimize risk.

Tax implications, deal flow, and regulatory landscape are among the many factors that influence the market. Private equity consulting, financial advisory, and investment banking services offer valuable insights and expertise to firms navigating these complexities. The market is characterized by its dynamic nature and constant evolution, driven by a diverse range of investment strategies, market trends, and regulatory developments. Private equity firms must remain agile and adaptive to capitalize on opportunities and manage risks in this ever-changing landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 885.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, India, Australia, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Private Equity Market Research and Growth Report?

- CAGR of the Private Equity industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the private equity market growth of industry companies

We can help! Our analysts can customize this private equity market research report to meet your requirements.