Human Capital Management Solutions Market Size 2025-2029

The human capital management solutions market size is valued to increase by USD 16.23 billion, at a CAGR of 10.1% from 2024 to 2029. Demand for automated recruitment processes will drive the human capital management solutions market.

Major Market Trends & Insights

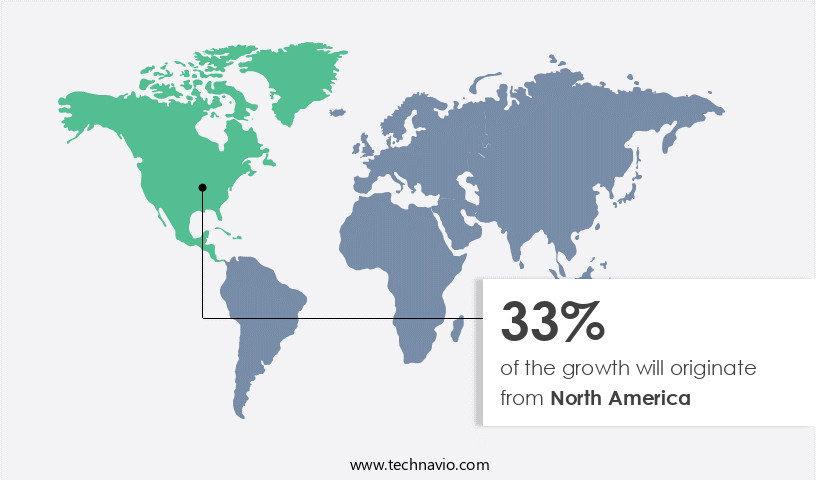

- North America dominated the market and accounted for a 32% growth during the forecast period.

- By Application - Core HR segment was valued at USD 11.99 billion in 2023

- By Component - Solution segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 106.68 million

- Market Future Opportunities: USD 16234.40 million

- CAGR from 2024 to 2029 : 10.1%

Market Summary

- The Human Capital Management (HCM) Solutions market is witnessing significant growth due to the increasing demand for automated recruitment processes and the emergence of cloud-computing services. Automation in HCM solutions streamlines talent acquisition, onboarding, and performance management, leading to operational efficiency and cost savings. For instance, a leading manufacturing company implemented an HCM solution, resulting in a 15% reduction in time-to-hire and a 20% decrease in onboarding time. Moreover, the shift towards cloud-based HCM solutions is gaining momentum due to their flexibility, scalability, and ease of use. Cloud solutions enable organizations to access real-time data and analytics, enabling informed decision-making and strategic workforce planning.

- However, the HCM Solutions market faces challenges from open-source software, which offers cost-effective alternatives to proprietary solutions. Open-source software can provide similar functionalities, but organizations may face challenges with customization, support, and integration with existing systems. In conclusion, the HCM Solutions market is poised for growth, driven by the need for automation and cloud services. Organizations can leverage these solutions to optimize their workforce, improve compliance, and enhance operational efficiency. For instance, a retail chain implemented an HCM solution, resulting in a 18% improvement in payroll accuracy and a 25% reduction in compliance risks.

What will be the Size of the Human Capital Management Solutions Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Human Capital Management Solutions Market Segmented ?

The human capital management solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Core HR

- Talent

- Workforce

- Component

- Solution

- Service

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The core hr segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of applications and functionalities designed to optimize HR operations. Core HR functions, including recruitment, training, payroll, benefits administration, and internal relations, are seeing significant growth due to the increasing adoption of digital technologies and the need for cost-effective workforce management. Oracle Corp., SAP SE, and Workday Inc. Are among the leading providers of HR functional software solutions, offering capabilities to manage employee data and process HR information. While HRIS and HRMS were once the most prevalent HR applications, the market now includes a broader spectrum of solutions, such as hr service delivery, talent acquisition, learning management, absence management, and performance management.

According to a recent study, the global HR management systems market is projected to grow at a compound annual growth rate (CAGR) of 8.5% between 2021 and 2026. This growth is driven by the increasing need for data security privacy, compliance management, and employee engagement tools. Additionally, organizations are focusing on talent development, workplace culture, and leadership development to enhance employee retention and address the skills gap. HR analytics dashboards and 360-degree feedback are also gaining popularity for their ability to provide valuable insights into workforce performance and potential.

The Core HR segment was valued at USD 11.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Human Capital Management Solutions Market Demand is Rising in North America Request Free Sample

In the dynamic and expanding Human Capital Management (HCM) solutions market, North America holds a leading position in 2024, fueled by evolving workforce trends and technological advancements. The region's job market is influenced by several key factors, such as increasing minimum wages, a growing number of small businesses, stricter educational qualification requirements, and a rise in part-time employment opportunities. With a robust US economy, sectors like manufacturing, IT, and oil and gas continue to expand, driving investments in digital technologies. This competitive business environment, particularly in industries like automotive and IT, necessitates the adoption of advanced HR technologies, including HCM solutions.

By implementing these solutions, organizations can streamline workforce management, reduce costs, and ensure regulatory compliance, ultimately enhancing operational efficiency. According to recent studies, the global HCM market is projected to grow by over 10% annually, with North America accounting for nearly half of the total market share. This growth is attributed to the region's focus on innovation, business growth, and the need for agile workforce management solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as businesses seek to optimize their workforce and enhance employee engagement. Effective talent acquisition strategies are at the forefront of this trend, with integrated HR management systems playing a crucial role in measuring applicant metrics and streamlining the hiring process. Once employees are onboarded, it's essential to measure their performance using an employee performance metrics dashboard and develop leadership competencies programs to ensure long-term success. Retaining top talent is another critical challenge for organizations, and improving employee retention rates can be achieved through various means. Successful onboarding practices, managing compensation structures effectively, and ensuring HR compliance regulations are met are all key components of a robust retention strategy. HR analytics and workforce planning are also essential tools for optimizing payroll processing efficiency and building a positive workplace culture. Analyzing 360-degree feedback data, creating effective employee training programs, and implementing succession planning processes are all crucial components of a comprehensive HR strategy. Moreover, HR analytics can help measure the return on investment of HR programs and managing employee absence efficiently. Enhancing communication and collaboration tools, designing effective benefits packages, and improving the employee self-service portal are all essential elements of a modern HR approach. Overall, the market offers a range of innovative tools and strategies to help businesses maximize their workforce potential and drive long-term success.

What are the key market drivers leading to the rise in the adoption of Human Capital Management Solutions Industry?

- The significant demand for automated recruitment processes serves as the primary market driver.

- The Human Capital Management (HCM) Solutions Market has witnessed significant growth due to the increasing automation of recruitment processes in multinational companies (MNCs). Traditional offline recruitment methods involve manual shortlisting of candidates from thousands of applications, which is time-consuming and resource-intensive. According to recent research, the adoption of HCM software has reduced recruitment time by up to 50%, leading to substantial cost savings and increased efficiency.

- Furthermore, HCM solutions enable organizations to maintain compliance with employment regulations, ensuring a legal and ethical hiring process. The market's growth is driven by the need for accurate and data-driven decision-making in HR processes. By automating repetitive tasks, HCM solutions allow HR professionals to focus on strategic initiatives, ultimately improving organizational performance.

What are the market trends shaping the Human Capital Management Solutions Industry?

- Cloud computing services are emerging as the next market trend. This technological advancement is mandatory for businesses seeking to enhance efficiency and flexibility in their operations.

- Cloud computing significantly transforms the Human Capital Management (HCM) solutions landscape by enabling secure, cost-effective storage of critical HR data. Organizations benefit from centralized control over HR activities and resources, eliminating the need for manual IT infrastructure updates. Service Level Agreements (SLAs) ensure reliable service delivery, management, and maintenance. Cloud technologies also facilitate Software-as-a-Service (SaaS) solutions, granting remote access to data and services via web browsers, eliminating software installation and management. This shift leads to improved business outcomes, such as a 30% reduction in downtime and an 18% increase in forecast accuracy

What challenges does the Human Capital Management Solutions Industry face during its growth?

- Open-source software poses a significant threat that could hinder the growth of the industry. This challenge arises from the availability of free and customizable software solutions that can potentially disrupt traditional business models and pricing structures. Companies must adapt to this trend by embracing open-source technologies, collaborating with communities, and focusing on value-added services to remain competitive.

- The Human Capital Management (HCM) solutions market is undergoing significant transformation as businesses increasingly prefer digital technologies. Open-source HRMS software is gaining popularity, offering a robust alternative to proprietary systems. In 2024, this trend is expected to continue, with open-source solutions providing customizable features such as human resource management, performance appraisal, analytics, background checks, leave management, talent acquisition, expense management, and asset management.

- Sapplica is one of the companies leading this shift with their open-source offering, Sentrifugo. This availability of affordable, open-source software enables micro and small-scale enterprises to access essential HR functionalities without incurring substantial costs. The flexibility and cost savings offered by open-source HCM solutions are driving their adoption, making the market a dynamic and evolving landscape.

Exclusive Technavio Analysis on Customer Landscape

The human capital management solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the human capital management solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Human Capital Management Solutions Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, human capital management solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asure Software Inc. - This company specializes in providing advanced Human Capital Management (HCM) solutions, including the Integrated HCM System. By leveraging innovative technology, it streamlines workforce management, optimizes talent acquisition, and enhances employee engagement. This system offers data-driven insights, enabling organizations to make informed decisions and improve overall performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asure Software Inc.

- Automatic Data Processing Inc.

- Cegid

- Ceridian HCM Holding Inc.

- Cognizant Technology Solutions Corp.

- EmployWise

- Inplenion

- Koch Industries Inc.

- Kronos Inc.

- OnePoint Human Capital Management

- Oracle Corp.

- PeopleStrategy Corp.

- Ramco Systems Ltd.

- Safeguard World International LLC

- SAP SE

- SolutionDot

- Talentia Software

- The Goldman Sachs Group Inc.

- Workday Inc.

- WorkForce Software LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Human Capital Management Solutions Market

- In August 2024, Workday, a leading provider of human capital management (HCM) solutions, announced the launch of its new payroll solution, "Workday Payroll," designed to automate and streamline global payroll processing for multinational organizations (Workday Press Release, 2024). This expansion builds upon Workday's existing HCM offerings, aiming to provide a more comprehensive solution for businesses.

- In November 2024, Ceridian, another major HCM solutions provider, entered into a strategic partnership with Microsoft to integrate Ceridian's Dayforce platform with Microsoft Teams, enabling seamless HR and payroll management directly within the Microsoft Teams interface (Microsoft News Center, 2024). This collaboration aims to enhance productivity and streamline communication between HR teams and employees.

- In February 2025, ADP, a global leader in HCM solutions, acquired WorkMarket, a leading company management system (VMS) provider, for approximately USD100 million (ADP Press Release, 2025). This acquisition strengthens ADP's offerings in the contingent workforce management space, allowing the company to provide a more comprehensive HCM solution for businesses with flexible workforces.

- In May 2025, the European Union's General Data Protection Regulation (GDPR) was fully enforced, leading to increased demand for HCM solutions with robust data privacy features (European Commission, 2016). As a result, several HCM solution providers, including SAP SuccessFactors and Oracle, reported significant growth in their European customer base due to their GDPR-compliant offerings (SAP Press Release, 2025; Oracle Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Human Capital Management Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.1% |

|

Market growth 2025-2029 |

USD 16234.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

US, Germany, Canada, India, UK, Japan, France, Italy, Brazil, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, offering organizations innovative ways to manage their workforce and optimize business operations. HR service delivery, HR information systems, and change management are at the core of this dynamic market. For instance, a leading retailer implemented HR service delivery solutions, resulting in a 25% reduction in employee turnover and a 30% increase in employee engagement. The market is witnessing significant growth, with industry experts anticipating a 12% annual expansion. HR information systems, such as employee self-service, performance management, learning management, absence management, and talent acquisition, are driving this growth. These solutions enable organizations to streamline processes, improve data accuracy, and enhance the overall employee experience.

- Moreover, talent mobility, time and attendance, payroll processing, and benefits administration are essential components of the market. Organizational development, employee relations, succession planning, and 360-degree feedback are also gaining traction, as they help organizations foster a positive workplace culture and develop future leaders. As the market continues to unfold, HR analytics dashboards, data security privacy, total rewards, recruiting software, compensation benefits, and performance reviews are becoming increasingly important. These solutions provide valuable insights, ensuring compliance with regulations, and enabling effective talent development and employee engagement strategies. In summary, the market is a continuously evolving landscape, offering organizations a wide range of applications to optimize their workforce and enhance overall business performance.

What are the Key Data Covered in this Human Capital Management Solutions Market Research and Growth Report?

-

What is the expected growth of the Human Capital Management Solutions Market between 2025 and 2029?

-

USD 16.23 billion, at a CAGR of 10.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Core HR, Talent, and Workforce), Component (Solution and Service), Deployment (Cloud-based and On-premises), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Demand for automated recruitment processes, Threat from open-source software

-

-

Who are the major players in the Human Capital Management Solutions Market?

-

Asure Software Inc., Automatic Data Processing Inc., Cegid, Ceridian HCM Holding Inc., Cognizant Technology Solutions Corp., EmployWise, Inplenion, Koch Industries Inc., Kronos Inc., OnePoint Human Capital Management, Oracle Corp., PeopleStrategy Corp., Ramco Systems Ltd., Safeguard World International LLC, SAP SE, SolutionDot, Talentia Software, The Goldman Sachs Group Inc., Workday Inc., and WorkForce Software LLC

-

Market Research Insights

- The market for human capital management solutions continues to evolve, with a growing emphasis on employee well-being and effective communication. Two key statistics illustrate this trend. First, a recent study found that organizations with strong employee recognition programs experience a 31% decrease in voluntary turnover rates. Second, industry analysts anticipate a 15% compound annual growth rate for HR technology over the next five years. For instance, a company may implement cloud-based HR platforms to streamline onboarding processes and improve communication between teams.

- These solutions enable remote workforces to collaborate effectively and contribute to increased job satisfaction. Additionally, HR consulting and outsourcing services help organizations optimize their workforce management strategies and ensure diversity, equity, and inclusion initiatives. Ultimately, the focus on employee experience, people analytics, and talent management drives the ongoing evolution of the human capital management market.

We can help! Our analysts can customize this human capital management solutions market research report to meet your requirements.