HR Software Market Size 2025-2029

The HR software market size is forecast to increase by USD 17.36 billion, at a CAGR of 12% between 2024 and 2029.

- The market is experiencing significant growth, fueled by increased budgets for HR technology solutions and the rising adoption of digital HR systems. Companies are recognizing the value of HR software in streamlining processes, improving efficiency, and enhancing the employee experience. However, this market is not without challenges. Organizational development and strategic workforce planning leverage big data analytics to identify trends and make informed decisions.

- To capitalize on market opportunities and navigate challenges effectively, companies must prioritize robust data security measures and transparent data handling practices. Additionally, staying informed about the latest HR technology trends and innovations will be crucial for staying competitive and meeting evolving business needs. Data privacy and security concerns are becoming increasingly prominent, as organizations grapple with the risks associated with storing and managing sensitive employee information. These concerns are heightened as HR software becomes more integrated with other business systems and processes.

What will be the Size of the HR Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping the industry landscape. Seamlessly integrated solutions now encompass various HR functions, including interview scheduling, HR service delivery, background checks, data privacy, HR analytics, project management, change management, learning management system, absence management, human capital management, integration capabilities, HR business partnering, and global payroll. User experience plays a pivotal role in the market, as organizations prioritize intuitive interfaces and streamlined processes for talent development, employee surveys, leave management, document management, API integrations, and interview scheduling are all integral components of this ever-evolving market.

The market is characterized by continuous innovation, as entities strive to meet the evolving needs of businesses across various sectors. The integration of these HR functions creates a comprehensive HR solution that enables organizations to effectively manage their workforce and optimize their human capital.

How is this HR Software Industry segmented?

The hr software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Core HR

- Talent management

- Employee collaboration and engagement

- Recruiting

- Workforce planning and analytics

- End-user

- Large enterprises

- SMEs

- Sector

- IT and tech

- Healthcare

- Manufacturing

- Retail

- Others

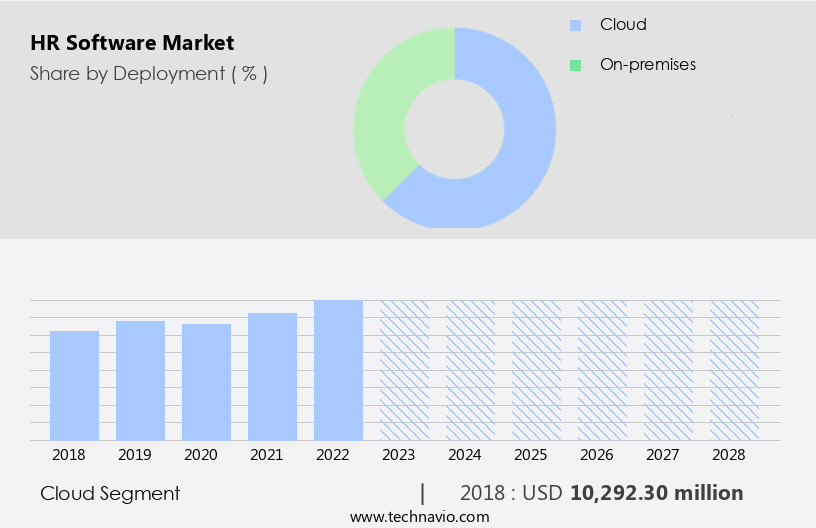

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- US

- Canada

- Europe

- Germany

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The core HR segment is estimated to witness significant growth during the forecast period. The human resources (HR) software market is experiencing significant evolution, with a focus on enhancing workforce management capabilities. Compensation management and benchmarking are becoming more sophisticated, allowing for user-friendly experiences and real-time analytics. Talent development is a key priority, with employee surveys and onboarding workflows streamlined to improve engagement and retention. Leave management, document management, and compliance reporting are being integrated with HR systems, ensuring seamless data flow and regulatory adherence. API integrations enable HR solutions to connect with other business applications, improving efficiency and data accuracy. Reference checking, policy management, and workflow automation are essential components of HR information systems, ensuring consistent processes and reducing manual tasks.

Recruitment marketing, applicant tracking systems, interview scheduling, and hr service delivery are essential components of the HR technology landscape, helping organizations attract, engage, and hire top talent. Background checks, data privacy, and hr analytics are also critical, ensuring compliance and informed decision-making. Project management, change management, and learning management systems are increasingly integrated with HR solutions, improving workforce development and organizational effectiveness. Absence management, human capital management, and integration capabilities are also key features, enabling comprehensive workforce administration and strategic HR business partnering. The market's evolution is driven by factors such as the rise in employment rates, the focus on employee well-being and compensation, and the adoption of advanced HR technologies such as AI, machine learning, and predictive analytics.

The Core HR segment was valued at USD 5.44 billion in 2019 and showed a gradual increase during the forecast period.

Workforce planning and talent management are increasingly important, with skills gap analysis and hr consulting services helping organizations address their talent needs. Performance reviews, goal setting, payroll processing, and leadership training are being modernized, with mobile HR solutions and employee feedback mechanisms improving accessibility and engagement. Data security and implementation services are critical considerations, ensuring the protection of sensitive information and a smooth transition to new HR technologies. Candidate relationship management, benefits administration, and offer management are becoming cloud-based, offering flexibility and scalability. Training and development, employee self-service, and succession planning are integrated into HR systems, promoting continuous learning and growth.

The HR software market is becoming essential for organizations aiming to streamline workforce management. Central to this evolution is the HR information system, which serves as the digital backbone for managing employee data and processes. Solutions now offer advanced time and attendance tracking, improving accuracy and efficiency in workforce scheduling. With integrated reporting and analytics, companies gain actionable insights to drive strategic decisions. Reliable support and maintenance ensure systems remain functional and secure, reducing operational downtime. Additionally, built-in tools for tax compliance simplify payroll and regulatory processes, minimizing the risk of penalties.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing adoption of cloud-based solutions and the high demand for cost-effective HR management. Social media's improved penetration is also playing a role in market expansion. HR software is essential for managing workforce planning, talent acquisition, performance reviews, payroll processing, and compliance reporting, among other functions. Cloud-based HR systems offer advantages such as real-time data access, automation of workflows, and integration capabilities with other business applications. Organizations are investing in HR software to streamline HR processes, improve employee engagement, and enhance data security. For instance, talent management solutions enable skills gap analysis, goal setting, and succession planning, while applicant tracking systems facilitate recruitment marketing and interview scheduling.

Performance management tools offer continuous feedback, goal tracking, and performance analytics. Moreover, the growing focus on employee well-being and compensation has led to increased spending in these areas. According to NFP's 2024 Benefits Trend Report, 47% of employers planned to increase spending on employee compensation, and 37% on well-being programs, despite economic concerns. HR software solutions provide tools for compensation benchmarking, onboarding workflow, and performance management, ensuring fair and competitive compensation practices. The market in North America is witnessing robust growth due to the increasing demand for cost-effective, cloud-based HR solutions that streamline processes, improve employee engagement, and enhance data security.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of HR Software Industry?

- A significant factor fueling market growth is the allocation of larger HR software budgets by organizations. HR technology spending is on the rise among businesses in various sectors due to the expanding labor market and a growing emphasis on human resource management for business transparency. HR teams with adequate funding and strong alignment with business leaders have demonstrated significant value to their organizations in today's global economy. Large corporations allocate approximately 10% of their HR budgets towards technology solutions, including Human Capital Management (HCM) and Human Resource Management System (HRMS) offerings. The shift towards cloud-based HR solutions has catalyzed substantial growth in this market.

- HR teams utilize these technologies for functions such as time tracking, hr data management, employee onboarding, candidate relationship management, benefits administration, offer management, training and development, employee self-service, employee engagement, succession planning, recruitment marketing, and applicant tracking system. Data security remains a top priority, with implementation services ensuring secure integration and adoption of these HR technologies.

What are the market trends shaping the HR Software Industry?

- The increasing prevalence of digital human resources (HR) technology represents a significant market trend. This shift towards advanced HR solutions is mandatory for businesses seeking to enhance operational efficiency and stay competitive in today's digital landscape. The market is experiencing significant growth due to the increasing adoption of digital HR technologies. Mobile applications, social media, analytics, and cloud technologies are key drivers in this transformation. With employees increasingly relying on mobile phones for work, organizations are leveraging mobile HR applications to streamline processes and improve the employee experience. HR service delivery, including interview scheduling and absence management, is being digitized, making it more efficient and convenient for employees.

- Project management, change management, learning management systems, and human capital management are other areas where HR software is making a significant impact. Integration capabilities are crucial in HR software, allowing organizations to connect various systems and streamline processes. HR business partnering is becoming more important, with HR software providing tools for HR professionals to act as strategic advisors to the business. Global payroll is also being digitized, making it easier for organizations to manage payroll across multiple locations. Overall, the market is evolving to meet the changing needs of organizations and their workforces. Background checks and data privacy are also becoming essential components of HR software, ensuring compliance with regulations and maintaining the security of sensitive information. HR analytics is gaining popularity, enabling organizations to make data-driven decisions and optimize their workforce.

What challenges does the HR Software Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, necessitating rigorous efforts to safeguard sensitive information and protect consumer trust. Cloud-based HR software solutions have gained significant traction among businesses due to their cost-effectiveness and ease of accessibility. These solutions offer various functionalities such as compensation management, including benchmarking and surveys, leave management, document management, and policy management. Additionally, they provide workflow automation for talent development, skills gap analysis, and compliance reporting.

- Government agencies, including federal, state, and local, have also adopted cloud-based HR software for improved information management, centralized data storage, and high-speed networks, leading to increased productivity, enhanced data sharing, and collaboration. API integrations enable seamless connectivity with other systems, enhancing overall efficiency. Cloud-based HR software solutions offer simplified maintenance and upgrades, low upfront costs, effective security, high reliability, and the ability to address functional gaps through integrations.

Exclusive Customer Landscape

The hr software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hr software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hr software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Automatic Data Processing Inc. - This company specializes in HR software solutions, encompassing payroll, human resources, talent management, and benefits administration, enhancing organizational efficiency and productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Automatic Data Processing Inc.

- Automatic Payroll Systems Inc.

- Bamboo HR LLC

- Cornerstone OnDemand Inc.

- Dayforce Inc.

- EmployWise

- Greytip Software Pvt. Ltd.

- International Business Machines Corp.

- isolved HCM LLC

- Namely Inc.

- Oracle Corp.

- PATRIOT SOFTWARE LLC

- Paycom Software Inc.

- Paycor HCM Inc.

- Paylocity Holding Corp.

- Rippling People Center Inc.

- SAP SE

- TriNet Group Inc.

- UKG Inc.

- Workday Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in HR Software Market

- In January 2024, Workday, a leading provider of human capital management (HCM) solutions, announced the launch of its new payroll product, Workday Payroll, designed to automate and streamline global payroll processes for multinational organizations (Workday Press Release, 2024).

- In March 2024, Ceridian, a global human capital management technology company, entered into a strategic partnership with Microsoft to integrate Ceridian's Dayforce platform with Microsoft Teams, enabling seamless HR and payroll processes within Microsoft's collaboration platform (Microsoft News Center, 2024).

- In May 2024, ADP, a prominent HR solutions provider, acquired DataCloud, a cloud-based HR analytics company, for USD 1.1 billion to strengthen its analytics and data-driven HR offerings (ADP Press Release, 2024).

- In February 2025, Namely, a modern HR platform, secured a USD 40 million Series D funding round led by Stripes, bringing the company's total funding to USD 120 million and fueling its growth in the small to mid-sized business HR market (Namely Press Release, 2025).

Research Analyst Overview

The market is witnessing significant advancements, with a focus on enhancing employee experience and driving business performance. Third-party integrations enable seamless data exchange between HR systems and other business applications, fostering efficiency and productivity. Diversity and inclusion initiatives are gaining momentum, with HR software solutions offering tools for tracking and reporting on workforce demographics and promoting equal opportunities. Succession planning and learning analytics are essential components of talent development, allowing organizations to identify and groom future leaders while optimizing employee training programs. Employee well-being is another priority, with HR software solutions incorporating features for mental health support, work-life balance, and stress management.

Access control and security protocols ensure data privacy and compliance with regulations, while machine learning and artificial intelligence facilitate performance improvement by analyzing employee data and providing personalized recommendations. Risk management and compliance audits are crucial for maintaining regulatory compliance and mitigating potential risks. Business intelligence, data visualization, and predictive analytics provide valuable insights into workforce performance and trends, while blockchain technology and natural language processing enhance data security and processing capabilities.

Robotic process automation streamlines HR processes and reduces manual labor, allowing HR teams to focus on strategic initiatives. The HR software market is transforming how organizations approach talent and technology. Talent mobility is at the forefront, enabling internal career growth and agile workforce planning. Companies are leveraging mobile learning platforms to deliver flexible, on-the-go training. New experiences such as virtual reality training and augmented reality training are revolutionizing employee development, making learning more engaging and impactful. As data privacy concerns rise, robust data encryption becomes a non-negotiable feature across systems. Seamless operations are driven by integration platforms that unify HR functions, while open APIs enhance adaptability, allowing businesses to customize and scale solutions effectively.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HR Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

248 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12% |

|

Market growth 2025-2029 |

USD 17.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.2 |

|

Key countries |

US, Germany, Canada, UK, The Netherlands, China, Brazil, Japan, India, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HR Software Market Research and Growth Report?

- CAGR of the HR Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hr software market growth of industry companies

We can help! Our analysts can customize this hr software market research report to meet your requirements.