Infectious Disease Market Size 2025-2029

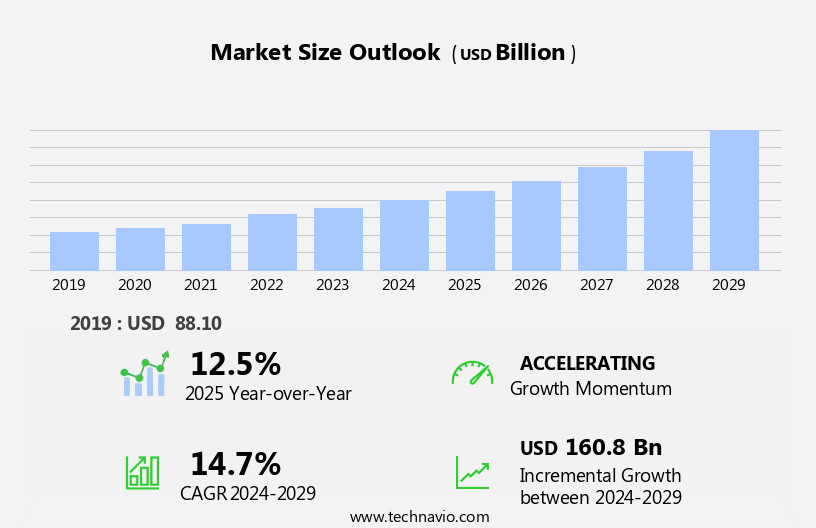

The infectious disease market size is forecast to increase by USD 160.8 billion at a CAGR of 14.7% between 2024 and 2029.

- The market is experiencing significant growth due to the rising prevalence of bacterial diseases such as Clostridium and Staphylococcus, which necessitate advanced diagnostics. Immunodiagnostics and next-generation sequencing (NGS) are emerging as key technologies in infectious disease diagnostics, offering faster and more accurate results than traditional methods. The development of novel drugs for tuberculosis (TB) and sepsis is another growth driver, as is the increasing demand for molecular diagnostics. However, the market faces challenges such as the adverse effects of generic drugs and the high cost of developing new anti-infective drugs. The use of NGS in infectious disease diagnostics is a major trend, enabling the identification of multiple pathogens in a single test and facilitating personalized treatment plans.

- In summary, the market is driven by the rising prevalence of infectious diseases, the development of novel drugs, and the adoption of advanced diagnostics, but is challenged by the high cost of drug development and the adverse effects of generic drugs. Immunodiagnostics and NGS are key technologies driving market growth.

What will be the Size of the Infectious Disease Market During the Forecast Period?

- The market encompasses diagnostic tools and technologies designed to promptly identify various pathogens, including bacteria, viruses, and parasites. This market is driven by the urgent need for accurate and rapid results in diverse healthcare settings, such as point-of-care diagnostic testing in urgent care centers, emergency rooms, and ambulances. The importance of infectious disease diagnostics extends beyond healthcare facilities, as personal health and infection control are increasingly prioritized in everyday life.

- Market dynamics are influenced by several factors, including inadequate infrastructure and poor water sanitation in certain regions, which contribute to the spread of infectious diseases. The ongoing demand for improved patient outcomes necessitates the development of advanced diagnostic technologies, such as immunodiagnostics, clinical microbiology, DNA sequencing, next-generation sequencing (NGS), DNA microarray, and various tests for diseases like hepatitis, syphilis, mosquito-borne diseases, gonorrhea, and RNA viruses.

- Healthcare professionals are under constant pressure to provide accurate diagnoses and implement effective infection control measures. As a result, there is a growing emphasis on training and education to ensure the proper use and interpretation of diagnostic tools. The market is expected to continue growing as the global population's healthcare needs evolve and advancements in diagnostics technology are made.

How is this Infectious Disease Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Drugs

- Vaccines

- End-user

- Hospital

- Multispecialty clinic

- Others

- Type

- Bacterial infections

- Viral infections

- Fungal infections

- Parasitic infections

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

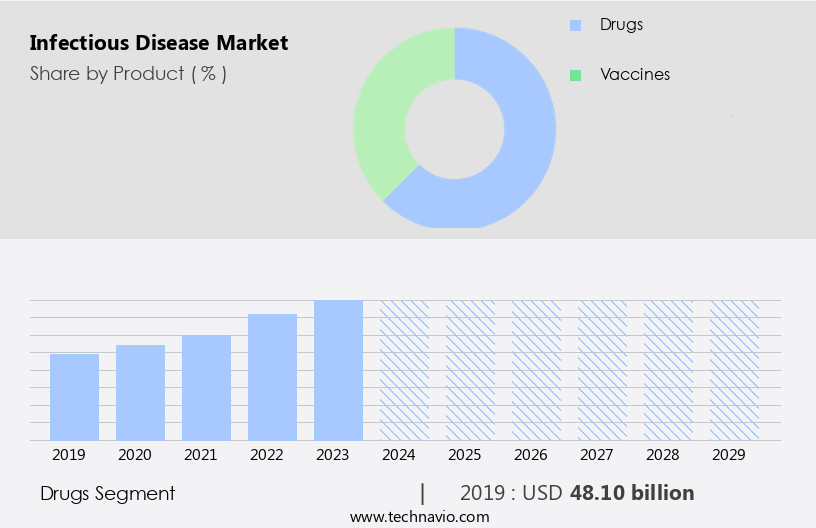

The drugs segment is estimated to witness significant growth during the forecast period. The market is driven by several key factors, including increasing government initiatives and non-profit organization efforts, the prevalence of various infectious diseases, and rising research and development funding. Infectious diseases such as influenza, giardiasis, HIV/AIDS, mononucleosis, and the common cold continue to pose a significant health concern. Point-of-care diagnostic testing, which offers rapid results and prompt diagnosis, is increasingly being adopted in urgent care centers, emergency rooms, ambulances, and physician offices. Inadequate infrastructure, poor water sanitation, and lack of training for healthcare professionals remain challenges in controlling the spread of infectious diseases. Pathogens such as bacteria, viruses, fungi, and parasites can cause respiratory diseases, hospital-acquired infections, sexually transmitted infections, and mosquito-borne diseases.

Technologies like chest X-rays, CT scans, physical exams, laboratory tests, PCR testing, and immunodiagnostics are used for diagnosis. Infection control, personal health, hygiene, and preventative healthcare are essential to mitigate the impact of infectious diseases. The market for infectious disease diagnostics includes kits, consumables, and diagnostic tests such as RT-PCR, RNA viruses, hepatitis, gonorrhea, hospital-acquired infections, human papillomavirus, tuberculosis, and hepatitis C. Government-funded programs and centralized laboratories are also significant contributors to the market. The geriatric population and lifestyle disorders are other factors driving market growth. Insurance companies and healthcare providers are increasingly investing in personalized medicines, genomics, proteomics, and next-generation sequencing to improve patient outcomes.

Get a glance at the market report of share of various segments. Request Free Sample

The Drugs segment was valued at USD 48.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

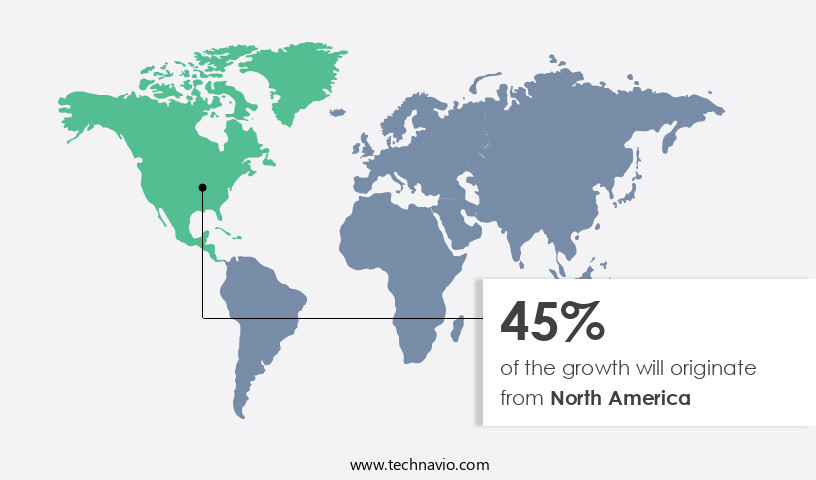

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is primarily driven by the United States, which accounts for a significant market share due to the presence of leading pharmaceutical companies. Their investments in marketing and patient awareness initiatives further bolster their market presence. In the US, innovative drug developers such as Aridis Pharmaceuticals, Entasis Therapeutics, and Merck are at the forefront of addressing various infectious diseases. These conditions include respiratory diseases caused by bacteria, viruses, fungi, and parasites, as well as hospital-acquired infections, sexually transmitted infections, tuberculosis, HIV/AIDS, and hepatitis.

Point-of-care testing plays a crucial role in prompt diagnosis, enabling urgent care centers, emergency rooms, ambulances, and physician offices to provide accurate results. Infection control, personal health, hygiene, and adequate infrastructure are essential factors influencing patient outcomes. Key challenges include inadequate infrastructure, poor water sanitation, and inadequate training for healthcare professionals. Infectious diseases encompass a wide range of pathogens, including RNA viruses like SARS-CoV-2, influenza, and hepatitis C. Diagnostic tests, such as RT-PCR, immunodiagnostics, clinical microbiology, isothermal nucleic acid amplification technology, DNA sequencing, next-generation sequencing, and DNA microarray, are essential for identifying and treating these diseases. Insurance companies and government-funded programs also play a role in driving market growth.

The market includes hospitals, clinical laboratories, reference laboratories, and physician offices. Infectious diseases, including tuberculosis, HIV/AIDS, sexually transmitted infections, hospital-acquired infections, Chlamydia trachomatis, Neisseria gonorrhea, HPV, syphilis, and mosquito-borne diseases, result in hospitalizations and non-notifiable infections, impacting hospitalization rates and healthcare costs. The market is further influenced by microbes, personalized medicines, genomics, proteomics, and preventative healthcare initiatives.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Infectious Disease Industry?

The increasing prevalence of infectious diseases is the key driver of the market.

- Infectious diseases pose a significant health challenge worldwide caused by pathogens, including bacteria, viruses, fungi, and parasites. Prevalence is increasing due to lifestyle changes, resulting in weakened immunity, and the emergence of drug-resistant organisms. HIV/AIDS remains a leading cause of death, with approximately 39.9 million people infected globally as of 2023. However, the incidence of some infections, such as meningococcal disease caused by Neisseria meningitides, has decreased in certain regions. Urgent care centers, emergency rooms, ambulances, and hospitals employ various diagnostic methods for prompt diagnosis. Point-of-care testing, including RT-PCR for RNA viruses like SARS-CoV-2 and Influenza, and immunodiagnostics for sexually transmitted infections like Chlamydia trachomatis and Neisseria gonorrhea, provide rapid results.

- Infection control measures, such as hygiene practices and personal health, play a crucial role in preventing the spread of infectious diseases. Hospitals, clinical laboratories, and reference laboratories utilize advanced technologies like isothermal nucleic acid amplification, DNA sequencing, and next-generation sequencing for diagnosis. The market is expanding, driven by the need for accurate, timely diagnosis, and the increasing burden of communicable diseases, including tuberculosis, hepatitis, and hospital-acquired infections. Insurance companies and government-funded programs support the growth of this market. Inadequate infrastructure and poor water sanitation in some regions necessitate the development of cost-effective, portable diagnostic kits and consumables.

- The field of infectious disease diagnostics is continually evolving, with ongoing research in genomics, proteomics, and personalized medicines.

What are the market trends shaping the Infectious Disease Industry?

The development of novel drugs is the upcoming market trend.

- The market is witnessing significant advancements in point-of-care diagnostic testing, enabling prompt diagnosis and effective infection control. Urgent care centers, emergency rooms, and ambulances are increasingly adopting these tests for rapid results, improving patient outcomes. Inadequate infrastructure and poor water sanitation in developing countries necessitate the need for training healthcare professionals in infection control practices. In the fight against infectious diseases, various diagnostic tests such as RT-PCR, RNA viruses, and immunodiagnostics are gaining popularity. These tests are used for the detection of pathogens like influenza, SARS-CoV-2, hepatitis C, and respiratory diseases. Respiratory infections caused by bacteria, viruses, fungi, and parasites are being diagnosed using chest X-rays, CT scans, physical exams, and laboratory tests.

- PCR testing of respiratory secretions and blood samples is a common diagnostic method. The market for infectious disease diagnostics is expanding, with the development of advanced technologies such as isothermal nucleic acid amplification, DNA sequencing, next-generation sequencing (NGS), and DNA microarray. These technologies are used for the diagnosis of various diseases, including hepatitis, gonorrhea, hospital-acquired infections (HAIS), human papillomavirus (HPV), tuberculosis (TB), and HIV hepatitis. Insurance companies and governments are investing in centralized laboratories to improve access to diagnostic services for communicable diseases such as tuberculosis, HIV, sexually transmitted infections, and mosquito-borne diseases. The geriatric population and lifestyle disorders are driving the demand for preventative healthcare, further fueling the growth of the market.

What challenges does the Infectious Disease Industry face during its growth?

Adverse effects of anti-infective drugs is a key challenge affecting the industry growth.

- Infectious diseases pose significant challenges to personal health and healthcare systems, necessitating prompt diagnosis and effective treatment. Point-of-care diagnostic testing, such as RT-PCR for RNA viruses like SARS-CoV-2 and Influenza, provides rapid results, enabling urgent care centers, emergency rooms, and even ambulances to make informed decisions. However, inadequate infrastructure, poor water sanitation, and inadequate training of healthcare professionals hinder the timely diagnosis and control of infectious diseases. The market for infectious disease diagnostics encompasses a wide range of applications, including respiratory diseases, and bacterial, viral, fungal, and parasitic infections. Technologies like Immunodiagnostics, Clinical Microbiology, Isothermal Nucleic Acid Amplification Technology, DNA Sequencing, Next-Generation Sequencing (NGS), and DNA Microarray play crucial roles in diagnosing various infectious diseases.

- Despite advancements in diagnostic technologies, anti-infective drugs remain a critical component of infectious disease management. However, these drugs come with potential adverse effects, such as bone marrow suppression, anaphylaxis, nephrotoxicity, and ototoxicity. For instance, PENTAM, an anti-infective used for Pneumocystis carinii pneumonia, can cause breathing problems, unusual bleeding or bruising, chest pain, and a fast, irregular heart rate. Similarly, Saquinavir, an antiviral for Human Immunodeficiency Virus, can have life-threatening side effects when taken with certain medications like cholesterol drugs and heart rhythm medicines. Infection control, personal hygiene, and preventative healthcare measures are essential in mitigating the spread and impact of infectious diseases.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, infectious disease market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Pfizer Inc.

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC (GSK)

- Merck & Co., Inc.

- Johnson & Johnson

- AbbVie Inc.

- Sanofi S.A.

- AstraZeneca PLC

- BioNTech SE

- Novartis International AG

- Hoffmann-La Roche AG

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Takeda Pharmaceutical Co. Ltd

- Boehringer Ingelheim GmbH

- Mylan N.V.

- CSL Limited

- Amgen Inc.

- Bayer AG

- Moderna, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of diagnostic tools and techniques used to identify various pathogens, including bacteria, viruses, fungi, parasites, and RNA viruses such as influenza and SARS-COV-2. Rapid and prompt diagnosis plays a crucial role in infection control and improving patient outcomes. Urgent care centers and emergency rooms are prime locations for the implementation of point-of-care (POC) diagnostic testing, enabling healthcare professionals to make informed decisions and initiate appropriate treatment plans. Inadequate infrastructure and poor water sanitation in certain regions can hinder the effective diagnosis and treatment of infectious diseases. Training and education of healthcare professionals are essential to ensure the accurate and efficient use of diagnostic kits, consumables, and technologies.

Moreover, respiratory diseases, including respiratory infections, are a significant application area for infectious disease diagnostics. Chest X-rays, CT scans, physical exams, and laboratory tests such as PCR testing and immunodiagnostics are commonly used to diagnose these conditions. Clinical microbiology and isothermal nucleic acid amplification technology are key techniques in the identification of pathogens. Hepatitis, tuberculosis, and sexually transmitted infections (STIs) such as gonorrhea and chlamydia trachomatis are among the communicable diseases that can significantly impact public health. Hospital-acquired infections (HAIs) are a growing concern, with HIV/AIDS, hepatitis, and tuberculosis being common examples. Preventative healthcare measures, including personal hygiene and lifestyle disorders, play a crucial role in reducing the spread of these diseases.

Furthermore, personalized medicines, genomics, and proteomics are emerging areas in the market. Centralized laboratories and government-funded programs are driving the adoption of advanced technologies such as DNA sequencing, next-generation sequencing (NGS), and DNA microarray for infectious disease diagnostics. The geriatric population is a vulnerable demographic for infectious diseases due to weakened immune systems and increased susceptibility to lifestyle disorders. Insurance companies are increasingly recognizing the importance of infectious disease diagnostics and are investing in POC testing and other advanced technologies to improve patient care and reduce healthcare costs. Mosquito-borne diseases, such as malaria and dengue fever, pose a significant threat to global health.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.7% |

|

Market Growth 2025-2029 |

USD 160.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.5 |

|

Key countries |

US, Canada, UK, China, Germany, France, Italy, Japan, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Infectious Disease Market Research and Growth Report?

- CAGR of the Infectious Disease industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the infectious disease market growth of industry companies

We can help! Our analysts can customize this infectious disease market research report to meet your requirements.