Aircraft Fuel Systems Market Size 2024-2028

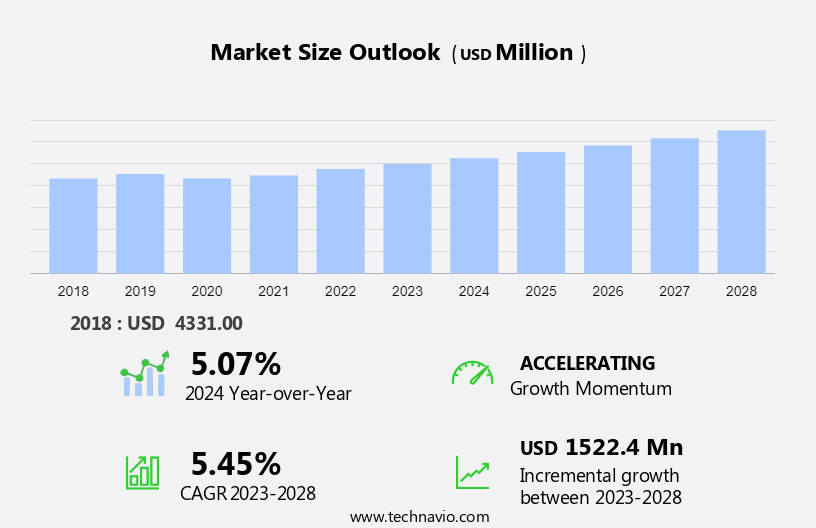

The aircraft fuel systems market size is forecast to increase by USD 1.52 billion at a CAGR of 5.45% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for fuel efficiency and optimized performance in the aviation industry. The use of measured quantities of fuel onboard is becoming increasingly important for airlines to reduce operational costs and improve environmental sustainability. This trend is further fueled by continuous advancements in aircraft components, which enable more efficient fuel consumption and reduced emissions. However, the market is not without challenges. Increasing environmental regulations, such as the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), are placing additional pressure on airlines to reduce their carbon footprint.

- This has led to a rise in demand for alternative fuels and more advanced fuel systems that can accommodate these new energy sources. Key elements include fuel management systems, fuel pumps, distribution and delivery systems, gauges, storage systems, refueling and transfer systems, valves, filters, lines, fuel efficiency systems, and fuel consumption optimization technologies. Companies seeking to capitalize on this market opportunity must stay abreast of regulatory developments and invest in research and development to meet these evolving demands. Overall, the market presents significant growth potential for companies that can offer innovative solutions to optimize fuel efficiency, reduce emissions, and comply with evolving regulations.

What will be the Size of the Aircraft Fuel Systems Market during the forecast period?

- The market encompasses a range of components essential for the efficient and safe delivery of fuel to aviation engines. This market continues to evolve, driven by increasing demand for fuel efficiency, safety, and environmental sustainability. Aircraft fuel control systems, along with aircraft fuel tank components, play a crucial role in the efficiency of aircraft fuel consumption. Regular aircraft fuel system inspection, aircraft fuel system repair, and aircraft fuel system upgrades are essential to maintain high fuel system performance. Aircraft fuel technology and aircraft fuel system advancements continue to improve, driving innovations in fuel system solutions and aircraft fuel system aftermarket services offered by aircraft fuel system manufacturers.

- Fuel system optimization and advanced technologies, such as electric and hybrid fuel systems, are gaining traction to reduce fuel consumption and emissions. The market is projected to grow steadily, underpinned by the expanding aviation industry and ongoing advancements in fuel systems technology. Aircraft fuel tanks, aircraft fuel pumps, aircraft fuel gauges, aircraft fuel valves, aircraft fuel filters, and aircraft fuel lines are essential components of an aircraft's fuel system, with aircraft fuel sensors and aircraft fuel monitoring systems providing real-time data for efficient aircraft fuel control. The aircraft fuel system design, aircraft fuel system engineering, and aircraft fuel system maintenance of these aircraft fuel system components ensure optimal performance, safety, and reliability in aviation. Aircraft fuel system performance is continually improving due to ongoing aircraft fuel system developments, which focus on enhancing efficiency, safety, and reliability in modern aviation.

How is the Aircraft Fuel Systems Industry segmented?

The aircraft fuel systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Fuel injection

- Pump feed

- Gravity feed

- Application

- Commercial

- Military

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- South America

- Middle East and Africa

- North America

By Technology Insights

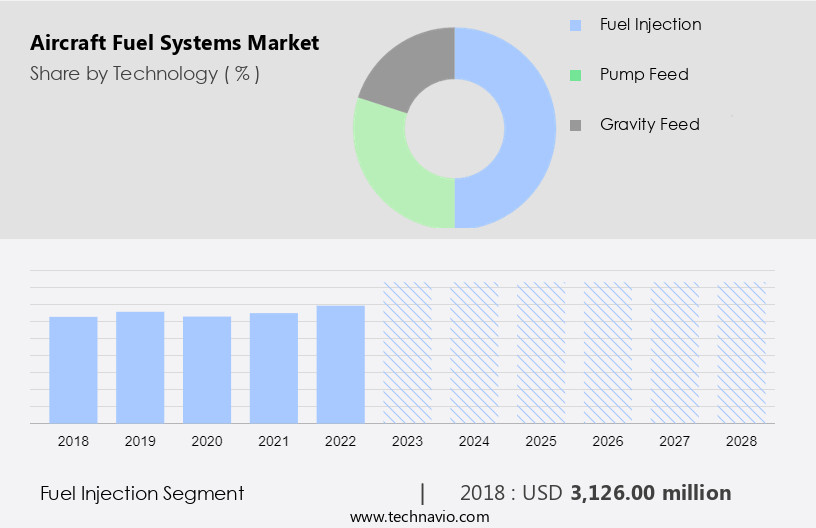

The fuel injection segment is estimated to witness significant growth during the forecast period. Aircraft fuel systems play a crucial role in ensuring the optimal performance and efficiency of aircraft engines. These systems consist of various components, including fuel tanks, aviation fuel systems, fuel management systems, fuel pumps, fuel distribution systems, fuel delivery systems, fuel gauges, fuel storage systems, refueling systems, fuel transfer systems, fuel valves, fuel filters, fuel lines, fuel sensors, fuel quantity indicators, fuel system integration, fuel system testing, fuel system certification, fuel system safety, fuel efficiency systems, and fuel system optimization.

These systems are integral to maintaining engine functionality while improving fuel economy and reducing carbon emissions. They offer advantages such as quick setup, enhanced fuel-burning efficiency, smooth engine operation, reduced fuel consumption, precise fuel flow to all cylinders, increased aircraft mileage, and adaptability to alternative fuels. By measuring, supplying, and optimizing fuel consumption, these systems contribute to prolonging engine life.

Get a glance at the market report of share of various segments Request Free Sample

The Fuel injection segment was valued at USD 3.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

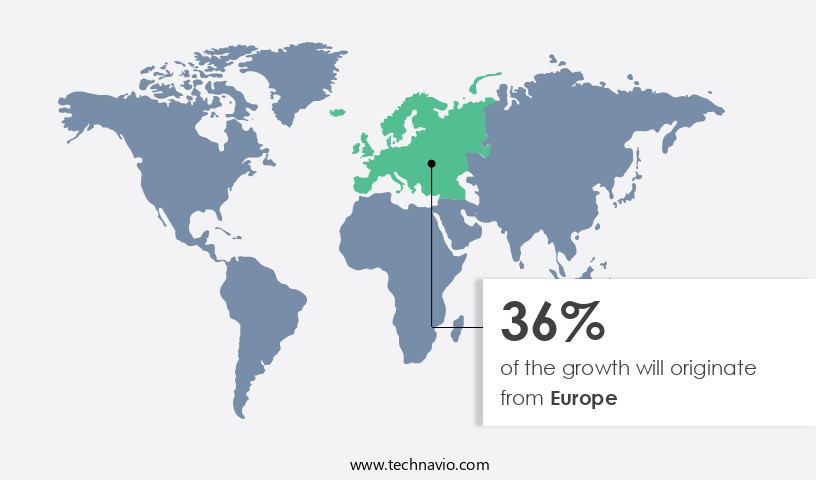

Europe is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market encompasses various components such as fuel tanks, aviation fuel systems, fuel management systems, fuel pumps, fuel distribution systems, fuel delivery systems, fuel gauges, fuel storage systems, refueling systems, fuel transfer systems, fuel valves, fuel filters, fuel lines, fuel sensors, fuel quantity indicators, fuel system integration, fuel system testing, fuel system certification, fuel system safety, fuel efficiency systems, and fuel system optimization. These systems play a crucial role in ensuring the reliable and efficient operation of aircraft. The North American market is significant due to the presence of a large aviation industry, particularly In the US, driven by military procurement programs.

However, the pandemic has adversely affected the aviation industry, leading to production shutdowns for Original Equipment Manufacturers (OEMs) like Boeing and Airbus. Despite challenges, advancements in fuel technology and aviation fuel innovations continue to prioritize fuel system reliability, safety, and optimization.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aircraft Fuel Systems Industry?

- The use of the measured quantity of fuel onboard to optimize performance is the key driver of the market. Aircraft fuel systems play a crucial role in optimizing the efficiency of aircraft by managing the amount of fuel carried on board. Fuel level monitoring is essential to ensure that an aircraft takes off with an optimal fuel load, especially for short-haul flights. Electrical capacitive sensor systems are employed to detect the fuel level in the tank by measuring the capacitance between the plates. These sensors help maintain the system's efficiency by providing real-time fuel level data to the cockpit.

- Moreover, advanced fuel management systems compensate for fuel temperature changes to maintain accurate fuel level readings. The fuel temperature influences the fuel density, and these systems use compensators to adjust the fuel level readings based on the fuel temperature. By utilizing these technologies, aircraft operators can optimize fuel consumption and reduce operational costs.

What are the market trends shaping the Aircraft Fuel Systems Industry?

- Continuous improvements in aircraft components is the upcoming market trend. The global aircraft fuel system market is experiencing significant dynamics due to the expansion of air travel routes, encompassing those at higher altitudes and those crossing the Arctic region. This growth is driven by the increasing airport traffic worldwide. To optimize flight routes and reach higher altitudes swiftly, aircraft require strong fuel systems.

- However, external environmental conditions can change rapidly, posing challenges to fuel systems. Ice formation, fire hazards, and fuel system failures are among the vulnerabilities. To ensure safety, the European Commission and industry players are collaborating to develop more dependable and long-lasting components for aircraft fuel systems. This ongoing effort underscores the importance of investing in advanced fuel system technologies to maintain optimal flight performance and safety.

What challenges does the Aircraft Fuel Systems Industry face during its growth?

- An increase in environmental regulations is a key challenge affecting the industry's growth. In the aviation industry, regulatory bodies such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency mandate safe operating conditions. The US Environmental Protection Agency (EPA) has identified aircraft emissions as a significant contributor to climate change and a threat to human health and the environment. These emissions, primarily from gas turbine engines with a rated thrust above 26 pounds, account for 12% of all US transportation greenhouse gas emissions and 3% of total US greenhouse gas emissions.

- The EPA has identified methane, carbon dioxide, hydrofluorocarbons, nitrous oxide, and other gases as the primary components of aircraft emissions, which contribute to greenhouse gas pollution. The aviation sector's environmental impact necessitates the development and implementation of sustainable fuel systems to reduce emissions and promote eco-friendly practices within the industry.

Exclusive Customer Landscape

The aircraft fuel systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft fuel systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft fuel systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aloft AeroArchitects - The company specializes in providing a range of sports-related offerings, ensuring optimal search engine visibility and delivering comprehensive research insights from a seasoned analyst's perspective.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aloft AeroArchitects

- BAE Systems Plc

- Bryant Fuel Systems

- Collins Aerospace

- Crane Aerospace and Electronics

- Eaton Corp. Plc

- General Atomics

- General Aviation Modifications Inc.

- GKN Aerospace Services Ltd.

- GNY Equipment Inc.

- Honeywell International Inc.

- Melrose Industries Plc

- Nabtesco Corp.

- Parker Hannifin Corp.

- PTI Technologies Inc.

- Safran SA

- Secondo Mona S.p.A.

- Senior Plc

- Triumph Group Inc.

- Woodward Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of components and systems designed to manage and deliver fuel to the engines of aircraft. These systems are essential for ensuring the safe and efficient operation of aviation engines. Fuel management systems play a crucial role in this process, monitoring fuel levels, regulating pressure, and ensuring that fuel is delivered to the engines in the correct quantity and quality. Fuel distribution systems are responsible for transporting fuel from the main fuel tanks to the engines. Fuel pumps play a key role in this process, providing the necessary pressure to move fuel through the system.

Moreover, fuel lines, filters, and valves are also important components of the fuel distribution system, ensuring that fuel flows smoothly and is free of contaminants. Fuel storage systems are another critical aspect of the aircraft fuel system market. These systems are designed to safely store fuel for extended periods, while also ensuring that it remains at the correct temperature and pressure. Fuel gauges and fuel quantity indicators provide pilots with real-time information about fuel levels, allowing them to make informed decisions about fuel consumption and refueling. Aircraft refueling systems are an essential part of the aviation industry, enabling aircraft to be fueled quickly and efficiently on the ground.

Furthermore, fuel transfer systems are used to move fuel between different tanks or fuel trucks and the aircraft, while fuel system integration ensures that all components of the fuel system work together seamlessly. Fuel system safety is a top priority in the aircraft fuel system market. Fuel system testing and certification are rigorous processes designed to ensure that fuel systems meet the highest safety standards. Fuel efficiency systems and fuel system optimization are also important considerations, as fuel is a significant operating cost for airlines. The aircraft fuel system market is driven by several key factors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.45% |

|

Market growth 2024-2028 |

USD 1.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.07 |

|

Key countries |

US, France, Germany, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Fuel Systems Market Research and Growth Report?

- CAGR of the Aircraft Fuel Systems industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft fuel systems market growth of industry companies

We can help! Our analysts can customize this aircraft fuel systems market research report to meet your requirements.