Gas Turbine Market Size 2025-2029

The gas turbine market size is valued to increase USD 3.34 billion, at a CAGR of 2.2% from 2024 to 2029. Enhanced efficiency and robustness of gas turbines will drive the gas turbine market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 48% growth during the forecast period.

- By Product - Heavy-duty gas turbine segment was valued at USD 19.59 billion in 2023

- By Technology - CCGT segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 17.85 million

- Market Future Opportunities: USD 3335.70 million

- CAGR from 2024 to 2029 : 2.2%

Market Summary

- The market experiences continuous expansion due to the increasing demand for reliable and efficient power generation solutions. A significant factor driving this growth is the enhanced efficiency and robustness of gas turbines, making them a preferred choice for various industries, including power generation and aviation. An intriguing trend in the market is the growing use of alternative types of fuel in aeroderivative gas turbines. This shift towards sustainable fuel sources not only reduces carbon emissions but also enhances energy security. For instance, the use of biogas, hydrogen, and synthetic natural gas in gas turbines is gaining momentum.

- Despite these advancements, the market faces inherent challenges, particularly in handling natural gas. The unpredictability of natural gas prices and the need for complex infrastructure to transport and store it pose significant hurdles. Moreover, the environmental concerns associated with natural gas extraction and combustion necessitate continuous innovation to minimize emissions and improve overall sustainability. With the global energy landscape evolving at a rapid pace, gas turbine manufacturers must stay abreast of these trends and challenges to maintain their competitive edge. According to recent reports, The market is expected to reach a value of over USD100 billion by 2027, underscoring its continued importance in the energy sector.

What will be the Size of the Gas Turbine Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Gas Turbine Market Segmented ?

The gas turbine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Heavy-duty gas turbine

- Aeroderivative gas turbine

- Technology

- CCGT

- OCGT

- End-user

- Energy and utilities

- Oil and gas

- Aerospace and defense

- Manufacturing

- Marine

- Capacity

- Above 300 MW

- 40-120 MW

- 120-300 MW

- 1-40 MW

- Application

- Power Generation

- Oil & Gas

- Aviation

- Industrial

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The heavy-duty gas turbine segment is estimated to witness significant growth during the forecast period.

The market is poised for continued growth, driven by the increasing demand for electric power and the shift towards cleaner energy sources. According to Technavio, the power generation sector will witness significant activities, particularly in developing countries, leading to increased demand for heavy-duty gas turbines. These turbines, capable of generating over 300 MW, will play a crucial role in meeting the rising power demands. Gas turbines are increasingly preferred over coal-based power generation due to environmental concerns and their higher energy conversion efficiency. Advanced technologies, such as turbine blade cooling, compressor aerodynamics, and combustion chamber design, are enhancing gas turbine efficiency and reducing fuel consumption rates.

Furthermore, the integration of emissions reduction technologies, such as exhaust gas recirculation and advanced combustion systems, is improving thermal efficiency and reducing carbon emissions. The market is also witnessing advancements in gas turbine maintenance, with the adoption of predictive maintenance techniques and turbine design software, enabling proactive maintenance and reducing downtime. The market is expected to grow at a steady pace during the forecast period, with a significant contribution from aerospace propulsion systems and marine propulsion systems. The market is expected to reach a compound annual growth rate of 5.2% between 2021 and 2026.

The Heavy-duty gas turbine segment was valued at USD 19.59 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Gas Turbine Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth, driven by the region's rapid industrialization and urbanization. Countries such as China, India, and Southeast Asian nations are leading this trend. The increasing demand for electricity to fuel industrial and urban development necessitates efficient power generation solutions. Gas turbines, with their reliability and flexibility, are a preferred choice. APAC's energy demand is among the fastest-growing globally, and gas turbines play a pivotal role in meeting this demand, particularly in industrial hubs, urban centers, and remote locations.

This trend underscores the market's robustness and the essential role gas turbines play in powering modern economies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as industries seek more efficient, reliable, and environmentally-friendly power generation solutions. Advanced cooling techniques for turbine blades and high-temperature combustion process optimization are key areas of focus, with many companies investing in research and development to enhance performance and extend the operational lifespan of their gas turbines. Predictive maintenance strategies are also gaining traction, enabling operators to identify potential issues before they escalate into costly downtime. Aerodynamic design for improved compressor efficiency and the impact of fuel properties on turbine performance are other critical factors shaping the market.

Gas turbine emissions reduction strategies are increasingly important, with companies exploring computational fluid dynamics turbine design, advanced materials for high-temperature applications, and innovative combustion systems to minimize emissions and meet stringent regulations. Condition-based maintenance for increased reliability and lifecycle cost analysis for gas turbine power generation are essential considerations for businesses looking to optimize their operations. Exhaust gas heat recovery systems are also gaining popularity, with many companies focusing on improving their efficiency to reduce energy waste and lower operational costs. Digital twin technology is revolutionizing gas turbine monitoring, providing real-time insights into performance and enabling proactive maintenance.

Advanced control strategies are being employed to optimize turbine performance, while innovative design features for gas turbine components are being explored to enhance durability and reduce maintenance requirements. Structural health monitoring for turbine blades, vibration analysis and fault detection systems, gas path analysis and diagnostics, and maintenance optimization for gas turbine operation are all crucial elements of the market. According to industry reports, more than 70% of new product developments in the power generation sector focus on improving thermal efficiency in combined cycle plants. This underscores the growing importance of advanced technologies and design innovations in the market.

What are the key market drivers leading to the rise in the adoption of Gas Turbine Industry?

- The market's growth is primarily driven by the enhanced efficiency and robustness of gas turbines, making them a preferred choice for power generation due to their reliability and improved performance.

- The market is experiencing significant growth due to the increasing demand for efficient and environmentally friendly power generation solutions. This trend is driven by the implementation of stringent carbon emission regulations and the reduction in the cost of power generation when gas turbines are utilized. Leading manufacturers, including General Electric and Siemens, are investing substantially in the development of high-efficiency gas turbines. For instance, General Electric Power and Water division's 9HA/7HA series CCGT and Siemens' SGT5-8000H are among the high-efficiency gas turbines in a combined-cycle configuration.

- These gas turbines belong to the H class, which is renowned for its superior efficiency levels. The continuous pursuit for more efficient gas turbines will fuel the market's expansion during the forecast period.

What are the market trends shaping the Gas Turbine Industry?

- The increasing adoption of alternative fuel types is a notable trend in the aeroderivative the market. Aeroderivative gas turbines are witnessing significant growth in the use of alternative fuels.

- The fuel cost is a significant component of the overall generation expense in power plants, including those in the marine sector. Aeroderivative gas turbines, a technology designed for fuel flexibility, have gained traction as an alternative to traditional natural gas-powered systems. While natural gas remains the primary fuel for aeroderivative gas turbines, alternative fuel sources are increasingly being explored due to their cost advantages.

- Biofuels and synthetic gases are among the emerging fuel types gaining popularity in the energy sector. However, the economic viability of producing these fuels on a large scale is still under development. The shift towards fuel flexibility is a key trend driving the advancement of new technologies and applications in the energy market.

What challenges does the Gas Turbine Industry face during its growth?

- The natural gas industry faces significant inherent challenges, which pose a key impediment to its growth.

- Natural gas-fired power plants offer improved efficiency compared to coal-fired counterparts. However, the environmental implications of natural gas, specifically methane leaks, pose a significant challenge. Methane, a primary component of natural gas, is 82 times more potent than carbon dioxide in contributing to global warming. Unnoticed methane leaks from natural gas storage are a major concern for environmental advocates. Stricter regulations on natural gas storage for gas turbine power plants are expected, which could potentially impede the expansion of the market.

- The environmental impact of methane leaks underscores the importance of addressing this issue through stringent regulations.

Exclusive Technavio Analysis on Customer Landscape

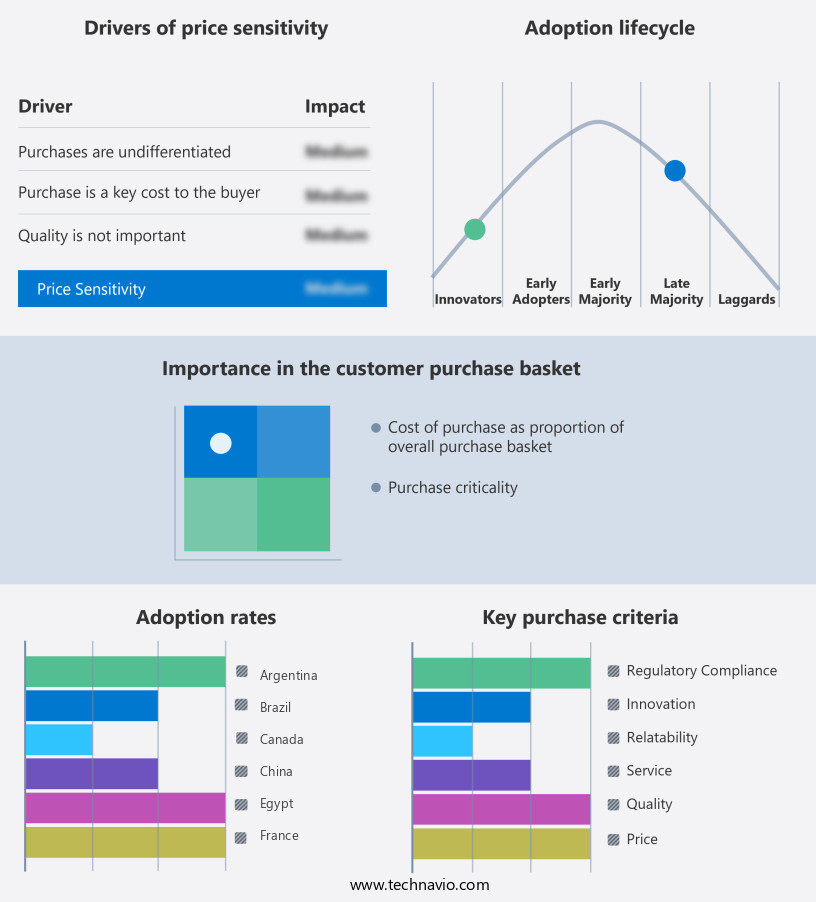

The gas turbine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gas turbine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Gas Turbine Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, gas turbine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ansaldo Energia Spa - This company specializes in innovative gas turbines, known for their durable design and cutting-edge technology. Delivering superior performance, these turbines boast a low environmental footprint, making them a top choice for industries seeking efficient and sustainable energy solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansaldo Energia Spa

- Bharat Heavy Electricals Ltd.

- Capstone Green Energy Corp.

- Caterpillar Inc.

- Destinus Energy

- Doosan Heavy Industries and Construction Co. Ltd.

- GE Vernova Inc.

- Harbin Turbine Co. Ltd.

- IHI Corp.

- Kawasaki Heavy Industries Ltd.

- MAN Energy Solutions SE

- MAPNA Group Co.

- Mitsubishi Power Ltd.

- Motor Sich JSC

- MTU Aero Engines AG

- Rolls Royce Holdings Plc

- Shanghai Electric Group Co.

- Siemens Energy AG

- Solar Turbines Inc.

- Wartsila Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gas Turbine Market

- In January 2024, Siemens Energy and Mitsubishi Power agreed to a strategic collaboration to jointly develop and market hydrogen-ready gas turbines, aiming to reduce carbon emissions in power generation. (Siemens Energy press release)

- In March 2024, GE Gas Power announced the launch of its latest HA+ gas turbine model, featuring advanced technologies to increase efficiency and reduce emissions. This new product is expected to capture a significant market share in the power generation sector. (GE Gas Power press release)

- In May 2024, Siemens Gamesa Renewable Energy and MHI Vestas Offshore Wind completed the merger, creating a leading renewable energy company with a combined market capitalization of over €30 billion. The merger is expected to strengthen their position in the wind energy market and expand their offerings to include gas turbines. (Siemens Gamesa Renewable Energy press release)

- In February 2025, the European Union approved the State Aid Guidelines on the Modernization of the Gas Turbine Fleets, enabling member states to provide financial support for upgrading existing gas turbines to more efficient and cleaner models. This initiative is expected to boost demand for gas turbine technologies in Europe. (European Commission press release)

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gas Turbine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.2% |

|

Market growth 2025-2029 |

USD 3335.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, China, Japan, UK, Canada, India, South Korea, Germany, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the dynamic landscape of industrial power generation, gas turbines continue to command significant attention due to their versatility and efficiency. These machines, integral to both industrial processes and aerospace propulsion systems, undergo constant evolution to meet the demands of a shifting market. Bearing lubrication systems have emerged as a critical focus area, ensuring optimal turbine performance and longevity. Turbine blade cooling systems, too, have gained traction, as they enable higher turbine inlet temperatures, boosting power generation capacity. Lifecycle cost assessment and control system optimization are essential elements in the market. Gas turbine efficiency, a key performance indicator, is continually being pushed to new heights through advancements in combustion systems and fuel consumption rate reduction.

- Turbine blade coatings and materials, compressor aerodynamics, and thermal efficiency improvement are other pivotal areas of research. Gas path analysis and emissions reduction technologies are crucial for reducing specific fuel consumption and ensuring environmental sustainability. The market encompasses a wide range of applications, from power generation and aerospace to marine propulsion. Advanced combustion systems and turbine design software are driving innovation in this sector, with high-pressure and low-pressure turbines benefiting from these advancements. Vibration monitoring systems and turbine rotor dynamics are essential for maintaining the health of these complex machines. Predictive maintenance techniques, such as exhaust gas recirculation and turbine blade materials analysis, are revolutionizing gas turbine maintenance.

- In the realm of aerospace propulsion, gas turbines are pushing the boundaries of energy conversion efficiency and specific fuel consumption. The integration of turbine blade cooling, advanced combustion systems, and emissions reduction technologies is paving the way for more efficient and sustainable aviation. In the industrial power generation sector, gas turbines are playing a vital role in meeting the world's growing energy demands while minimizing environmental impact. The market for these machines is expected to witness robust growth, with bearing lubrication systems, turbine blade cooling, and control system optimization being key drivers. According to recent studies, the market is projected to account for over 40% of the global power generation market by 2026.

- This underscores the market's significance and the potential opportunities it presents for innovators and investors alike.

What are the Key Data Covered in this Gas Turbine Market Research and Growth Report?

-

What is the expected growth of the Gas Turbine Market between 2025 and 2029?

-

USD 3.34 billion, at a CAGR of 2.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Heavy-duty gas turbine and Aeroderivative gas turbine), Technology (CCGT and OCGT), End-user (Energy and utilities, Oil and gas, Aerospace and defense, Manufacturing, and Marine), Capacity (Above 300 MW, 40-120 MW, 120-300 MW, and 1-40 MW), Geography (APAC, North America, Europe, Middle East and Africa, and South America), and Application (Power Generation, Oil & Gas, Aviation, and Industrial)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Enhanced efficiency and robustness of gas turbines, Inherent challenges in handling natural gas

-

-

Who are the major players in the Gas Turbine Market?

-

Ansaldo Energia Spa, Bharat Heavy Electricals Ltd., Capstone Green Energy Corp., Caterpillar Inc., Destinus Energy, Doosan Heavy Industries and Construction Co. Ltd., GE Vernova Inc., Harbin Turbine Co. Ltd., IHI Corp., Kawasaki Heavy Industries Ltd., MAN Energy Solutions SE, MAPNA Group Co., Mitsubishi Power Ltd., Motor Sich JSC, MTU Aero Engines AG, Rolls Royce Holdings Plc, Shanghai Electric Group Co., Siemens Energy AG, Solar Turbines Inc., and Wartsila Corp.

-

Market Research Insights

- The industrial the market is characterized by continuous advancements in technology, driven by the need for higher efficiency, operational reliability, and emissions reduction. Pressure ratio optimization and data analytics techniques play a significant role in enhancing turbine performance. For instance, high-temperature materials and seal integrity assessment contribute to extended component lifespan and improved thermal stress analysis. Gas turbine upgrades, such as control algorithm tuning and nox emissions control, are essential for power plant modernization and fuel efficiency increase. Renewable energy integration and condition-based maintenance are becoming increasingly important, with power output improvement and rotor balancing methods being key focus areas.

- Fault detection systems and cooling air management are also critical for ensuring operational reliability. Aerodynamic design improvements and computational fluid dynamics simulations help in optimizing turbine blade fabrication, utilizing advanced materials like ceramic matrix composites. Structural health monitoring and maintenance scheduling are integral to ensuring the longevity of industrial gas turbines. The market also encompasses the development of advanced technologies for aircraft engine applications, including fault detection systems, combustion stability, and co emissions reduction. Marine gas turbines represent another significant segment, with a focus on power output improvement and fuel efficiency increase.

We can help! Our analysts can customize this gas turbine market research report to meet your requirements.