Automotive Two-Post Lift Market Size 2024-2028

The automotive two-post lift market size is forecast to increase by USD 655.9 million at a CAGR of 9.59% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. The increasing market for four-wheelers and the rising average age of vehicles are driving the automotive repair and maintenance service industry, thereby fueling the demand for two-post lifts. Raw material costs and logistics and distribution challenges pose challenges, but technology innovations such as artificial intelligence and machine learning are addressing these issues. Additionally, the increasing repair and maintenance costs in automobiles are compelling garage owners and workshops to invest in advanced and efficient lifting solutions, such as two-post lifts, to enhance productivity and reduce labor costs. These trends are expected to continue, making the market an attractive investment opportunity for manufacturers and suppliers.

What will be the Size of the Automotive Two-Post Lift Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to increasing vehicle numbers and the aging fleet requiring frequent maintenance in automotive service centers, repair shops, and garages. Developing economies also contribute to the market expansion as their growing middle class invests in personal transportation, particularly passenger cars. Light-duty automotive two-post lifts remain popular solutions for 4s shops and automobile repair businesses due to their versatility and production capacity.

- Market dynamics include rising part prices and vehicle complexity, which necessitate advanced two-post lifts to accommodate various vehicle types. Furthermore, the growing focus on safety and efficiency in automotive repair and maintenance services is also boosting the market growth. Additionally, the shift towards electric vehicles, IoT, and automation is driving the market towards safety standards and advanced features, ensuring a strong future for the automotive two-post lift industry.

How is this Automotive Two-Post Lift Industry segmented and which is the largest segment?

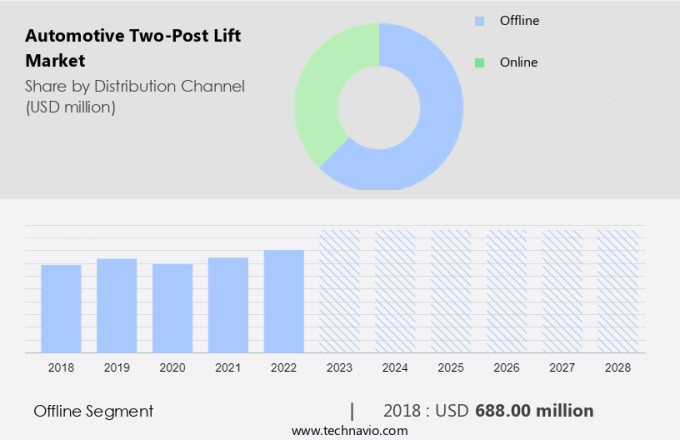

The automotive two-post lift industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Vehicle Type

- Passengers

- Commercial

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market is experiencing growth due to the increasing sales of passenger cars and commercial vehicles. This trend is driven by the preference for privately-owned vehicles and the growing economy in various regions. The market is segmented into online and offline channels for distribution. Online channels, including e-commerce platforms and direct sales, are expected to grow at a faster pace due to the convenience and accessibility they offer. In contrast, offline channels, including automotive part and component stores, distributors, independent retailers, and specialty retailers, are projected to grow at a slower pace.

The demand for automotive two-post lifts is fueled by the increasing number of vehicles worldwide, with significant sales in countries such as the US and China. Manufacturers focus on using raw materials and advanced technology to increase production capacity and meet market demand.

Get a glance at the Automotive Two-Post Lift Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 688.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

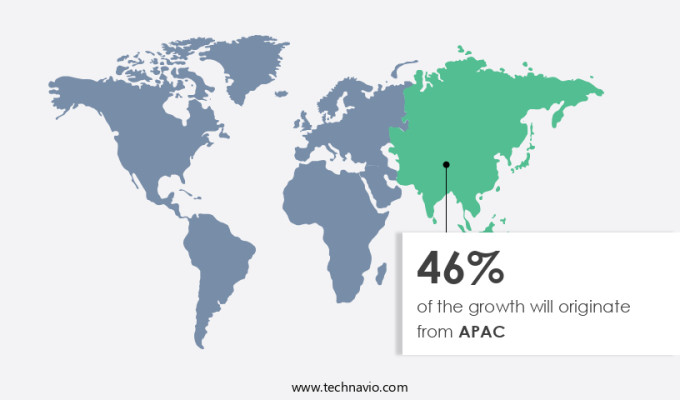

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is currently the fastest-growing market for automotive two-post lifts. With high volumes of passenger car sales, countries such as China, India, Japan, and South Korea are significant contributors to this market's growth. In 2023, approximately 21.7 million units of passenger cars were sold in China, representing a 6.6% year-on-year increase. The passenger car segment in APAC is projected to expand at a faster rate than other regions during the forecast period, leading to increased demand for automotive two-post lifts. This trend is expected to strengthen APAC's position In the market.

Market Dynamics

Our automotive two-post lift market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Automotive Two-Post Lift Industry?

The growing market for four-wheelers is the key driver of the market.

- The market is experiencing significant growth due to the increasing vehicle numbers, particularly In the passenger cars segment, in developing economies. The aging fleet In the US and other regions necessitates regular maintenance, driving the demand for automotive service centers, repair shops, and garages. The rise in part prices and vehicle complexity, coupled with raw material costs and logistics and distribution challenges, are key factors influencing the market. Vehicle maintenance solutions are increasingly adopting advanced technologies such as artificial intelligence, machine learning, electric vehicles, IoT, automation, and safety standards to enhance reliability and safety. These technological advancements are transforming the market, with auto manufacturers integrating diagnostic tools and self-leveling capabilities into their products.

- Moreover, the residential sector is emerging as a new market for automotive two-post lifts as consumers seek to perform repairs and maintenance tasks at home. The market's growth is further fueled by the increasing production capacity and raw materials availability, as well as the ongoing technological innovations. Despite the challenges, the market's future looks promising, with continued investment in research and development and a focus on improving safety standards and customer experience. The market is poised for sustained growth, offering significant opportunities for stakeholders In the automotive repair shop, 4S shop, and production industries.

What are the market trends shaping the Automotive Two-Post Lift Industry?

Increasing the average age of vehicles to push the automotive repair and maintenance service industry is the upcoming market trend.

- The market is driven by the growing demand for vehicle maintenance solutions in both developing and developed economies. The increasing number of passenger cars and four-wheelers on the road, particularly due to the aging fleet in developed regions, is fueling this demand. In the US, for instance, the average age of vehicles has been on the rise, reaching an all-time high in recent years. This trend is similar In the EU, where the average age of vehicles has increased by approximately two years In the last five years.

- The market is also influenced by various factors such as part prices, vehicle complexity, raw material costs, logistics and distribution, and safety and reliability concerns. The integration of advanced technologies like artificial intelligence, machine learning, IoT, automation, and safety standards in automotive two-post lifts is further enhancing their appeal to automobile repair shops, 4S shops, garages, and the residential sector. The market is also witnessing significant growth due to the increasing production capacity and technological advancements in raw materials and diagnostic tools.

What challenges does the Automotive Two-Post Lift Industry face during its growth?

Increasing repair and maintenance costs in automobiles is a key challenge affecting the industry's growth.

- The market faces a significant challenge due to escalating repair and maintenance costs. The aging fleet of vehicles, with an increasing average age, is a primary factor driving up repair expenses. Modern passenger cars and four-wheelers, particularly those In developing economies, are becoming more complex, leading to higher labor rates and pricier parts. Raw material costs, such as those for steel and aluminum, also contribute to the rising part prices. Automotive service centers, repair shops, garages, and 4S shops In the residential sector are all impacted by these trends. The reliability and safety of modern vehicles necessitate the use of advanced diagnostic tools and technologies, including artificial intelligence, machine learning, IoT, automation, and safety standards.

- These technologies are integrated into automotive two-post lifts, further increasing their cost. Moreover, the production capacity of auto manufacturers is also affected by these factors, as they must invest in new technologies and raw materials to keep up with the evolving market. The increasing complexity of vehicles and the need for smart technologies in automotive two-post lifts necessitate a focus on logistics and distribution to ensure timely delivery and efficient operations.

Exclusive Customer Landscape

The automotive two-post lift market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive two-post lift market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive two-post lift market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aichi Brand

- Amfos International

- ARI HETRA

- ATS ELGI

- BendPak Inc.

- Challenger Lifts Inc.

- EAE Automotive Equipment Co. Ltd.

- Force Auto Solutions

- Hunter Engineering Co.

- LAUNCH Shanghai Machinery Co. Ltd.

- MAHA Maschinenbau Haldenwang GmbH and Co. KG

- MBL Impex Pvt. Ltd.

- Newtech Equipment

- Nussbaum Automotive Solutions LP

- PEAK Corp.

- PRAMUKH EQUIPMENTS

- Rotary Lift

- Shailendra Enterprises

- Shivalik Automotive Garage Equipments

- Stertil Koni USA Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a significant segment of the global automotive service industry. This market caters to the lifting requirements of various vehicle types, including passenger cars and four-wheelers, in both commercial and residential sectors. The demand for automotive two-post lifts is driven by several factors, primarily the aging fleet and the increasing complexity of vehicles. Developing economies are witnessing a rise in automotive growth, leading to an increase In the number of repair shops, garages, and automotive service centers. The need for efficient and effective vehicle maintenance solutions is on the rise, fueling the demand for automotive two-post lifts.

Moreover, these lifting systems offer numerous advantages, such as reliability, safety, and versatility, making them an essential tool for automobile repair shops and 4S (Sales, Service, Spare parts, and Solutions) shops. The production capacity of automotive two-post lifts is influenced by several factors, including raw material costs, logistics and distribution, and technology advancements. Raw material costs have been a significant concern for manufacturers, with fluctuations in prices impacting the overall cost structure of the lifting systems. Technology, on the other hand, plays a crucial role in enhancing the functionality and efficiency of automotive two-post lifts. Artificial intelligence (AI) and machine learning are increasingly being integrated into automotive two-post lifts, enabling self-leveling capabilities and smart technologies.

Furthermore, these advancements improve the lifting experience, ensuring precise positioning and optimal use of space. Additionally, the growing popularity of electric vehicles is driving innovation In the market, with manufacturers focusing on developing lifting systems compatible with these vehicles. The Internet of Things (IoT) and automation are transforming the automotive service industry, and automotive two-post lifts are no exception. These technologies enable remote monitoring, predictive maintenance, and real-time data analysis, enhancing the overall efficiency and productivity of repair shops and garages. Furthermore, safety standards continue to evolve, with manufacturers prioritizing safety features In their automotive two-post lifts to ensure the well-being of technicians and vehicle owners.

|

Automotive Two-Post Lift Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.59% |

|

Market growth 2024-2028 |

USD 655.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.52 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Two-Post Lift Market Research and Growth Report?

- CAGR of the Automotive Two-Post Lift industry during the forecast period

- Detailed information on factors that will drive the Automotive Two-Post Lift growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive two-post lift market growth of industry companies

We can help! Our analysts can customize this automotive two-post lift market research report to meet your requirements.