Music Market Size 2025-2029

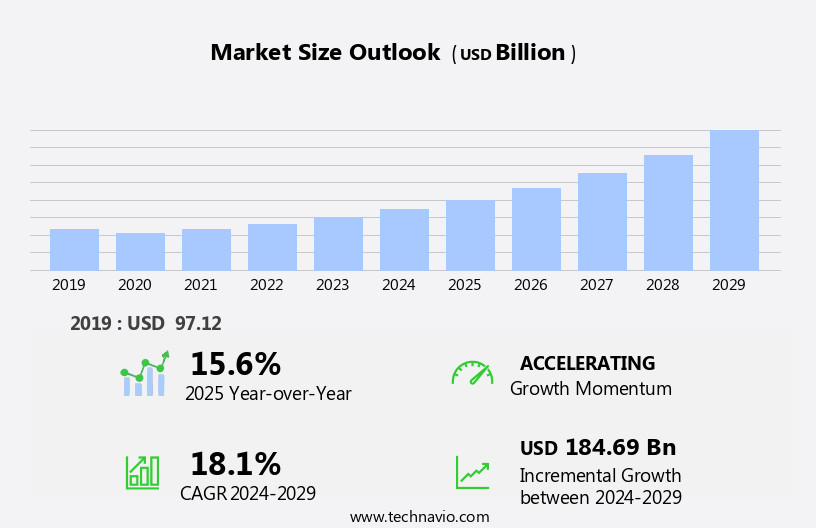

The music market size is forecast to increase by USD 184.69 billion, at a CAGR of 18.1% between 2024 and 2029.

- The digital transformation of the music industry is actively reshaping the global music market, driven by the increasing adoption of digital music platforms. These platforms are altering how consumers access content, shifting listening behaviors toward personalized, on-demand experiences. This evolving landscape is encouraging new business models and expanding opportunities across licensing, distribution, and artist engagement. Strategic alliances and new entrants continue to intensify competition, further accelerating innovation in platform features, pricing strategies, and content curation methods. As players seek competitive advantage, the market is witnessing continual realignment through mergers and acquisitions, reflecting an ongoing effort to consolidate market share and scale offerings.

- Despite this momentum, the market faces a persistent challenge illegal downloads and piracy. This issue significantly undermines the revenue potential of legitimate streaming services and complicates efforts to enforce copyright protections. Comparatively, while digital music platform adoption continues to grow steadily, the prevalence of piracy continues to offset gains in monetization. This contrast highlights the need for comprehensive industry collaboration to ensure both secure access and sustainable growth.

Major Market Trends & Insights

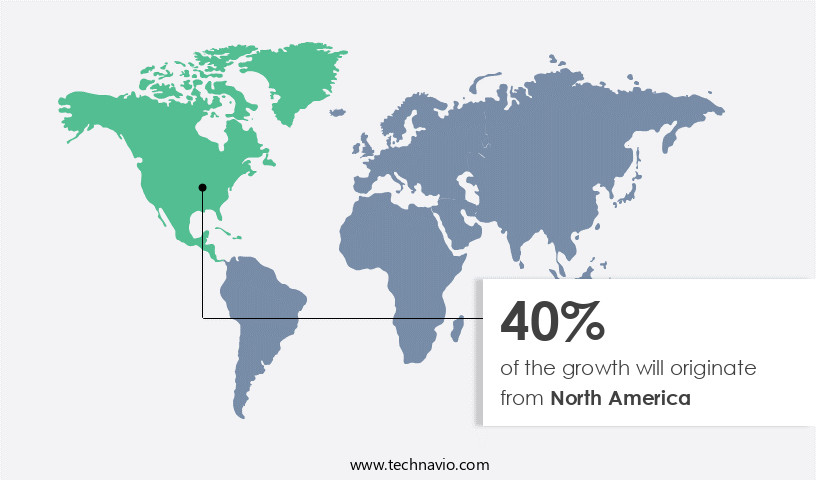

- North America dominated the market and accounted for a 40% share in 2023

- The market is expected to grow significantly in North America region as well over the forecast period.

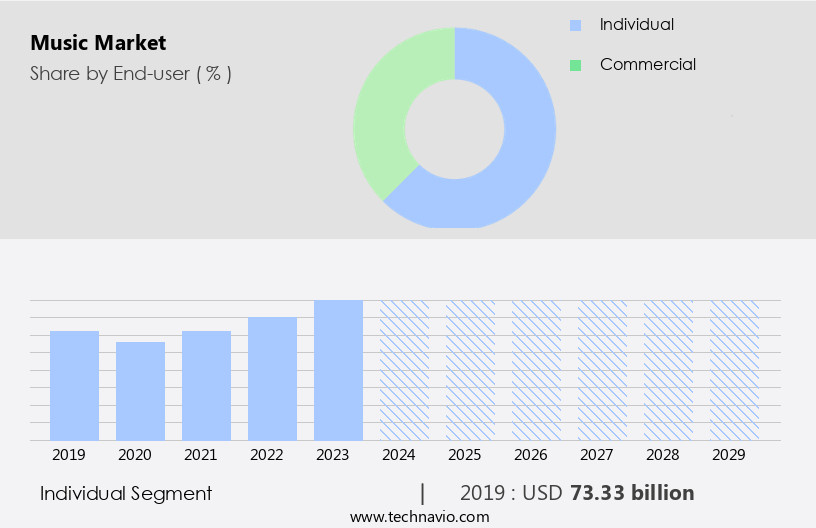

- Based on the End-user, the individual segment led the market and was valued at USD 93.42 billion of the global revenue in 2023

- Based on the Source the Recording accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 237.19 Bilion

- Future Opportunities: USD 184.69 Billion

- CAGR (2024-2029): 18.1%

- APAC : Largest market in 2023

What will be the Size of the Music Market during the forecast period?

- The global music market is experiencing continuous evolution driven by innovation across digital rights management (DRM), music recommendation systems, and personalized playlists. As user experience (UX) design and audience engagement metrics reshape how music is consumed and monetized, platforms are integrating immersive audio and interactive music experiences to better align with audience behavior. AI music generation and music discovery tools are also becoming integral, enhancing the efficiency of music recommendation algorithms and enabling dynamic user interaction across streaming services and music licensing platforms. Growth in music technology has introduced loop libraries, sample packs, and advanced plugin development, driving demand for high-performance audio plugins and flexible music software.

- Meanwhile, music hardware is evolving to support 3D audio capabilities, further elevating listening experiences. Challenges such as music piracy and music copyright infringement are prompting stronger music licensing agreements and improved music search frameworks. Educational shifts are evident through online music education, while artists increasingly explore global music collaborations and use music visualization tools to engage audiences across digital and live formats.

- A major shift is underway as mobile music production, home recording studios, and virtual instruments redefine the creative process, empowering independent creators and expanding access to professional-grade tools. The rise of live streaming concerts, interactive music scores, and virtual concerts reflects growing demand for virtual-first music consumption. Additionally, lossless audio, spatial audio, and high-resolution audio formats are gaining traction, driven by a user base that increasingly values sound fidelity alongside convenience.

- Current adoption of digital music distribution systems has expanded by 28.4%, demonstrating a clear preference for platform-based access and convenience over traditional formats. In contrast, growth expectations for digital music licensing are set at 46.7%, indicating a faster acceleration in rights-based monetization relative to distribution infrastructure. This contrast highlights the industry's shift toward more sophisticated rights management and monetization models, reinforcing the need for comprehensive music metadata, streaming analytics, and music data analytics to support licensing, royalties, and copyright enforcement.

How is this Music Industry segmented?

The music industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Individual

- Commercial

- Source

- Recording

- Live

- Licensing

- Distribution Channel

- Physical

- DigitalLive Events

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The individual segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by advancements in technology and consumer preferences. Music streaming platforms have become increasingly popular, with mobile data traffic surging due to the proliferation of 4G and 3G networks. This trend is particularly notable in the individual user segment, which is expected to dominate the market. Music licensing, a key component of the market, is benefiting from the rise of streaming services and podcast hosting. Digital music distribution and music education are also thriving, with music notation software, music theory, and music production techniques gaining traction. R&B, country music, electronic music, and hip hop continue to be popular genres, while classical music and world music are also seeing growth.

Brass instruments, woodwind instruments, string instruments, and electronic instruments are in demand for live music events and studio recordings. Music merchandising, music festivals, and talent scouting are other areas of growth. Intellectual property, effects processors, and music therapy are also gaining importance. Record labels, artist management, and music promotion are essential services in the market. Music history and Music Publishing are integral to the industry's rich heritage. Overall, the market is an ever-evolving landscape, with innovation and creativity at its core.

The Individual segment was valued at USD 73.33 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American the market of 2024, streaming revenue experienced significant double-digit growth. The US dominated this market due to its large population base and numerous music publishers and streaming service providers. Apple and Spotify, two major streaming service players, each boasted paid subscriber bases surpassing 25 million. Companies in the region are expanding their influence by collaborating with artists for exclusive content or acquiring smaller global the market entities. The music industry is a dynamic landscape, with various genres including R&B, country, electronic, folk, hip hop, and classical gaining traction. Musicians are engaging fans through live events, merchandise, and digital distribution.

Musical instruments, from brass and woodwind to electronic and string, continue to be in demand for both amateur and professional use. Music education and theory are essential components of the industry, with various resources available for learners. The market also encompasses music licensing, production techniques, sound design, and music therapy. Music promotion through various channels, including podcast hosting and social networking and media, is crucial for artists seeking to build a fanbase. Record labels, A&R, and artist management play vital roles in the industry, while music festivals showcase diverse genres and talent scouting opportunities. Intellectual property protection is crucial in the music industry, with effects processors, midi controllers, and audio interfaces being essential tools for music production. Overall, the North American the market is a thriving, innovative industry that continues to evolve with technology and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global music market continues to evolve as digital innovation reshapes the way music is created, distributed, and experienced. Central to this evolution is the influence of technology on music creation and distribution, where digital signal processing plays a crucial role in shaping production quality. The development of new audio signal processing algorithms enables producers to push creative boundaries while maintaining precise control over sound elements. Applications of artificial intelligence in music composition and the implementation of machine learning in music recommendation are driving personalization and discovery, enhancing user engagement and reshaping consumption patterns. The examination of music streaming business models highlights how monetization strategies are adapting in real time to shifting listener behaviors.

A critical aspect of quality in this market lies in the impact of audio compression on music quality. The comparison of lossless and lossy audio codecs shows measurable differences in clarity and fidelity that directly affect the listener's experience. Studies have also delved into the effects of room acoustics on sound perception, underlining the importance of environment in professional and consumer audio setups. Evaluations of different audio mixing techniques and the analysis of musical instrument design parameters further demonstrate the market's depth in supporting innovation and experimentation. The relationship between music and emotional response, along with the impact of virtual reality on live music experiences, reflects growing integration between music and immersive technology. Meanwhile, ongoing study of music copyright and licensing issues and the investigation into music information retrieval systems ensure that content management and ownership remain aligned with market growth and consumer expectations.

What are the key market drivers leading to the rise in the adoption of Music Industry?

- The global music market continues to evolve as the usage of digital music accelerates across consumer and professional segments. Advances in cloud integration and device interoperability are reshaping how users create, edit, and distribute music content, while demand for flexible software tools supports expanded adoption across education, entertainment, and commercial industries. This ongoing shift in user engagement models is driving increased investments in product innovation and service scalability.

- Digital music consumption remains a central driver, contributing to a 12.6% increase in software adoption compared to the previous year. In contrast, future projections indicate a 14.3% expected growth rate over the next cycle, reflecting expanding user bases and deeper platform integration. This difference underscores a steady upward trend aligned with emerging technologies and user expectations for mobility, personalization, and collaborative workflows. The market's pace of expansion continues to be shaped by evolving delivery formats, AI-driven personalization, and cloud-based production environments.

What are the market trends shaping the Music Industry?

- The global music market is experiencing evolving structural shifts, with a notable increase in mergers and acquisitions alongside strategic alliances among companies. These collaborative efforts are transforming competitive dynamics by enabling resource pooling, expanding product portfolios, and accelerating entry into high-growth segments such as AI-assisted composition and remote collaboration tools. The consolidation trend is also helping streamline innovation pipelines and scale distribution networks across digital platforms.

- Current consolidation activities have driven a 9.8% increase in joint ventures and acquisitions year-over-year, reflecting heightened strategic alignment across firms. Future expectations project a 13.1% growth in alliance-based initiatives, signaling continued momentum in market unification and shared technology development. This comparison highlights how the market's evolution is increasingly shaped by synergistic strategies that emphasize interoperability, platform expansion, and sustained product differentiation across both consumer and enterprise user bases.

What challenges does the Music Industry face during its growth?

- Piracy and illegal downloads continue to pose a significant threat to the global music market, undermining legitimate revenue streams and deterring investment in product innovation. These unauthorized distribution channels reduce the incentive for developers to enhance features or maintain quality standards, affecting overall market stability. Additionally, widespread access to cracked software erodes brand value and skews usage data critical to product development strategies.

- The current market impact of piracy is reflected in a 12.4% estimated loss in potential revenue attributed to unauthorized downloads. Future projections indicate that if left unchecked, piracy-related losses could rise by 15.6%, creating further financial strain across the value chain. This data comparison underscores the urgency for enhanced digital rights management, legal enforcement mechanisms, and user education to safeguard long-term industry growth and ensure fair monetization of creative and technical assets.

Exclusive Customer Landscape

The music market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the music market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, music market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - This company delivers music services encompassing audio streaming, video content, and lyrical information, enhancing user experience through innovative technology and extensive content library.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Apple Inc.

- Bertelsmann SE and Co. KGaA

- Curb Records Inc.

- Deezer SA

- Kobalt Music Group Ltd.

- NORTHERN MUSIC Co. Ltd.

- Pioneer Music Co.

- Sirius XM Holdings Inc.

- Sony Group Corp.

- Spotify Technology SA

- Tencent Music Entertainment Group

- THEME MUSIC Co. Pvt. Ltd.

- TIDAL

- Universal Music Group N.V.

- Vivendi SE

- Warner Music Group Corp.

- Yamaha Corp.

- YouTube

- Zee Entertainment Enterprises Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Music Market

- In January 2024, Spotify, a leading music streaming platform, announced the launch of "Spotify HiFi," a high-fidelity sound quality tier, aiming to offer lossless audio and high-resolution streaming for select premium subscribers (Spotify Press Release, 2024).

- In March 2024, Apple Music and Amazon Music entered into a strategic partnership, allowing Amazon Music users to access Apple Music's catalog through Alexa voice commands and Amazon's music app (Apple Press Info, 2024).

- In May 2024, Tencent Music Entertainment, the largest music streaming platform in China, completed a USD1.1 billion funding round, led by Alibaba Group Holding, further solidifying its market dominance (Reuters, 2024).

- In April 2025, the European Union passed the Digital Single Market Act, which aims to create a unified digital market for music streaming services, enabling easier access to music across borders and promoting fair competition (European Commission, 2025).

Research Analyst Overview

- The global music market continues to evolve as digital audio workstations, audio engineering techniques, and music licensing models reshape production and distribution. With growing integration of music marketing strategies and streaming services, the industry is leveraging fan engagement and music promotion tools to align with changing consumer behaviors. As digital music distribution increases recording a 28.4% rise platforms are adapting to support intellectual property management and music publishers with improved analytics.

- Simultaneously, industry growth expectations for music licensing stand at 46.7%, reflecting increased demand for content monetization through rights-based models. From podcast hosting to music education and therapy applications, software innovations support diverse sectors, including live music events, music theory training, and electronic instruments. Advancements in studio equipment, effects processors, and MIDI controllers enable broader accessibility to music production techniques, while music streaming platforms and artist management systems facilitate real-time audience interaction and talent scouting within an increasingly digitized creative economy.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Music Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.1% |

|

Market growth 2025-2029 |

USD 184.69 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.6 |

|

Key countries |

US, Germany, Canada, UK, China, France, Japan, South Korea, Italy, The Netherlands, UAE, Brazil, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Music Market Research and Growth Report?

- CAGR of the Music industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the music market growth of industry companies

We can help! Our analysts can customize this music market research report to meet your requirements.