Music Publishing Market Size 2025-2029

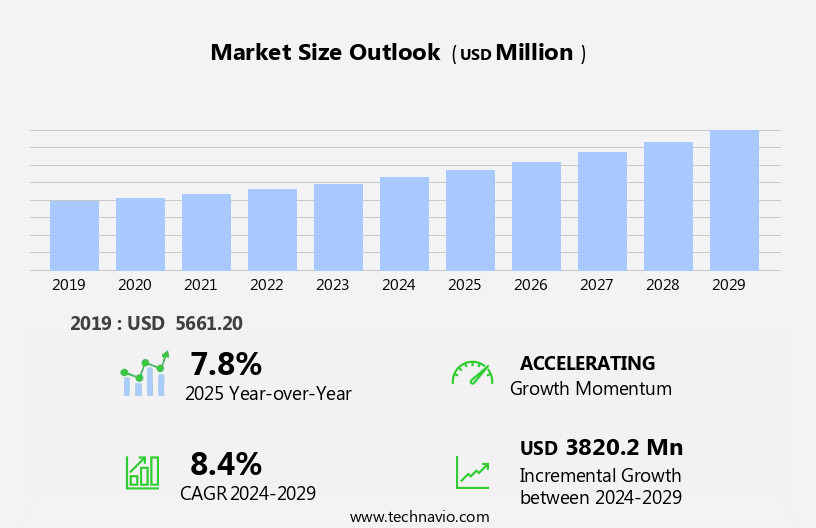

The music publishing market size is forecast to increase by USD 3.82 billion, at a CAGR of 8.4% between 2024 and 2029.

- The market is poised for significant growth, driven by the expansion of the global music industry and the burgeoning advertising sector. The music industry's resurgence is fueled by the increasing popularity of digital platforms and the rise of streaming services. Simultaneously, the advertising industry's evolution towards more personalized and engaging content has created a demand for high-quality music in commercials and promotional materials. However, the market faces challenges as well. The lack of clear ownership structures for streaming music and the complexities of integrating music rights into digital platforms pose significant hurdles. These issues require innovative solutions to ensure that content creators and publishers are fairly compensated while maintaining the ease of use and accessibility that consumers demand.

- Companies seeking to capitalize on market opportunities must navigate these challenges effectively, fostering collaborative partnerships and employing advanced technology to streamline licensing and royalty management processes. By doing so, they can seize the potential of this dynamic market and contribute to its continued growth.

What will be the Size of the Music Publishing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic market forces and technological advancements. Entities such as record labels, music publishers, and independent artists navigate this landscape, engaging in various activities to monetize musical compositions and recordings. Publishing agreements, copyright registration, and licensing agreements form the backbone of this industry, safeguarding compositional elements and securing revenue streams. Digital distribution channels, including streaming services and digital platforms, have revolutionized access to music, leading to new revenue models and creative services. Performance rights, synchronization rights, and mechanical rights are essential components of this market, ensuring artists and publishers receive fair compensation for their work.

Music technology, including audio plugins, music editing software, and master recordings, plays a crucial role in the production process. Music therapy, music libraries, and music education are emerging sectors, demonstrating the versatility and reach of music in various applications. Regulations and industry standards, such as data analytics, legal services, and financial services, help maintain order and foster growth. The continuous unfolding of market activities and evolving patterns is evident in areas like sound design, music supervision, and public relations. As technology advances and consumer preferences shift, the market adapts, ensuring its relevance and impact in an ever-changing world.

How is this Music Publishing Industry segmented?

The music publishing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Live performance

- Digital

- Mehanical

- Synchronization

- Synchronization

- Others

- Application

- Commercial

- Non-commercial

- Other

- Type

- Royalties

- Licensing

- Subscription

- Administration

- Catalog Acquisition

- Advances

- Direct Publishing

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

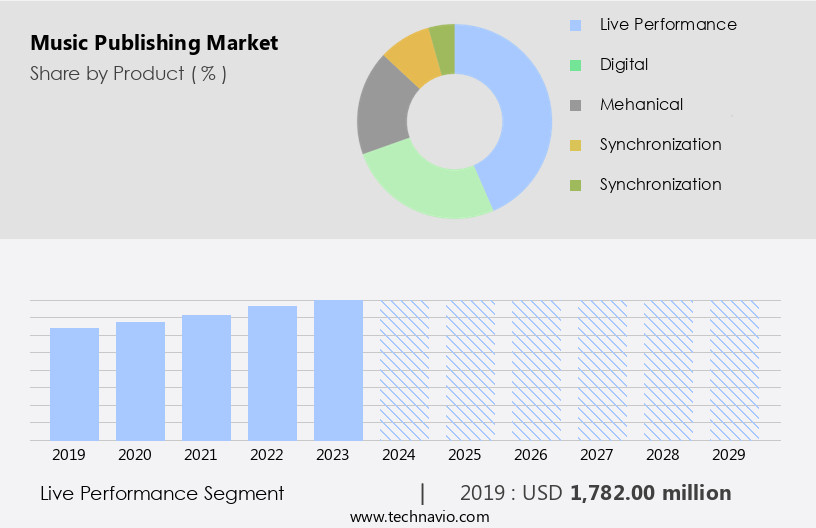

The live performance segment is estimated to witness significant growth during the forecast period.

The market is characterized by the integration of various entities, including international copyright treaties, digital distribution, publishing agreements, musical notation, music piracy, time signature, compositional elements, sound design, record labels, copyright registration, copyright infringement, music editing, distribution channels, music technology, public relations, independent artists, music production, music education, music supervisors, sync licensing, music publishers, audio plugins, synchronization rights, master recordings, artist management, streaming royalties, digital platforms, creative services, music therapy, music libraries, key signature, music industry regulations, data analytics, sheet music, musical compositions, mechanical rights, physical media, album artwork, streaming services, legal services, digital audio files, financial services, and licensing agreements.

The live performance segment is experiencing notable growth in The market. This expansion is attributed to the escalating number of musicians, artists, and disc jockeys, fueling the growing interest in music. Furthermore, the demand for live performances is on the rise, owing to the increasing number of music festivals such as Electric Daisy Carnival, Tomorrowland, New Orleans Jazz and Heritage Festival, Sziget Festival, Rock in Rio, and Liverpool Sound City, which attract millions of music enthusiasts annually. Music technology plays a pivotal role in the market, enabling digital distribution, music editing, and sound design. Copyright registration and licensing agreements are crucial components of the music publishing process, ensuring that composers and publishers receive fair compensation for their work.

Music piracy remains a significant challenge, necessitating the implementation of robust anti-piracy measures. Performance rights organizations and artist management companies play a crucial role in collecting and distributing royalties to artists and composers. Streaming services and digital platforms have revolutionized the way music is consumed, leading to new revenue models and opportunities for independent artists. Music education and music therapy are emerging areas of growth, with a growing recognition of the therapeutic benefits of music. In conclusion, the market is a dynamic and evolving industry, shaped by a complex interplay of various entities and trends. From live performances and music technology to copyright regulations and artist management, the market presents numerous opportunities and challenges for stakeholders.

The Live performance segment was valued at USD 1.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

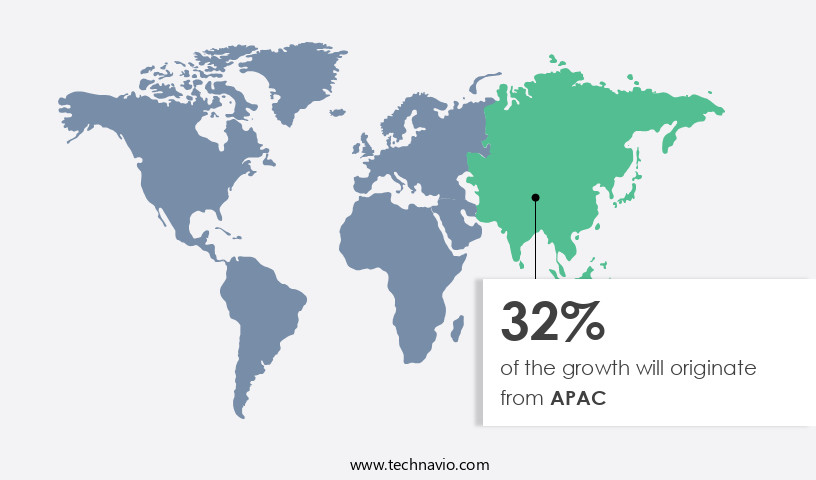

APAC is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth, driven by the rising number of music publishing deals, particularly among independent and established publishing houses in the US. Major music publishing companies like Sony Music Publishing LLC (Sony Music), Universal Music Publishing Group (UMPG), and Warner Music Group (Warner Music) provide platforms for numerous musicians, including Post Malone, Justin Bieber, Ed Sheeran, and Shawn Mendes, to showcase their talents. Live music events are prevalent in North America, with annual festivals such as Voodoo Music + Arts Experience, Electric Daisy Carnival, New Orleans Jazz and Heritage Festival, and Kaaboo, attracting large crowds.

Music piracy remains a challenge, but digital distribution and licensing agreements have mitigated its impact. Musical notation, compositional elements, and sound design are essential aspects of music production, with music technology and audio engineering playing significant roles. Record labels, copyright registration, and performance rights organizations facilitate revenue generation through various revenue models, including streaming royalties and mechanical rights. Music education, music therapy, and creative services are expanding markets, with music libraries and streaming services offering access to vast musical compositions. Sync licensing, artist management, and public relations are crucial components of the music industry, while music supervisors and master recordings ensure synchronization rights for various media projects.

Music publishing agreements, distribution channels, and legal services are essential for managing copyright infringement and ensuring financial services for artists. Data analytics and sheet music sales provide valuable insights into market trends and consumer preferences. In summary, the North American the market is dynamic, with various entities, including music publishers, record labels, music technology companies, and artists, collaborating to create, distribute, and monetize musical compositions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Nestled within the dynamic and ever-evolving world of music, the market plays a pivotal role in bringing compositions to life. This market encompasses licensing, distribution, and royalty collection for musical works, bridging the gap between creators and users. Publishers curate and manage copyrights, securing opportunities for songwriters and artists to monetize their intellectual property. They collaborate with music supervisors, filmmakers, and advertisers to place compositions in various media, ensuring a steady revenue stream. Digital platforms, streaming services, and sync licensing are key components, driving growth and innovation in this market. Publishers also offer services like sheet music production and educational resources, catering to diverse audiences. Overall, the market is an integral part of the music industry, fostering creativity, and providing financial sustainability for music creators.

What are the key market drivers leading to the rise in the adoption of Music Publishing Industry?

- The global music industry's growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth, driven by several key factors. One of the primary drivers is the increasing popularity of music streaming services, with paid subscriptions accounting for approximately one-third of recorded music revenue in 2024. Interactive streaming platforms such as YouTube, Spotify, Apple Music, and Amazon Music Unlimited are particularly influential in this growth. Additionally, the passion for music among people continues to fuel the market, as evidenced by the rising number of concerts and live performances worldwide. Music technology is another significant factor contributing to the market's expansion. Innovations in music production, such as audio plugins and advanced music education tools, are enabling independent artists to produce high-quality music from their homes.

- Moreover, sync licensing has emerged as a lucrative revenue stream for music publishers, with music being used extensively in films, television shows, advertisements, and video games. Music supervisors play a crucial role in the synchronization of music with visual content, further boosting the demand for music publishing. The market is expected to continue its growth trajectory, with distribution channels expanding to include digital and physical formats, as well as various licensing models. Overall, the market dynamics are harmonious and immersive, with a focus on providing quality music to audiences across various platforms and formats.

What are the market trends shaping the Music Publishing Industry?

- The global advertising industry is experiencing significant growth, making it a noteworthy market trend for professionals. This expansion signifies a promising opportunity for businesses seeking to increase their brand visibility and reach a larger audience.

- The digital the market is experiencing significant growth due to the increasing adoption of mobile devices and the shift towards online marketing. With the widespread use of smartphones and tablets, music streaming and downloading services have become readily available and often free of charge for mobile users. This trend is driving revenue for digital music service providers through mobile advertising, which is becoming a major source of income in the industry. Furthermore, advertising agencies are recognizing the importance of music in creating effective and engaging advertising campaigns. The use of fitting music in advertisements can significantly increase customer attention and memorability.

- As a result, the demand for music publishing rights in the digital space is on the rise. Moreover, the market is also witnessing growth in areas such as music therapy, music libraries, and creative services. Performance rights and audio engineering are crucial aspects of the music publishing process, and regulations in the music industry continue to evolve to address these areas. Overall, the digital the market is expected to continue its growth trajectory as technology and consumer preferences continue to shape the industry.

What challenges does the Music Publishing Industry face during its growth?

- The integration challenges and lack of clear ownership rights in the streaming music industry represent significant hurdles to its growth.

- Music publishing encompasses the licensing and distribution of musical compositions and sheet music in various formats. The music industry has seen significant shifts with the rise of digital music and streaming services. These platforms, such as SoundCloud and gaana.Com, have gained popularity due to their vast music libraries and convenience. However, listeners do not own the music they access through these services, and internet connectivity is essential. Data analytics plays a crucial role in the market, enabling publishers to understand consumer preferences and trends. Mechanical rights, which grant permission to reproduce and distribute musical compositions, are a key aspect of music publishing.

- Physical media, including CDs and vinyl records, continue to hold value for collectors and audiophiles. Album artwork, an integral part of music publishing, adds visual appeal to music releases. Legal services are essential for managing licensing agreements and ensuring copyright protection. Digital audio files and streaming services have disrupted traditional music distribution models, necessitating the need for financial services to manage royalties and revenue sharing. Licensing agreements between music publishers, streaming services, and financial institutions ensure fair compensation for creators and rights holders. Digital music publishing offers opportunities for growth and innovation, making it an exciting and dynamic industry.

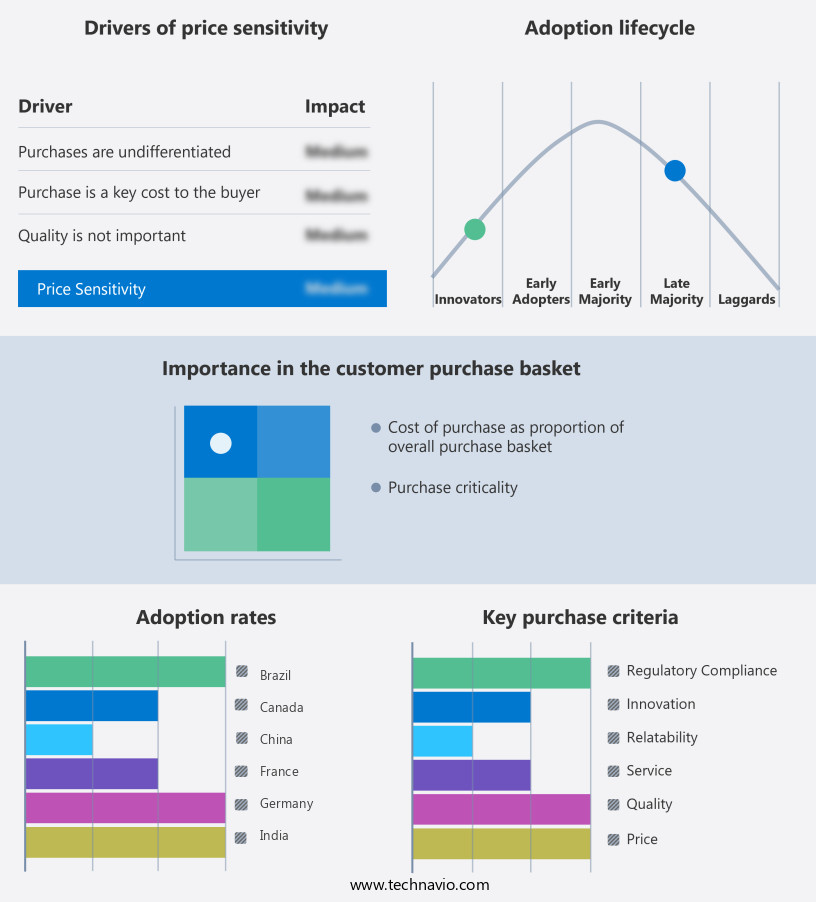

Exclusive Customer Landscape

The music publishing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the music publishing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, music publishing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bertelsmann SE and Co. KGaA - The company specializes in music publishing services, managing copyright administration, synchronization licensing, royalty accounting, and income tracking for various musical compositions. Through expert analysis and meticulous attention to detail, we ensure accurate and timely payment of royalties to rightsholders while securing licensing agreements for music usage in various media platforms. Our comprehensive approach maximizes revenue potential and streamlines the complexities of music publishing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bertelsmann SE and Co. KGaA

- Concord Music Group Inc.

- CTM Entertainment BV

- Deezer SA

- Downtown Music Holding LLC

- Kobalt Music Group Ltd.

- peermusic.com Inc.

- Primary Wave

- PULSE Music Group

- Recognition Music Ltd.

- Round Hill Music LP

- Sony Group Corp.

- Spirit Music Group

- The Royalty Network Inc.

- Universal Music Group N.V.

- Warner Music Group Corp.

- Wise Music Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Music Publishing Market

- In January 2024, Warner Chappell Music, a leading music publishing company, announced the launch of its innovative "Songtradr Sync" platform, designed to streamline the licensing process for music used in TV shows, films, and advertisements (Warner Chappell Music Press Release). This digital solution aimed to increase efficiency and reduce costs for media professionals, marking a significant technological advancement in the music publishing industry.

- In March 2024, Sony/ATV Music Publishing, the world's largest music publisher, entered into a strategic partnership with Amazon Music to expand its reach and offerings in the digital music space. This collaboration allowed Sony/ATV to provide its extensive catalog to Amazon Music subscribers, strengthening both parties' positions in the competitive digital music market (Sony/ATV Music Publishing Press Release).

- In May 2024, Universal Music Publishing Group (UMPG) completed the acquisition of EMI Music Publishing, creating the largest music publishing company in the world. The deal, valued at approximately USD4.7 billion, combined two of the industry's leading players, enhancing UMPG's global presence and market share (Billboard).

- In January 2025, the European Union passed the Directive on Copyright in the Digital Single Market, which included provisions for fair compensation for music creators and publishers when their works are used online. This regulatory change was a significant milestone in the music publishing industry, ensuring a more equitable distribution of royalties for creators and publishers (European Parliament).

Research Analyst Overview

- In the dynamic the market, talent scouting and discovery have gained significant importance through digital platforms. Affiliate marketing and digital marketing strategies are employed to reach wider audiences and monetize music content. Audio mastering techniques and music production technology continue to evolve, enhancing the listening experience. Audience engagement is maximized through music data analysis and trend analysis, while music metadata standards ensure seamless music distribution technology. Music publishing contracts are negotiated with a focus on financial forecasting and royalty collection, with royalty accounting and music streaming analytics providing transparency. Competitor analysis and influencer marketing are essential for business development and brand building.

- Music licensing platforms facilitate efficient copyright protection and copyright law adherence. Email marketing and social media marketing are utilized to reach fans directly, fostering artist relations and promoting new releases. Pay-per-click (PPC) advertising and content marketing strategies further expand reach and revenue streams. Song catalog management and contract negotiation skills remain crucial for publishers in this competitive landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Music Publishing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 3820.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

US, China, UK, Germany, Japan, Canada, India, Brazil, Mexico, Saudi Arabia, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Music Publishing Market Research and Growth Report?

- CAGR of the Music Publishing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the music publishing market growth of industry companies

We can help! Our analysts can customize this music publishing market research report to meet your requirements.