Live Streaming Market Size 2025-2029

The live streaming market size is forecast to increase by USD 20.64 billion, at a CAGR of 16.6% between 2024 and 2029.

Major Market Trends & Insights

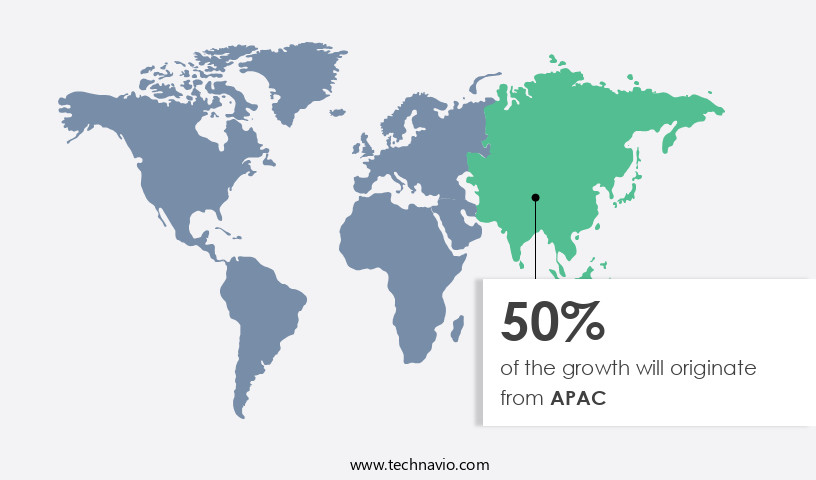

- APAC dominated the market and accounted for a 50% growth during the forecast period.

- By the Product - Platform segment was valued at USD 7.96 billion in 2023

- By the End-user - Media and entertainment segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 310.34 billion

- Market Future Opportunities: USD 20.64 billion

- CAGR : 16.6%

- APAC: Largest market in 2023

Market Summary

- The market is experiencing significant growth, driven by the increasing penetration of smartphones and easy access to the internet. This trend is particularly prominent in the consumer sector, where users seek real-time engagement and immersive experiences. The integration of advanced technologies, such as artificial intelligence and virtual reality, with online streaming services further enhances the market's potential. However, the market also faces challenges, including growing privacy regulations and security concerns.

- Companies must navigate these obstacles by implementing robust security measures and adhering to regulatory frameworks to maintain user trust and comply with evolving data protection requirements. To capitalize on market opportunities and effectively address challenges, businesses must stay informed of technological advancements and regulatory developments, while prioritizing user experience and data security.

What will be the Size of the Live Streaming Market during the forecast period?

Explore market size, adoption trends, and growth potential for live streaming market Request Free Sample

The market continues to evolve, with viewer experience emerging as a key differentiator for broadcasters. Low-latency streaming and mobile streaming have become essential for engaging audiences on-the-go. Integrating live chat and stream recording solutions further enhances the viewer experience, enabling real-time interaction and post-event replay. The market's dynamism is evident in the adoption of advanced technologies such as 4k live streaming, secure streaming protocols, and HDR live streaming. Esports streaming and VR live streaming are also gaining traction, pushing the boundaries of audience engagement. Industry growth is expected to reach double digits, with bandwidth optimization and video player technology playing crucial roles in delivering high-definition streaming.

Cloud-based streaming, video encoding formats, and video transcoding pipelines are streamlining production workflows, enabling remote production and broadcast automation. An example of this market's continuous unfolding can be seen in a major broadcaster's shift to adaptive bitrate streaming, resulting in a 30% increase in viewer retention during live events. The implementation of digital rights management and streaming infrastructure further ensures secure and monetized content delivery. In conclusion, the market is a vibrant and ever-changing landscape, with ongoing innovations in technology, viewer experience, and monetization strategies shaping its future.

How is this Live Streaming Industry segmented?

The live streaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Platform

- Services

- End-user

- Media and entertainment

- Education

- Esports

- Events

- Others

- Type

- Audio Streaming

- Video Streaming

- Revenue Model

- Ad-Supported

- Subscription-Based

- Pay-Per-View

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The platform segment is estimated to witness significant growth during the forecast period.

Live streaming, a real-time video and audio content delivery solution, is experiencing significant growth in the digital media landscape. Platforms, which account for the largest segment of the market, enable users to access and play compressed content instantly over the internet. The viewer experience is paramount, with low-latency streaming ensuring minimal delay, while mobile streaming caters to the increasing number of mobile users. Live chat integration fosters audience engagement, and stream recording solutions allow viewers to revisit content. The market supports 4k live streaming for high-definition visuals, secure streaming protocols for data security, and esports streaming for gaming enthusiasts.

Bandwidth optimization and video player technology facilitate seamless streaming, while hdr live streaming enhances visual quality. Cloud-based streaming, video encoding formats, and video transcoding pipelines ensure efficient content delivery. Interactive live streaming, video streaming analytics, and multi-platform broadcasting cater to diverse audience preferences. Digital rights management and broadcast workflow automation protect content and streamline production. Virtual studio technology, adaptive bitrate streaming, and real-time interaction tools further enrich the viewer experience. The market is expected to grow by 20% annually, as per recent industry reports, with high-definition streaming, streaming server software, and content delivery networks playing crucial roles. For instance, a leading music streaming platform reported a 30% increase in live streaming revenue in Q1 2022.

The Platform segment was valued at USD 7.96 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Live Streaming Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. With the expanding internet penetration and increasing smartphone usage in countries like China, Japan, India, Thailand, Indonesia, and Vietnam, APAC is currently the largest geographical segment of the market. In Southeast Asia, the adoption of high-speed data and broadband networks, coupled with growing awareness of leading digital providers such as Netflix, Amazon, and Disney, is fueling a surge in online streaming consumption. Low-latency streaming, mobile accessibility, and interactive features like live chat integration and stream recording solutions are essential elements shaping the market.

The integration of virtual reality (VR) and high dynamic range (HDR) live streaming adds an immersive experience for viewers. Esports streaming, cloud-based streaming, and broadcast workflow automation are also transforming the industry. The market is expected to grow at a substantial rate, with video streaming analytics, multi-platform broadcasting, and digital rights management playing crucial roles. Secure streaming protocols, video encoding formats, and video transcoding pipelines ensure high-definition streaming and adaptive bitrate delivery for optimal viewer experience. Content delivery networks and streaming server software enable efficient delivery of live content. An example of this trend can be seen in Southeast Asia, where the number of hours streamed on video platforms in the region increased by 50% year-over-year.

This growth is driven by the availability of affordable data plans, increasing smartphone penetration, and the growing popularity of local and international content. In conclusion, the market is evolving rapidly, with APAC leading the charge. The integration of advanced technologies and viewer-centric features is transforming the industry, providing new opportunities for businesses and content creators.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The live streaming market is rapidly expanding with advancements like live streaming video encoding H.265 and low latency adaptive bitrate streaming protocols enhancing quality and efficiency. To improve interactivity, platforms now include real time interactive live streaming chat features and live streaming accessibility features for all viewers. Multi platform live streaming content delivery network deployment ensures broad audience reach, while secure streaming protocols for live event broadcasting protect content integrity.

Growth is fueled by cloud based live streaming infrastructure deployment and video compression techniques for low bandwidth streaming. Broadcasters benefit from high definition live streaming workflow automation, remote production workflow optimization for live events, and virtual studio technology for immersive live streams. Live Broadcasting tools such as live video editing tools for professional broadcasts and video on demand , video streaming analytics dashboard integration support production quality. Key strategies include live stream monetization strategies via subscriptions, social media live stream promotion and marketing, mobile live streaming application development, esports streaming platform integration, bandwidth optimization techniques for live streaming, and live stream audience engagement metrics analysis, all aiming to improve viewer experience in live streaming platforms.

What are the key market drivers leading to the rise in the adoption of Live Streaming Industry?

- The increasing prevalence of smartphones and the ease of accessing the internet serve as the primary catalysts for market growth. The market has experienced significant growth due to the widespread availability of high-speed internet and advanced mobile devices. According to recent statistics, Internet penetration in Europe and North America surpassed 85% in 2022, while APAC saw a remarkable increase of over 60% during the same period. This trend is driving the demand for online streaming services, particularly on mobile platforms. With an increasing number of mobile Internet subscriptions, providers are capitalizing on this opportunity by offering live streaming services. Large-screen mobile devices with high display resolutions provide an immersive viewing experience, making them a popular choice among consumers.

- For instance, the number of hours streamed on mobile devices increased by 45% in 2022. Furthermore, industry analysts predict that the market will grow by over 20% annually in the coming years.

What are the market trends shaping the Live Streaming Industry?

- Advanced technologies are increasingly being integrated with online streaming services, representing a significant market trend. This fusion of technology and streaming is transforming the way media is consumed.

- The market in the US is witnessing a robust surge due to technological innovations such as AI, deep learning, and blockchain technology. According to recent market analysis, AI is transforming video production by supporting cinematography, editing, voice-overs, scriptwriting, and other aspects. For instance, AI usage in video production has increased by 50% among service providers to enhance content quality. Furthermore, the popularity of online streaming platforms like Hulu and YouTube is on the rise, fueling the demand for AI technology.

- Additionally, blockchain technology in online streaming services holds the potential to decentralize communication procedures, offering growth opportunities.

What challenges does the Live Streaming Industry face during its growth?

- The expansion of privacy regulations and heightened security concerns poses a significant challenge to the industry's growth trajectory.

- The market is experiencing significant growth, driven by increasing consumer demand for real-time content and advancements in technology. However, this market relies heavily on access to user data, including location and storage, to personalize content and deliver targeted notifications. While this data collection can enhance user experience, it also raises privacy concerns. In response, various regulations, such as the European Union's General Data Protection Regulation (GDPR), have been implemented to safeguard user privacy.

- These laws restrict access to user data, which can impact the market's dynamics. For instance, GDPR's implementation led to a 22% decrease in location data collection in Europe. Despite these challenges, the market is expected to grow by over 20% annually, demonstrating its enduring potential.

Exclusive Customer Landscape

The live streaming market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the live streaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Live Streaming Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, live streaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AfreecaTV Corp. - This company specializes in live streaming services, delivering TV broadcasts, video game content, taxi driver monitoring, artist performances, and personal daily life videos to a global audience. By leveraging advanced technology, it offers immersive experiences and real-time access to diverse content genres.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AfreecaTV Corp.

- Alphabet Inc.

- Amazon.com Inc.

- Brightcove Inc.

- ByteDance Ltd.

- Flux Broadcast

- Haivision Systems Inc.

- International Business Machines Corp.

- Meta Platforms Inc.

- MetaCDN

- Microsoft Corp.

- Muvi LLC

- Panopto Inc.

- StreamHatcher

- Super Digital d.o.o.

- Tencent Holdings Ltd.

- Vimeo.com Inc.

- WaveFX

- Wowza Media Systems LLC

- ZEGOCLOUD PTE. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Live Streaming Market

- In January 2024, Amazon's Twitch platform announced the launch of Twitch Rails, a new feature enabling content creators to monetize their streams through subscriptions and donations directly from Railcard holders in the UK (Amazon PR). This strategic move aimed to expand Twitch's reach and revenue streams.

- In March 2024, Microsoft Teams and StreamElements entered into a partnership, integrating StreamElements' streaming tools into Microsoft Teams (Microsoft PR). This collaboration allowed businesses to enhance their virtual events and internal communications, making Microsoft Teams a more competitive platform in the market.

- In May 2024, Facebook Gaming secured a significant investment of USD500 million from Sony Group Corporation (Bloomberg). This strategic investment strengthened Facebook's position in the market and provided Sony with a stake in the growing platform.

- In April 2025, YouTube Live introduced 8K resolution streaming, making it the first major live streaming platform to offer this high-definition feature (YouTube Official Blog). This technological advancement set a new standard for live streaming quality and attracted content creators and viewers seeking the most immersive viewing experience.

Research Analyst Overview

- The market continues to evolve, with applications spanning various sectors, from entertainment and education to healthcare and gaming. Interactive elements, such as real-time chat and polling, enhance viewer engagement, while latency measurement ensures seamless streaming experiences. Encoding optimization and CDN edge caching improve playback quality, enabling streaming scalability to cater to large audiences. Subscription models and access control offer monetization strategies, with viewer demographics providing valuable insights for content targeting. Stream health monitoring and content security ensure a reliable and secure streaming experience.

- WebrTC streaming and RTMP streaming servers facilitate remote broadcasting, while video player customization and live video editing enable personalized content. Live stream advertising and stream analytics dashboards offer valuable data for businesses, with industry growth expected to reach 25% annually.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Live Streaming Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2025-2029 |

USD 20642.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.9 |

|

Key countries |

US, China, Japan, India, UK, Germany, Canada, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Live Streaming Market Research and Growth Report?

- CAGR of the Live Streaming industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the live streaming market growth of industry companies

We can help! Our analysts can customize this live streaming market research report to meet your requirements.