Data Analytics Market Size 2025-2029

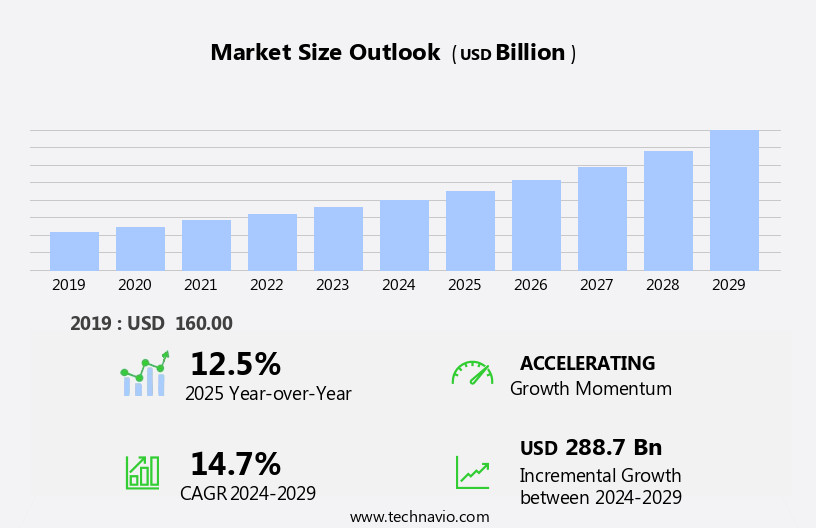

The data analytics market size is forecast to increase by USD 288.7 billion, at a CAGR of 14.7% between 2024 and 2029.

- The market is driven by the extensive use of modern technology in company operations, enabling businesses to extract valuable insights from their data. The prevalence of the Internet and the increased use of linked and integrated technologies have facilitated the collection and analysis of vast amounts of data from various sources. This trend is expected to continue as companies seek to gain a competitive edge by making data-driven decisions. However, the integration of data from different sources poses significant challenges. Ensuring data accuracy, consistency, and security is crucial as companies deal with large volumes of data from various internal and external sources.

- Additionally, the complexity of data analytics tools and the need for specialized skills can hinder adoption, particularly for smaller organizations with limited resources. Companies must address these challenges by investing in robust data management systems, implementing rigorous data validation processes, and providing training and development opportunities for their employees. By doing so, they can effectively harness the power of data analytics to drive growth and improve operational efficiency.

What will be the Size of the Data Analytics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic and ever-evolving the market, entities such as explainable AI, time series analysis, data integration, data lakes, algorithm selection, feature engineering, marketing analytics, computer vision, data visualization, financial modeling, real-time analytics, data mining tools, and KPI dashboards continue to unfold and intertwine, shaping the industry's landscape. The application of these technologies spans various sectors, from risk management and fraud detection to conversion rate optimization and social media analytics. ETL processes, data warehousing, statistical software, data wrangling, and data storytelling are integral components of the data analytics ecosystem, enabling organizations to extract insights from their data.

Cloud computing, deep learning, and data visualization tools further enhance the capabilities of data analytics platforms, allowing for advanced data-driven decision making and real-time analysis. Marketing analytics, clustering algorithms, and customer segmentation are essential for businesses seeking to optimize their marketing strategies and gain a competitive edge. Regression analysis, data visualization tools, and machine learning algorithms are instrumental in uncovering hidden patterns and trends, while predictive modeling and causal inference help organizations anticipate future outcomes and make informed decisions. Data governance, data quality, and bias detection are crucial aspects of the data analytics process, ensuring the accuracy, security, and ethical use of data.

Supply chain analytics, healthcare analytics, and financial modeling are just a few examples of the diverse applications of data analytics, demonstrating the industry's far-reaching impact. Data pipelines, data mining, and model monitoring are essential for maintaining the continuous flow of data and ensuring the accuracy and reliability of analytics models. The integration of various data analytics tools and techniques continues to evolve, as the industry adapts to the ever-changing needs of businesses and consumers alike.

How is this Data Analytics Industry segmented?

The data analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Services

- Software

- Hardware

- Deployment

- Cloud

- On-premises

- Type

- Prescriptive Analytics

- Predictive Analytics

- Customer Analytics

- Descriptive Analytics

- Others

- Application

- Supply Chain Management

- Enterprise Resource Planning

- Database Management

- Human Resource Management

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

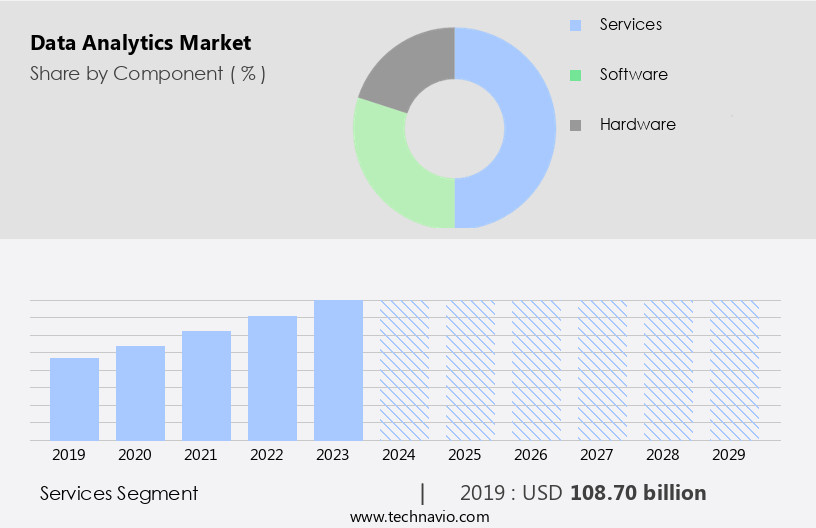

By Component Insights

The services segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth as businesses increasingly rely on advanced technologies to gain insights from their data. Natural language processing is a key component of this trend, enabling more sophisticated analysis of unstructured data. Fraud detection and data security solutions are also in high demand, as companies seek to protect against threats and maintain customer trust. Data analytics platforms, including cloud-based offerings, are driving innovation in areas such as real-time analytics, predictive modeling, and machine learning. Social media analytics and sentiment analysis are also gaining traction, as businesses look to better understand customer sentiment and engagement. Clustering algorithms and data integration are essential for effective data management, while ETL processes and data pipelines facilitate data flow between systems.

Risk management and data governance are critical for ensuring data quality and compliance. Data visualization tools and business intelligence platforms help organizations make data-driven decisions, while marketing analytics and customer segmentation enable targeted campaigns and improved customer engagement. Machine learning and deep learning are driving advances in areas such as computer vision and predictive modeling. Data warehousing, data lakes, and data meshes provide the infrastructure for storing and managing large volumes of data. Algorithm selection, feature engineering, and model deployment are key components of the machine learning process. Data mining tools and regression analysis help uncover hidden patterns and trends, while time series analysis and statistical software enable more accurate forecasting.

KPI dashboards and model monitoring provide insights into performance metrics, while a/b testing and regression algorithms enable continuous improvement. Healthcare analytics and supply chain analytics are two vertical markets where data analytics is making a significant impact. Overall, the market is dynamic and evolving, with a focus on innovation, efficiency, and data-driven decision making.

The Services segment was valued at USD 108.70 billion in 2019 and showed a gradual increase during the forecast period.

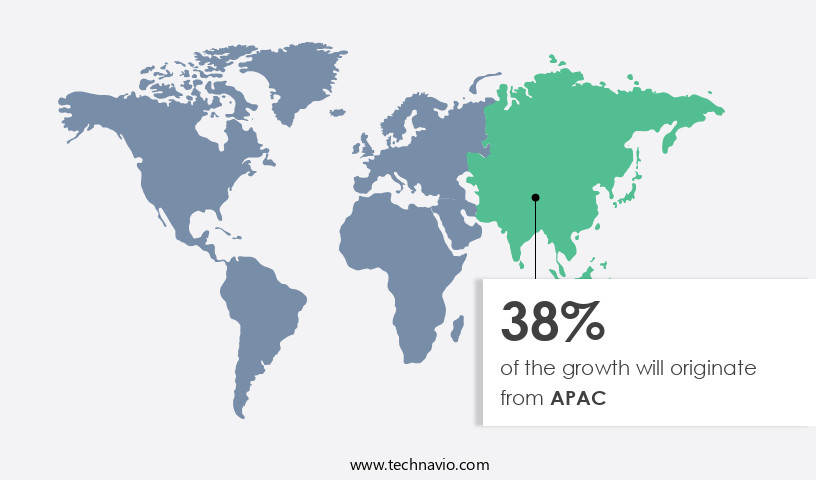

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America, which currently holds the largest market share. This region's dominance is attributed to its advanced economies, including Canada and the US, and their emphasis on technology innovation and research and development. The increasing use of smartphones, wearable devices, and other connected gadgets has led to a surge in data production. North America's early adoption of technologies across industries makes it an attractive market for data analytics solutions. Advanced technologies like natural language processing, fraud detection, data security, conversion rate optimization, data analytics platforms, social media analytics, clustering algorithms, ETL processes, risk management, cloud computing, deep learning, data warehousing, statistical software, data wrangling, data storytelling, explainable AI, time series analysis, data integration, data lakes, algorithm selection, feature engineering, marketing analytics, computer vision, data visualization, financial modeling, real-time analytics, data mining tools, KPI dashboards, data pipelines, regression analysis, data visualization tools, data-driven decision making, web analytics, classification algorithms, data governance, bias detection, supply chain analytics, data quality, NoSQL databases, sentiment analysis, SQL databases, customer segmentation, business intelligence, model monitoring, A/B testing, regression algorithms, data mining, machine learning, causal inference, model deployment, healthcare analytics, predictive modeling, big data, and data meshes are transforming the market.

Cloud computing and deep learning are driving the market's growth, enabling real-time analytics, predictive modeling, and machine learning. Data security and risk management are crucial concerns, leading to the adoption of advanced encryption and access control technologies. Data storytelling and explainable AI are gaining importance to make data insights accessible to non-technical stakeholders. Data integration, data lakes, and data pipelines facilitate seamless data flow across systems and platforms. Marketing analytics, computer vision, and sentiment analysis are revolutionizing industries like retail, finance, and healthcare. Predictive modeling and healthcare analytics are improving patient outcomes and disease diagnosis. Business intelligence and data visualization tools are making data-driven decision making more accessible and effective.

In conclusion, the market is witnessing significant growth, with North America leading the charge. Advanced technologies, a focus on innovation, and the abundance of data are driving the market's evolution. Security, data quality, and data governance are crucial concerns, and the market is responding with advanced solutions. The future of data analytics lies in real-time insights, predictive modeling, and machine learning.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving landscape of business intelligence, the market plays a pivotal role in driving insights-driven decision-making. Companies harnessing the power of data analytics solutions are revolutionizing their operations, enhancing customer experiences, and unlocking new opportunities. These advanced tools enable real-time data processing, predictive analytics, machine learning, and data visualization. Businesses leverage data analytics to optimize marketing strategies, streamline supply chains, improve customer engagement, and mitigate risks. Furthermore, the integration of cloud technologies, IoT, and big data is fueling the growth of the market. This market caters to various industries, including finance, healthcare, retail, and manufacturing, providing customized solutions to cater to their unique data needs. Data analytics solutions offer actionable insights, enabling organizations to make informed decisions and gain a competitive edge.

What are the key market drivers leading to the rise in the adoption of Data Analytics Industry?

- The extensive utilization of modern technology in company operations serves as the primary catalyst for market growth.

- Data analytics has become a crucial element in today's business landscape, driven by advancements in technologies such as cloud computing, deep learning, and natural language processing. These innovations have led to the development of sophisticated data analytics platforms that enable businesses to gain valuable insights from their data. One significant application of data analytics is in fraud detection, where clustering algorithms and statistical software help identify anomalous patterns and potential threats. Data security is another critical area where data analytics plays a pivotal role, with ETL processes and data warehousing ensuring data integrity and compliance. Moreover, social media analytics has emerged as a key area of focus, allowing businesses to understand customer behavior and preferences, and optimize conversion rates.

- Risk management is another domain where data analytics is making a significant impact, with predictive analytics and real-time monitoring helping organizations mitigate risks and make informed decisions. Deep learning and machine learning algorithms are also gaining popularity, providing businesses with the ability to analyze large volumes of data and derive meaningful insights. However, data wrangling and data preprocessing remain significant challenges, requiring businesses to invest in the right tools and expertise. Overall, the application of data analytics is transforming the business ecosystem, enabling organizations to gain a competitive edge and drive growth.

What are the market trends shaping the Data Analytics Industry?

- The increasing prevalence of the Internet and the growing adoption of linked and integrated technologies represent a significant market trend. This shift towards digital connectivity and seamless technology integration is shaping the business landscape in a profound way.

- The digital age has brought about an unprecedented increase in data generation, fueled by the widespread use of the Internet and high-speed connectivity. Globalization and economic expansion have further accelerated data creation, making every customer interaction a valuable data point. In response, organizations are investing in data analytics to gain insights from this vast amount of information. Data scientists and analysts are now essential hires, tasked with handling and interpreting data to inform business decisions. Data storytelling, explainable AI, time series analysis, data integration, data lakes, algorithm selection, feature engineering, marketing analytics, computer vision, data visualization, financial modeling, real-time analytics, and data mining tools are all crucial components of modern data analytics.

- These techniques enable organizations to derive meaningful insights from their data, enhancing their marketing efforts, improving operational efficiency, and driving revenue growth. Additionally, the potential for generating revenue from data analytics is a significant driver of adoption. Data integration, for instance, allows organizations to combine data from various sources to gain a comprehensive view of their business operations. Time series analysis, on the other hand, helps in understanding trends and patterns over time, while data visualization makes complex data easily interpretable. Machine learning algorithms, such as those used in explainable AI, can uncover hidden insights and patterns, while data mining tools enable organizations to extract valuable information from large datasets.

- In summary, the increasing volume of data and the need to make informed business decisions have led to the widespread adoption of data analytics. Techniques such as data storytelling, explainable AI, time series analysis, data integration, data lakes, algorithm selection, feature engineering, marketing analytics, computer vision, data visualization, financial modeling, real-time analytics, and data mining tools are essential components of modern data analytics, enabling organizations to gain valuable insights from their data and drive growth.

What challenges does the Data Analytics Industry face during its growth?

- The integration of data from various sources poses a significant challenge to the industry's growth, requiring professional expertise and advanced technologies to ensure accurate and seamless data processing.

- Data analytics plays a pivotal role in enabling businesses to make data-driven decisions, minimize risks, and identify valuable consumer insights. However, consolidating data from various sources can pose challenges, particularly for large corporations. Data exchanges and ecosystems offer solutions by facilitating the analysis of consolidated data in a centralized location. These tools enable the extraction and cross-checking of essential business components. The implementation of data exchanges and ecosystems varies based on the perceived value of data for different client groups. Regardless, these platforms are essential for effective data utilization. Data pipelines facilitate the seamless flow of data into these systems, while data visualization tools enable the interpretation of complex data sets.

- Techniques such as regression analysis, classification algorithms, and sentiment analysis aid in deriving meaningful insights. Data quality is crucial for accurate analysis, necessitating the implementation of data governance practices and bias detection mechanisms. SQL and NoSQL databases provide the necessary infrastructure for data storage and retrieval. Web analytics and supply chain analytics offer valuable insights into customer behavior and operational efficiency, respectively. In conclusion, data analytics is a vital investment for businesses seeking to gain a competitive edge. Data exchanges and ecosystems streamline the process of consolidating and analyzing data, enabling organizations to make informed decisions based on accurate and timely information.

Exclusive Customer Landscape

The data analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alteryx Inc. - This company specializes in data analytics, providing automated, end-to-end solutions for data preparation, blending, and analysis. Predictive, statistical, and spatial analytics are applied to gain deeper insights from diverse data sources. Our advanced technology enhances search engine exposure, delivering clear, informative insights without geographic limitation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alteryx Inc.

- Amazon.com Inc.

- Datameer Inc.

- Dell Technologies Inc.

- Fair Isaac Corp.

- Google LLC

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Microsoft Corp.

- Mu Sigma

- Oracle Corp.

- Rapidops Inc.

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Sisense Ltd.

- Teradata Corp.

- ThoughtSpot Inc.

- TIBCO Software Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Analytics Market

- In January 2024, IBM announced the acquisition of DataMirror, a leading data replication and integration software provider, to strengthen its data integration capabilities and enhance its hybrid cloud offerings (IBM Press Release). In March 2024, Microsoft and Adobe signed a strategic partnership to integrate Microsoft Power BI with Adobe Experience Cloud, enabling marketers to gain deeper insights from their customer data (Microsoft News Center).

- In May 2024, Google Cloud Platform launched its new BigQuery ML, an automated machine learning service for data analysts, allowing users to build and deploy machine learning models without requiring extensive data science expertise (Google Cloud Blog). In February 2025, Amazon Web Services (AWS) secured a significant contract with the U.S. Central Intelligence Agency (CIA) to provide cloud services for its data analytics needs, marking a significant expansion of AWS's presence in the public sector market (Reuters).

Research Analyst Overview

- In the dynamic the market, trends revolve around advanced techniques for managing and analyzing complex data sets. Data architecture and knowledge representation are crucial for effective data management, while graph databases facilitate efficient trend analysis. Metadata and reference data management are essential for maintaining data lineage and ensuring data accuracy. GPS data and sensor data are driving the need for real-time processing and geospatial analysis. GIS software and spatial statistics enable location-based insights, while simulation modeling and agent-based modeling provide predictive capabilities. Change data capture and outlier detection help identify anomalies, and change point detection offers valuable insights into data shifts.

- Data augmentation and synthetic data generation enhance data volumes for machine learning applications. Seasonality analysis and forecasting models help businesses anticipate trends, while differential privacy and text mining ensure data security and extract meaningful insights from unstructured data. Serverless computing, data virtualization, and information retrieval offer scalable solutions for handling large volumes of data. Data versioning and master data management ensure data consistency, while real-time processing and federated learning enable collaborative analytics. IoT data, web scraping, and semantic web technologies expand data sources and facilitate data integration. Network analysis and data cataloging offer insights into data relationships, and synthetic data generation supports privacy-preserving analytics.

- Monte Carlo simulation and streaming data processing provide robust modeling capabilities, while knowledge graphs and social network analysis offer advanced insights into complex relationships. Edge computing and data cataloging enable localized data processing and analysis, further enhancing data analytics capabilities.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Analytics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.7% |

|

Market growth 2025-2029 |

USD 288.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.5 |

|

Key countries |

US, Germany, UK, Canada, France, China, Brazil, Japan, India, South Korea, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Analytics Market Research and Growth Report?

- CAGR of the Data Analytics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data analytics market growth of industry companies

We can help! Our analysts can customize this data analytics market research report to meet your requirements.