Visitor Management System Market Size 2024-2028

The visitor management system market size is forecast to increase by USD 2.94 billion at a CAGR of 23.92% between 2023 and 2028.

What will be the Size of the Visitor Management System Market During the Forecast Period?

How is this Visitor Management System Industry segmented and which is the largest segment?

The visitor management system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- BFSI

- Healthcare and life sciences

- Government and defense

- Retail and consumer goods

- Others

- Component

- Software

- Services

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

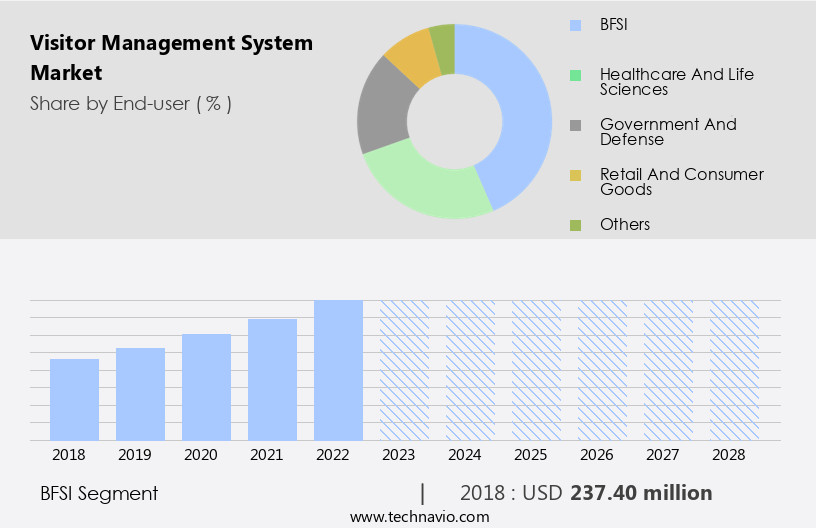

By End-user Insights

The bfsi segment is estimated to witness significant growth during the forecast period. Visitor management systems have become indispensable tools In the banking, financial services, and insurance (BFSI) sector for ensuring security and efficiency. These systems are widely adopted in various BFSI institutions, including banks and financial institutions. In bank branches, visitor management systems streamline access control, maintain a secure environment, and monitor customer visits. By implementing these solutions, banks can accurately record visitor information, such as identification, visit purpose, and check-in/check-out times. Legal standards, data protection, and penalties demand robust visitor management systems. Advanced features include suspicious behavior monitoring, resource allocation, and access control. Biometric data, contact details, and identification documents are securely stored in cloud-based databases.

Advanced analytics and reporting capabilities offer valuable insights. In case of malfunctions or technical issues, troubleshooting and data security measures ensure minimal disruption. Compliance requirements, risk mitigation, and security breaches are addressed through advanced security infrastructure. Healthcare facilities, workplace security, and industrial infrastructure also benefit from visitor management systems.

Get a glance at the market report of various segments Request Free Sample

The BFSI segment was valued at USD 237.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Visitor Management System (VMS) market in North America is the largest, driven by the region's advanced technological infrastructure, stringent legal standards, and high adoption of digital solutions. Corporate offices, government institutions, healthcare facilities, educational institutions, and event venues, among others, dominate the market in North America due to the need for efficient and secure visitor management systems. Compliance with data protection regulations, prevention of penalties and legal liabilities, and ensuring health and safety are key considerations. VMS solutions offer features such as contact details and identification document recording, biometric data capture, advanced analytics, reporting capabilities, and suspicious behavior monitoring.

Security measures include access control, security cameras, biometric devices, and mobile applications. Cloud-based databases ensure data security and facilitate contactless check-ins, health screenings, and capacity management. The North American market is expected to continue growing due to digital transformations in industrial infrastructure, workplace security, and the manufacturing, hospitality, and healthcare sectors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Visitor Management System Industry?

- Increasing focus on security across organizations is the key driver of the market.The market is experiencing significant growth due to the heightened emphasis on security and compliance in various industries. Organizations are prioritizing the safety and protection of their premises, assets, and personnel, leading to an increased demand for advanced visitor management solutions. These systems offer streamlined check-in procedures, ensuring data protection and adherence to legal standards. Visitor management systems enable organizations to verify the identification documents of visitors, screen them against legal watchlists and databases, and grant access based on predefined criteria. By implementing these systems, organizations can mitigate risks associated with unauthorized access, intrusions, and security breaches.

Advanced analytics and reporting capabilities facilitate resource allocation and suspicious behavior monitoring. Security measures such as biometric data collection, access control, security cameras, and biometric devices enhance the overall security infrastructure. Cloud-based databases and mobile applications offer convenience and flexibility, while maintaining data security. Financial data breaches and human errors can lead to legal liabilities and penalties, making it essential for organizations to invest in reliable visitor management systems. The healthcare facilities sector, industrial infrastructure, manufacturing, hospitality, and digital transformations are major contributors to the market's growth. Visitor management systems play a vital role in workplace security, risk mitigation, and compliance with various regulations.

Despite the benefits, challenges such as malfunctions, technical issues, and capacity management require troubleshooting and continuous improvement efforts. In conclusion, the market is witnessing steady growth due to the increasing need for security, data protection, and compliance across various industries. These systems provide organizations with advanced access control, monitoring, and reporting capabilities, ensuring a safer and more efficient visitor management process.

What are the market trends shaping the Visitor Management System market?

- Growing adoption of cloud-based visitor management solutions is the upcoming market trend.Cloud-based visitor management systems are gaining popularity among organizations due to their scalability and flexibility. These systems allow businesses to effortlessly expand their visitor management capabilities according to their evolving needs, whether they have a single location or multiple sites. The use of cloud infrastructure eliminates the need for substantial investments in hardware and intricate setup processes, making it an economical solution for managing visitor access. Moreover, cloud-based systems offer advanced features such as legal standards compliance, data protection, and access control. Organizations can monitor and record contact details, identification documents, and biometric data to ensure security and safety.

Advanced analytics and reporting capabilities enable resource allocation and risk mitigation, while suspicious behavior can be flagged and addressed promptly. Security measures like security cameras, biometric devices, and mobile applications provide an additional layer of protection against potential threats. In the event of malfunctions or technical issues, troubleshooting and data security are ensured through robust systems and processes. Visitor screening and check-in procedures are streamlined, ensuring personalized badges and efficient processing. Watchlist screening and capacity management are also crucial features for organizations dealing with sensitive information and compliance requirements. In the Singapore market, the cloud segment is witnessing significant growth due to the increasing need for security and safety, contactless check-ins, health screenings, and digital transformations.

However, organizations must ensure the security infrastructure is reliable and can handle financial data breaches and human errors. Cloud-based visitor management systems offer a cost-effective and efficient solution for managing visitor access while addressing security challenges in various industries, including healthcare facilities, industrial infrastructure, manufacturing, hospitality, and workplace security.

What challenges does the Visitor Management System Industry face during its growth?

- Privacy and data security concerns associated with visitor management solutions is a key challenge affecting the industry growth.Visitor management systems have become essential for organizations to monitor and manage access to their facilities. However, the collection and storage of personal data, including contact details, identification documents, and biometric data, necessitate stringent data protection measures. Legal standards, such as the GDPR and CCPA, impose penalties and legal liabilities for non-compliance. Healthcare facilities, industrial infrastructure, and other sensitive environments require advanced analytics, reporting capabilities, and suspicious behavior monitoring for risk mitigation. Visitor management systems offer contactless check-ins, health screenings, and capacity management to ensure health and safety. These systems employ access control, security cameras, biometric devices, mobile applications, and cloud-based databases to streamline check-in procedures and personalize badges.

However, malfunctions, technical issues, and human errors can compromise data security and safety. Organizations must prioritize data security, security measures, and compliance requirements to prevent financial data breaches and protect sensitive information. Advanced systems provide troubleshooting features, alerting for security breaches, and watchlist screening. In the Singapore market, the cloud segment is gaining popularity due to its flexibility and scalability. Despite these benefits, organizations must address security challenges, such as mass shootings and industrialization, through digital transformations in workplace security and manufacturing, hospitality, and other industries.

Exclusive Customer Landscape

The visitor management system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the visitor management system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, visitor management system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AlertEnterpise Inc. - The market encompasses solutions that provide automatic vetting and validation services, ensuring compliance and integrating DNA and VIP lists. These features streamline the visitor registration process, enhancing security and efficiency for organizations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AlertEnterpise Inc.

- Asiatact S Pte Ltd.

- Building Intelligence Inc.

- Condeco Group Ltd.

- Envoy Inc.

- Genetec Inc.

- Greetly Inc.

- HID Global Corp.

- Honeywell International Inc.

- iLobby

- InVentry Ltd.

- Jolly Technologies Inc.

- MRI Software LLC

- Parabit Systems Inc.

- Pitney Bowes Inc.

- Qminder Ltd.

- Smartice Pvt. Ltd.

- SmartSpace Software PLC

- Splan Inc.

- Vuetura Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses solutions that facilitate the streamlined processing of visitors in various industries, ensuring adherence to legal standards and data protection. These systems play a crucial role in mitigating potential penalties and legal liabilities for organizations, particularly those in sectors such as healthcare facilities. Contact details and identification documents of visitors are essential components of visitor management systems. Advanced analytics and reporting capabilities enable the monitoring of suspicious behavior and resource allocation. Security measures, including access control, security cameras, and biometric devices, are integral to these systems. Malfunctions and technical issues can arise, necessitating troubleshooting and data security measures.

Biometric data, financial data, and sensitive information require robust security infrastructure to prevent security breaches and maintain compliance with regulations. Visitor screening and check-in procedures are critical aspects of these systems, ensuring the identification of visitors and the issuance of personalized badges. Capacity management and contactless check-ins are becoming increasingly popular due to the current health crisis. Health and safety are paramount, with some systems offering health screenings and monitoring capabilities. The market for cloud-based visitor management systems is growing, providing flexibility and ease of use for organizations. The market faces various challenges, including security concerns, such as mass shootings and other security threats.

Digital transformations in industries like industrial infrastructure, manufacturing, hospitality, and workplace security are driving the adoption of these systems. The market for visitor management systems is diverse, with various solutions available from providers such as AlertEnterprise, Envoy, AsiaTact, Sine, Proxyclick, Genetech, iLobby, Traction Guest, and others. These solutions cater to different industries and offer varying features, including advanced analytics, reporting capabilities, and integration with other systems. Despite the benefits, challenges remain, including human errors in registration processes, malfunctions, and the need for ongoing troubleshooting. Organizations must carefully consider their specific needs and choose a solution that meets their requirements while ensuring data security and compliance with regulations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.92% |

|

Market growth 2024-2028 |

USD 2943 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.98 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Visitor Management System Market Research and Growth Report?

- CAGR of the Visitor Management System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the visitor management system market growth of industry companies

We can help! Our analysts can customize this visitor management system market research report to meet your requirements.