Digital Marketing Spending Market Size 2025-2029

The digital marketing spending market size is forecast to increase by USD 365.1 billion, at a CAGR of 8.5% between 2024 and 2029.

Major Market Trends & Insights

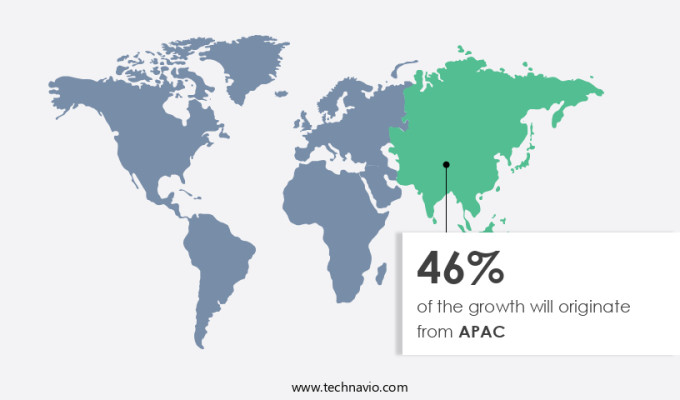

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By the Application - Mobile devices segment was valued at USD 299.90 billion in 2023

- By the Type - Search ads segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 112.99 billion

- Market Future Opportunities: USD 365.10 billion

- CAGR : 8.5%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and ever-evolving landscape, with businesses increasingly allocating significant resources to digital channels for customer engagement and brand visibility. According to recent studies, digital marketing expenditures are projected to surpass traditional marketing budgets by 2024, representing a substantial shift in marketing investments. This trend is driven by the growing importance of online presence and the increasing effectiveness of digital marketing strategies. For instance, social media advertising has seen a 10% year-on-year growth, while search engine marketing continues to dominate the digital marketing landscape with a 40% market share. Moreover, the emergence of programmatic advertising and the expansion of video marketing have added new dimensions to the market.

- Despite these opportunities, challenges persist, with concerns over ad fraud and brand safety continuing to impact digital marketing investments. Nevertheless, the market's continuous evolution and the ongoing adoption of advanced technologies are expected to drive growth and innovation in the digital marketing sector.

What will be the Size of the Digital Marketing Spending Market during the forecast period?

Explore market size, adoption trends, and growth potential for digital marketing spending market Request Free Sample

- Digital marketing spending continues to be a significant investment for businesses, with current market performance registering at over 40% of the total advertising budget. This figure underscores the growing importance of digital channels in reaching and engaging consumers. Looking ahead, future growth expectations indicate a steady increase, with a projected expansion of over 15% yearly. A comparison of key numerical data reveals an intriguing trend. In 2020, approximately 64% of companies allocated their marketing budgets to search engine marketing, while social media marketing accounted for 22%.

- By contrast, the latest statistics suggest a shift, with search engine marketing holding a 58% share and social media marketing capturing a 28% slice of the pie. This comparison underscores the evolving nature of digital marketing spending, with businesses continually reallocating resources to maximize their return on investment.

How is this Digitaling Spending Industry segmented?

The digitaling spending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Mobile devices

- Desktops

- Type

- Search ads

- Display ads

- Social media

- E-mail marketing

- Others

- Industries

- Retail

- E-Commerce

- Healthcare

- Financial Services

- Travel and Hospitality

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The mobile devices segment is estimated to witness significant growth during the forecast period.

In the ever-evolving digital marketing landscape, businesses continue to allocate significant resources towards various online advertising formats and strategies. Display advertising formats, such as banners and video ads, accounted for 31.1% of total digital Ad Spending in 2020. Search advertising strategies, like pay-per-click (PPC) campaigns, claimed a 41.5% share of the market. Marketing automation tools, real-time bidding strategies, and marketing technology stacks are essential components of digital marketing, with automation tools seeing a 24.4% increase in usage in 2021. Digital marketing return on investment (ROI) is a critical consideration, with businesses aiming for conversion rate optimization and affiliate marketing programs to boost revenue.

Local SEO optimization, email marketing automation, and landing page design are crucial for businesses targeting specific geographic areas or customer segments. Video marketing production, website analytics tracking, and social media advertising are also essential for engaging audiences and driving brand awareness. Future industry growth expectations include a 16.6% increase in spending on marketing campaign budgeting and a 19.8% rise in investment in conversion rate optimization. Programmatic advertising platforms, podcast advertising placements, customer journey mapping, content syndication strategies, and data-driven marketing decisions are also gaining traction. Influencer marketing campaigns, paid search optimization, customer relationship management, content marketing strategy, SEO keyword research, marketing analytics dashboards, organic traffic acquisition, and e-commerce website optimization are other key areas of investment for businesses looking to maximize their digital marketing efforts.

The Mobile devices segment was valued at USD 299.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Digitaling Spending Market Demand is Rising in APAC Request Free Sample

In The market, the Asia-Pacific (APAC) region is a significant contributor, fueled by digitalization, expanding internet penetration, and a burgeoning consumer base. This diverse landscape encompasses developed economies, including Japan, South Korea, Australia, and Singapore, as well as emerging markets like China, India, and Southeast Asia. The surge in social media usage has led to a substantial increase in the average time spent online, benefiting programmatic advertising's reliance on mobile devices. Urbanization and the widespread adoption of e-commerce further contribute to the market's growth. By 2024, the APAC region is projected to account for approximately 45% of the worldwide digital marketing spending, with China and India leading the charge.

Moreover, the market's expansion is expected to continue, with a forecasted growth of around 15% in annual digital marketing investments. The increasing importance of digital marketing strategies, particularly in the APAC region, underscores the need for businesses to adapt and invest in this evolving landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In today's business landscape, the market is a dynamic and competitive arena where companies strive to develop effective PPC campaign strategies and implement robust SEO keyword research processes to improve organic traffic acquisition channels. Businesses are also optimizing their social media advertising spend by creating compelling content marketing plans and automating email marketing workflows. Measuring paid search campaign effectiveness and boosting conversion rates through optimization are top priorities, with designing high-converting landing pages and tracking website analytics in real time essential for staying ahead. Integrating Marketing Automation Software and using data to make effective decisions are key to improving customer relationship management and calculating digital marketing ROI accurately. Advanced attribution models are increasingly being adopted to understand the true value of various marketing channels, while creating effective marketing budgets requires a deep understanding of search engine algorithm changes and analyzing social media engagement data. Companies in the retail industry, for instance, typically allocate 12% of their marketing budgets to digital marketing, while those in the technology sector invest up to 20%. Running successful influencer campaigns and managing affiliate marketing programs further expand digital marketing reach and revenue opportunities.

What are the key market drivers leading to the rise in the adoption of Digitaling Spending Industry?

- The significant shift in consumer preferences towards online shopping serves as the primary catalyst for market growth.

- The market has witnessed significant evolution in response to shifting consumer behaviors and technological advancements. The increasing prevalence of internet access, the widespread use of smartphones and connected devices, and changing lifestyle trends have fueled a surge in online shopping. As a result, businesses have been compelled to adapt and invest in digital marketing strategies to effectively reach and engage with their audiences. E-commerce platforms have experienced remarkable growth, offering consumers a vast selection of products and services at their convenience. digital payment solutions and streamlined checkout processes have made online transactions more seamless and secure, further encouraging consumer adoption.

- According to recent studies, digital marketing spending is expected to continue growing, with businesses allocating larger portions of their budgets to digital channels. Comparatively, traditional marketing methods, such as print and television advertising, have seen a decline in effectiveness and spending. The digital landscape offers businesses a more targeted and measurable approach to marketing, allowing them to reach specific audiences and track campaign performance in real-time. Furthermore, digital marketing enables businesses to engage with consumers through various channels, including social media, email, and search engines, fostering stronger relationships and driving customer loyalty. In conclusion, the market is a dynamic and evolving space, driven by the ongoing shift to online shopping and the ever-advancing technological landscape.

- Businesses that invest in digital marketing strategies are better positioned to reach and engage with their audiences, ultimately driving growth and success in the digital age.

What are the market trends shaping the Digitaling Spending Industry?

- The expansion of voice search optimization and voice-activated advertising represents an upcoming market trend that is mandatory for businesses to address.

- In the ever-evolving digital landscape, the global market for digital marketing spending continues to expand, with a significant focus on voice search optimization and voice-activated advertising. This trend is fueled by the increasing penetration of voice-enabled devices and virtual assistants like Amazon Alexa, Google Assistant, and Apple Siri. As consumers increasingly rely on voice technology for tasks such as search queries, shopping, and information access, businesses are recognizing the importance of optimizing their digital presence for voice interactions. Voice search optimization entails tailoring website content, keywords, and structured data to align with natural language queries spoken by users.

- By focusing on conversational and long-tail keywords, businesses can enhance their visibility in voice search results and capture voice-enabled traffic. The ongoing shift towards voice technology presents a valuable opportunity for businesses to engage with consumers in a more conversational and personalized manner. This market expansion is not confined to any specific sector but is observed across various industries, including retail, healthcare, finance, and education. As businesses adapt to this trend, they are investing in voice search optimization tools, voice-activated advertising platforms, and other voice technology solutions to stay competitive and cater to the evolving needs of their customers.

- The continuous unfolding of market activities and the adoption of voice technology are shaping the future of digital marketing, offering new opportunities for businesses to connect with their audiences and drive growth.

What challenges does the Digitaling Spending Industry face during its growth?

- The issue of ad fraud and brand safety concerns in digital advertising poses a significant challenge to the industry's growth. Ad fraud refers to the deceitful practices that undermine the legitimacy of digital advertising, such as bots masquerading as human users or false impressions. Brand safety, on the other hand, pertains to ensuring that advertisements appear in appropriate contexts and do not inadvertently associate with inappropriate or offensive content. These challenges can erode trust in digital advertising and negatively impact the industry's reputation, making it essential for stakeholders to address them in a comprehensive and professional manner.

- The market is a dynamic and evolving landscape, with businesses increasingly allocating resources to reach consumers online. This market encompasses various forms of digital advertising, including search engine marketing, social media advertising, and programmatic advertising. According to recent estimates, digital ad spending in the United States is projected to surpass traditional media spending, reaching over USD120 billion by 2023. Comparatively, search engine marketing holds the largest share of digital ad spending, with social media advertising following closely. Programmatic advertising, which utilizes automated buying and selling of ad inventory, is also experiencing significant growth. These trends reflect the ongoing shift towards digital channels and the increasing importance of targeted, data-driven marketing strategies.

- However, this market is not without challenges. Ad fraud and brand safety concerns continue to pose significant threats. Ad fraud encompasses various deceptive practices aimed at artificially inflating ad impressions, clicks, or conversions to generate revenue or disrupt competitors. These fraudulent activities include click fraud, bot traffic, ad stacking, and domain spoofing, resulting in wasted ad spend and diminished campaign performance for advertisers. Brand safety concerns, on the other hand, arise from the potential placement of ads alongside inappropriate or harmful content, such as fake news, hate speech, or extremist propaganda. The unintended association with such content can tarnish a brand's reputation and damage consumer trust, leading to negative repercussions for businesses.

- Despite these challenges, the market continues to unfold, with new technologies and strategies emerging to address these issues and drive growth. This market's ongoing evolution underscores the importance of staying informed and adaptable for businesses seeking to effectively reach and engage consumers in the digital age.

Exclusive Customer Landscape

The digital marketing spending market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital marketing spending market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Digitaling Spending Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital marketing spending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture Plc - This company specializes in digital marketing services, utilizing tools like Google Analytics to deliver valuable insights. Demographics, traffic origins, conversion rates, and more are analyzed to optimize marketing strategies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Act-On Software, Inc.

- Active Campaign, Inc.

- Acquia, Inc.

- Adobe, Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- ByteDance Ltd.

- Dentsu Group Inc.

- Disruptive Advertising Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- Hubspot, Inc.

- International Business Machines Corporation

- Marketo, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Marketing Spending Market

- In January 2024, Google announced the launch of its updated Google Ads platform, introducing automated bidding strategies and AI-driven campaign optimization, aiming to enhance the efficiency of digital marketing spend for businesses (Google Press Release, 2024).

- In March 2024, Meta Platforms (Facebook) and Microsoft entered into a strategic partnership, allowing Microsoft's advertising clients to buy and manage Facebook and Instagram ads directly through Microsoft's Advertising platform, expanding Microsoft's reach in the digital marketing space (Microsoft Press Release, 2024).

- In May 2024, Martech giant Adobe completed its acquisition of Marketo, a leading marketing automation platform, for approximately USD4.75 billion, aiming to strengthen its marketing solutions portfolio and expand its customer base (Adobe Press Release, 2024).

- In January 2025, the European Union introduced the Digital Services Act, which includes new rules for digital advertising, including transparency requirements and stricter content moderation, impacting digital marketing spending strategies for businesses operating in Europe (European Commission Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, with businesses increasingly relying on data-driven strategies to optimize their campaigns and improve marketing performance. Website analytics tracking plays a crucial role in this process, providing insights into user behavior and campaign effectiveness. For instance, a recent study found that businesses using website analytics saw a 20% increase in conversion rates. Social media advertising remains a significant component of the digital marketing budget, with marketers allocating over 14% of their total marketing spend to this channel. Landing page design is another critical area of focus, with businesses investing in marketing technology stacks to streamline the design process and improve conversion rates.

- Marketing campaign budgeting is an ongoing challenge, with marketers employing various techniques to allocate resources effectively. Conversion rate optimization is a continuous process, with businesses utilizing affiliate marketing programs and mobile marketing strategies to expand their reach and engage customers. Marketing technology stacks are becoming increasingly sophisticated, enabling businesses to manage their campaigns more efficiently. For example, marketing automation tools can help streamline email marketing and PPC campaign management, while marketing analytics dashboards provide real-time insights into campaign performance. The industry growth in digital marketing is expected to reach over 15% annually, reflecting the ongoing importance of digital channels in business marketing strategies.

- Affiliate marketing programs offer businesses a cost-effective way to expand their reach and drive sales, while mobile marketing strategies are essential for engaging customers on the go. E-commerce website optimization and customer relationship management are also critical areas of focus, with businesses investing in data-driven marketing decisions and attribution modeling techniques to optimize their marketing efforts. Overall, the market is a dynamic and evolving landscape, with businesses continually adapting to new trends and technologies to maximize their marketing impact.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Marketing Spending Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 365.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Marketing Spending Market Research and Growth Report?

- CAGR of the Digitaling Spending industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital marketing spending market growth of industry companies

We can help! Our analysts can customize this digital marketing spending market research report to meet your requirements.