Data Security Market Size 2025-2029

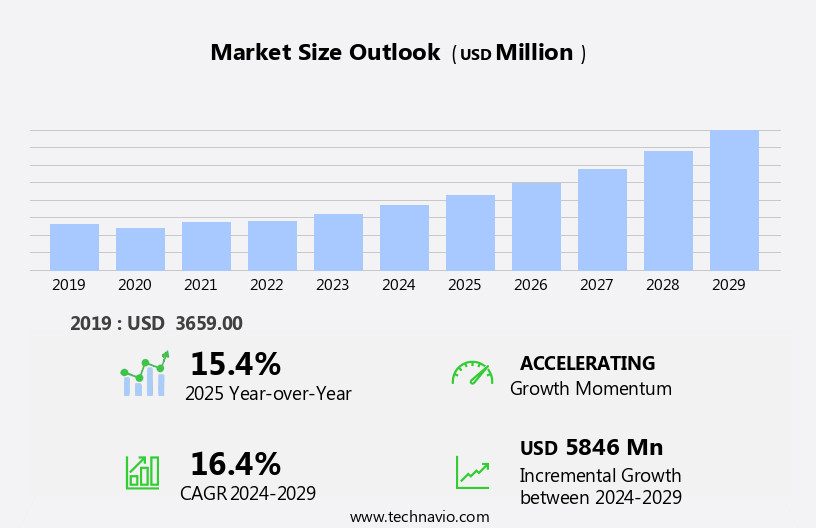

The data security market size is forecast to increase by USD 5.85 billion, at a CAGR of 16.4% between 2024 and 2029.

- The market is driven by stringent regulations mandating robust data protection, as organizations face increasing scrutiny and potential penalties for data breaches. This regulatory pressure fuels the demand for advanced security solutions, particularly in sectors such as healthcare and finance. Additionally, there is a growing trend toward data security automation, as businesses seek to streamline processes and improve efficiency. However, challenges persist, including system integration and interoperability issues. As organizations adopt various security tools and technologies, ensuring seamless communication and collaboration between them can be a significant hurdle.

- Successfully navigating these challenges requires strategic planning and investment in solutions that prioritize interoperability and ease of use. Companies that can effectively address these market dynamics will be well-positioned to capitalize on the opportunities presented by the evolving data security landscape.

What will be the Size of the Data Security Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping the landscape. Encryption keys play a crucial role in safeguarding sensitive information, while network security measures protect against unauthorized access. Access control ensures only authorized users gain entry, and risk assessment identifies potential vulnerabilities. Data masking conceals sensitive data, and disaster recovery plans safeguard against data loss. AI-powered security solutions and threat intelligence provide real-time threat detection, enhancing overall security posture. Cloud security, business continuity planning, and zero trust security are essential in today's digital world. Database security, digital certificates, application security, and data classification are integral components of a comprehensive security strategy.

Vulnerability management, behavioral analytics, data governance, single sign-on (SSO), multi-factor authentication (MFA), incident response, data encryption, and cryptographic algorithms are all essential elements that continually adapt to emerging threats and evolving security needs. The market remains in a constant state of flux, with ongoing innovation and development shaping the future of data protection.

How is this Data Security Industry segmented?

The data security industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Type

- Large enterprise

- SME

- End-user

- BFSI

- Healthcare

- IT and telecommunications

- Government

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

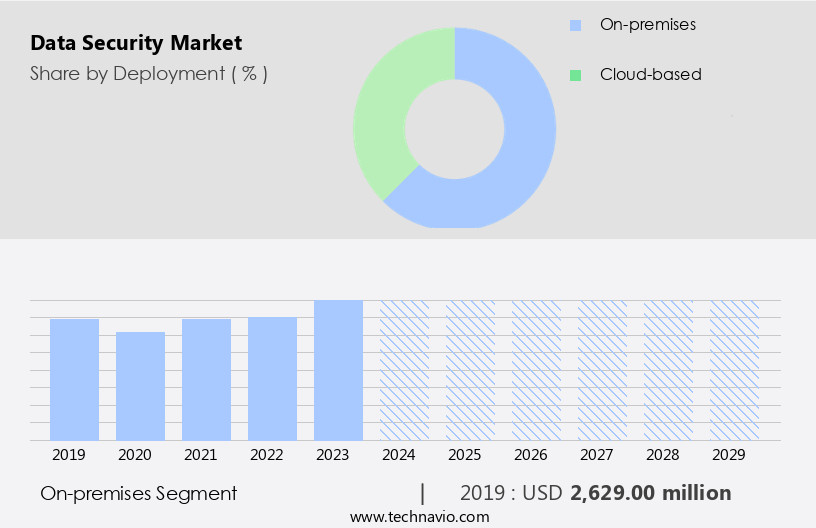

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

In the realm of data security, businesses employ various strategies to safeguard their digital assets. On-premises servers represent a traditional approach, where companies house all hardware and software within their secure facilities. This infrastructure includes servers and storage units, requiring specialized IT support for management and maintenance. Threat modeling and secure coding practices are essential components of on-premises security. Businesses invest in security awareness training to ensure employees understand the importance of data protection. Antivirus and antimalware software are installed to prevent malicious software from infiltrating the system. Data retention policies are enforced, and regular security audits are conducted to assess vulnerabilities.

Penetration testing simulates cyber-attacks to identify weaknesses and improve defenses. Cloud security is integrated to extend protection beyond on-premises boundaries. Business continuity planning ensures data remains accessible during disasters, while zero trust security models limit access based on user behavior and risk assessment. Database security is fortified with encryption keys, digital certificates, and access control. Vulnerability management, data masking, and disaster recovery plans are implemented to mitigate risks. AI-powered security, threat intelligence, and blockchain security add advanced layers of protection. Behavioral analytics, data governance, single sign-on, and multi-factor authentication enhance user experience and security. Incident response teams are prepared to address any data breaches, and data encryption and cryptographic algorithms are employed to protect sensitive information.

Network security is maintained through firewalls, intrusion detection systems, and access control lists. The market for data security is dynamic, with businesses continually adapting to emerging threats and technologies. This includes the integration of emerging technologies like AI, threat intelligence, and blockchain security. The focus remains on maintaining robust security while ensuring business continuity and user experience.

The On-premises segment was valued at USD 2.63 billion in 2019 and showed a gradual increase during the forecast period.

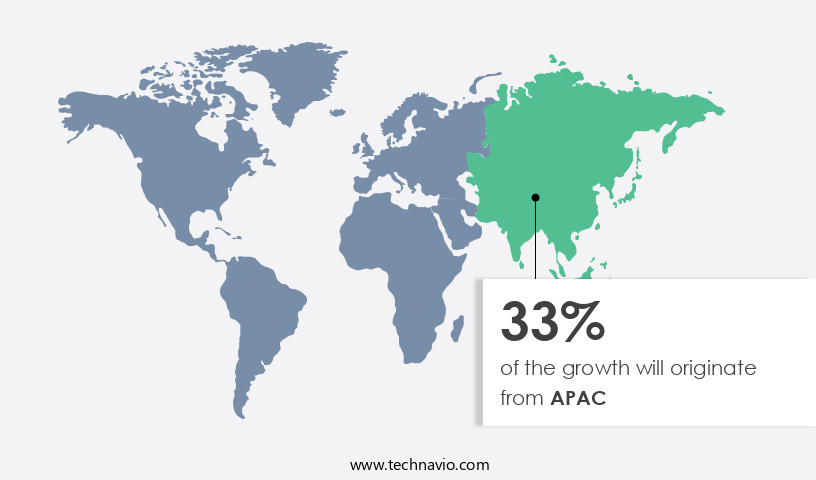

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, particularly in the US and Canada, is poised for substantial growth in the coming years. In 2023, the US accounted for the largest revenue share in the North American market, a trend expected to continue. The US has experienced a significant number of data breaches over the past decade, leading to substantial financial losses for affected companies. Consequently, there has been a heightened awareness of the importance of safeguarding business data. To mitigate potential threats, organizations are implementing various security measures. Threat modeling and secure coding practices are essential components of a robust security strategy.

Security awareness training is another critical element, ensuring employees are vigilant against potential cyber threats. Antivirus and antimalware software are standard tools used to protect against malware and viruses. Data retention policies, security audits, and penetration testing help identify vulnerabilities and ensure regulatory compliance. Cloud security and business continuity planning are crucial for companies that rely on digital platforms. Zero trust security, database security, and digital certificates are essential for maintaining data integrity. Application security, data classification, vulnerability management, encryption keys, network security, access control, risk assessment, data masking, disaster recovery, and incident response are all integral parts of a comprehensive security strategy.

AI-powered security, threat intelligence, blockchain security, behavioral analytics, data governance, single sign-on (SSO), and multi-factor authentication (MFA) are emerging trends in the market. Cryptographic algorithms play a vital role in data encryption, ensuring data confidentiality and integrity. The market's evolution reflects the increasing importance of data security in the digital age.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving digital landscape, the market plays a pivotal role in safeguarding valuable business assets and maintaining customer trust. This market encompasses a range of solutions designed to protect sensitive information from unauthorized access, data breaches, and cyber threats. Key players offer encryption technologies, firewalls, intrusion detection systems, and vulnerability assessments. Additionally, the market caters to identity and access management, security analytics, and compliance solutions. Furthermore, cloud security, mobile security, and IoT security are emerging sub-markets, reflecting the growing importance of securing data across diverse platforms. Businesses across industries rely on these offerings to ensure data confidentiality, integrity, and availability. Data loss prevention, incident response, and disaster recovery are crucial services that further strengthen data security strategies. Overall, the market is a vital component in the digital transformation journey, enabling organizations to securely leverage data for competitive advantage.

What are the key market drivers leading to the rise in the adoption of Data Security Industry?

- Strict regulations governing data protection serve as the primary driver for the market's growth.

- The expanding use of Internet-connected devices globally has led to a substantial increase in the generation of user data. This trend has necessitated the need for robust data security measures, driving market growth. Strict regulations, such as the GDPR in Europe, have been implemented to safeguard personal data and ensure compliance. These regulations introduce new rules for organizations conducting business within their jurisdictions.

- Cloud security, business continuity planning, zero trust security, database security, digital certificates, application security, data classification, and vulnerability management are crucial aspects of data security. Companies are investing in these areas to protect sensitive information and maintain customer trust.

What are the market trends shaping the Data Security Industry?

- The emphasis on automating data security is a significant market trend moving forward. It is essential for organizations to prioritize this area to ensure the protection of sensitive information.

- Data security automation is a significant trend in the IT industry, gaining traction as organizations seek to enhance their data security measures in the face of increasing cyber threats. Automation streamlines mundane data security processes, enabling understaffed teams to focus on more complex tasks. Data security automation tools and platforms offer various functionalities, including asset management, vulnerability assessments, data monitoring, and asset maintenance. These solutions enable organizations to identify potential vulnerabilities, monitor data in real-time, and maintain the condition of their virtual and physical assets. Automation also enhances threat detection capabilities by continuously analyzing data and identifying anomalous behavior.

- Additionally, automation of data security solutions is crucial for disaster recovery and business continuity plans. AI-powered security and threat intelligence further bolster data security automation, providing advanced threat detection and response capabilities. Data masking and encryption keys are essential components of data security automation, ensuring data confidentiality and integrity. Network access control and disaster recovery are other critical aspects of data security automation, ensuring data availability and preventing unauthorized access. By automating data security processes, organizations can improve their overall security posture and reduce the risk of data breaches.

What challenges does the Data Security Industry face during its growth?

- The integration and interoperability of systems represent a significant challenge that impedes industry growth, requiring professionals to address complex issues and ensure seamless communication and data exchange between different systems.

- The market is experiencing significant growth due to the increasing adoption of advanced technologies in various industries, including finance, telecommunications, transportation, and public sector. However, this adoption brings about integration challenges as organizations strive to seamlessly incorporate data security solutions into their existing IT infrastructure. Technical issues, such as server errors and hacking-induced malfunctions, can lead to operational inefficiencies and high costs for businesses. To address these concerns, companies must offer unified data security solutions that can be easily integrated. Behavioral analytics, data governance, single sign-on (SSO), multi-factor authentication (MFA), incident response, data encryption, and cryptographic algorithms are essential components of robust data security solutions.

- By prioritizing these technologies, organizations can enhance their security posture, protect sensitive data, and mitigate potential risks. Moreover, the importance of incident response and data encryption cannot be overstated in today's digital landscape. Effective incident response plans help organizations minimize damage and recover quickly from cyber attacks, while data encryption ensures the confidentiality and integrity of sensitive information. In summary, the market is witnessing increased demand due to the growing need for advanced security solutions. To cater to this demand, providers must focus on offering seamless integration, addressing technical challenges, and incorporating essential security features such as behavioral analytics, data governance, SSO, MFA, incident response, data encryption, and cryptographic algorithms.

Exclusive Customer Landscape

The data security market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data security market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data security market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company specializes in providing advanced data security solutions, including Amazon Web Services (AWS) Cloud Security. Leveraging cutting-edge technologies, we ensure robust protection for valuable data assets. Our approach focuses on continuous monitoring, threat detection, and response, enabling clients to mitigate risks effectively. By implementing multi-layered security measures, we fortify networks, secure applications, and safeguard sensitive information. Our team of experienced security analysts stays updated on the latest threats and vulnerabilities, ensuring our clients remain shielded from potential breaches. With a commitment to innovation and excellence, we empower businesses to secure their digital future.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Broadcom Inc.

- Centrify Corp.

- Cisco Systems Inc.

- Cloudera Inc.

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- Imperva Inc.

- International Business Machines Corp.

- McAfee LLC

- Microsoft Corp.

- NetApp Inc.

- Oracle Corp.

- Palo Alto Networks Inc.

- Proofpoint

- Sirius Computer Solutions Inc.

- Sophos Ltd.

- Thales Group

- Varonis Systems Inc.

- Zscaler Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Security Market

- In January 2024, IBM announced the acquisition of Reason Software, a cybersecurity startup specializing in AI-powered threat detection and response. The deal, valued at USD400 million, aimed to bolster IBM's Security Services portfolio and enhance its ability to offer advanced threat intelligence and incident response services to clients (IBM Press Release, 2024).

- In March 2024, Microsoft and Amazon Web Services (AWS) joined forces to strengthen their cloud security offerings. They announced a strategic partnership to integrate Azure Sentinel, Microsoft's security information and event management (SIEM) solution, with AWS's security services. This collaboration aimed to provide customers with a more comprehensive and seamless security experience across both platforms (Microsoft News Center, 2024).

- In May 2024, Palo Alto Networks launched Cortex XSOAR, an open-security orchestration, automation, and response (SOAR) platform. This new offering aimed to help security teams manage and respond to security incidents more effectively and efficiently, integrating with over 350 security applications and services (Palo Alto Networks Press Release, 2024).

- In April 2025, the European Union's General Data Protection Regulation (GDPR) was expanded to include the Digital Operational Resilience Act (DORA). This new regulation, which took effect in May 2025, requires organizations to implement robust cybersecurity measures to protect their digital infrastructure and ensure business continuity (European Commission, 2025).

Research Analyst Overview

- In the dynamic the market, organizations are increasingly focusing on proactive measures to mitigate cyber threats. Two such approaches gaining traction are purple teaming and red teaming, which blend blue teaming's defensive strategies with offensive tactics to identify vulnerabilities. Endpoint security remains a priority, with incident management and social engineering among the top concerns. Zero-day exploits and insider threats pose significant risks, necessitating robust compliance frameworks and change management processes. Security testing, threat hunting, and security analytics are crucial for proactive threat detection, while identity management and data masking techniques protect sensitive information.

- Distributed denial-of-service (DDoS) attacks and denial-of-service (DoS) incidents continue to plague businesses, underscoring the importance of vulnerability scanning and log management. Patch management and configuration management are essential for maintaining a secure IT infrastructure, mitigating the risks of data breaches.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Security Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.4% |

|

Market growth 2025-2029 |

USD 5846 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.4 |

|

Key countries |

US, Germany, China, UK, Canada, France, Japan, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Security Market Research and Growth Report?

- CAGR of the Data Security industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data security market growth of industry companies

We can help! Our analysts can customize this data security market research report to meet your requirements.