Analytics Market Size 2024-2028

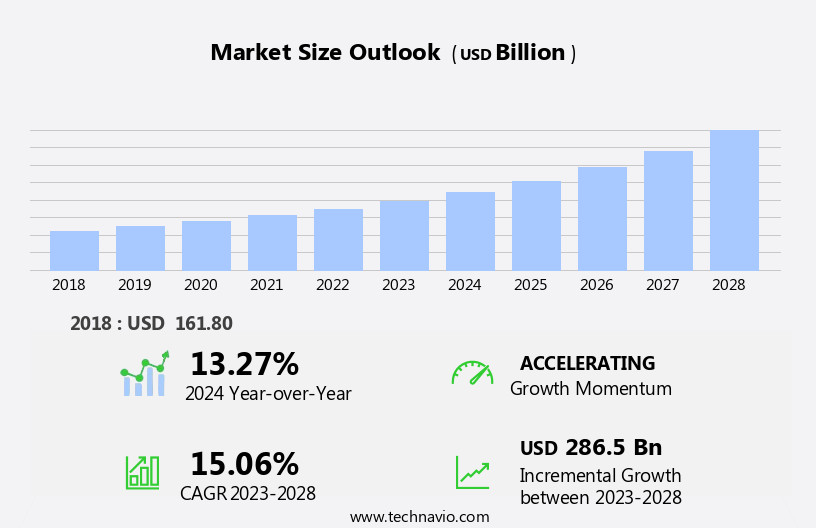

The analytics market size is forecast to increase by USD 286.5 billion at a CAGR of 15.06% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increasing availability and complexity of data are driving market expansion, as organizations seek to gain insights from their data to make informed business decisions. Additionally, advances in natural language processing (NLP), machine learning, and artificial intelligence (AI) technologies are enabling more sophisticated data analysis and prediction capabilities.

- However, data privacy and security concerns remain a challenge, as organizations must ensure the confidentiality, integrity, and availability of their data. Overall, these trends and challenges are shaping the market and presenting opportunities for innovation and growth.

What will be the Size of the Analytics Market During the Forecast Period?

- The market is experiencing significant modernization, driven by the adoption of advanced technologies such as AI and orchestration. Discovery tools and innovation in manufacturing, healthcare, and science are catalyzing the need for more robust analytics solutions. Governance frameworks, privacy regulations, and security best practices are becoming essential components of the analytics landscape. Manufacturing and retail industries are leveraging advanced analytics tools for quality management, lifecycle management, and pipeline optimization. In healthcare, analytics is playing a crucial role in vaccine research and patient care, while in finance, predictive modeling and financial analysis are driving business decision-making. Businesses across industries are turning to advanced analytics platforms for customer relationship management, sales intelligence, and customer segmentation.

- AI adoption is enabling personalized experiences, while virtualization and cloud-based analytics are streamlining operations. Governance, integrity tools, and migration to advanced analytics management platforms are critical for ensuring data accuracy and security. Advanced analytics is also being used for quality management, predictive modeling, and business process optimization in various sectors. Innovation in visualization tools, cataloging, and storytelling is making data more accessible and actionable for businesses, enabling them to gain valuable insights and make informed decisions. Overall, the market is evolving rapidly, with a focus on innovation, efficiency, and data security.

How is this Analytics Industry segmented and which is the largest segment?

The analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Services

- Software

- Hardware

- End-user

- BSFI

- Manufacturing

- Retail

- Healthcare

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Middle East and Africa

- South America

- North America

By Component Insights

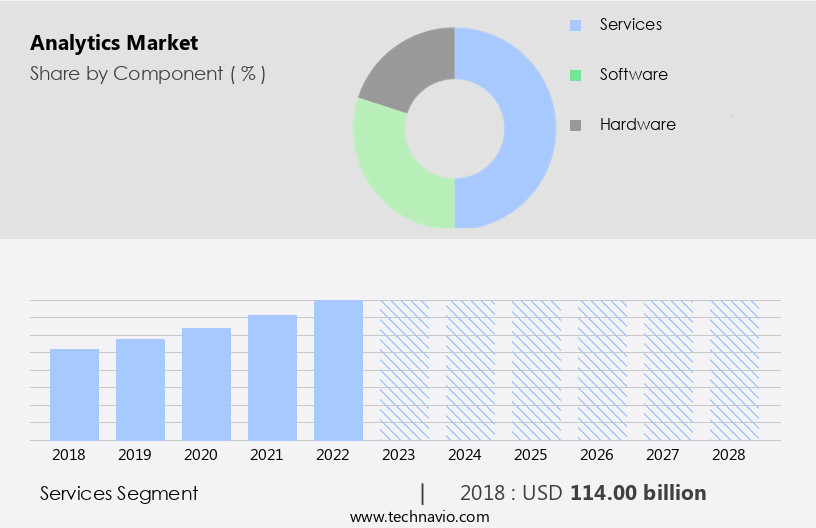

- The services segment is estimated to witness significant growth during the forecast period.

In today's business landscape, analytics plays a pivotal role in driving growth and gaining a competitive edge. companies cater to diverse industry needs by providing customized analytics services, including AI, ETL, social media, meta discovery, hybrid multi-cloud, smart retail, proteins, governance, decision-making, self-service consumption, healthcare, scalability, integration, fabrics, customer experience, sensors, real-time healthcare, IoT solutions, active meta discovery, immersive gaming, analytics apps, digital experience, outbreaks, processing power, network devices, healthcare analytics capabilities, engineering, self-service consumption, AI solutions, text analytics, AI-powered BI, geospatial analysis, business intelligence, e-commerce, customer analytics, security, cross-product access management, human resource management, product promotions, social media advertising, enterprise resource planning, and geospatial analytics.

Service providers enhance data security, discover new revenue streams, transform service support for better productivity, and enable informed business decisions. The increasing competition and innovation necessitate industry-specific, consumer group-specific, and region-specific data analysis, making professional services indispensable.

Get a glance at the Analytics Industry report of share of various segments Request Free Sample

The Services segment was valued at USD 114.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

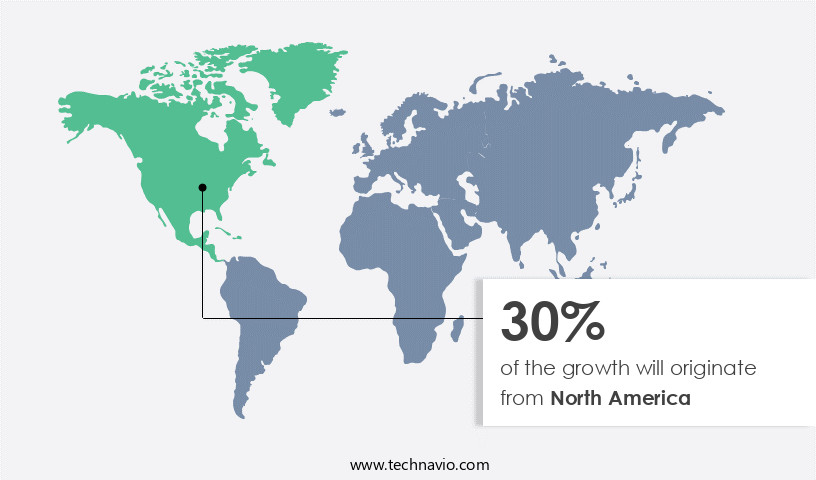

- North America is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the region's high adoption rate of advanced technologies and its status as a leader in innovation. Driving this growth are sectors such as retail, healthcare, and manufacturing, which are increasingly utilizing analytics solutions to improve operations and customer experiences. In healthcare, the adoption of advanced medical devices and compliance with regulations like the Affordable Care Act (ACA) are key factors fueling growth. The aging population in Canada, particularly, is expected to contribute to market expansion in the sector. Additionally, the retail industry's focus on enhancing customer experiences and the manufacturing sector's need for scalability and integration are other factors contributing to the market's growth.

The market in North America encompasses various applications, including AI, ETL, social media, meta discovery, hybrid multi-cloud, smart retail, proteins, governance, decision-making, self-service consumption, healthcare workers, scalability, integration, fabrics, customer experience, sensors, real-time healthcare, IoT solutions, active meta, immersive gaming, analytics apps, digital experience, outbreaks, processing power, network devices, healthcare analytics capabilities, engineering, self-service consumption, AI solutions, text analytics, AI-powered base management, medicine, management, social media analytics, real-time analysis, security, cross-product access management, human resource management, product promotions, social media advertising, enterprise resource planning, geospatial analysis, business intelligence, e-commerce, customer analytics, and security concerns. Predictive analytics and AI-powered geospatial analytics are also gaining traction In the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Analytics Industry?

Growing availability and complexity of data is the key driver of the market.

- The market is experiencing significant growth due to the increasing volume and complexity of data in organizations. Artificial Intelligence (AI) and Machine Learning (ML) technologies are playing a pivotal role in extracting valuable insights from this data. ETL (Extract, Transform, Load) processes and hybrid multi-cloud solutions are enabling the integration and processing of data from various sources, including social media and IoT sensors. In the healthcare sector, AI-powered analytics capabilities are revolutionizing patient care by facilitating real-time healthcare analysis and predicting outbreaks. AI solutions are also being used in self-service consumption for decision-making, human resource management, and product promotions.

- Text analytics and predictive analytics are essential components of AI-powered analytics, providing valuable insights from unstructured data. Moreover, the integration of AI in geospatial analysis is leading to the development of AI-powered geospatial analytics, enhancing business intelligence and e-commerce. However, security concerns are a major challenge In the market, necessitating cross-product access management and security measures. Scalability and integration are critical factors In the selection of analytics solutions. Fabrics and fabric architectures are being used to address these challenges, providing a unified view of data and enabling seamless integration of various analytics apps. In conclusion, the market is witnessing significant growth due to the availability of vast amounts of data and the need to extract valuable insights from it.

- AI and ML technologies are playing a crucial role in this process, enabling real-time analysis, predictive analytics, and self-service consumption. However, security concerns and the need for scalability and integration are major challenges that need to be addressed.

What are the market trends shaping the Analytics Industry?

Growing advances in NLP, ML, and AI technologies is the upcoming market trend.

- The market is experiencing significant growth due to the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and neural networks. AI, a branch of computer science that enables machines to learn and perform tasks without human intervention, is increasingly being used to develop systems capable of contextually understanding data for analysis or triggering activities based on findings. ML and neural network techniques are enabling companies to teach machines to think more like humans, leading to increased precision in analytic models and reduced human errors. ETL (Extract, Transform, Load) processes, hybrid multi-cloud environments, and fabric-based architectures are also driving market growth.

- The market is expanding its reach to various industries, including healthcare, retail, and manufacturing, with applications ranging from real-time healthcare monitoring and predictive analytics to customer experience management and product promotions. Social media analytics, text analytics, and geospatial analysis are also gaining popularity, providing valuable insights into customer behavior and market trends. Scalability, integration, and security are critical factors In the market. Companies are investing in AI solutions to improve decision-making capabilities and enhance self-service consumption. In healthcare, AI-powered solutions are being used for active meta discovery, real-time healthcare monitoring, and IoT solutions to improve patient care and outcomes.

- In retail, smart retail solutions are being used for predictive analytics and customer analytics to optimize inventory management and improve customer experience. The market is also being driven by the increasing use of sensors and network devices, which are generating vast amounts of data that require processing power and analytics capabilities. Real-time analysis, cross-product access management, and human resource management are also key areas of focus. However, security concerns are a major challenge, with the need for robust data governance and compliance with regulations such as HIPAA and GDPR. In conclusion, the market is experiencing significant growth due to the integration of advanced technologies such as AI, ML, and neural networks.

- The market is expanding its reach to various industries, with a focus on scalability, integration, and security. Companies are investing in AI solutions to improve decision-making capabilities and enhance self-service consumption, while also addressing security concerns and regulatory compliance. The future of analytics is bright, with applications ranging from healthcare to retail, and from text analytics to geospatial analysis.

What challenges does the Analytics Industry face during its growth?

Data privacy and security concerns is a key challenge affecting the industry growth.

- In today's data-driven business landscape, the market is experiencing significant growth due to the increasing adoption of artificial intelligence (AI) and machine learning solutions. This includes the use of ETL processes to extract, transform, and load data from various sources for analysis. Social media analytics is a key area of focus, with AI-powered text analytics enabling organizations to gain valuable insights from customer interactions. The hybrid multi-cloud environment is also driving the market, as businesses seek scalability and integration across different cloud platforms. In the retail sector, smart retail solutions are being implemented to enhance the customer experience through real-time analytics and IoT sensors.

- However, data privacy and security concerns are major challenges In the market. With the increasing use of AI solutions, there is a need for robust governance frameworks to ensure secure decision-making and self-service consumption. Healthcare workers, in particular, require real-time healthcare analytics to improve patient outcomes and manage outbreaks, but this data must be protected to maintain patient confidentiality. Furthermore, the integration of analytics capabilities into various applications, such as enterprise resource planning and e-commerce platforms, is driving growth In the market. Predictive analytics and AI-powered geospatial analytics are also gaining popularity, as they enable organizations to gain insights from large data sets and make informed decisions in real-time.

- Despite these opportunities, there are also challenges related to the processing power required for advanced analytics and the need for cross-product access management and security. As the market continues to evolve, it will be important for organizations to prioritize data privacy and security while leveraging the latest AI and IoT solutions to gain a competitive edge.

Exclusive Customer Landscape

The analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Alphabet Inc.

- Amazon.com Inc.

- Dell Technologies Inc.

- Infor Inc.

- Informatica Inc.

- Infosys Ltd.

- International Business Machines Corp.

- Open Text Corporation

- Microsoft Corp.

- MicroStrategy Inc.

- Oracle Corp.

- QlikTech international AB

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- TIBCO Software Inc.

- Wipro Ltd.

- WNS Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as businesses increasingly prioritize data-driven decision-making. This trend is driven by the increasing availability of data from various sources, including ETL processes, social media, and IoT sensors. The ability to process and analyze this data in real-time is crucial for gaining valuable insights and staying competitive. One key area of focus In the market is the integration of AI solutions to enhance analytics capabilities. AI-powered text analytics, for instance, can help organizations gain deeper insights from unstructured data. Self-service consumption of analytics apps is also becoming increasingly popular, allowing businesses to access and analyze data on their own terms.

Another important aspect of the market is the need for scalability and integration. Hybrid multi-cloud solutions are gaining traction as they offer the flexibility to handle large volumes of data while maintaining security and compliance. Fabric-based architectures are also being adopted to ensure seamless integration across various systems and applications. In the healthcare industry, real-time analytics is becoming essential for improving patient outcomes and reducing costs. AI-powered solutions are being used to analyze patient data and identify potential health risks, enabling early intervention and more effective treatment plans. Security is a major concern in the market, with cross-product access management and security becoming key priorities for organizations.

Predictive analytics is also gaining popularity as it can help businesses anticipate future trends and customer behavior, enabling them to make informed decisions and stay ahead of the competition. The market is also seeing significant growth In the e-commerce and retail sectors, with customer analytics playing a crucial role in personalizing the digital experience for customers. Geospatial analysis is another area of focus, enabling businesses to gain insights into customer behavior and trends based on location data. Despite the many benefits of analytics, there are also challenges to overcome. Engineering and managing analytics systems can be complex and time-consuming, requiring specialized skills and resources.

Additionally, there are concerns around the ethical use of data and privacy, which must be addressed to ensure trust and compliance. In conclusion, the market is experiencing significant growth as businesses increasingly prioritize data-driven decision-making. The integration of AI solutions, scalability, security, and real-time analysis are key priorities for organizations across various industries. However, there are also challenges to overcome, including engineering and managing complex analytics systems and addressing ethical concerns around data use and privacy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.06% |

|

Market growth 2024-2028 |

USD 286.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.27 |

|

Key countries |

US, China, UK, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Analytics Market Research and Growth Report?

- CAGR of the Analytics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the analytics market growth of industry companies

We can help! Our analysts can customize this analytics market research report to meet your requirements.