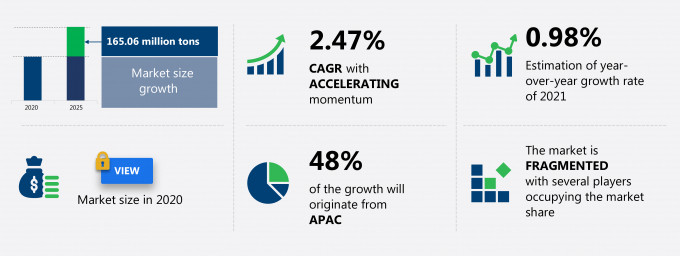

The acrylic fibers market share is expected to increase by 165.06 million tons from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 2.47%.

This acrylic fibers market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers acrylic fibers market segmentation by type (staple and filament) and geography (APAC, North America, Europe, South America, and MEA). The acrylic fibers market report also offers information on several market vendors, including Aditya Birla Management Corp. Pvt. Ltd., Aksa Akrilik Kimya Sanayii AS, China Petrochemical Corp., Dralon GmbH, Formosa Plastics Corp., Kaneka Corp., Mitsubishi Chemical Corp., Radici Partecipazioni Spa, Toray Industries Inc., and Toyobo Co. Ltd. among others.

What will the Acrylic Fibers Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Acrylic Fibers Market Size for the Forecast Period and Other Important Statistics

Acrylic Fibers Market: Key Drivers, Trends, and Challenges

The rise in demand from developing countries is notably driving the acrylic fibers market growth, although factors such as volatility in raw material prices may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the acrylic fibers market industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Acrylic Fibers Market Driver

The rising demand for acrylic fibers from developing countries is one of the key drivers for the market in focus. The acrylic fibers market in developing countries, mainly China, India, Indonesia, Brazil, and Mexico, is witnessing significant growth. Many vendors of acrylic fibers are shifting their manufacturing activities to developing countries. Raw material and land availability, low transportation cost, cheap labor, and less stringent regulations are expected to augment market growth in developing countries. The emergence of China and India as manufacturing hubs for textiles, construction, and automobile industries in APAC is also expected to drive the demand for acrylic fibers. The use of acrylic fibers as industrial fibers for various applications, such as construction and automobiles, is expected to drive the global acrylic fibers market. In the construction industry, acrylic fibers are used as reinforcement materials for producing concrete. The rapid growth in urbanization necessitated the demand for building new establishments post lockdown in the last half of 2020. The increase in residential construction activities in APAC is expected to boost market growth during the forecast period.

Key Acrylic Fibers Market Trend

Growth in demand from niche applications is one of the key trends for the market in focus. Homopolymer acrylic fiber is produced from a single polymer. Homopolymer acrylic fibers provide high strength, chemical and abrasion resistance, and thermal stability to the final products in comparison with co-polymer acrylic fibers. The growing use of homopolymer acrylic fibers to produce dust filter bags is expected to drive market growth during the forecast period. Good permeability, large porosity, and anti-chemical property are some of the major features of filter bags. Dust filter bags are used in various industrial applications, such as cement mills, coal-operated power generation plants, and waste incineration plants.Acrylic fibers are also used in the production of car batteries and brake lining in the automotive industry. The better durability and fire-retardant properties of acrylic fibers make them suitable for these applications. The increase in the demand for passengers and commercial vehicles in APAC is expected to drive market growth. An increase in the use of acrylic fibers in other niche applications such as power generation and the automotive industry is expected to drive market growth during the forecast period.

Key Acrylic Fibers Market Challenge

Volatility in raw material prices is a key challenge for the market in focus. Acrylonitrile is the main raw material used in the production of acrylic fibers. The increase in the prices of acrylonitrile is expected to hinder the growth of the global acrylic fibers market. The increased turnarounds and production bottlenecks have contributed to the tight supply of acrylonitrile. The oil and gas industry is a major supplier of propylene to the producers of acrylonitrile. The fluctuations in crude oil prices will negatively affect the prices of petroleum fraction products, impacting the production cost of acrylonitrile. Thus, the heavy dependency of the global acrylic fibers market on acrylonitrile is expected to hinder the market growth.

This acrylic fibers market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global acrylic fibers market as a part of the global commodity chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the acrylic fibers market during the forecast period.

Who are the Major Acrylic Fibers Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- Aksa Akrilik Kimya Sanayii AS

- China Petrochemical Corp.

- Dralon GmbH

- Formosa Plastics Corp.

- Kaneka Corp.

- Mitsubishi Chemical Corp.

- Radici Partecipazioni Spa

- Toray Industries Inc.

- Toyobo Co. Ltd.

This statistical study of the acrylic fibers market encompasses successful business strategies deployed by the key vendors. The acrylic fibers market is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The acrylic fibers market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Acrylic Fibers Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the acrylic fibers market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the commodity chemicals market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Acrylic Fibers Market?

For more insights on the market share of various regions Request for a FREE sample now!

48% of the market's growth will originate from APAC during the forecast period. China and Japan are the key markets for acrylic fibers in APAC. Market growth in this region will be faster than the growth of the market in North America and Europe.

The growth of APAC's textile industry will facilitate the acrylic fibers market growth in the region over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The rise in the number of COVID-19 cases in countries across the region resulted in the unavailability of workforce and imbalance in the supply of raw materials, which led to the closure of several manufacturing units, including those that develop acrylic fibers. This resulted in a decrease in the production volume of acrylic fibers during the first few months of 2020 in the region. Furthermore, the demand for new acrylic fibers from end-users such as apparel, home textile, and automotive industries was limited. All these factors hampered the growth of the market in APAC in 2020. However, the rise in the construction of residential establishments across the region, the increasing demand for high-quality acrylic fibers from the apparel industry and for home furnishings, and the expected rise in the disposable income of people in several countries are major factors that are expected to boost the growth of the acrylic fibers market in the region during the forecast period.

What are the Revenue-generating Type Segments in the Acrylic Fibers Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The acrylic fibers market share growth in the staple segment will be significant during the forecast period. The short-staple length provides a soft and warm texture similar to cashmere and wool and, hence, acrylic fibers in the staple form have a high adoption rate in the global acrylic fibers market.

This report provides an accurate prediction of the contribution of all the segments to the growth of the acrylic fibers market size and actionable market insights on post COVID-19 impact on each segment.

|

Acrylic Fibers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.47% |

|

Market growth 2021-2025 |

165.06 million tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

0.98 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 48% |

|

Key consumer countries |

US, China, UK, Germany, Japan, and France |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Aditya Birla Management Corp. Pvt. Ltd., Aksa Akrilik Kimya Sanayii AS, China Petrochemical Corp., Dralon GmbH, Formosa Plastics Corp., Kaneka Corp., Mitsubishi Chemical Corp., Radici Partecipazioni Spa, Toray Industries Inc., and Toyobo Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Acrylic Fibers Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive acrylic fibers market growth during the next five years

- Precise estimation of the acrylic fibers market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the acrylic fibers industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of acrylic fibers market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch