Aesthetic Lasers Market Size 2025-2029

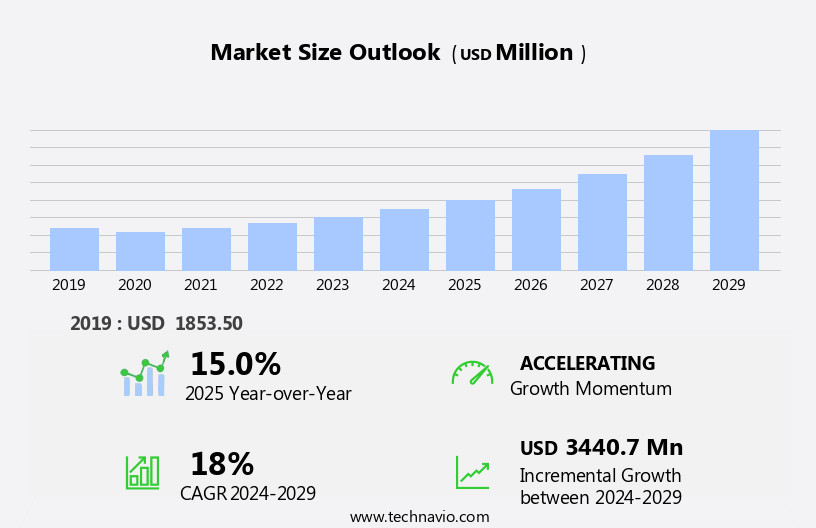

The aesthetic lasers market size is forecast to increase by USD 3.44 billion at a CAGR of 18% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing global awareness and acceptance of medical aesthetics. This trend is particularly noticeable in the rising popularity of cosmetic procedures among both women and men. The male aesthetics industry is witnessing a in demand, presenting a lucrative opportunity for market participants. However, the high cost of aesthetic laser devices remains a challenge for market penetration, particularly in developing regions. To capitalize on this market, companies must focus on developing affordable and effective solutions.

- Additionally, strategic partnerships, collaborations, and mergers and acquisitions can help market players expand their reach and enhance their product offerings. As the market continues to evolve, staying abreast of emerging trends and consumer preferences will be crucial for success. Companies that can effectively navigate these challenges and seize new opportunities will be well-positioned to thrive in the dynamic the market.

What will be the Size of the Aesthetic Lasers Market during the forecast period?

- The market encompasses a range of minimally invasive treatments used to address various cosmetic concerns, including vascular lesions, sagging skin, and unwanted hair. This market is driven by the growing geriatric population and the increasing demand for anti-aging solutions. Anti-aging treatments, such as laser skin resurfacing and laser-assisted lipoplasty, are popular choices for individuals seeking to improve the appearance of facial wrinkles, blemishes, acne scars, and facial pigmentation. Additionally, vascular conditions, such as rosacea and telangiectasias, are effectively treated with Intense Pulsed Light (IPL) laser treatment.

- The aesthetic devices industry continues to innovate, with advancements in laser hair removal technology and the introduction of new lasers, such as CO2 and erbium lasers, expanding the scope of treatments available. Overall, the market for aesthetic lasers is expected to grow steadily due to the increasing acceptance of laser procedures as safe and effective solutions for a wide range of cosmetic concerns.

How is this Aesthetic Lasers Industry segmented?

The aesthetic lasers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Standalone laser devices

- Multiplatform laser devices

- End-user

- Hospitals

- Clinics

- Medical spas

- Application

- Skin Resurfacing

- Hair Removal

- Tattoo Removal

- Others

- Skin Resurfacing

- Hair Removal

- Tattoo Removal

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Asia

- Rest of World (ROW)

- North America

By Type Insights

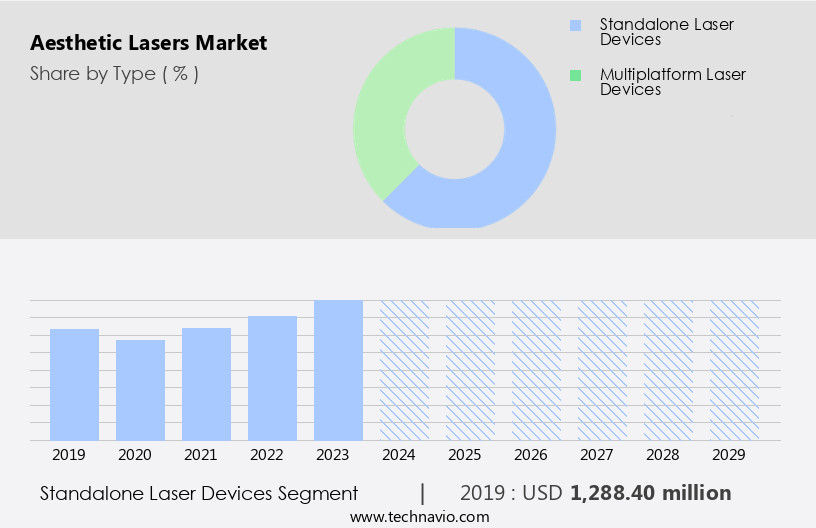

The standalone laser devices segment is estimated to witness significant growth during the forecast period.

Standalone aesthetic lasers are self-contained units that deliver laser energy for various cosmetic treatments, including hair removal, skin rejuvenation, tattoo removal, and acne treatment. The geriatric population, driven by aging baby boomers, seeks anti-aging solutions, fueling market growth. Advanced laser platforms, such as Picosecond and Candela Medical's, offer versatility with multiple wavelengths and adjustable settings. These minimally invasive procedures address skin irregularities, including pigmented lesions, vascular lesions, and facial wrinkles. Brands like Alma Lasers, Fotona Laser, Cynosure, and others provide laser resurfacing, IPL treatment, and laser-assisted lipoplasty.

Get a glance at the market report of share of various segments Request Free Sample

The Standalone laser devices segment was valued at USD 1.29 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

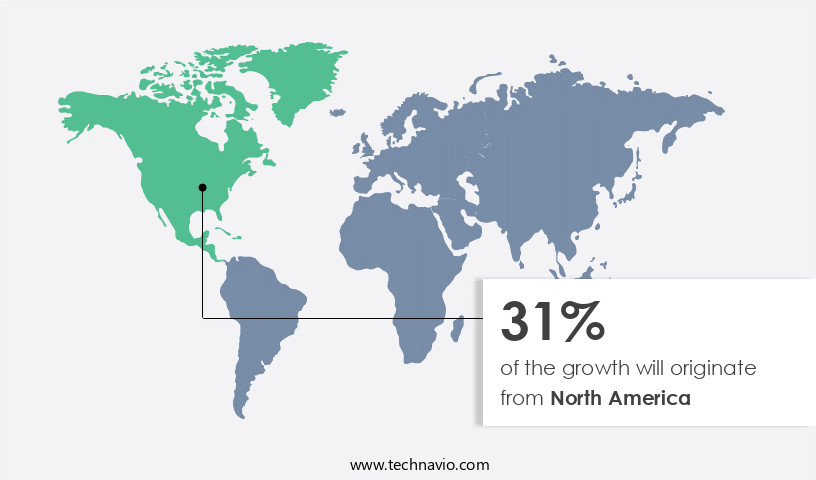

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds the largest share in the global aesthetic lasers industry, driven by the increasing acceptance and utilization of minimally invasive medical aesthetic treatments. Advanced healthcare infrastructure, skilled healthcare practitioners, and the availability of innovative diagnostic techniques are significant factors fueling market growth in this region. The US and Canada are the primary contributors to the North American market, primarily due to the aging baby boomer population and the presence of major companies, including Candela Medical. Aesthetic lasers are utilized for various applications, such as pigmented lesions, vascular lesions, facial wrinkles, blemishes, and hair removal.

Key applications include tattoo removal, laser skin resurfacing, laser-assisted lipoplasty, and laser hair removal. Other applications include the treatment of facial pigmentation, vascular conditions, and skin irregularities. The aesthetic devices industry continues to evolve, with advancements in laser procedures, laser resurfacing, and minimally invasive treatments. Notable companies in the market include Alma Lasers, CO2 laser, Erbium laser, Pulsed dye laser, Alexandrite laser, Diode laser, and others.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aesthetic Lasers Industry?

- Increasing global awareness about medical aesthetics is the key driver of the market.

- Medical aesthetic treatments, which offer non-invasive cosmetic solutions for a natural and healthy appearance, are experiencing significant growth worldwide. These treatments, including Thermage by Bausch Health for skin tightening, are popular due to their quick results and minimal downtime. Thermage utilizes radiofrequency technology to infuse heat into the skin, stimulating collagen production and resulting in smoother, tighter skin. Typically, only one treatment is required, with optimal results emerging around six months post-procedure.

- The increasing preference for non-surgical cosmetic enhancements contributes to the market's expansion. Medical aesthetic treatments cater to consumers seeking to maintain their youthful appearance without undergoing invasive procedures.

What are the market trends shaping the Aesthetic Lasers Industry?

- Opportunities for growth in male aesthetics industry is the upcoming market trend.

- The market is experiencing growth due to the increasing preference for non-surgical cosmetic procedures among men. Men are seeking out non-invasive treatments to improve the appearance of their skin and prevent conditions such as sagging neck skin, commonly referred to as "Turkey neck," and excess skin from the upper eyelids. The benefits of non-surgical procedures have made male aesthetics more accepted and popular, contributing to the market's revenue growth.

- As societal norms continue to shift, there is a significant opportunity for brands to innovate and cater specifically to male consumers. This trend is expected to continue driving the growth of the market.

What challenges does the Aesthetic Lasers Industry face during its growth?

- High cost of aesthetic laser devices is a key challenge affecting the industry growth.

- The market is influenced by several factors that determine the cost of non-surgical skin tightening procedures. On average, these treatments range from USD450 to USD2,000 for the entire course. The cost varies due to individual patient needs and the specific skin rejuvenation method used. Advancements in cosmetic dermatology have led to the development of various skin tightening systems, each offering distinct light intensity and cooling mechanisms.

- The type of equipment employed during laser skin tightening procedures significantly impacts the cost. Despite the high costs, the demand for these procedures remains relatively low in developing countries like India and China due to affordability concerns.

Exclusive Customer Landscape

The aesthetic lasers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aesthetic lasers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aesthetic lasers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Australian Aesthetic Devices Pty Ltd - The company specializes in providing advanced aesthetic laser treatments, including the Thermage System, Clear + Brilliant, and Fraxel therapy. These innovative technologies are designed to enhance skin appearance and improve texture, delivering noticeable results for individuals seeking to improve their complexion. By utilizing the latest laser technology, the company aims to provide effective and safe treatments that cater to diverse skin types and concerns.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Australian Aesthetic Devices Pty Ltd

- Bausch Health Companies Inc.

- Candela Corp.

- Cutera Inc.

- Cynosure LLC

- DEKA M.E.L.A. S.r.l.

- Elesta SpA

- Fotona d.o.o

- Galderma S.A.

- Gooch and Housego Plc

- Hologic Inc.

- Lumenis Be Ltd.

- Lutronic Inc.

- Lynton Lasers Ltd.

- Quanta System S.p.A.

- Sciton Inc.

- Shanghai Fosun Pharmaceutical Group Co. Ltd.

- SharpLight Technologies Inc.

- Sisram Medical Ltd

- Strata Skin Sciences Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of advanced technologies utilized in the cosmetic industry for addressing various skin concerns. These lasers leverage light energy to stimulate cellular regeneration and provide solutions for a multitude of aesthetic issues. The global population continues to age, leading to an increasing demand for anti-aging treatments. A significant portion of this demographic seeks minimally invasive procedures to address signs of aging, such as facial wrinkles, blemishes, and sagging skin. Pigmented lesions and vascular conditions are also prevalent concerns, driving the market for lasers used in tattoo removal and laser-assisted lipoplasty. Aesthetic lasers cater to diverse skin types and conditions, including facial pigmentation, vascular lesions, and skin irregularities.

Technological advancements have led to the development of various laser platforms, such as picosecond laser systems and nanosecond lasers, offering enhanced efficacy and safety. The aesthetic devices industry has witnessed considerable growth due to the increasing popularity of minimally invasive treatments. Laser procedures, including IPL laser treatment and laser skin resurfacing, have gained significant traction among consumers. Co2 lasers, erbium lasers, pulsed dye lasers, and diode lasers are some of the commonly used laser systems in the market. Alexandrite lasers and Fotona lasers are other popular choices for aesthetic applications, offering benefits such as minimal downtime and improved patient comfort.

Cynosure, Alma Lasers, and Candela Medical are some of the key players in the market, providing innovative solutions for various skin concerns. The market dynamics are influenced by factors such as technological advancements, increasing consumer awareness, and growing demand for non-surgical cosmetic procedures. The industry is expected to continue its growth trajectory, driven by the expanding geriatric population and the desire for improved aesthetic appearance. In , the market presents significant opportunities for growth, fueled by the increasing demand for minimally invasive treatments and the expanding aging population. These lasers offer effective solutions for a wide range of skin concerns, making them an essential component of the cosmetic industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18% |

|

Market growth 2025-2029 |

USD 3440.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.0 |

|

Key countries |

US, Canada, China, Germany, UK, Australia, Japan, India, France, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aesthetic Lasers Market Research and Growth Report?

- CAGR of the Aesthetic Lasers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aesthetic lasers market growth of industry companies

We can help! Our analysts can customize this aesthetic lasers market research report to meet your requirements.