Aircraft Wireless Routers Market 2024-2028

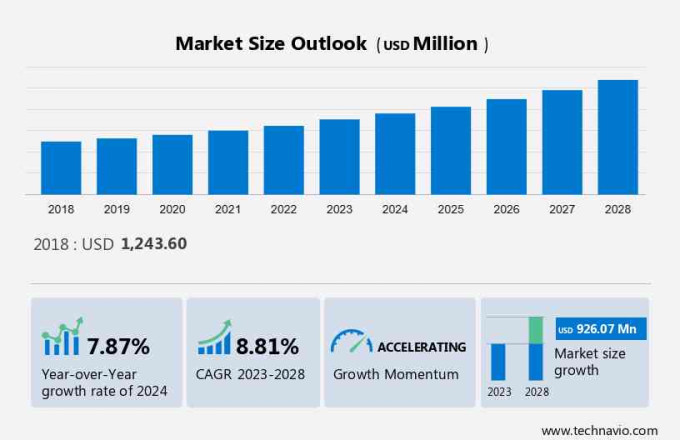

The aircraft wireless routers market size is estimated to grow at a CAGR of 8.81% between 2023 and 2028. The market size is forecast to increase by USD 926.07 million. The growth of the market depends on several factors such as the growing number of air passengers, growing advancements in military aircraft and the rising expansion of low-cost aircraft carriers.

The report offers extensive research analysis on the aircraft wireless routers market with a categorization based on Product, including 3G, 3.5G, and 4G. It further segments the market by Application, encompassing commercial, business aircraft, and military aircraft. Additionally, the report provides geographical segmentation, covering APAC, Europe, North America, the Middle East and Africa, and South America. Market size, historical data (2018-2022), and future projections are presented in terms of value (in USD million) for all the mentioned segments.

What will be the Size of the Aircraft Wireless Routers Market During the Forecast Period?

Aircraft Wireless Routers Market Forecast 2024-2028

To learn more about this report, Request Free Sample

Aircraft Wireless Routers Market Dynamic

Our researchers studied the data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market. Although there has been a disruption in the growth of the market during the COVID-19 pandemic, a holistic analysis of drivers, trends, and challenges will help companies refine marketing strategies to gain a competitive advantage.

Driver - Growing number of air passengers

The rise in disposable income is fueling the number of air passengers across the globe. Also, airlines are increasingly becoming the preferred means of facilitating trade, tourism, and cultural exchanges as the world becomes more connected. For example, Airport Council International (ACI) reported global passenger traffic up by 54% in 2022. The use of air transport has improved efficiency, convenience, and safety owing to advances in technology. The growth of the air transport sector has been greatly influenced by advances in technology.

As a result, the number of air passengers is growing significantly, thereby driving the demand for aircraft wireless routers. The travelers' requirement for the Internet for distinct perspectives such as entertainment is fueling the demand for aircraft wireless routers, thereby driving the growth of the aircraft wireless routers market during the forecast period.

Trends- Rise in popularity of streaming services

The way people consume information and entertainment is changing owing to technology. People while traveling prefer to watch shows and listen to music on an on-demand basis. The growing preference for streaming platforms such as Netflix owing to consumer behaviour has significantly influenced to convenience and accessibility offered by streaming platforms. Consumers have the liberty to choose their own entertainment experiences with a huge selection of content available at their fingertips. Binge-watching has become a cultural phenomenon that allows viewers to take full advantage of their favourite stories by watching all the shows in one instance.

Furthermore, streaming platforms will be able to tailor content recommendations and increase user engagement as a result of the increasing influence of artificial intelligence and data analytics. Thus, the growing emphasis on streaming services will fuel the demand for Internet on air while travelling, which, in turn, will drive the growth of the aircraft wireless routers market during the forecast period.

Challenge- Reliability issues of aircraft wireless network

Aircraft Wi-Fi has been around for decades, but its reliability and speeds can vary widely depending on the airline, the route the type, and the age of the aircraft. For example, Wi-Fi speed and experience differ from ground network and Wi-Fi services are not available in the Indian, Iranian, and Turkish airspace when an aircraft is flying into India, Iran, or Turkey because of insufficient satellite coverage and legislation requirements. Also, the captive portal method- the process by which passengers are connected to an appropriate Wi-Fi, navigate to landing pages, determine what Wi-Fi product they would like, and finally sign up for payment is one main factor that causes connectivity problems.

However, inaccessibility of Wi-Fi, poor signal quality, and high price for the purchase of service are common difficulties that typically plague passengers on a flight with Wi-Fi. For the average person, it can be difficult to move from having a permanent connection on the ground to an unreliable connection in the air. Hence, the reliability issues of the aircraft wireless network are expected to negatively affect the growth of the aircraft wireless routers market during the forecast period.

Aircraft Wireless Routers Market Segmentation by Product, Application and Geography

Product Segment Analysis:

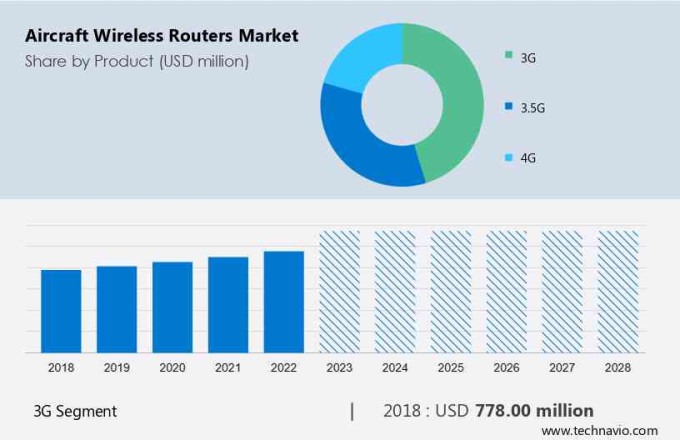

The 3G segment is estimated to witness significant growth during the forecast period. The third-generation (3G) segment held the largest market share in the global aircraft wireless routers market in 2023. High-speed data transfer for gadgets such as laptops, smartphones, and tablets is made possible via 3G routers. These routers can be used in aircraft and typically give rates of up to 100 megabits per second (Mbps).

Customised Report as per your requirements!

The 3G segment was the largest and was valued at USD 778.00 million in 2018. The wireless fidelity (Wi-Fi) hotspot allows several users to access the Internet, so they are not restricted to connecting with just one person. Military aircraft are using wireless routers more often for a variety of uses, including data transmission between UAVs via satellite links and giving the armed forces Internet access while in flight. Moreover, these routers are also utilized in surveillance systems that have cameras, sensors, and microphones installed. The growing need for communication in the air and the growing applications of the Internet in military aircraft is expected to fuel the growth of the 3G segment, which, in turn, will fuel the growth of the global aircraft wireless routers market during the forecast period.

Applicartion Segment Analysis

Based on application, the market has been segmented into commercial, business aircraft, and military aircraft. The commercial?segment will account for the largest share of this segment.?The commercial and business aircraft segment held a significant market share in the global aircraft wireless routers market in 2023. The growing number of air passengers across the globe is fueling the demand for Internet connectivity, which, in turn, fuels the global aircraft wireless routers market. For example, Airbus SE, a European multinational aerospace corporation, delivered 661 commercial aircraft to 84 customers in 2022 and registered 1,078 gross new orders. There were 7,239 aircraft on the Airbus backlog as of December 2022. Thus, the growing number of air passengers and high demand for commercial aircraft is expected to fuel the demand for aircraft wireless routers from commercial and business aircraft, thereby driving the aircraft wireless routers market during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download Sample PDF now!

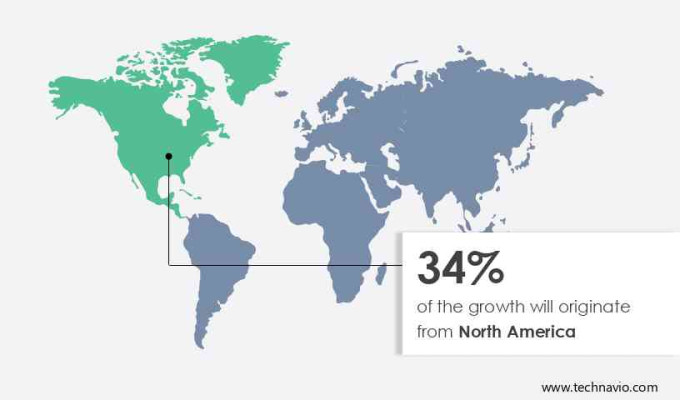

North America is estimated to contribute 34% to the growth by 2028. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. The aircraft wireless routers market in North America is expected to grow significantly during the forecast period as countries such as the US and Canada are among the most technologically advanced military countries. With the US being one of the global leaders in technology, the country records a high penetration of aircraft wireless technology. Also, the region is home to prominent vendors of aircraft wireless routers, such as Cisco Systems Inc., Verizon Communications Inc., and more. Thus, the presence of such vendors gives significant advantages to the end-users, including commercial and business aircraft operators, which, in turn, drives the regional aircraft wireless routers market.

In addition, the presence of the busiest airports across the globe includes a few airports from the region, such as Hartsfield-Jackson Atlanta International Airport, US, which signifies the high number of flyers in the region, which positively affects the growth of the aircraft wireless routers market. Also, the growing military expenditure and upgradation of UAVs are further expected to fuel the growth of the aircraft wireless routers market in North America during the forecast period.

COVID Recovery Analysis:

In 2020, the growth of the aircraft wireless routers market in the region witnessed a decline due to the rapid spread of COVID-19. However, the large-scale vaccination drives conducted by the governments eased the lockdown restrictions in 2021, and economic conditions resumed to recover. The resumption of international trade and travel activities through air fueled the commercial and business aircraft operations in the region in 2022. Moreover, the growing defense budget and the adoption of highly advanced military aircraft in the region are expected to fuel the growth of the regional aircraft wireless routers market during the forecast period.

Who are the Major Aircraft Wireless Routers Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AT and T Inc. - The company offers aircraft wireless routers such as Nighthawk M6, Nighthawk M6 Pro, and Franklin A50.

We also have detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

AT and T Inc., Cisco Systems Inc., Cobham Ltd., Comcast Corp., Curtiss Wright Corp., Honeywell International Inc., Juniper Networks Inc., Netgear Inc., Raytheon Technologies Corp., Verizon Communications Inc., Viasat Inc., and ZTE Corp.

Technavio report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The aircraft wireless routers market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Product Outlook

- 3G

- 3.5G

- 4G

- Application Outlook

- Commercial

- Business aircraft

- Military aircraft

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Aircraft Wireless Routers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.81% |

|

Market Growth 2024-2028 |

USD 926.07 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.87 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AT and T Inc., Cisco Systems Inc., Cobham Ltd., Comcast Corp., Curtiss Wright Corp., Honeywell International Inc., Juniper Networks Inc., Netgear Inc., Raytheon Technologies Corp., Verizon Communications Inc., Viasat Inc., and ZTE Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Aircraft Wireless Routers Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the aircraft wireless routers market between 2024 and 2028

- Precise estimation of the aircraft wireless routers market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of aircraft wireless routers market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch