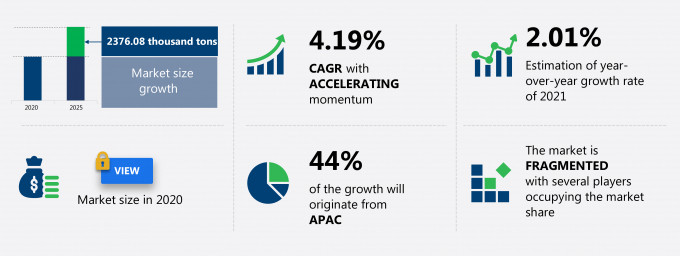

The aluminum market for packaging industry share is expected to increase by 2376.08 thousand tons from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.19%. This aluminum market for packaging industry research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The aluminum market for packaging industry report also offers information on several market vendors, including Alcoa Corp., Amcor Plc, Ardagh Group SA, Ball Corp., Constellium SE, Crown Holdings Inc., Ess Dee Aluminium Ltd., Hindalco Industries Ltd., Norsk Hydro ASA, and United Company Rusal IPJSC among others. Furthermore, this report extensively covers aluminum market for packaging industry segmentation by type (foils, sheets, and others), application (consumer packaging and pharmaceutical packaging), and geography (APAC, Europe, North America, South America, MEA, APAC, Europe, North America, South America, and MEA).

What will the Aluminum Market For Packaging Industry Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Aluminum Market for Packaging Industry Size for the Forecast Period and Other Important Statistics

Aluminum Market For Packaging Industry: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and post COVID-19 era. The growing need for sustainable packaging is notably driving the aluminum market for packaging industry growth, although factors such as volatility in raw material prices may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the aluminum market for packaging industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Aluminum Market For Packaging Industry Driver

The growing need for sustainable packaging is notably driving the aluminum market growth for the packaging industry. Packaging helps in protecting its contents from environmental influences. Also, it helps in protecting the environment from potentially dangerous products that are present in it. Out of all the raw materials used for packaging, aluminum has one of the most robust recycling infrastructures compared with other packaging materials. They are 100% recyclable and can be recycled many times within a short time, without any loss in the quality of the material. Also, aluminum cans are lightweight, unbreakable, and provide superior product protection.Aluminum cans can be easily separated from substrates in a waste stream. Aluminum can be separated by using eddy current technology. Hence, it is easy for vendors to separate these metals from waste and reuse them for packaging. Due to the presence of effective metal-segregation methods, most metals used for packaging are recycled across the globe. For instance, 65%-75% of all aluminum cans are recycled globally, thus making metal packaging the world s most sustainable packaging product.The unique sustainability feature of metal packaging is one of its biggest advantages compared with other packaging materials. This, in turn, drives the growth of the global aluminum market for the packaging industry.

Key Aluminum Market For Packaging Industry Trend

Increasing adoption of lightweight packaging is another factor driving the aluminum market growth for the packaging industry. Lightweight packaging is achieved through the reduction of the number of raw materials used while manufacturing the product. Lighter packaging lowers transportation costs and supports improved sustainability and company profitability targets. Vendors and manufacturers are investing in R&D to innovate lightweight aluminum foil packaging to enhance the end-user segment usability and reduce wastage. This kind of packaging is cost-effective and recyclable. Because glass is heavy, it is cumbersome to transport, which scales up the cost of bottling and production. Below are some of the recent introduction of lightweight weight aluminum packaging:In January 2020, aluminum packaging solution provider Ball Corp. announced that it was set to launch a new recyclable extruded aluminum bottle line, which would be lightweight and could be conveniently recycled.In January 2020, Ball Corp. released a new range of 360 aerosol cans that can protect the product while in transit yet being lightweight

Key Aluminum Market For Packaging Industry Challenge

Volatility in raw material prices is a major hindrance to the aluminum market growth for the packaging industry. The cost of raw materials is one of the major factors determining the end-product price. Hence, any fluctuation in raw material prices affects the vendors operating in the global aluminum market for the packaging industry. The widening of the gap between demand and supply in the last few years has led to a considerable increase in the price of raw materials. Factors affecting the price of raw materials are mentioned below:Changing economic conditionsCurrency fluctuationsCommodity price fluctuationsTransportation costsResource availabilityPolitical instabilityThe buyers of aluminum, which include end-user segments such as food and beverage, cosmetics, and pharmaceuticals, are required to pay high premium charges for the aluminum they purchase from the manufacturer. The premium is a surcharge, which aluminum consumers must pay on top of the prevailing prices to take the delivery of metal from the warehouses. A large part of these premiums is due to the rent that warehouses charge for storing aluminum. Large financial companies like Morgan Stanley, Goldman Sachs, and JPMorgan Chase own these warehouses. The premium may help the manufacturing companies, but the consumers face a disadvantage as they pay a surcharge of up to 20%, which may increase or decrease when the price of aluminum fluctuates. The fluctuations in raw material prices are expected to pose a challenge to the global metal packaging market during the forecast period.

This aluminum market for packaging industry analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes aluminum market for packaging industry as a part of global metal and glass containers market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the aluminum market for packaging industry during the forecast period.

Who are the Major Aluminum Market For Packaging Industry Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alcoa Corp.

- Amcor Plc

- Ardagh Group SA

- Ball Corp.

- Constellium SE

- Crown Holdings Inc.

- Ess Dee Aluminium Ltd.

- Hindalco Industries Ltd.

- Norsk Hydro ASA

- United Company Rusal IPJSC

This statistical study of the aluminum market for packaging industry encompasses successful business strategies deployed by the key vendors. The aluminum market for packaging industry is fragmented and the vendors are deploying growth strategies such as organic and inorganic strategies to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The aluminum market for packaging industry forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Aluminum Market For Packaging Industry Value Chain Analysis

Our report provides extensive information on the value chain analysis for the aluminum market for packaging industry, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global metal and glass containers market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Aluminum Market For Packaging Industry?

For more insights on the market share of various regions Request for a FREE sample now!

44% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for aluminum for the packaging industry in APAC. Market growth in APAC will be faster than the growth of the market in other regions.

The increasing demand for dairy and cosmetics products will facilitate the aluminum market for packaging industry growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of respiratory and infectious diseases in APAC has declined the growth of the aluminum market in the packaging industry. Several countries such as China, India, Nepal, Pakistan, South Korea, Malaysia, Sri Lanka, and the Philippines are under partial or full lockdowns due to the COVID-19 pandemic. As of April, 2021 the total number of confirmed coronavirus cases in India was around 17.3 million, with approximately 195,000 deaths. In March 2020, India had imposed a full lockdown to prevent the community spread of the disease. Other countries in APAC, such as China, the Philippines, and Mongolia, also imposed lockdowns. All manufacturing industries across APAC have been highly affected by these lockdowns and stringent regulations. Their production units have been either closed or halted, which will have a negative impact on the growth of the aluminum market for the packaging industry in the region during the forecast period.

What are the Revenue-generating Type Segments in the Aluminum Market For Packaging Industry?

To gain further insights on the market contribution of various segments Request for a FREE sample

The aluminum market share growth for the packaging industry by the foils segment will be significant during the forecast period. The aluminum foil market will grow at a faster rate than any other aluminum product type owing to its increasing use in packaging. It is widely used for aseptic packaging and pharmaceutical packaging as it can be easily sterilized and is resistant to microorganisms.

This report provides an accurate prediction of the contribution of all the segments to the growth of the aluminum market for packaging industry size and actionable market insights on post COVID-19 impact on each segment.

|

Aluminum Market For Packaging Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.19% |

|

Market growth 2021-2025 |

2376.08 thousand tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

2.01 |

|

Regional analysis |

APAC, Europe, North America, South America, MEA, APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 44% |

|

Key consumer countries |

US, China, UK, Japan, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alcoa Corp., Amcor Plc, Ardagh Group SA, Ball Corp., Constellium SE, Crown Holdings Inc., Ess Dee Aluminium Ltd., Hindalco Industries Ltd., Norsk Hydro ASA, and United Company Rusal IPJSC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Aluminum Market For Packaging Industry Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive aluminum market for packaging industry growth during the next five years

- Precise estimation of the aluminum market for packaging industry size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the aluminum market for packaging industry industry across APAC, Europe, North America, South America, MEA, APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of aluminum market for packaging industry vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch