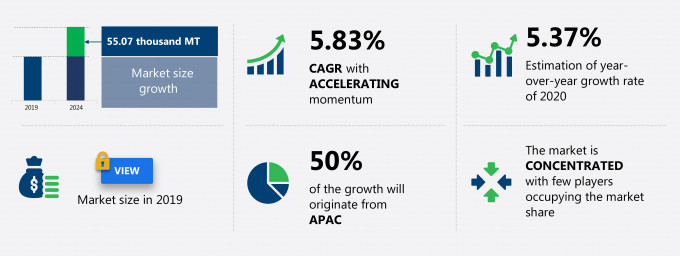

The aluminum welding wires market share is expected to increase by 55.07 thousand MT from 2019 to 2024, and the market’s growth momentum will accelerate at a CAGR of 5.83%.

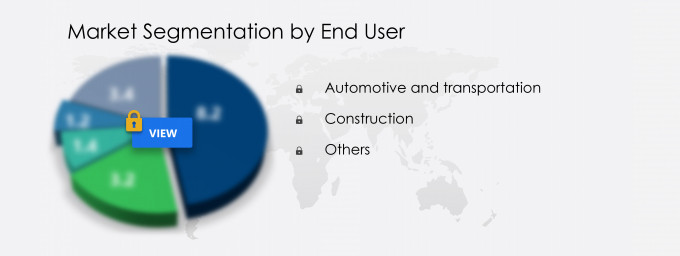

This aluminum welding wires market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers aluminum welding wires market segmentations by end-user (automotive and transportation, construction, and others) and geography (APAC, Europe, North America, South America, and MEA). The aluminum welding wires market report also offers information on several market vendors, including Air Liquide SA, Colfax Corp., CTP Srl, DRAHTWERK ELISENTAL W. Erdmann GmbH & Co., Hilarius Haarlem Holland BV, Novametal SA, Safra Spa, SURAL, The Lincoln Electric Co., and voestalpine AG among others.

What will the Aluminum Welding Wires Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Aluminum Welding Wires Market Size for the Forecast Period and Other Important Statistics

Aluminum Welding Wires Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and post COVID-19 era. The increasing demand for lightweight vehicles is notably driving the aluminum welding wires market growth, although factors such as fluctuating LME prices influence premium and production plans may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the aluminum welding wires industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Aluminum Welding Wires Market Driver

The increasing demand for lightweight vehicles is notably driving the aluminum welding wires market growth. The global demand for aluminum has been on the rise, with the growing demand for lightweight vehicles that use materials such as aluminum as a welding material to bring down the overall weight of a vehicle. The implementation of stringent global standards, such as the national pollution-control standards set by the US Department of Transportation or the US Environmental Protection Agency, has also fueled demand for aluminum welding wires. Aluminum is identified as a versatile material and is the second most chosen material after steel. It is used for applications in different end-use industries, such as building and construction, electrical, machinery, automotive, transportation, and other machinery. Aluminum is used in many forms in the automotive industry, ranging from sheets for the vehicle body to welding owing to its unique features such as lightweight, corrosion resistance, and recyclability. The use of advanced technologies to reduce emission levels, increase fuel efficiency, and improve the driving dynamics of the vehicle is increasing in the automotive industry.

Key Aluminum Welding Wires Market Trend

An increase in demand for welding wires for repair and maintenance is the key trend driving the aluminum welding wires market growth. There has been a considerable increase in the demand for aluminum welding wires for repair and maintenance applications in various sectors, especially the automotive and infrastructure segments. Various initiatives taken by organizations are helping to boost market growth for repair and maintenance applications. For instance, the Long Life Bridges project, funded by the EU, assists public authorities in deciding on the maintenance or repair of bridges by employing new models to accurately calculate the value of bridges. The increase in vehicle numbers also leads to a higher requirement for maintenance and repair services, driving the demand for aluminum welding wires. The global automotive industry is on the rise owing to increased digital demands and diverging markets. The industry is fueled by demands from countries such as Japan and South Korea.

Key Aluminum Welding Wires Market Challenge

The major challenge impeding the aluminum welding wires market growth is the fluctuating LME prices influence premium and production plans. After the pandemic, the price of aluminum declined due to a demand-supply gap in 2020. The price rose drastically due to revised supply-demand level in 2021. By April 2021, LME (London Metal Exchange) aluminum price was $2,344.01 per ton. At present, the trend is again moving toward the recession period when the prices were low. Therefore, the fluctuations in LME prices play a significant role in the production volumes and profit margins of vendors. The premiums are also affected by price change as they are directly related to the LME prices. The buyers of aluminum, which include end-use segments such as automotive, construction, and shipbuilding, are required to pay high premium charges for the aluminum they purchase from the manufacturer. The premium is a surcharge that aluminum consumers must pay in addition to the main prices to receive the delivery of the metal from the warehouses. Such fluctuation can hinder the growth of the aluminum welding wires in the future.

This aluminum welding wires market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2020-2024.

Parent Market Analysis

Technavio categorizes the global aluminum welding wires market as a part of the global diversified metals and mining market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the aluminum welding wires market during the forecast period.

Who are the Major Aluminum Welding Wires Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Air Liquide SA

- Colfax Corp.

- CTP Srl

- DRAHTWERK ELISENTAL W. Erdmann GmbH & Co.

- Hilarius Haarlem Holland BV

- Novametal SA

- Safra Spa

- SURAL

- The Lincoln Electric Co.

- voestalpine AG

This statistical study of the aluminum welding wires market encompasses successful business strategies deployed by the key vendors. The aluminum welding wires market is concentrated and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- CTP Srl - The company offers aluminium welding wires that are used for electric cables, transformer windings, metal components, motor windings.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The aluminum welding wires market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Aluminum Welding Wires Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the aluminum welding wires market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Aluminum Welding Wires Market?

For more insights on the market share of various regions Request for a FREE sample now!

50% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for aluminum welding wires market in APAC.

The investments in process automation in countries such as China to keep up with the competition will facilitate the aluminum welding wires market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In early 2020, the COVID-19 pandemic in APAC led to the closure of many construction projects, where aluminum welding wires are used. In addition, the closed international trading amid the pandemic resulted in decreased demand for aluminum welding wires from importers, hence reducing the growth rate of the market in focus in APAC. However, the construction of new hospitals and advancing infrastructure for oxygen delivery in hospitals in countries like China helped vendors sustain growth in 2020. Furthermore, the reopening of international trade in Q4 of 2020 is expected to boost the demand for aluminum welding wires in APAC during the forecast period.

What are the Revenue-generating End-user Segments in the Aluminum Welding Wires Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The aluminum welding wires market share growth by the automotive and transportation segment will be significant during the forecast period. Vehicle manufacturers are focusing on scaling their operations to meet the rising demand for vehicles. For instance, in October 2018, Suzuki Motors announced its plans to build a second manufacturing plant in Gujarat, India, by 2021. The facility would have three assembly lines with a manufacturing capacity of 250,000 vehicles per year. Therefore, the increasing demand for vehicles and subsequent efforts of manufacturers in enhancing their businesses will fuel the demand for aluminum welding wires products.

This report provides an accurate prediction of the contribution of all the segments to the growth of the aluminum welding wires market size and actionable market insights on post COVID-19 impact on each segment.

|

Aluminum Welding Wires Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2019 |

|

Forecast period |

2020-2024 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.83% |

|

Market growth 2020-2024 |

55.07 thousand MT |

|

Market structure |

Concentrated |

|

YoY growth (%) |

5.37 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 50% |

|

Key consumer countries |

China, US, Japan, Germany, and France |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Air Liquide SA, Colfax Corp., CTP Srl, DRAHTWERK ELISENTAL W. Erdmann GmbH & Co., Hilarius Haarlem Holland BV, Novametal SA, Safra Spa, SURAL, The Lincoln Electric Co., and voestalpine AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Aluminum Welding Wires Market Report?

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will drive aluminum welding wires market growth during the next five years

- Precise estimation of the aluminum welding wires market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the aluminum welding wires industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of aluminum welding wires market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch