Antimicrobial Therapeutics Market Size 2024-2028

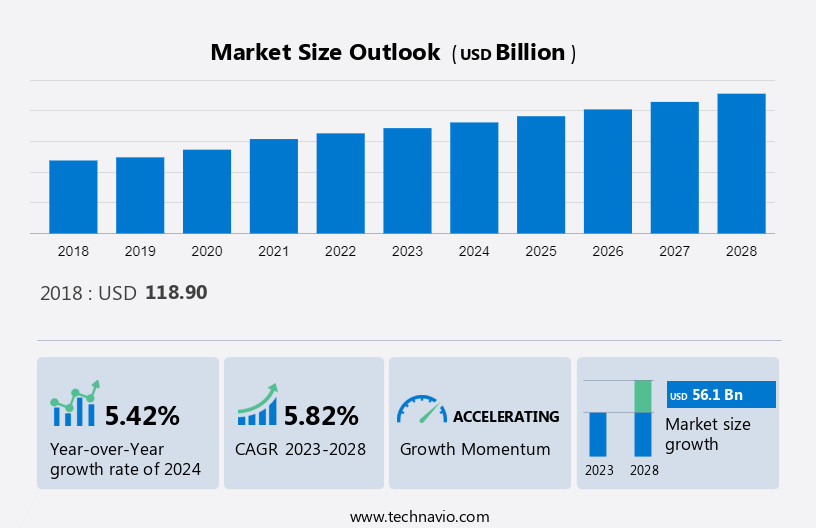

The antimicrobial therapeutics market size is forecast to increase by USD 56.1 billion at a CAGR of 5.82% between 2023 and 2028. The growth of the market hinges on multiple factors, notably recent drug approvals and a robust pipeline, alongside initiatives from government agencies in the pharmaceutical industry. Additionally, increasing awareness about microbial diseases plays a pivotal role. With a surge in novel drug developments and supportive regulatory frameworks, the market is poised for expansion. Government interventions and funding further stimulate research and development efforts. Moreover, heightened awareness among healthcare professionals and the general public about the significance of combating microbial threats fuels the demand for advanced antimicrobial solutions, fostering market growth and innovation.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

The market is pivotal in addressing the global challenges posed by infections and multidrug-resistant infections. Researchers are tackling polymer degradation issues and ensuring chemical stability in formulations, exploring both organic and inorganic compounds as raw materials. Advanced formulations are being developed with self-cleansing properties for various surfaces, particularly in the medical and healthcare sector. Chemical solution providers are key players, offering a diverse range of chemical products for home care and cleaning, plastics & rubber, pulp & paper, textile, and leather & footwear industries.

Further, market expansion extends to business segments like surface technologies, nutrition & care, agricultural solutions, and safety & construction. Collaboration among business identities and nutrition & biosciences sectors drives innovation, supporting applications in transportation & industrial, electronics & imaging, and non-core industries. Emerging therapies like Remdesivir, Paxlovid, and Combination therapies from companies like Qpex Biopharma and Biocon Pharma show promise in combating infections, alongside advancements in antifungal drugs and point-of-care diagnostics to improve the drug development process and enhance patient outcomes. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The initiatives from government agencies in the pharmaceutical industry are notably driving the demand during the forecast period. Government insurance programs for medicines aid in the treatment of patients with microbial infections in many developed countries, including the United States, Canada, the United Kingdom, Germany, France, Australia, and Japan. Antimicrobial disease eradication requires significant funding from both government and private organizations. Antimicrobial diseases are receiving more funding as a result of their inclusion on the WHO's list of diseases that need to be eradicated.

Moreover, the Bill and Melinda Gates Foundation provided USD 15 million to the Infectious Disease Research Institute to develop a vaccine to prevent leishmaniasis. Such government initiatives are expected to drive the market in focus over the forecast period. Various government and non-governmental organizations, including the Bill and Melinda Gates Foundation and the World Bank Group, are conducting various awareness campaigns and providing funding to eradicate microbial diseases. Hence, such factors are driving the market during the forecast period.

Significant Market Trend

The increased disease diagnostic modalities is a new trend in the market. Over the last five years, the healthcare sector has been equipped with sophisticated diagnostic modalities and POC diagnostic tests as a result of improved new technologies. Diagnostics and biomarkers (measurable cellular, biochemical, or molecular alterations in biological samples that indicate any biological, pathogenic, or therapeutic response) are being introduced to the world. Many companies are currently focusing on developing proof-of-concept products that can significantly reduce diagnostic time while maintaining high patient compliance.

Further, several promising laboratory-based viral load technologies and simple point-of-care (POC) tests, for example, are expected to be widely available in the near future. Thus, disease diagnostic modalities are expected to drive market growth during the forecast period.

Major Market Challenge

The increased availability of generic drugs is a major challenge that may hinder the global market growth during the forecast period. Due to patent expiry and loss of exclusivity, Companies are focusing on manufacturing low-cost alternative drugs, which reduces sales of approved drugs. The global market is completely saturated with generic formulations. Furthermore, generic drugs, vaccines, antibiotics, and biosimilars are less expensive than branded drugs.

Moreover, Gilead Sciences Inc. (Gilead) plans to launch authorised generics of Epclusa and Harvoni for the treatment of chronic Hepatitis C for USD 24,000, which is nearly 75% less than the price of branded drugs. Lexiva, another drug developed by ViiV Healthcare (a joint venture between Pfizer and GlaxoSmithKline), is used to prevent. Mylan Inc. (Mylan) currently sells the generic version of Lexiva in the United States. Hence, such factors are hindering the market during the forecast period.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbbVie Inc.- The company offers azactam injection which is used as medicine to treat symptoms of bacterial infections that occur in the blood and urinary tract.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Astellas Pharma Inc.

- Bavarian Nordic AS

- Biocidium Biopharmaceuticals Inc.

- Bristol Myers Squibb Co.

- Cadila Pharmaceuticals Ltd.

- CSL Ltd.

- Emergent BioSolutions Inc.

- F. Hoffmann La Roche Ltd.

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Inovio Pharmaceuticals Inc.

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Mitsubishi Corp.

- Novartis AG

- Novavax Inc.

- Pfizer Inc.

- Sanofi SA

- Wockhardt Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

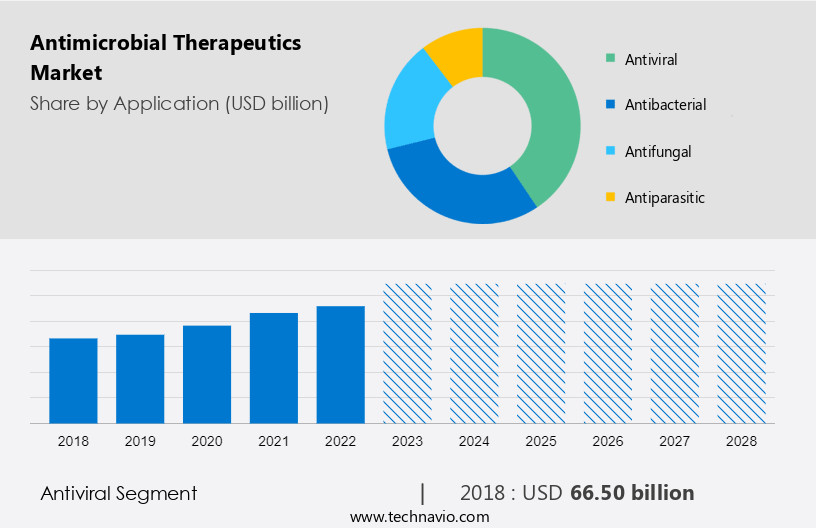

The market share growth by the antiviral segment will be significant during the forecast period. During the forecast period, the antiviral segment is expected to grow moderately. The market encompasses solutions for inhibiting the growth of infection-causing microorganisms, including bacteria, fungi, algae, yeasts, mildew, and parasites. Untreated particles can lead to discoloration, unpleasant odors, and polymer degradation. To address these issues, antimicrobials offer enhanced properties such as dimensional stability, heat resistance, and chemical resistance. These benefits are crucial in various industries, including mining operations and the production of chemical solutions and products for industrial applications, nutrition, packaging & prints, and paint & coatings.

Get a glance at the market contribution of various segments View the PDF Sample

The antiviral segment was valued at USD 66.50 billion in 2018. The robust pipeline of antiviral drugs is one of the major factors driving the market. Increased antiviral drug use results in the development of pipeline drugs and novel therapies with novel targets and mechanisms of action. For instance, Immune Response BioPharma's (Immune Response) REMUNE is in Phase II clinical trials for the treatment of HIV/AIDS in paediatric patients. Furthermore, Abivax SA (Abivax) developed ABX464 for the treatment of HIV. It is a small oral molecule that prevents HIV replication by removing viral reservoirs and lowering viral load in HIV patients. As a result, the market in focus is expected to experience accelerated growth momentum during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

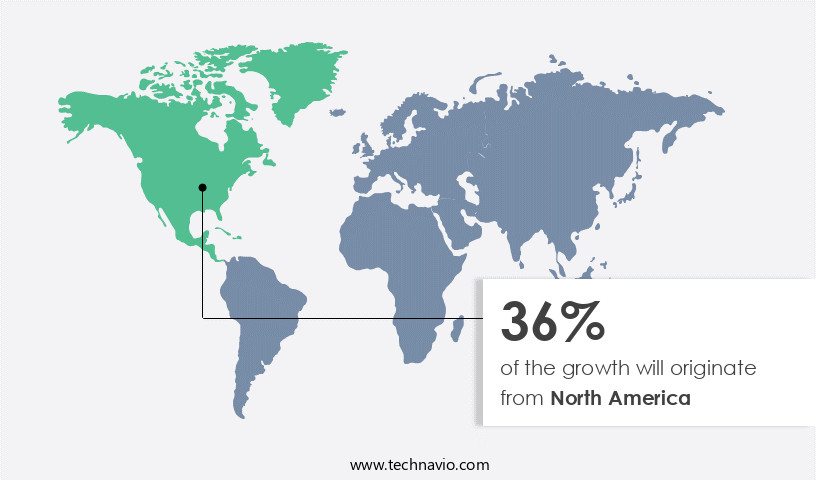

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in North America is driven by the prevalence of infection-causing microorganisms, including bacteria, fungi, algae, yeasts, mildew, and parasites. Untreated particles can lead to discoloration, unpleasant odors, and polymer degradation. Enhanced antimicrobial properties, such as dimensional stability, heat resistance, and chemical resistance, are essential for various industries, including mining operations and chemical solution providers. The risk of contaminant pathogens spreading demands effective antimicrobial solutions. Key metals used include silver, copper, and zinc. Applications include industrial processes, nutrition, packaging & prints, paint & coatings, and personal care & hygiene. Setbacks, such as the outbreak of fever-causing microorganisms like influenza, HIV/AIDS, and COVID-19, increase market demand.

Moreover, the presence of strong reimbursement schemes for the treatment of deadly microbial diseases in the US is expected to drive the market. For instance, the Vaccines for Children (VFC) programme provides free vaccines for children who are uninsured, Medicaid-eligible, and under-insured. The Centers for Medicare and Medicaid Services in the United States reimburses all elderly patients with microbial infections such as HIV. Hence, such factors are driving the market growth in North America during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application Outlook

- Antiviral

- Antibacterial

- Antifungal

- Antiparasitic

- End-user Outlook

- Pharmacies

- Hospitals and clinics

- Research and academic institutes

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- Asia

- China

- India

- Rest of World (ROW)

- Saudi Arabia

- South Africa

- Brazil

- North America

You may also interested in below market reports:

- Sepsis Therapeutics Market: Sepsis Therapeutics Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Japan, Germany, UK - Size and Forecast

- Antibiotics Market: Antibiotics Market Analysis Asia, North America, Europe, Rest of World (ROW) - US, China, India, UK, Japan - Size and Forecast

- Human Microbiome Therapeutics Market: Human Microbiome Therapeutics Market Analysis North America,Europe,Asia,Rest of World (ROW) - US,Germany,France,UK,Japan - Size and Forecast

Market Analyst Overview

The market is a significant segment in the healthcare industry, focusing on the development and distribution of medicines to prevent or treat infections caused by microorganisms. These therapeutics include antibiotics, antivirals, antifungals, and antiparasitics. The market is driven by the increasing prevalence of infectious diseases, rising antibiotic resistance, and technological advancements in antimicrobial research and development. Infectious diseases such as tuberculosis, malaria, HIV/AIDS, and hepatitis continue to pose a global health threat, necessitating the need for effective antimicrobial therapeutics. Furthermore, the emergence of multi-drug resistant strains of bacteria and viruses has fueled the demand for new antimicrobial agents. The market is also influenced by regulatory policies, pricing pressures, and reimbursement scenarios. The use of advanced technologies such as gene editing, nanotechnology, and artificial intelligence in antimicrobial research and development is expected to revolutionize the market in the coming years.

The market encompasses the development, production, and distribution of pharmaceutical agents used to prevent or treat infections caused by microorganisms such as bacteria, viruses, fungi, and parasites. Pathogens pose a significant threat to public health, leading to an increasing demand for effective antimicrobial therapies. The demand is driven by factors such as the rising prevalence of infectious diseases, increasing antibiotic resistance, and growing awareness and initiatives to combat antimicrobial resistance. The market for antimicrobial therapeutics is diverse, with various classes of antimicrobials including antibiotics, antivirals, antifungals, and antiparasitics. The market is expected to grow significantly in the coming years due to the increasing burden of infectious diseases and the need for effective antimicrobial agents to combat them. The industry is also witnessing significant research and development efforts to discover new antimicrobial agents and improve existing ones to address the growing issue of antibiotic resistance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.82% |

|

Market Growth 2024-2028 |

USD 56.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.42 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., Astellas Pharma Inc., Bavarian Nordic AS, Biocidium Biopharmaceuticals Inc., Bristol Myers Squibb Co., Cadila Pharmaceuticals Ltd., CSL Ltd., Emergent BioSolutions Inc., F. Hoffmann La Roche Ltd., Gilead Sciences Inc., GlaxoSmithKline Plc, Inovio Pharmaceuticals Inc., Johnson and Johnson Services Inc., Merck and Co. Inc., Mitsubishi Corp., Novartis AG, Novavax Inc., Pfizer Inc., Sanofi SA, and Wockhardt Ltd. |

|

Market dynamics |

Parent market growth analysis, Market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market report during the forecast period

- Detailed information of market analysis and report on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market and its contribution in focus to the parent market

- Accurate predictions about upcoming market trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.