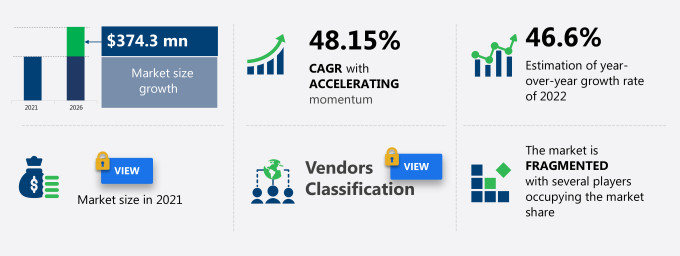

The artificial intelligence market share in the education sector in the US is expected to increase by USD 374.3 million from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 48.15%.

This artificial intelligence market in the education sector in the US research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers the artificial intelligence market segmentation in the education sector in US by end-user (higher education and K-12) and education model (learner model, pedagogical model, and domain model). The artificial intelligence market in the education sector in US report also offers information on several market vendors, including Alphabet Inc., Carnegie Learning Inc., Century-Tech Ltd., Cognii, DreamBox Learning Inc., Fishtree Inc., Intellinetics Inc., International Business Machines Corp., Jenzabar Inc, John Wiley and Sons Inc., LAIX Inc., McGraw Hill Education Inc., Microsoft Corp., Nuance Communications Inc., Pearson Plc, PleIQ Smart Toys Spa, Providence Equity Partners LLC, Quantum Adaptive Learning LLC, Tangible Play Inc., and True Group Inc. among others.

What will the Artificial Intelligence Market Size in the Education Sector in US be During the Forecast Period?

Download Report Sample to Unlock the Artificial Intelligence Market Size in the Education Sector in US for the Forecast Period and Other Important Statistics

Artificial Intelligence Market in the Education Sector in the US: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and post-COVID-19 era. The increasing demand for ITS is notably driving the artificial intelligence market growth in the education sector in the US, although factors such as security and privacy concerns may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the artificial intelligence industry in the education sector. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Artificial Intelligence Market Driver in the Education Sector in US

The increasing demand for ITS is one of the major drivers impacting the artificial intelligence market in the education sector growth. ITS is increasingly being adopted in schools, colleges, and universities owing to the various benefits offered by it. Vendors such as Carnegie Mellon University offer AI software that acts as tutors, guiding students by devising step-by-step personalized learning paths. Carnegie Mellon University offers a series of mathematics tutors for middle schoolers. In addition, the increasing adoption of IAL software further drives the demand for ITS. Mc Graw Hill offers IAL software called ALEKS. It is a web-based AI assessment and learning system that uses adaptive learning to assess the knowledge of students. The advent of these AI technologies drives the growth of the market.

Key Artificial Intelligence Market Trend in the Education Sector in US

Growing emphasis on crowdsourced tutoring is one of the major trends influencing the artificial intelligence market in the education sector growth. One of the major trends that foster market growth is the rising emphasis on the use of AI for crowdsourced tutoring. Today, children do not just learn in the classroom; social media platforms also play an important role in their learning. The advent of online educational services has further fostered knowledge acquisition from social platforms. With the increase in the advent of AI learning technologies such as ML, deep learning, and NLP, it has become easy to obtain remote help from social websites and social networks. For example, the Brainly app enables users to ask homework questions and receive automatic answers that are verified by fellow students as well as educators on the platform. It also uses AI algorithms to personalize its platform's networking features and provide users with an experiential learning environment.

Key Artificial Intelligence Market Challenge in the Education Sector in US

Security and privacy concerns is one of the major challenges impeding the artificial intelligence market in the education sector growth. Artificial intelligence software is highly vulnerable to cyber-attacks. Considering that it contains a ton of data, hackers are constantly devising ways to attack this software to breach the data. It could be dangerous for the victims of such cyber-attacks to have their personal information in the open. AI models use student data to design personalized pathways for students. The process of developing an AI algorithm and its functioning often requires the algorithm to collect huge amounts of student data such as their performance, personal details, learning patterns, and other private information. The possibility of this data being compromised and misused limits market demand. Further, certain AI solutions such as ITS track activities and emotional and behavioral patterns of students. Such data need to be protected against potential misuse by education providers and recruitment organizations. Hence, the security and privacy concerns associated with AI impede the growth of the market.

This artificial intelligence market in the education sector in the US analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the artificial intelligence market in the education sector in the US in the US as a part of the global education market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the artificial intelligence market in the education sector in US during the forecast period.

Who are the Major Artificial Intelligence Market Vendors in the Education Sector in US?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alphabet Inc.

- Carnegie Learning Inc.

- Century-Tech Ltd.

- Cognii

- DreamBox Learning Inc.

- Fishtree Inc.

- Intellinetics Inc.

- International Business Machines Corp.

- Jenzabar Inc

- John Wiley and Sons Inc.

- LAIX Inc.

- McGraw Hill Education Inc.

- Microsoft Corp.

- Nuance Communications Inc.

- Pearson Plc

- PleIQ Smart Toys Spa

- Providence Equity Partners LLC

- Quantum Adaptive Learning LLC

- Tangible Play Inc.

- True Group Inc.

This statistical study of the artificial intelligence market in the education sector in US encompasses successful business strategies deployed by the key vendors. The artificial intelligence market in the education sector in the US is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The artificial intelligence market in the education sector in the US forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Artificial Intelligence Market in the Education Sector in US Value Chain Analysis

Our report provides extensive information on the value chain analysis for the artificial intelligence market in the education sector in US, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

What are the Revenue-generating End-user Segments in the Artificial Intelligence Market in the Education Sector in US?

To gain further insights on the market contribution of various segments Request a PDF Sample

The AI market in the higher education sector in the US is expected to record a steady growth rate during the forecast period. Colleges and universities in the US are increasingly opting for tools that not only improve the quality of education but also ensure that students are provided with an experiential learning environment.

This report provides an accurate prediction of the contribution of all the segments to the growth of the artificial intelligence market in the education sector in US size and actionable market insights on the post-COVID-19 impact on each segment.

|

Artificial Intelligence Market Scope in the Education Sector in US |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 48.15% |

|

Market growth 2022-2026 |

$ 374.3 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

46.6 |

|

Regional analysis |

US |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alphabet Inc., Carnegie Learning Inc., Century-Tech Ltd., Cognii, DreamBox Learning Inc., Fishtree Inc., Intellinetics Inc., International Business Machines Corp., Jenzabar Inc, John Wiley and Sons Inc., LAIX Inc., McGraw Hill Education Inc., Microsoft Corp., Nuance Communications Inc., Pearson Plc, PleIQ Smart Toys Spa, Providence Equity Partners LLC, Quantum Adaptive Learning LLC, Tangible Play Inc., and True Group Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Artificial Intelligence Market in the Education Sector in US Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive the artificial intelligence market growth in the education sector in US during the next five years

- Precise estimation of the artificial intelligence market in the education sector size in US and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the artificial intelligence industry in the education sector across the US

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of the artificial intelligence market vendors in the education sector in US

We can help! Our analysts can customize this report to meet your requirements. Get in touch