Automotive Diecast Scale Model Market Size 2024-2028

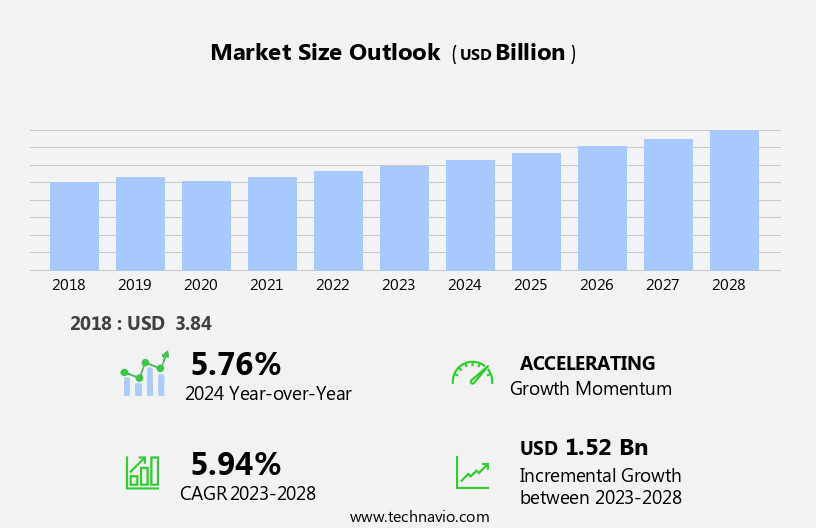

The automotive diecast scale model market size is forecast to increase by USD 1.52 trillion billion at a CAGR of 5.94% between 2023 and 2028.

What will be the Size of the Automotive Diecast Scale Model Market During the Forecast Period?

How is this Automotive Diecast Scale Model Industry segmented and which is the largest segment?

The automotive diecast scale model industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Cars

- Bikes

- End-user

- Collectors

- Non-collectors

- Material

- Metal

- Resin

- Plastic

- Alloy

- Composite

- License Type

- License

- Licensed

- Unlicensed

- Custom

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

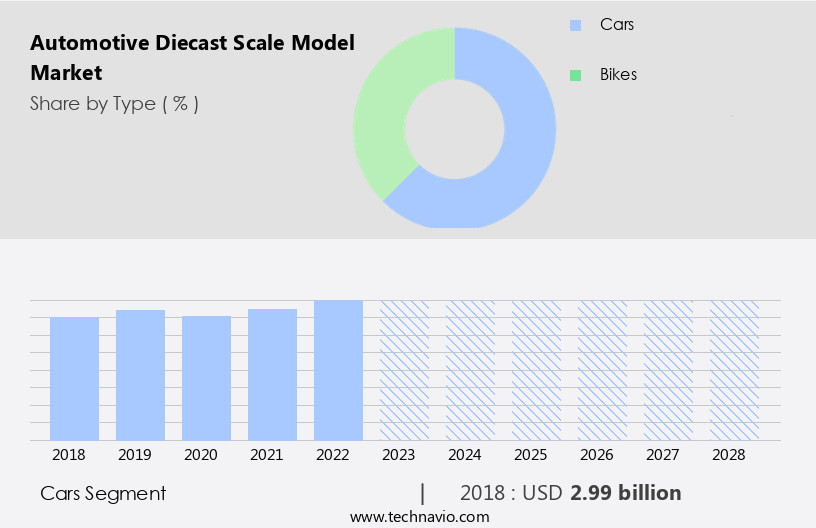

- The cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing growth due to increasing demand for both smaller and larger-scale models. While smaller models are often considered toy-quality items for children's play, such as slot racing, the cars segment is expected to expand significantly. Moreover, the vintage automobile sector is driving growth In the market, with collectors seeking authentic and licensed replica versions of luxury vehicles, such as the Bburago Ferrari SF 90 Stradale Signature Edition 1/18 and GT Spirit Mercedes Benz AMG S 63 Limited Edition Diamond White Bright 1/18. Production processes have advanced to include high-quality items with intricate detailing, appealing to collectors. The market also caters to automotive parts enthusiasts, offering lightweight chassis, electric vehicles, and heritage models.

Sales channels include model display events, online retailers, and collector clubs. Consumer spending on these items is influenced by EPA regulations encouraging the use of lightweight metals, such as aluminum alloys, in production processes. Revenue generation In the market is subject to market competition and product authenticity.

Get a glance at the Automotive Diecast Scale Model Industry report of share of various segments Request Free Sample

The Cars segment was valued at USD 2.99 trillion billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

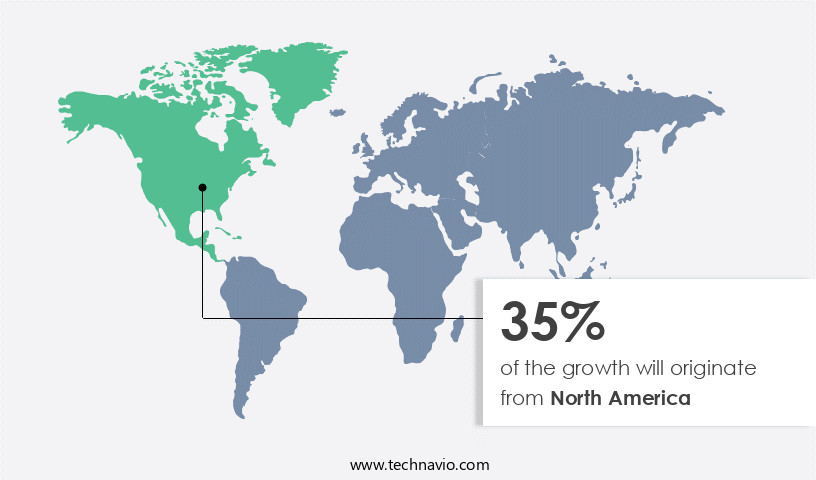

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for automotive diecast scale models is primarily driven by the United States, where consumers prioritize model quality and reliability. Collectors seek exclusivity, leading to a higher demand for premium models, despite moderate price sensitivity. Established brands benefit from this trend due to increased revenue generation. A significant collector community in North America, particularly In the US, fuels the demand for these models. The production process involves die-cast components, lightweight chassis, and high-quality items, including replica versions of luxury vehicles, automotive parts, vintage vehicles, and heritage models. EPA regulations encourage the use of lightweight metals, such as aluminum alloys, in manufacturing.

Sales channels include model display events, online retailers, and collector clubs. Consumer spending on automotive diecast scale models continues to grow, with recyclability offering an added advantage. Market competition is intense, with emphasis on product authenticity and innovation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Diecast Scale Model Industry?

Potential high resale value of certain diecast scale model is the key driver of the market.

What are the market trends shaping the Automotive Diecast Scale Model Industry?

Rising focus on preservation and legacy revival among car enthusiasts is the upcoming market trend.

What challenges does the Automotive Diecast Scale Model Industry face during its growth?

Consumer-specific cost constraints is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The automotive diecast scale model market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive diecast scale model market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive diecast scale model market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ACME Trading Co. - The company specializes In the distribution of authentic automotive diecast scale models, featuring renowned brands such as Alfa Romeo, Arrow Mclaren, and Aston Martin. These collectible replicas encompass iconic vehicles like the Alfa Romeo 8C 2300 Monza, Arrow Mclaren SP, and Aston Martin DB5 Vantage. With a commitment to accuracy and detail, these models cater to enthusiasts and collectors seeking high-quality representations of their favorite automobiles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACME Trading Co.

- Amalgam Collection

- Auto World Store

- AUTOart

- AutoCult GmbH

- Automania India

- Automodello

- Corgi Model Club

- Ducal LLC

- GreenLight LLC

- Hamleys of London Ltd.

- KYOSHO Corp.

- Mattel Inc.

- May Cheong Group

- Model Car World GmbH

- Motormax Toy Factory Ltd.

- Scale Arts India

- Simba Dickie Group GmbH

- Spark Models

- Sun Star Models Development Ltd.

- Welly Die Casting Factory Ltd.

- Minimax Import and Export Co. Ltd.

- Norev

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and distribution of replica versions of collectable automobiles. These intricately detailed models cater to car enthusiasts seeking authentic representations of their favorite vehicles. The market is driven by several factors, including the collector's sector's continued interest in luxury vehicles and heritage models. Production processes for these high-quality items involve meticulous attention to detail, often utilizing lightweight chassis and die-cast components made from various metals, such as aluminum alloys. The integration of electric vehicles into the market adds a modern twist, as collectors seek sustainable alternatives to traditional gasoline-powered models. The automotive parts industry plays a significant role In the diecast scale model market, with many manufacturers collaborating to create accurate and authentic replicas.

The collaboration ensures product authenticity and enhances the overall consumer experience. Consumer spending In the market is influenced by various driving factors, including the desire for unique and rare items, nostalgia, and the appeal of owning a miniature version of a desirable vehicle. Collector clubs and model display events further fuel demand, providing platforms for enthusiasts to showcase their collections and connect with like-minded individuals. EPA regulations and the focus on recyclability have led to advancements In the production processes, with manufacturers exploring more sustainable materials and manufacturing methods. This not only benefits the environment but also adds value to the market by catering to the growing demand for eco-friendly products.

The market competition is fierce, with numerous players vying for market share. Manufacturers differentiate themselves through product quality, innovation, and customer service. Revenue generation is achieved through various sales channels, including direct-to-consumer sales, retail stores, and online marketplaces. In conclusion, the market is a dynamic and evolving industry driven by the passion and dedication of car enthusiasts. The market's continued growth is fueled by innovation, collaboration, and a focus on sustainability, ensuring its relevance and appeal to collectors and enthusiasts worldwide.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.94% |

|

Market growth 2024-2028 |

USD 1.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.76 |

|

Key countries |

US, Japan, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Diecast Scale Model Market Research and Growth Report?

- CAGR of the Automotive Diecast Scale Model industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive diecast scale model market growth of industry companies

We can help! Our analysts can customize this automotive diecast scale model market research report to meet your requirements.