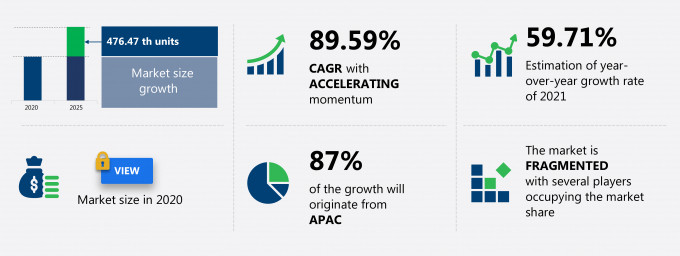

The automotive in-wheel motor market share is expected to increase by 476.47 thousand units from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 89.59%.

This automotive in-wheel motor market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers automotive in-wheel motor market segmentations by technology (direct drive and gear reduction), drive type (rear-wheel drive, front-wheel drive, and all-wheel drive), and geographic (APAC, Americas, EMEA, APAC, Americas, and EMEA). The automotive in-wheel motor market report also offers information on several market vendors, including Daimler AG, ECOmove GmbH, e-Gle Co. Ltd., Elaphe Propulsion Technologies Ltd., GEM motors d.o.o, Michelin Group, Nidec Corp., NSK Ltd., Protean Electric Ltd., and REE Automotive Ltd. among others.

What will the Automotive In-wheel Motor Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive In-wheel Motor Market Size for the Forecast Period and Other Important Statistics

Automotive In-wheel Motor Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The increased need for safety and handling efficiency in vehicles is notably driving the automotive in-wheel motor market growth, although factors such as high cost of production associated with automotive in-wheel motor s may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive in-wheel motor industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive In-wheel Motor Market Driver

One of the key factors driving the automotive in-wheel motor market growth is the increased need for safety and handling efficiency in vehicles. Features that aid in vehicle handling and enhance safety are always preferred by buyers. Hence, vehicle manufacturers have been updating their models within multiple driver-assist features that enable the driver to with superior control of a vehicle. Further, automotive regulatory authorities such as the European Commission, the US National Highway Traffic Safety Administration, GB standards of China, Test Requirements and Instructions for Automobile Standards of Japan, and Automotive Industry Standards of India are implementing various stringent regulations that mandate certain safety and driver-assist features in vehicles to mitigate vehicle accidents. Vehicle makers are keen on offering many driver-assist features in electric vehicles to augment their utility and improve sales. The deployment of in-wheel motors in electric vehicles will allow manufacturers to offer a higher number of quick-response driver-assist and safety features n vehicles. Moreover, the use of in-wheel motors will give electric vehicles more space in the chassis for accommodating a bigger battery or cargo. A bigger battery can increase the performance range of an electric vehicle and give it an edge over competitors.

Key Automotive In-wheel Motor Market Trend

Another key factor driving the automotive in-wheel motor market growth is the integration of compact inverters in automotive in-wheel motors. Vehicle makers are downsizing various components in an electric vehicle to reduce weight and increase efficiency. The extra space thus available can be used for accommodating a bigger battery, among other things. Automotive in-wheel motor makers are developing various designs that incorporate multiple systems like inverters in in-wheel motors to enhance overall efficiency. The inverter is an important component that monitors the amount of electricity exchanged between the motor and the battery. It consists of a cooling system, condensers, and semiconductor modules. Manufacturers of in-wheel motors are combining inverters with automotive in-wheel motors to offer a streamlined package that reduces the overall space taken by the inverter and motor. For instance, Nissan Motor offers an automotive in-wheel motor model integrated with a compact inverter. As an inverter in an electric vehicle controls a large amount of energy transfer, this increases its operating temperatures. The company has also successfully developed a new compact inverter the size of a coffee cup. The compact inverter, Pivo 2, can be integrated into in-wheel motors to increase operational efficiency.

Key Automotive In-wheel Motor Market Challenge

High cost of production associated with automotive in-wheel motors is one of the key challenges hindering the automotive in-wheel motor market growth. Producing an automotive in-wheel motor requires significant amounts of investment in terms of the materials used, design, and various other factors. Increased production costs associated with automotive in-wheel motors will restrict the market's growth during the forecast period. Automotive in-wheel motors are priced at between $1,300 and 1,600 per motor, which would significantly increase vehicle costs. Automotive in-wheel motors use powerful permanent magnets as they are lighter, durable, and highly efficient over conventional copper coil-based induction motors. Vehicle makers are now switching to neodymium-based motors to enhance efficiency. Moreover, China, the top producer of neodymium, has imposed a ban on its exports, which has raised the price of this rare earth metal drastically. Therefore, increasing prices of raw materials add to the production costs of automotive in-wheel motors. The wide adoption of expensive technology such as in-wheel motors in a vehicle segment like electric vehicles that occupy a small share of the global automotive industry can prove to be a high-risk venture.

This automotive in-wheel motor market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global automotive in-wheel motor market as a part of the global automotive components and accessories market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive in-wheel motor market during the forecast period.

Who are the Major Automotive In-wheel Motor Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Daimler AG

- ECOmove GmbH

- e-Gle Co. Ltd.

- Elaphe Propulsion Technologies Ltd.

- GEM motors d.o.o

- Michelin Group

- Nidec Corp.

- NSK Ltd.

- Protean Electric Ltd.

- REE Automotive Ltd.

This statistical study of the automotive in-wheel motor market encompasses successful business strategies deployed by the key vendors. The automotive in-wheel motor market is fragmented and the vendors are deploying growth strategies such as organic and inorganic strategies to compete in the market.

Product Insights and News

- Daimler AG - The company offers automotive in-wheel motor solutions, under the subsidiary company YASA ltd. with product series of YASA 750R which is a axial flux motor with high torque and power densities.

- Daimler AG -In June 2021, Mercedes Benz Trucks announced the launch of battery electric eActros for heavy-duty short-radius distribution. The standard model of the eActros is planned to roll off the production line in Worth am Rhein, Germany, from autumn 2021.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive in-wheel motor market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive In-wheel Motor Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive in-wheel motor market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Automotive In-wheel Motor Market?

For more insights on the market share of various regions Request for a FREE sample now!

87% of the market’s growth will originate from APAC during the forecast period. China, Japan, and South Korea (Republic of Korea) are the key markets for automotive in-wheel motor market in APAC. Market growth in this region will be slower than the growth of the market in other regions.

The penetration of electric vehicles will facilitate the automotive in-wheel motor market growth in APAC over the forecast period. The growth of the automotive in-wheel motor market depends mainly on the production of high-performance electric vehicles. Moreover, growing governmental investments to set up infrastructure such as quick-charging stations is driving the adoption of electric vehicles in countries such as China. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

COVID-19-related lockdowns and social distancing norms affected automobile sales in the region in 2020, as customers avoided purchasing cars for a prolonged period. Furthermore, movement restrictions led to supply chain disruptions, which hampered the sales of automobiles in the region. For instance, according to the Society of Electric Vehicle Manufacturers (SMEV), in early 2020, electric vehicle registrations in India declined by more than 18% to around 235,000 units as compared to 2019. However, the sales of automobiles, including electric vehicles, have been recovering in 2021 with relaxations in travel restrictions and rise in automobile production in the region. This is expected to foster the growth of the automotive in-wheel motor market in the region during the forecast period.

What are the Revenue-generating Technology Segments in the Automotive In-wheel Motor Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive in-wheel motor market share growth by the direct drive will be significant during the forecast period. The direct drive system is the most common motor type found in in-wheel electric motors. Most in-wheel motor manufacturers are replacing gear reducers with direct drive motors. The use of direct drive motors in automotive in-wheel motors is preferred as they decrease vehicle weight, eliminate noise, enhance operational efficiency by eliminating mechanical losses, and offer higher durability.

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive in-wheel motor market size and actionable market insights on post COVID-19 impact on each segment.

|

Automotive In-wheel Motor Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 89.59% |

|

Market growth 2021-2025 |

476.47 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

59.71 |

|

Regional analysis |

APAC, Americas, EMEA, APAC, Americas, and EMEA |

|

Performing market contribution |

APAC at 87% |

|

Key consumer countries |

China, Japan, US, South Korea (Republic of Korea), and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Daimler AG, ECOmove GmbH, e-Gle Co. Ltd., Elaphe Propulsion Technologies Ltd., GEM motors d.o.o, Michelin Group, Nidec Corp., NSK Ltd., Protean Electric Ltd., and REE Automotive Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive In-wheel Motor Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive automotive in-wheel motor market growth during the next five years

- Precise estimation of the automotive in-wheel motor market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive in-wheel motor industry across APAC, Americas, EMEA, APAC, Americas, and EMEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive in-wheel motor market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch