Bearings Market Size 2025-2029

The bearings market size is forecast to increase by USD 17.29 billion at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing growth, driven primarily by the surging demand for high-quality bearings in various industries, including automotive, manufacturing, and renewable energy. One of the most significant trends shaping the market is the increasing adoption of electric vehicles (EVs), which require a higher number of bearings due to their complex powertrains. However, the market is not without challenges. The proliferation of counterfeit and used bearings in the market poses a significant threat to market players, as they undermine the quality and reliability of the products.

- To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on innovation, quality assurance, and supply chain transparency. By investing in research and development, implementing quality control measures, and collaborating with suppliers and distributors to ensure authenticity, market participants can differentiate themselves and build trust with their customers.

What will be the Size of the Bearings Market during the forecast period?

- The global bearing market encompasses a wide range of products and services, including bearing noise reduction, custom bearings, and replacement. These offerings cater to various industries, with applications in bearing installation, assembly, and alignment. Shielded bearings, remanufacturing, and lubrication systems are essential components of this market, alongside high-performance bearings and specialized types such as hydrodynamic, journal, axial, and sliding bearings. Bearing optimization software, hydrostatic, sealed, ultra-precision, and hybrid bearings are also integral parts of the market's landscape. Services like bearing repair, preloading, and condition assessment are in high demand, along with bearing simulation, stiffness assessment, and monitoring.

- Additionally, the market offers various types of bearings, including thrust, clearance, low-temperature, super-sized, and corrosion-resistant bearings. Miniature bearings, vibration analysis, disassembly, and torque solutions are other essential offerings. Air bearings and open bearings cater to specific applications, while bearing recycling and simulation software contribute to the market's continuous growth.

How is this Bearings Industry segmented?

The bearings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

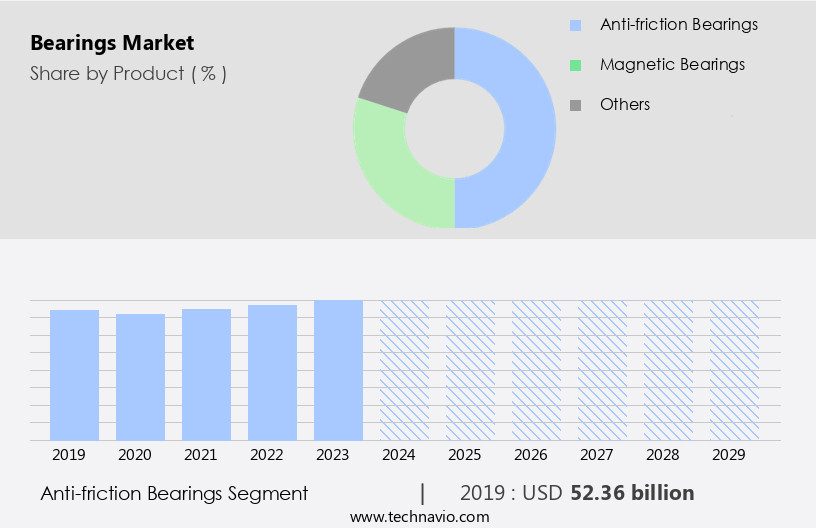

- Product

- Anti-friction bearings

- Magnetic bearings

- Others

- End-user

- Automotive industry

- Heavy industry

- ARS Industry

- Others

- Type

- Ball Bearings

- Roller Bearings

- Plain Bearings

- Distribution Channel

- OEM

- Aftermarket

- Measurement

- 30 to 40 mm

- 41 to 50 mm

- 51 to 60 mm

- 61 to 70 mm

- 70 mm and above

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- UAE

- APAC

By Product Insights

The anti-friction bearings segment is estimated to witness significant growth during the forecast period.

Anti-friction bearings are integral components in machinery, minimizing friction between moving parts like shafts, axles, and wheels. Current market trends favor application-specific bearings due to their efficiency and ease of use. The industrial and automotive sectors, driven by increasing core manufacturing processes, fuel the demand for these bearings. Extensive usage of bearings is observed in various industries, including automotive, aerospace, railways, wind generation, and defense. In wind power generation, bearings are essential for wind turbines' various parts, such as shaft, gearbox, generator, and yaw and pitch systems. Temperature resistance, a critical factor in bearing performance, ensures their functionality in diverse applications.

Heavy-duty bearings cater to high load capacities, while bearing innovation and design enhance efficiency. Bearing seals prevent contamination, and high-precision bearings ensure accuracy in high-speed applications. Corrosion resistance is crucial in extreme environments, and bearing certifications guarantee quality. Bearing materials, including stainless steel and ceramics, offer enhanced wear resistance and durability. Lubricant technology and bearing coatings further improve performance and life expectancy. Miniature bearings cater to smaller applications, while bearing distributors streamline the supply chain. Bearing life prediction and optimization are essential for maintaining reliability and minimizing downtime. Bearing failure analysis and maintenance-free bearings reduce maintenance requirements. Medical devices and electric vehicles also utilize bearings, with speed rating and load capacity being essential considerations.

Roller bearings, tapered roller bearings, and spherical bearings are some types that cater to specific applications. Thrust bearings and linear bearings address linear motion requirements, while cylindrical roller bearings handle radial loads. Bearing manufacturers focus on meeting industry standards and providing customized solutions. Wind turbines and machine tools rely on bearings for optimal performance, while precision manufacturing and bearing testing ensure quality. Electric motors and ball bearings are other significant applications. Wear resistance and noise level are essential factors in bearing selection.

Get a glance at the market report of share of various segments Request Free Sample

The Anti-friction bearings segment was valued at USD 52.36 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

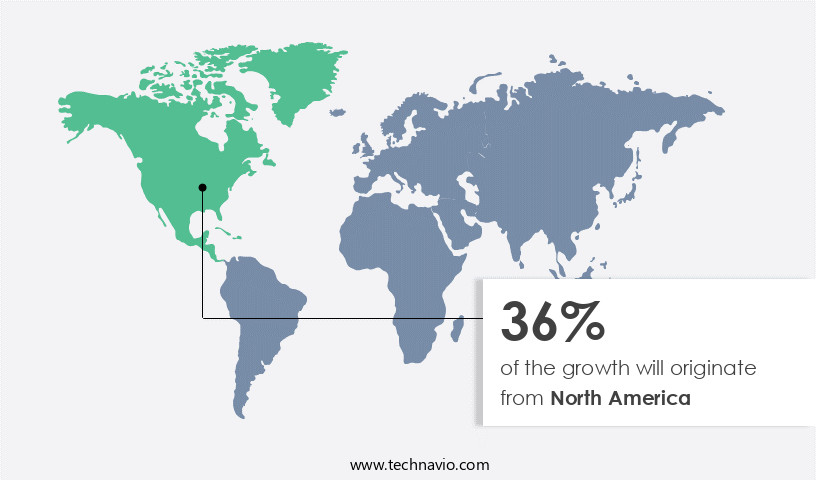

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, with China being a major contributor to this expansion. The increasing demand for bearings in sectors such as automotive, aerospace, electronics, electrical, and healthcare devices, driven by rising disposable income and industrialization in developing countries like China and India, is a primary factor fueling market growth. APAC's vast manufacturing industry, encompassing automobiles, electrical and electronics, healthcare devices, metals, and plastics, further bolsters the market's growth. Bearing innovation and design continue to advance, with an emphasis on temperature resistance, corrosion resistance, and noise reduction. High-precision bearings, miniature bearings, and maintenance-free bearings are gaining popularity in high-speed applications, electric motors, and wind turbines.

Bearing manufacturers are also focusing on optimizing bearing materials, coatings, and lubricant technology to enhance bearing reliability, life expectancy, and wear resistance. Bearing standards, certifications, and supply chain management are essential aspects of the market, ensuring product quality and customer satisfaction. Thrust bearings, tapered roller bearings, and spherical bearings are crucial components in various industries, including machine tools, electric vehicles, and medical devices. Bearing failure analysis and maintenance are also critical for ensuring the longevity and efficiency of these integral components. In extreme environments, bearings made of stainless steel, ceramics, and other specialized materials are increasingly being used due to their superior properties.

Linear bearings and needle bearings are also gaining traction in specific applications. As the market evolves, bearing optimization and testing are becoming essential to meet the demands of various industries and applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bearings Industry?

- Strong demand for high-quality bearings is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for efficient machinery in both industrial and household applications. Developing economies, in particular, are driving this trend as they seek to manufacture high-quality goods with minimal friction to enhance productivity and reduce energy consumption. Advanced bearings, which help control manufacturing costs by significantly reducing frictional losses, are becoming increasingly popular among machinery manufacturers.

- The competitive landscape is intensifying, compelling companies to focus on operational efficiency and profitability. By adopting advanced bearings, these companies can extend the life of their machinery, reduce downtime, and improve overall performance. This market dynamic is expected to continue as the demand for energy-efficient and environmentally-friendly machinery increases.

What are the market trends shaping the Bearings Industry?

- Increasing adoption of electric vehicles is the upcoming market trend.

- The electric vehicle market's growth in Europe, the US, and Asia Pacific, particularly in China and Japan, is driving the demand for new hydraulic equipment due to stringent regulations on carbon emissions and environmental safety. Between June 2023 and June 2024, electric car sales experienced a significant increase of approximately 15%. In response, automakers are introducing innovative designs and advanced features for electric vehicles. To capitalize on the high growth potential of the electric vehicle market in China and other Asian countries, several manufacturers are relocating their facilities.

- Companies are also investing in eco-friendly technologies to minimize the carbon footprint of electric vehicles. This market trend underscores the importance of hydraulic equipment in the electric vehicle industry, as these components play a crucial role in the vehicle's functionality and performance.

What challenges does the Bearings Industry face during its growth?

- Increasing popularity of counterfeit and used bearings is a key challenge affecting the industry growth.

- The bearing market is a significant sector, with annual sales in the billions, driven by the need to minimize frictional loss in machinery components. However, this large market attracts counterfeit products, which pose a challenge. These illegitimate bearings, labeled and priced like authentic brands, can lead to frequent factory breakdowns and negatively impact original manufacturers' reputations. Additionally, high-priced new bearings may encourage the use of used bearings in machinery, as some end-users opt for cost savings and shorter downtime.

- The used bearing market caters to this demand, offering an alternative solution for those unwilling to wait for the end of a bearing's lifecycle.

Exclusive Customer Landscape

The bearings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bearings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bearings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB SKF - The company specializes in providing a range of advanced bearings, including mounted bearings, super precision bearings, slewing bearings, plain bearings, magnetic bearings, and thin section bearings. These offerings cater to various industries and applications, ensuring optimal performance and durability. Our expertise lies in delivering high-quality, innovative solutions to meet diverse customer needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- ASAHI SEIKO Co. Ltd.

- C and U Group

- Calnetix Technologies LLC

- Grupo NBI

- HKT BEARINGS Ltd.

- ISB Industries

- JTEKT Corp.

- Luoyang JCB Bearing Technology Co. Ltd.

- LYC Bearing Corp.

- MinebeaMitsumi Inc.

- NACHI FUJIKOSHI Corp.

- NSK Ltd.

- NTN Corp.

- RBC Bearings Inc.

- Regal Rexnord Corp.

- Schaeffler AG

- SRIJI GOPALJI INDUSTRIES PVT LTD.

- THB Bearings Co. Ltd.

- The Timken Co.

- Wafangdian Guangyang Bearing Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The bearing market encompasses a diverse range of products, each designed to meet specific application requirements. Central to this market are bearings' ability to withstand extreme temperatures, making temperature resistance a crucial factor in their design and selection. Heavy duty bearings, engineered for high load capacity, are often employed in industries where equipment operates under harsh conditions. Bearing innovation continues to shape the market, with advancements in design and materials leading to the development of high precision bearings for high-speed applications. Bearing seals, an essential component, ensure effective lubrication and prevent contamination. Corrosion resistance is another key consideration, particularly in applications where bearings are exposed to harsh environments.

Bearing standards play a significant role in ensuring product quality and interchangeability. Cylindrical roller bearings, tapered roller bearings, and ball bearings are among the most commonly used types, each with their unique characteristics and applications. Noise level is an important factor in many applications, leading to the development of maintenance-free bearings and innovative bearing designs. Thrust bearings and linear bearings are critical components in various industries, including electric motors, wind turbines, and machine tools. Stainless steel bearings and ceramic bearings offer enhanced durability and wear resistance, making them suitable for extreme environments and high-performance applications.

Bearing reliability and life expectancy are essential considerations for manufacturers and end-users alike. Lubricant technology plays a vital role in extending bearing life and improving performance. Miniature bearings are essential in precision manufacturing and other applications where space is a constraint. Bearing distributors play a crucial role in the supply chain, ensuring timely delivery and availability of a wide range of bearing types and sizes. Bearing life prediction and maintenance-free bearings are becoming increasingly popular, reducing downtime and maintenance costs. Bearing materials, including steel, ceramics, and coatings, are continually evolving to meet the demands of various industries.

Medical devices, for instance, require bearings with high precision and biocompatibility. Electric vehicles rely on bearings for efficient power transmission and durability. Bearing failure analysis and optimization are essential for improving product design and performance. Speed rating, load capacity, and bearing testing are crucial factors in ensuring bearing suitability for specific applications. Overall, the bearing market is dynamic, with ongoing innovation and evolving application requirements shaping its future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

262 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 17.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, Japan, Germany, India, UK, South Korea, Canada, Italy, France, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bearings Market Research and Growth Report?

- CAGR of the Bearings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bearings market growth of industry companies

We can help! Our analysts can customize this bearings market research report to meet your requirements.