Bullet Train and High-Speed Rail Market Size 2022-2026

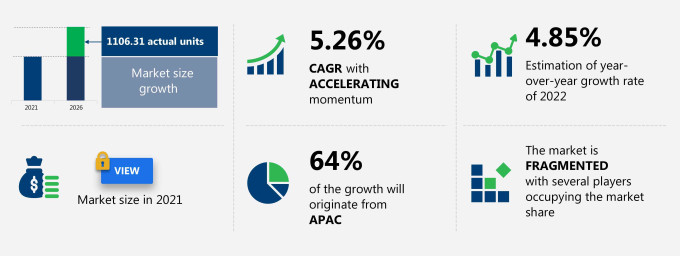

Based on Technavio's market sizing methodology, the bullet train and high-speed rail market size is predicted to surge to 1106.31 actual units from 2021 to 2026 at a CAGR of 5.26%.

This report further entails bullet train and high-speed rail market segmentation, including:

- Application - Passenger and freight

- Geography - APAC, Europe, North America, South America, and Middle East and Africa

What will the Bullet Train and High-Speed Rail Market Size be During the Forecast Period?

Download the Free Report Sample

The bullet train and high-speed rail market is experiencing significant growth, driven by rail infrastructure investment aimed at transforming railway connectivity and advancing rail technology innovation. Governments and private sector stakeholders are increasingly focusing on railway modernization to improve commuter rail services and expand intercity rail travel, offering fast travel options that reduce journey time for passengers. High-speed trains, with their bullet train speed and efficient freight transport capabilities, are setting new standards for low-carbon transport and green transportation.

The development of high-speed rail networks is integral to railway electrification, a crucial step in minimizing carbon emissions and promoting environmental sustainability. Railway policy and budget allocation are key factors influencing railway development and railway accessibility, ensuring that railway safety and railway signaling systems meet global standards. The adoption of railway automation and smart railway solutions enhances operational efficiency and reduces maintenance costs, making railway infrastructure improvement more cost-effective.

This bullet train and high-speed rail market research report provide valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The bullet train and high-speed rail market report also offers information on several market vendors, including ABB Ltd., ALSTOM SA, Construcciones y Auxiliar de Ferrocarriles SA, CRRC Corp. Ltd., Fuji Electric Co. Ltd., General Electric Co., Hitachi Ltd., Kawasaki Heavy Industries Ltd., Larsen and Toubro Ltd., Mitsubishi Heavy Industries Ltd., Siemens AG, Strukton Groep NV, Talgo SA, and Toshiba Corp. among others.

Bullet Train and High-Speed Rail Market: Key Drivers, Trends, and Challenges

The low cost of high-speed rail freight and sustainable mode of transport is notably driving the bullet train and high-speed rail market growth, although factors such as low market penetration in the US may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the bullet train and high-speed rail industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Bullet Train and High-Speed Rail Market Driver

The afordability of high-speed rail freight and its sustainability make it a key driver for the growth of the bullet train and high-speed rail market. Transporting goods via rail freight is more cost-effective than road or air freight, particularly as rising fuel prices drive up the cost of air and road transport. Airfreight, in particular, sees increased costs as operators pass fuel price hikes onto customers through fuel surcharges. In the APAC region, road freight charges are also rising due to higher fuel prices.

High-speed rail freight stands out as the most sustainable transport option, contributing minimally to global GHG emissions compared to other modes, excluding bicycles. This low-cost and environmentally friendly nature of rail freight is expected to positively impact the bullet train and high-speed rail market during the forecast period, supporting its continued growth.

Key Bullet Train and High-Speed Rail Market Trends

The rise of digitalization and connected rail systems is one of the key trends driving growth in the bullet train and high-speed rail market. Connected rail benefits from the development of IoT networks, as more end customers prefer staying connected through smartphones and other digital platforms. IoT enables the integration of AI in connected rail, allowing real-time data to be accessed from the cloud and adjusting driving patterns accordingly.

This technology also enhances safety by reducing the risk of collisions and accidents, as trains can communicate with each other about critical factors like speed and braking distances. As the use of AI and IoT in connected trains continues to grow, it will accelerate the adoption of connected rail solutions in bullet trains and high-speed rail networks, paving the way for smarter, safer, and more efficient transportation systems in the near future.

Key Bullet Train and High-Speed Rail Market Challenge

One of the key challenges hindering the growth of the bullet train and high-speed rail market is its low market penetration in the US. The high cost of building a high-speed railway network, which is more expensive than a traditional railway network, makes bullet trains and high-speed rails less economical for less densely populated countries like the US and Canada. Additionally, the heavy reliance of US citizens on private transport and commercial vehicles limits the potential for a high-speed rail network.

In the US, much of the long-distance railway infrastructure is owned by freight companies, leading passenger train service providers to focus primarily on freight trains rather than passenger services. These factors create significant barriers to the adoption of bullet trains and high-speed rails in the US, which could slow the market's growth during the forecast period.

This bullet train and high-speed rail market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global bullet train and high-speed rail market as a part of the global railroads market within the global transportation market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the bullet train and high-speed rail market during the forecast period.

Who are the Major Bullet Train and High-Speed Rail Market Vendors?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- ABB Ltd.

- ALSTOM SA

- Construcciones y Auxiliar de Ferrocarriles SA

- CRRC Corp. Ltd.

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Kawasaki Heavy Industries Ltd.

- Larsen and Toubro Ltd.

- Mitsubishi Heavy Industries Ltd.

- Siemens AG

- Strukton Groep NV

- Talgo SA

- Toshiba Corp.

This statistical study of the bullet train and high-speed rail market encompasses successful business strategies deployed by the key vendors. The bullet train and high-speed rail market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Global.abb - The company offers complete traction systems for high-speed trains including traction converters, traction motors, as well as auxiliary converters.

- Alstom.com - The company offers rolling stock solutions such as emissions-free propulsion systems such as batteries and hydrogen.

- Caf.net - The company offers high-speed rail such as 120 and 121 series for RENFE, and 12 units for Turkish railways.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The bullet train and high-speed rail market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Bullet Train and High-Speed Rail Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the bullet train and high-speed rail market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Bullet Train and High-Speed Rail Market?

For more insights on the market share of various regions Request for a FREE sample now!

64% of the market's growth will originate from APAC during the forecast period. China and Japan are the key markets for bullet train and high-speed rails in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The countries such as China, Japan, India, and South Korea have been investing heavily in high-speed rail transport systems to cope with rising road traffic congestion and improve the transportation facilities, which will facilitate the bullet train and high-speed rail market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the outbreak of COVID-19 adversely impacted the growth of the regional market. However, the initiation of COVID-19 vaccination drives and the rising awareness among people regarding the measures to contain the spread of the disease led to the resumption of end-user activities in 2021. This has resulted in rapid investment in high-speed bullet train projects in APAC. Thus, such factors will drive the growth of the regional bullet train and high-speed rail market during the forecast period.

What are the Revenue-generating Application Segments in the Bullet Train and High-Speed Rail Market?

To gain furthehts on the r insigmarket contribution of various segments Request for a FREE sample

The bullet train and high-speed rail market share growth by the passenger segment will be significant during the forecast period. High-speed passenger trains and the growing tourism industry are anticipated to be the key factors for the growth of the passenger segment in the near future. Moreover, growing concern from governments across the globe regarding climate change is expected to drive the demand for bullet trains and high-speed rails and thereby driving the market growth.

This report provides an accurate prediction of the contribution of all the segments to the growth of the bullet train and high-speed rail market size and actionable market insights on post COVID-19 impact on each segment.

Market Research Overview

One of the most significant advantages of bullet train development is the passenger capacity and passenger experience, offering more comfortable and efficient travel. Furthermore, railway capacity expansion facilitates greater passenger rail services and freight transportation, boosting the economic impact of the sector. Rail freight logistics and intermodal connectivity improve the movement of goods across regions, enhancing the competitiveness of countries' domestic markets.

The railway economic impact extends beyond transportation, stimulating industrial activity and contributing to regional development. Public-private partnerships are increasingly being utilized to fund high-speed rail construction and railway integration projects. The integration of electromagnetic wheels and safety regulations ensures safer transport and secure transport options for both passengers and freight.

Rail tourism and the rise of railway tourism infrastructure offer exciting opportunities for community engagement and land use planning, creating new sources of tourism infrastructure while reducing noise pollution and improving air quality. As cities invest in urban rail transit and land acquisition, the social impact of these rail projects continues to grow, with regional development and economic sustainability driving long-term benefits.

The future of high-speed rail lies in its ability to meet growing demand through technology adoption, including bullet train testing and future trends in railway design. Policymakers are conducting cost-benefit analysis and evaluating project feasibility to ensure the development of sustainable transportation systems that meet safety regulations while driving innovation in railway employment and promoting competitor analysis.

|

Bullet Train and High-Speed Rail Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.26% |

|

Market growth 2022-2026 |

1106.31 actual units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.85 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 64% |

|

Key consumer countries |

Canada, China, Japan, Spain, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ABB Ltd., ALSTOM SA, Construcciones y Auxiliar de Ferrocarriles SA, CRRC Corp. Ltd., Fuji Electric Co. Ltd., General Electric Co., Hitachi Ltd., Kawasaki Heavy Industries Ltd., Larsen and Toubro Ltd., Mitsubishi Heavy Industries Ltd., Siemens AG, Strukton Groep NV, Talgo SA, and Toshiba Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Bullet Train and High-Speed Rail Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive bullet train and high-speed rail market growth during the next five years

- Precise estimation of the bullet train and high-speed rail market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the bullet train and high-speed rail industry across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of bullet train and high-speed rail market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch