Bunker Oil Market Size 2022-2026

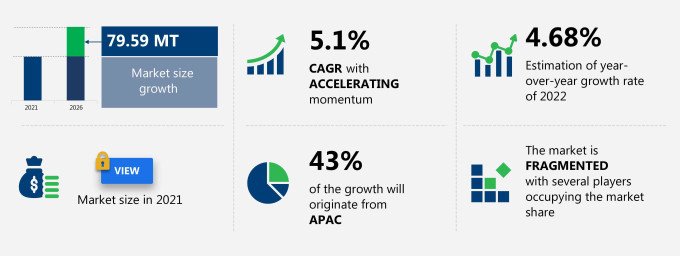

The bunker oil market share is expected to increase by 79.59 million tons from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 5.1%.

The maritime transportation sector strives to balance the demand for cargo, shipping efficiency, and environmental responsibility, the adoption of LNG, scrubbers, and eco-friendly fuels like liquefied natural gas is transforming the industry. Emission regulations, coupled with research and development, are driving the creation of cleaner, more efficient technologies that reduce air pollution, improve operational efficiency, and ensure sustainable shipping routes well into the future.The bunker oil market is evolving rapidly due to advancements in shipping technology and growing demand for fuel efficiency and clean fuels. Green shipping initiatives are encouraging the adoption of alternative marine fuels such as biofuels, LNG, and hydrogen fuel cells, driving changes in LNG bunkering infrastructure and fuel optimization technologies. The rise of autonomous shipping and digital shipping is enhancing shipping logistics, while maritime data analytics and shipping analytics provide insights into fuel supply, port operations, and shipping emissions. With maritime decarbonization efforts, shipping finance and shipbuilding are shifting towards high-performance vessels powered by renewable energy sources. The market also faces challenges related to maritime cybersecurity, maritime law, and shipping regulations, driving the need for maritime security and shipping insurance.

What will the Bunker Oil Market Size be During the Forecast Period?

Download the Free Report Sample

The shipping industry is undergoing significant transformation as it faces increasing pressure to reduce its carbon footprint and comply with stringent emission regulations. This shift is particularly evident in the adoption of eco-friendly fuels and exhaust cleaning technologies, such as scrubbers, which are now commonly used on maritime vessels like tankers, container ships, and bulk carriers to reduce sulphur oxides and nitrogen oxides emissions. One of the most notable changes is the switch to low-sulphur fuels, in line with global initiatives to cut down on air pollution, particularly in shipping routes near major urban areas and coastal regions.

In addition to low-sulphur fuels, the industry is increasingly turning to liquefied natural gas (LNG) as an alternative to traditional heavy fuel oil. LNG-based vessels are more efficient and emit fewer pollutants, offering an attractive solution for maritime transportation. Companies are also looking into LPG (liquefied petroleum gas) for power generation on vessels. As part of efforts to decarbonize shipping, organizations like SEA-LNG are advocating for the widespread adoption of LNG-based vessels as an alternative to more polluting fuels.The demand for fuel supply stability and reliability has also led to the rise of logistical networks that support the growing number of LNG-based vessels, and this includes securing reserves and ensuring proper bunker fuels availability at ports. Vessels that run on liquefied petroleum gas or LNG are seen as a viable option to meet both regulatory compliance and the shipping industry's operational needs.

Bunker Oil Market Dynamics

Based on our research output, there has been a negative impact on the market growth during and post-COVID-19 era. The increasing naval expenditure is notably driving the bunker oil market growth, although factors such as fluctuations in oil and gas prices may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the bunker oil industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Bunker Oil Market Driver

The increasing naval expenditure is one of the key factors driving the growth of the global bunker oil market. In the current scenario, the external threats that any country faces pertain to security issues. These external threats may be another country, a terrorist organization, or an individual. To combat this, governments in various countries are increasing their spending to raise the defense capacities of their countries. As a crucial part of the armed forces, overall naval spending has also witnessed a significant increase. Moreover, global military expenditure is likely to increase during the forecast period. In 2019, The US topped the list of the largest defense spending nations globally, followed by China, Saudi Arabia, India, and Russia. In addition, certain countries such as Indonesia and South Korea have also increased their military spending substantially over the past few years. However, most naval ships perform patrolling operations around the globe apart from their littoral zones; they also conduct joint naval exercises as well as rescue operations in times of natural calamities. The increase in naval spending, as well as naval operational activities, will boost the growth of the global bunker oil market.

Key Bunker Oil Market Trend

The growing LNG market will fuel the global bunker oil market growth. The demand for LNG as a marine fuel is increasing significantly. LNG is used to reduce emissions of greenhouse gases (GHG), as it is odorless, non-toxic, and non-corrosive. It also evaporates quickly when exposed to air, leaving no residue behind. Though oil-based fuels serve as the main fuel type for ocean-going vessels, LNG is also gradually gaining importance. The number of vessels that are using LNG as fuel is increasing rapidly, which is spurred by the many LNG projects that are under execution and in the planning stage. The main reason for LNG becoming an important alternative fuel is that it complies with the current emission norms, as its usage can reduce SOx, nitrogen oxide (NOx), and carbon dioxide (CO2) emissions considerably. Thus, the increase in the use of LNG will be crucial for the growth of the global bunker oil market.

Key Bunker Oil Market Challenge

The fluctuations in oil and gas prices are a major challenge for the global bunker oil market growth. The price of bunker oil is directly linked to global crude oil prices, and its success or failure depends on the pricing of this commodity. The oil and gas industry has witnessed a prolonged period of low crude oil prices since July 2014. The prices declined continuously owing to the supply-demand imbalance. Upstream oil and gas companies experienced a phase of reduced revenues, which directly impacted their cash flows. As per the data published by the Organisation for Economic Co-operation and Development (OECD) in 2021, crude oil import prices witnessed fluctuations globally. However, with global crude oil prices gradually stabilizing, the cost of bunker oil is also expected to increase, thereby affecting the operating cost of vendors. Also, the new routes chosen for transportation during the phase of low commodity prices may need to be changed, as they might not be feasible with the current or future pricing of bunker fuel. Such fluctuations in global crude oil prices can provide a temporary increase in the profit margins but pose a challenge for the global bunker oil market during the forecast period.

This bunker oil market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global bunker oil market as a part of the global oil and gas storage and transportation market within the global oil and gas market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the bunker oil market during the forecast period.

Who are the Major Bunker Oil Market Vendors?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- BP Plc

- Chevron Corp.

- China National Petroleum Corp.

- Exxon Mobil Corp.

- Hindustan Petroleum Corp. Ltd.

- Marquard and Bahls AG

- Public Joint Stock Company Gazprom

- Royal Dutch Shell Plc

- TotalEnergies SE

- Toyota Tsusho Petroleum Pte. Ltd.

Product Insights and News

- BP Plc - The company offers different kinds of industrial fuel, namely BP 80 fuel oil, BP fuel oil F60, BP 180 fuel oil, and underground mining fuel

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments while maintaining their positions in the slow-growing segments.

The bunker oil market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the leading companies' production, sustainability, and prospects.

Bunker Oil Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the bunker oil market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global oil and gas market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Bunker Oil Market?

For more insights on the market share of various regions Request for a FREE sample now!

43% of the market's growth will originate from APAC during the forecast period. Singapore and China are the key markets for the bunker oil market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The increasing naval expenditure will facilitate the bunker oil market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID-19 Impact and Recovery Analysis

In 2020, China and India were the most affected countries in the region by the COVID-19 pandemic. Moreover, many APAC countries were hit by the second wave of the outbreak during the Q1 and Q2 of 2021. Governments in the region imposed nationwide lockdowns in 2020, which resulted in the suspension of business activities and restricted trade activities. This led to market disruptions in 2020. However, in Q4 2020, many countries across APAC lifted restrictions on various business activities. Vendors were then able to resume their routine operations by adhering to COVID-19 guidelines that mandated social distancing measures and restrictions on the entry of non-essential visitors at their facilities. Such initiatives are expected to help vendors remain operational and allow the regional market to recover slowly and grow during the forecast period.

What are the Revenue-generating Product Segments in the Bunker Oil Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The bunker oil market share growth by the Residual fuel segment will be significant during the forecast period. The fuel oil that is obtained from the refinery after the distillation process has various classifications based on its further use across different industries. This fuel oil is primarily obtained as a distillate or a residue. The classification depends on the boiling point as well as the composition of the product.

This report provides an accurate prediction of the contribution of all the segments to the growth of the bunker oil market size and actionable market insights on the post-COVID-19 impact on each segment.

|

Bunker Oil Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2022-2026 |

79.59 mn tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.68 |

|

Regional analysis |

North America, Europe, APAC, South America, and MEA |

|

Performing market contribution |

APAC at 43% |

|

Key consumer countries |

Singapore, US, China, UAE, and The Netherlands |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

BP Plc, Chevron Corp., China National Petroleum Corp., Exxon Mobil Corp., Hindustan Petroleum Corp. Ltd., Marquard and Bahls AG, Public Joint Stock Company Gazprom, Royal Dutch Shell Plc, TotalEnergies SE, and Toyota Tsusho Petroleum Pte. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Bunker Oil Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive bunker oil market growth during the next five years

- Precise estimation of the bunker oil market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the bunker oil industry across North America, Europe, APAC, South America, and MEA

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of bunker oil market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch