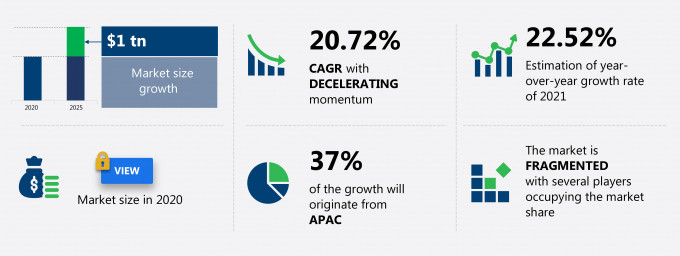

The BYOD and enterprise mobility market share is expected to increase by USD 1 trillion from 2020 to 2025, and the market’s growth momentum will decelerate at a CAGR of 20.72%.

This BYOD and enterprise mobility market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers BYOD and enterprise mobility market segmentation by type (devices, security, and software) and geography (North America, Europe, APAC, MEA, and South America). The BYOD and enterprise mobility market report also offers information on several market vendors, including Alphabet Inc., Apple Inc., ASUSTeK Computer Inc., Cisco Systems Inc., Citrix Systems Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corp., Microsoft Corp., Oracle Corp., and Samsung Electronics Co. Ltd. among others.

What will the BYOD And Enterprise Mobility Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the BYOD and Enterprise Mobility Market Size for the Forecast Period and Other Important Statistics

BYOD And Enterprise Mobility Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post COVID-19 era. The cost savings with BYOD is notably driving the BYOD and enterprise mobility market growth, although factors such as the growth of complementary technologies such as sdn and nfv may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the BYOD and enterprise mobility industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key BYOD And Enterprise Mobility Market Driver

The cost savings with BYOD is one of the key factors driving the growth of the global BYOD and enterprise mobility market. BYOD is an IT policy wherein employees of a company are encouraged to use their own personal mobile devices such as smartphones, tablets, and laptops to access enterprise data. Implementing a BYOD policy in an organization is a tricky business as the concept has advantages as well as disadvantages (if the policy is not implemented properly). BYOD helps in increasing productivity and promoting innovation. Employees are more comfortable with and adept at using their own mobile devices, making them more productive and increasing the probability of innovation. Employees prefer using their own devices as they can avoid carrying multiple devices to their workstations. BYOD offers a huge benefit to the company in terms of cost-saving as the organizations do not have to spend on expensive devices for employees. In addition, employees can work from almost anywhere using the same device for both business and personal requirements.

Key BYOD And Enterprise Mobility Market Trends

The growing awareness of cloud-based BYOD security will fuel the global BYOD and enterprise mobility market growth. Cloud is a convenient and cost-effective way to store business-critical data, and thus its adoption is increasing among small- and medium-sized businesses (SMBs) worldwide. The need for cloud security solutions, such as cloud-based BYOD security, is also increasing in effect. The adoption of premise-based security software among SMEs is limited due to budget constraints, sparse resources, and a lack of expertise to address security problems. Cloud-based BYOD security does not require any hardware or software and is controlled remotely, making it cost-effective for end-users. It responds to new security threats and unauthorized activities very fast. Cloud systems allow the firms to use software solutions on a pay-per-use basis and lessen their expenditure. Some of the factors like less dependency on internal IT personnel, no licensing costs, minimal maintenance costs, very limited hardware infrastructure, as well as the easier and faster implementation of IT solutions are driving SMEs toward the adoption of cloud-based BYOD security.

Key BYOD And Enterprise Mobility Market Challenge

The growth of complementary technologies such as SDN and NFV is a major challenge for the global BYOD and enterprise mobility market growth. The software focuses on solutions such as SDN and NFV. It has set up SDN and NFV testbeds to support European 5G developments. The dynamic virtual configuration of these solutions will allow the deployment of centralized and distributed architecture in public, private, and hybrid cloud systems, enabling fully managed 5G global digitalization. Virtualization technology will lower CAPEX and OPEX, thereby creating investments to develop innovative applications and services in a competitive 5G environment. SDN and NFV will mainly impact the high-end segment of this market during the forecast period as these technologies are at the inception level. The increased adoption of these virtualization technologies among enterprises is expected to decrease the sales of wireless computer network hardware equipment, such as adapters, access points, routers, repeaters, and antennas, which is a major threat to market growth.

This BYOD and enterprise mobility market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

The global BYOD and enterprise mobility market is a part of the global information technology spending market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the BYOD and enterprise mobility market during the forecast period.

Who are the Major BYOD And Enterprise Mobility Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alphabet Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Cisco Systems Inc.

- Citrix Systems Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Samsung Electronics Co. Ltd.

This statistical study of the BYOD and enterprise mobility market encompasses successful business strategies deployed by the key vendors. The BYOD and enterprise mobility market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Alphabet Inc. - The company offers BYOD and enterprise mobility under Android Enterprise.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The BYOD and enterprise mobility market forecast report offer in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

BYOD And Enterprise Mobility Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the BYOD and enterprise mobility market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global information technology spending market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for BYOD And Enterprise Mobility Market?

For more insights on the market share of various regions Request for a FREE sample now!

37% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for BYOD and enterprise mobility market in APAC. Market growth in this region will be faster than the growth of the market in regions.

The cost savings will facilitate the BYOD and enterprise mobility market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The COVID-19 pandemic has resulted in an increase in the number of cyberattacks. According to government data presented in the Indian parliament, there were 1.16 million cases of cyberattacks in 2020 and a significant increase in the number of cyberattacks in 2020, and this number may continue to rise due to the COVID-19 pandemic in the region. Therefore, the above-mentioned factors have increased the demand for security services in the region, thereby driving market growth in the region.

What are the Revenue-generating Type Segments in the BYOD And Enterprise Mobility Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The BYOD and enterprise mobility market share growth by the segments.1 segment will be significant during the forecast period. Employees have shown an inclination to adopt a single device for professional and personal applications to circumvent the inconvenience caused by carrying separate mobile devices. Enterprises are encouraging employees to bring their own mobile devices, such as smartphones, laptops, and tablets, to the office to provide flexibility in the workplace. BYOD policy helps in increasing the productivity of an organization.

This report provides an accurate prediction of the contribution of all the segments to the growth of the BYOD and enterprise mobility market size and actionable market insights on post COVID-19 impact on each segment.

|

BYOD And Enterprise Mobility Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 20.72% |

|

Market growth 2021-2025 |

$ 1 tn |

|

Market structure |

Fragmented |

|

YoY growth (%) |

22.52 |

|

Regional analysis |

North America, Europe, APAC, MEA, and South America |

|

Performing market contribution |

APAC at 37% |

|

Key consumer countries |

US, China, India, UK, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alphabet Inc., Apple Inc., ASUSTeK Computer Inc., Cisco Systems Inc., Citrix Systems Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corp., Microsoft Corp., Oracle Corp., and Samsung Electronics Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this BYOD And Enterprise Mobility Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive BYOD and enterprise mobility market growth during the next five years

- Precise estimation of the BYOD and enterprise mobility market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the BYOD and enterprise mobility industry across North America, Europe, APAC, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of BYOD and enterprise mobility market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch