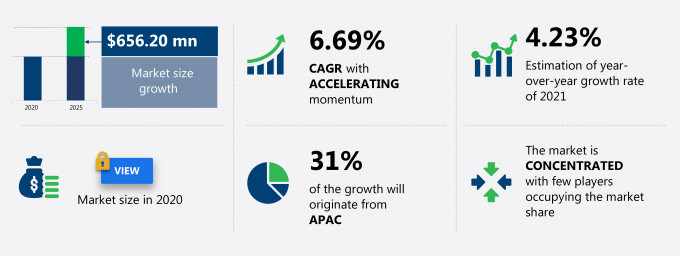

The commercial aircraft health monitoring systems (AHMS) market share is expected to increase by USD 656.20 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 6.69%.

This commercial aircraft health monitoring systems (AHMS) market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers commercial aircraft health monitoring systems (AHMS) market segmentation by type (narrow-body aircraft, wide-body aircraft, turboprops, and regional jets) and geography (APAC, North America, Europe, MEA, and South America). The commercial aircraft health monitoring systems (AHMS) market report also offers information on several market vendors, including AFI KLM E&M, Airbus SE, Deutsche Lufthansa AG, FLYHT Aerospace Solutions Ltd., General Electric Co., Meggitt Plc, Raytheon Technologies Corp., Safran SA, SITA, and The Boeing Co. among others.

What will the Commercial Aircraft Health Monitoring Systems (AHMS) Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Commercial Aircraft Health Monitoring Systems (AHMS) Market Size for the Forecast Period and Other Important Statistics

Commercial Aircraft Health Monitoring Systems (AHMS) Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The growing usage of fiber optic sensors is notably driving the commercial aircraft health monitoring systems (AHMS) market growth, although factors such as concerns with aircraft maintenance may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the commercial aircraft health monitoring systems (AHMS) industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Commercial Aircraft Health Monitoring Systems (AHMS) Market Driver

One of the key factors driving the global commercial aircraft health monitoring systems (AHMS) market growth is the growing usage of fiber optic sensors. These sensors have advantages in terms of durability, high bandwidth, immunity to electromagnetic interference, and lightweight, which make them preferable for integration with aircraft. Moreover, their small size enables the integration of a larger number of sensors in the same aircraft. Few of these sensors are expensive, difficult to integrate or deploy over large composite structures, vulnerable to harsh environments, or tough to operate for longer durations. However, FOS has emerged as a suitable solution for commercial AHMS owing to its distinctive advantages such as durability, higher sensitivity, and immunity to electromagnetic interference. Such factors are expected to positively impact the market growth in the forecast period.

Key Commercial Aircraft Health Monitoring Systems (AHMS) Market Trend

Another key factor driving the global commercial aircraft health monitoring systems (AHMS) market growth is the implementation of real-time monitoring in aircraft. It also allows monitoring of in-flight aircraft performance, when the aircraft is in motion. Real-time monitoring alerts ground staff and maintenance crew beforehand to facilitate faster response and reduction of the overall turnaround time of an aircraft. With the implementation of real-time monitoring systems aboard the airplane, the aircraft operators can efficiently oversee flight performance and engine effectiveness. These systems enable proper and precise maintenance, which would also help in reducing the overall maintenance and repair costs of an aircraft, which will further support the market growth during the forecast period.

Key Commercial Aircraft Health Monitoring Systems (AHMS) Market Challenge

One of the key challenges to the global commercial aircraft health monitoring systems (AHMS) market growth is the concerns with aircraft maintenance. With a net profit margin of less than 4%, aircraft operators focus on reducing their operational expenses and simultaneously maintain a high level of safety and services as desired by air regulatory authorities and passengers. The operational fleet of aircraft poses several concerns for aircraft operators and MRO service providers because of their need for improved damage detection, frequent inspection, and increased maintenance. Schedule-based maintenance works well during the desired service life. At the same time, it results in increased inspection time, increased operational and maintenance costs, and decreased availability of the aircraft due to downtime for maintenance. Thus, concerns with aircraft maintenance and expenditure are expected to limit the growth of the market in focus during the forecast period.

This commercial aircraft health monitoring systems (AHMS) market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global commercial aircraft health monitoring systems (AHMS) market as a part of the global aerospace and defense market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the commercial aircraft health monitoring systems (AHMS) market during the forecast period.

Who are the Major Commercial Aircraft Health Monitoring Systems (AHMS) Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AFI KLM E&M

- Airbus SE

- Deutsche Lufthansa AG

- FLYHT Aerospace Solutions Ltd.

- General Electric Co.

- Meggitt Plc

- Raytheon Technologies Corp.

- Safran SA

- SITA

- The Boeing Co.

This statistical study of the commercial aircraft health monitoring systems (AHMS) market encompasses successful business strategies deployed by the key vendors. The commercial aircraft health monitoring systems (AHMS) market is concentrated and the vendors are deploying growth strategies such as investment in research and developments to compete in the market.

Product Insights and News

- AFI KLM E&M - The company develops PROGNOS, a predictive analysis program, which is used in aircraft monitoring and helps in minimizing AOG risks and related operating costs.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The commercial aircraft health monitoring systems (AHMS) market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Commercial Aircraft Health Monitoring Systems (AHMS) Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the commercial aircraft health monitoring systems (AHMS) market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global aerospace and defense market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Marketing and sales

- Aftermarket and service

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Commercial Aircraft Health Monitoring Systems (AHMS) Market?

For more insights on the market share of various regions Request for a FREE sample now!

31% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for commercial aircraft health monitoring systems (AHMS) in APAC. Market growth in this region will be faster than the growth of the market in North America and South America.

The significant increase in new aircraft numbers and the growth in passenger traffic will facilitate the commercial aircraft health monitoring systems (AHMS) market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The COVID-19 pandemic in 2020 affected the aviation sector in the region. Several countries, such as China, India, Nepal, Pakistan, South Korea, Malaysia, Sri Lanka, and the Philippines, are under a partial or full lockdown in 2021. This has led to several domestic and international travel restrictions in the countries. However, operations in various industries gradually restarted with a limited workforce and adherence to social distancing norms, which is expected to stabilize the growth of the market during the forecast period.

What are the Revenue-generating Type Segments in the Commercial Aircraft Health Monitoring Systems (AHMS) Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The commercial aircraft health monitoring systems (AHMS) market share growth by the narrow-body aircraft segment will be significant during the forecast period. An increase in demand for low-cost carriers has been illustrated by the emergence and growth of airlines, such as Air Asia, Tigerair, Lion Air, and Jetstar Airways. The growing demand for such aircraft is expected to drive the global commercial narrow-body aircraft health monitoring systems market during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the commercial aircraft health monitoring systems (AHMS) market size and actionable market insights on post COVID-19 impact on each segment.

|

Commercial Aircraft Health Monitoring Systems (AHMS) Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.69% |

|

Market growth 2021-2025 |

$ 656.20 million |

|

Market structure |

Concentrated |

|

YoY growth (%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, MEA, and South America |

|

Performing market contribution |

APAC at 31% |

|

Key consumer countries |

US, China, UK, Japan, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AFI KLM E&M, Airbus SE, Deutsche Lufthansa AG, FLYHT Aerospace Solutions Ltd., General Electric Co., Meggitt Plc, Raytheon Technologies Corp., Safran SA, SITA, and The Boeing Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Commercial Aircraft Health Monitoring Systems (AHMS) Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive commercial aircraft health monitoring systems (AHMS) market growth during the next five years

- Precise estimation of the commercial aircraft health monitoring systems (AHMS) market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the commercial aircraft health monitoring systems (AHMS) industry across APAC, North America, Europe, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of commercial aircraft health monitoring systems (AHMS) market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch