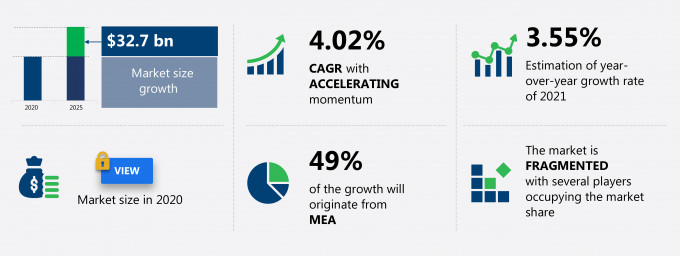

The crude oil flow improvers market share is expected to increase by USD 32.7 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.02%.

This crude oil flow improvers market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers crude oil flow improvers market segmentation by product (paraffin inhibitors, asphaltene inhibitors, scale inhibitors, drag-reducing agents, and hydrate inhibitors), application (extraction, refining, and transportation), and geography (MEA, North America, Europe, APAC, and South America). The crude oil flow improvers market report also offers information on several market vendors, including Baker Hughes Co., BASF SE, Clariant International Ltd., Croda International Plc, Dorf Ketal Chemicals (I) Pvt. Ltd., Dow Inc., Evonik Industries AG, Infineum International Ltd., Schlumberger Ltd., and The Lubrizol Corp. among others.

What will the Crude Oil Flow Improvers Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Crude Oil Flow Improvers Market Size for the Forecast Period and Other Important Statistics

Crude Oil Flow Improvers Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post COVID-19 era. The shift from shallow to deep water exploration is notably driving the crude oil flow improvers market growth, although factors such as stringent regulations and policies may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the crude oil flow improvers industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Crude Oil Flow Improvers Market Driver

The shift from shallow to Deepwater exploration is one of the key factors driving the growth of the global crude oil flow improvers market. Most of the offshore production is mainly concentrated in shallow waters because of the low cost and technical challenges. Advances in drilling technology, floating production, dynamic positioning equipment, and drilling units have made deepwater exploration a viable option. The exhaustion of some of the shallow offshore resources has pushed the vendors to explore and produce oil and gas from deepwater and ultra-deepwater (at depths of 1,500 meters or more) resources. The increasing oil exploration in deepwater and ultra-deepwater is expected to drive the demand for crude oil flow improvers. Low temperatures and high pressure on offshore locations can lead to the precipitation of waxes, hydrates, and asphaltenes. Crude oil flow improvers enhance the flow assurance of crude oil and help in increasing production capacity.

Key Crude Oil Flow Improvers Market Trend

The refracturing of old crude oil wells will fuel the global crude oil flow and improvers market growth. Refracturing shale wells is a topical issue as operators can use the latest technologies on old wells, thereby increasing the production without incurring costs on new wells. The functions of old or underperforming wells are stopped, and hydraulic stimulation is applied for completion. The application of hydraulic stimulation in horizontal shale wells is in the initial phase. The fracking process uses horizontal drilling to access the shale deposits that were previously inaccessible using conventional drilling methods. After drilling into the earth, a high-pressure water mixture, which is called fracking fluid, is applied to the rock to trigger the release of the gas and petroleum present inside. The rising adoption of the fracking technique has enabled energy companies to discover and obtain very large quantities of oil and natural gas in various parts of the world. Such instances of mergers and acquisitions are expected to foster market growth during the forecast period.

Key Crude Oil Flow Improvers Market Challenge

The stringent regulations and policies are a major challenge for the global crude oil flow and improvers market growth. The US Environmental Protection Agency (EPA) is undertaking a study to understand the relationship between hydraulic fracturing and drinking water resources and focus on the fracturing of shale natural gas wells. In California, a lawsuit was filed, which challenged the Federal government's insufficient investigation of the offshore fracking threats on the coast of California. Following France, Bulgaria, and Germany, Scotland banned the fracking process in 2015 because of its harmful environmental effects. The UK, Romania, Denmark, Ireland, South Africa, and the Czech Republic have imposed moratoriums on fracking. However, under an emergency order, the US EPA forced three oil production companies operating in the Fort Peck Reservation in the US to repay the city of Poplar, Montana, US, for expenditure on water infrastructure incurred as a result of their drilling activities. All these regulations have restricted improvements in hydraulic fracturing technology, thereby slowing down the growth of the global crude oil flow improvers market.

This crude oil flow improvers market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global crude oil flow improvers market as a part of the global commodity chemicals market within the global chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the crude oil flow improvers market during the forecast period.

Who are the Major Crude Oil Flow Improvers Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Baker Hughes Co.

- BASF SE

- Clariant International Ltd.

- Croda International Plc

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- Dow Inc.

- Evonik Industries AG

- Infineum International Ltd.

- Schlumberger Ltd.

- The Lubrizol Corp.

This statistical study of the crude oil flow improvers market encompasses successful business strategies deployed by the key vendors. The crude oil flow improvers market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Baker Hughes Co. - The company offers crude oil flow improvers under the brand, TOLAD

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The crude oil flow improvers market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Crude Oil Flow Improvers Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the crude oil flow improvers market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global chemicals market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for Crude Oil Flow Improvers Market?

For more insights on the market share of various regions Request for a FREE sample now!

49% of the market’s growth will originate from MEA during the forecast period. Saudi Arabia and Iraq are the key markets for crude oil flow improvers market in MEA. Market growth in this region will be faster than the growth of the market in regions.

The shift from shallow to Deepwater exploration will facilitate the crude oil flow improvers market growth in MEA over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

MEA has also been affected by the outbreak of the COVID-19 pandemic, which is posing a major challenge to oil and gas extraction activities. Iran, Saudi Arabia, Qatar, Egypt, Bahrain, Iraq, the UAE, Kuwait, South Africa, and Algeria are some of the key countries affected by the pandemic in the region. Hence, oil production units in the region have been closed to contain the spread of the pandemic. However, in 2021, the initiation of large-scale vaccination drives lifted the lockdown and travel restrictions, which led to the resumption of supply chain activities. Such factors are expected to drive the market during the forecast period.

What are the Revenue-generating Product Segments in the Crude Oil Flow Improvers Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The crude oil flow improvers market share growth by the paraffin inhibitors segment will be significant during the forecast period. Rising global demand for paraffin inhibitors, especially in middle eastern markets, has led to a surge in technology advancements by market players in recent past years.

This report provides an accurate prediction of the contribution of all the segments to the growth of the crude oil flow improvers market size and actionable market insights on post COVID-19 impact on each segment.

|

Crude Oil Flow Improvers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.02% |

|

Market growth 2021-2025 |

$ 32.7 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.55 |

|

Regional analysis |

MEA, North America, Europe, APAC, and South America |

|

Performing market contribution |

MEA at 49% |

|

Key consumer countries |

US, Saudi Arabia, Russian Federation, Canada, and Iraq |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Baker Hughes Co., BASF SE, Clariant International Ltd., Croda International Plc, Dorf Ketal Chemicals (I) Pvt. Ltd., Dow Inc., Evonik Industries AG, Infineum International Ltd., Schlumberger Ltd., and The Lubrizol Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Crude Oil Flow Improvers Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive crude oil flow improvers market growth during the next five years

- Precise estimation of the crude oil flow improvers market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the crude oil flow improvers the market industry across MEA, North America, Europe, APAC, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of crude oil flow improvers market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch