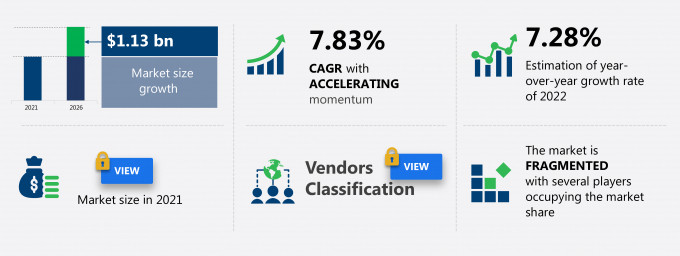

The DC distribution networks market share in China is expected to increase by USD 1.13 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 7.83%.

This DC distribution networks market in China research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers DC distribution networks market segmentation in China by end-user (telecom, industrial, commercial, and others) and type (medium voltage, low voltage, and high voltage). The DC distribution networks market in China report also offers information on several market vendors, including ABB Ltd., Emerson Electric Co., ENGIE Mobisol GmbH, Generac Power Systems Inc., IDEALPLUSING TECHNOLOGY, Johnson Controls International Plc, Nextek Power Systems, Shenzhen Mulview Technology Co. Ltd., Siemens AG, and Signify NV among others.

What will the DC Distribution Networks Market Size in China be During the Forecast Period?

Download the Free Report Sample to Unlock the DC Distribution Networks Market Size in China for the Forecast Period and Other Important Statistics

DC Distribution Networks Market in China: Key Drivers, Trends, and Challenges

The better transmission capacity is notably driving the DC distribution networks market growth in China, although factors such as growing preference for gas generators may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the DC distribution networks industry in China. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key DC Distribution Networks Market Driver in China

One of the key factors driving growth in the DC distribution networks market in China is the better transmission capacity. The use of low-voltage DC distribution leads to new network development opportunities. For example, a 1.5 kV DC system transfers 16 times more power than a 0.4 kV AC system with the same voltage drop and the same cable. Even though AC voltage ratings are presently being used to their maximum potential, DC voltage is still underutilized in power distribution systems. Power electronics component prices have been steadily declining over the previous decade, allowing them to be employed in a wider range of applications. The electricity generated by DC systems is less expensive than that generated by AC systems, which benefits the end-user. This, in turn, is expected to positively impact the market in focus during the forecast period.

Key DC Distribution Networks Market Trend in China

The growing developments toward using DC power sources in data centers is a DC distribution networks market trend in China that is expected to have a positive impact in the coming years. The high demand for data storage and transfer due to the evolution of cloud computing and the increasing number of connected devices has propelled the adoption of data centers. However, the AC power source is adopted across data centers. AC power is converted to DC power at the server. About half of the power supplied to a data center is lost in power conversion and distribution. However, there is an increase in the demand for maximizing every opportunity to reduce power consumption and associated costs. One such opportunity is to use a 380 V DC power system. The use of a 380 V DC power system can increase the operational efficiency of a data center. Additionally, DC power distribution takes less space than AC power distribution, which creates more space for the server racks and cooling equipment in the data center. Thus, such factors are expected to increase the adoption of DC power source in data centers, which, in turn, will drive the growth of the DC distribution networks market in China.

Key DC Distribution Networks Market Challenge in China

The growing preference for gas generators will be a major challenge for the DC distribution networks market in China during the forecast period. Generators are the main substitutes for DC distribution networks. Diesel generators are facing challenges due to the increasing focus of regulators across the world on reducing the emission of harmful greenhouse gases that pollute the environment and deplete the ozone layer. Customers have the option to shift toward gas generators that run on natural gas. As gas is one of the most accessible fuel sources, the demand for natural gas generators is increasing due to their benefits over their diesel counterparts. Most of the economies have gas pipelines to every household or the supply of gas through cylinders. The easy availability of gas makes gas generators an ideal option for most customers. This is acting as a crucial challenge for the adoption of DC distribution networks in developed countries. Factors such as improvements in gas generator designs and production, reducing costs of natural gas, and new regulations that prohibit polluting and noisy engines and on-site fuel storage are expected to increase the popularity of gas generators during the forecast period. This is expected to hinder the growth of the DC distribution networks market in China.

This DC distribution networks market in China analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the DC distribution networks market in China as a part of the global electronic equipment and instruments market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the DC distribution networks market in China during the forecast period.

Who are the Major DC Distribution Networks Market Vendors in China?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- ABB Ltd.

- Emerson Electric Co.

- ENGIE Mobisol GmbH

- Generac Power Systems Inc.

- IDEALPLUSING TECHNOLOGY

- Johnson Controls International Plc

- Nextek Power Systems

- Shenzhen Mulview Technology Co. Ltd.

- Siemens AG

- Signify NV

This statistical study of the DC distribution networks market in China encompasses successful business strategies deployed by the key vendors. The DC distribution networks market in China is fragmented and the vendors are deploying growth strategies such as focusing on increasing the adoption of DC distribution networks to compete in the market.

Product Insights and News

-

ABB Ltd. - The company offers DC distribution networks that enables simple, flexible, and functional integration of energy sources such as variable speed gensets, shaft generators, batteries and fuel cells.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The DC distribution networks market in China forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

DC Distribution Networks Market in China Value Chain Analysis

Our report provides extensive information on the value chain analysis for the DC distribution networks market in China, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the electronic equipment and instruments market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- After-sales service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating End-user Segments in the DC Distribution Networks Market in China?

To gain further insights on the market contribution of various segments Request for a FREE sample

The DC distribution networks market share growth in China by the telecom segment will be significant during the forecast period. Telecom power is dependent on the DC power supply to maintain its online status. Hence, the growth of the telecom sector in China drives the demand for DC distribution networks. Prominent vendors are offering DC distribution networks for telecom-specific applications. For instance, Huawei Technologies offers DC distribution networks for telecom applications. The telecom market has almost reached saturation, and the demand for voice calls is also declining because of greater Internet penetration and the popularity of broadband. Mobile Internet technologies such as 4G are anticipated to become saturated by 2022-2023. Hence, the market is expected to witness marginal growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the DC distribution networks market size in China and actionable market insights on post COVID-19 impact on each segment.

|

DC Distribution Networks Market Scope in China |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.83% |

|

Market growth 2022-2026 |

$ 1.13 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

7.28 |

|

Regional analysis |

China |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ABB Ltd., Emerson Electric Co., ENGIE Mobisol GmbH, Generac Power Systems Inc., IDEALPLUSING TECHNOLOGY, Johnson Controls International Plc, Nextek Power Systems, Shenzhen Mulview Technology Co. Ltd., Siemens AG, and Signify NV |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this DC Distribution Networks Market in China Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive DC distribution networks market growth in China during the next five years

- Precise estimation of the DC distribution networks market size in China and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the DC distribution networks industry in China

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of DC distribution networks market vendors in China

We can help! Our analysts can customize this report to meet your requirements. Get in touch