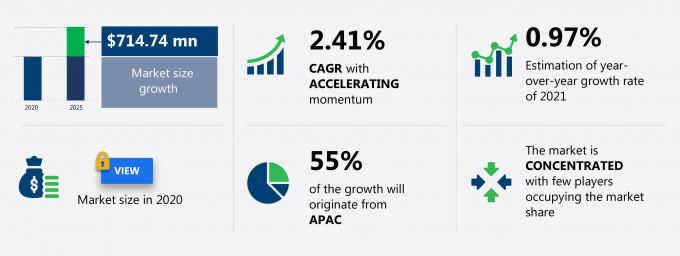

The diesel rotary ups (drups) market share is expected to increase by USD 714.74 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 2.41%.

This diesel rotary ups (drups) market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers diesel rotary ups (drups) market segmentation by type (1000-2000 kVA, Above 2500 kVA, 2000-2500 kVA, and 100-1000 kVA), application (it and telecom, semiconductor, healthcare, aviation, and defense), and geography (APAC, North America, Europe, MEA, and South America). The diesel rotary ups (drups) market report also offers information on several market vendors, including Air Water Inc., Cummins Inc., Hitachi Ltd., HITZINGER GmbH, Industrial Electric Mfg., Langley Holdings Plc, Rolls-Royce Plc, Schneider Electric SE, Thycon Pty Ltd., and Vertiv Holdings Co. among others.

What will the Diesel Rotary UPS (DRUPS) Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Diesel Rotary UPS (DRUPS) Market Size for the Forecast Period and Other Important Statistics

Diesel Rotary UPS (DRUPS) Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The rapid growth in the construction of data centers is notably driving the diesel rotary ups (drups) market growth, although factors such as the environmental impact of drups may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the diesel rotary ups (drups) industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Diesel Rotary UPS (DRUPS) Market Driver

The rapid growth in the construction of data centers is notably driving the diesel rotary ups (drups) market growth. The increase in the construction of data centers is facilitated by the rising demand for cloud-based service offerings. The demand for cloud-based services is growing among CSPs such as Google, Microsoft, and AWS. These companies are expanding their data center footprint by establishing hyper-scale data center facilities. The demand for cloud-based services has also aided the adoption of data centers by colocation and telecommunication service providers. In most countries in Eastern Europe, Africa, and Southeast Asia, government agencies are encouraging the establishment of data centers. DRUPS is one of the mandatory elements of infrastructure that must be present in a data center. Rapid growth in the construction of data centers will drive the DRUPS market.

Key Diesel Rotary UPS (DRUPS) Market Trend

The increase in the demand for the DRUPS from emerging economies is the key market trend driving the diesel rotary ups (drups) market growth. The global DRUPS market is expected to grow significantly due to the rise in demand for DRUPS from emerging economies such as China, India, Vietnam, and Indonesia. The DRUPS market in developing countries such as India and China has high growth potential owing to the increasing affordability. Besides, the demand for DRUPS from the industrial sectors is rising in emerging economies. The strong growth of the economy of these countries is contributing to the growth of the DRUPS market. According to The World Bank Group, the annual percentage growth in the value addition of the industrial sector in 2018 was 8.85%, 7.66%, 5.8%, and 4.34% for Vietnam, India, China, and Indonesia, respectively. The GDP of emerging economies is increasing significantly. Economic growth and increased income of consumers in emerging economies are boosting the demand for DRUPS in the industrial sector and driving the growth of the global DRUPS market.

Key Diesel Rotary UPS (DRUPS) Market Challenge

The environmental impact of drups is the major challenge impeding the diesel rotary ups (drups) market growth. DRUPS is highly vulnerable to dirt and water. Impurities present in the fuel can damage the engine or reduce the efficiency of the motor. A drop-in efficiency can be caused by improper combustion, which results in high diesel emissions. DRUPS is installed outside a building or within a specially built enclosure. This deviation in noise occurs because rotary UPS often relies on flywheels as its source of energy storage. Thus, the adoption of DRUPS can be harmful to the environment. Governments across the world have emission regulations that limit the number of hours per month a diesel generator can run. Such limitations can hinder the growth of the market.

This diesel rotary ups (drups) market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global diesel rotary UPS (DRUPS) market as a part of the global electrical components and equipment market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the diesel rotary ups (drups) market during the forecast period.

Who are the Major Diesel Rotary UPS (DRUPS) Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Air Water Inc.

- Cummins Inc.

- Hitachi Ltd.

- HITZINGER GmbH

- Industrial Electric Mfg.

- Langley Holdings Plc

- Rolls-Royce Plc

- Schneider Electric SE

- Thycon Pty Ltd.

- Vertiv Holdings Co.

This statistical study of the diesel rotary ups (drups) market encompasses successful business strategies deployed by the key vendors. The diesel rotary ups (drups) market is concentrated and the vendors are deploying growth strategies such as partnering with consortiums to compete in the market.

Product Insights and News

- Rolls-Royce Plc - The company offers diesel rotary UPS through its subsidiary mtu.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The diesel rotary ups (drups) market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Diesel Rotary UPS (DRUPS) Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the diesel rotary ups (drups) market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Diesel Rotary UPS (DRUPS) Market?

For more insights on the market share of various regions Request for a FREE sample now!

55% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for the diesel rotary ups (drups) market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Increasing demand for the smartphone will increase the establishment of semiconductor manufacturing facilities in the region, which will facilitate the diesel rotary ups (drups) market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The COVID-19 outbreak in APAC countries, including in India, disrupted supply chains and resulted in supply-side barriers in 2020. Various project expansion plans were either delayed or canceled due to financial uncertainties and disruptions in the supply of DRUPS across the region. This also had a negative impact on other APAC countries, such as Japan. However, the large-scale COVID-19 vaccination drives have helped usher in investments in the region. For instance, Equinix invested over $140 million and launched its new International Business Exchange data center in Singapore. Such developments are expected to boost the growth of the regional DRUPS market during the forecast period.

What are the Revenue-generating Type Segments in the Diesel Rotary UPS (DRUPS) Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The diesel rotary ups (drups) market share growth by the 1000-2000 kVA segment will be significant during the forecast period. The DRUPS has a capacity of 1000-2500 kVA. They can be used in wafer fabrication plants, telecom base stations, glass manufacturing plants, and others. Its growing usage will facilitate the growth of the segment during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the diesel rotary ups (drups) market size and actionable market insights on post COVID-19 impact on each segment.

|

Diesel Rotary UPS (DRUPS) Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.41% |

|

Market growth 2021-2025 |

$ 714.74 million |

|

Market structure |

Concentrated |

|

YoY growth (%) |

0.97 |

|

Regional analysis |

APAC, North America, Europe, MEA, and South America |

|

Performing market contribution |

APAC at 55% |

|

Key consumer countries |

China, US, Japan, UK, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Air Water Inc., Cummins Inc., Hitachi Ltd., HITZINGER GmbH, Industrial Electric Mfg., Langley Holdings Plc, Rolls-Royce Plc, Schneider Electric SE, Thycon Pty Ltd., and Vertiv Holdings Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Diesel Rotary UPS (DRUPS) Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive diesel rotary ups (drups) market growth during the next five years

- Precise estimation of the diesel rotary ups (drups) market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the diesel rotary ups (drups) industry across APAC, North America, Europe, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of diesel rotary ups (drups) market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch