Enjoy complimentary customisation on priority with our Enterprise License!

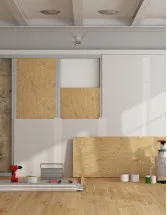

The Europe - Do-it-Yourself (DIY) Home Improvement Retailing Market size is estimated to grow at a CAGR of 4.23% between 2023 and 2028. The market size is forecast to increase by USD 48.33 billion. The growth of the market depends on several factors such as the rising interest in DIY home improvement projects, smart home technology, and the growth of the residential real estate industry.

The report offers extensive research analysis on the Europe - Do-it-Yourself (DIY) Home Improvement Retailing Market, with a categorization based on Distribution Channel, including offline and online. It further segments the market by Product, encompassing lumber and landscape management, decor and indoor garden, kitchen, painting and wallpaper, and tools and hardware and others. Market size, historical data (2018-2022), and future projections are presented in terms of value (in USD billion) for all the mentioned segments

For More Highlights About this Report, Download Free Sample in a Minute

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

One of the key factors driving the Europe DIY home improvement market growth is smart home technology. Smart home technology is a primary trend in the residential household segment. In addition, it covers various areas of homes, such as entertainment, home intelligence, health and wellness, home safety and security, home comfort, home Internet connectivity, access controls, and energy efficiency.

Moreover, with the improvements in voice control and artificial intelligence (AI), the intelligent assistant has become a viable control center for connected homes. In addition, prominent vendors promote several standalone devices that can be used to control various smart appliances installed in houses. Therefore, such factors are positively impacting the Europe - do-it-yourself home improvement retailing market. Hence, it is expected to drive the Europe DIY home improvement market growth during the forecast period.

A key factor shaping the Europe DIY home improvement market growth is the advent of cordless DIY power tools. The growing demand for cordless homes as well as garden and lawn power tools, including power drills, nail guns, screw guns, hedge trimmers, grass trimmers, leaf blowers, brush cutters, and others, is one of the primary trends in the market. In addition, the global cordless power tools market is expected to post a CAGR of over 6%.

Moreover, the demand for cordless power tools from residential buildings, owing to multiple advantages such as no requirement for electricity supply and portability, is driving the growth of the DIY home improvement retailing market in Europe. In addition, most DIY power tool manufacturers are now offering cordless power tools equipped with efficient and lightweight lithium batteries. Therefore, such factors are positively impacting the Europe - do-it-yourself home improvement retailing market. Hence, it is expected to drive the Europe DIY home improvement market growth during the forecast period.

Intense rivalry among market competitors is one of the key challenges hindering the Europe DIY home improvement market growth. Various large and local competitors of DIY home improvement retailing fall under the organized part of the market. In addition, they are competing on various parameters that include product portfolio, premiumization, differentiation, and pricing.

Moreover, market players are differentiating their product offerings to stay ahead in the market. In addition, the entry of a few new players due to weaker regulatory bodies and easy access to distribution channels will further intensify the competition, which can lead to price wars. Therefore, such factors are negatively impacting the Europe - DIY home improvement retailing market. Hence, it is expected to hinder the Europe DIY home improvement market growth during the forecast period.

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Europe DIY Home Improvement Market Customer Landscape

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BAUHAUS AG: The company offers do-it-yourself home improvement retailing products such as tools and building materials for gardening.

The research report also includes detailed analyses of the competitive landscape of the market and information about 18 market companies, including:

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The offline segment is estimated to witness significant growth during the forecast period. Brick-and-mortar do-it-yourself retail outlets are the main type of offline distribution channel in the do-it-yourself home improvement retailing market in Europe. In addition, these physical stores provide a large selection of building supplies, tools, paint, flooring, and gardening equipment, among other goods and materials for home renovation tasks.

Get a glance at the market contribution of various segments Download the PDF Sample

The offline segment was the largest segment and was valued at USD 118.68 billion in 2018. Moreover, brick-and-mortar DIY retail outlets give customers the ease of in-person product comparison and browsing. In addition, they frequently have competent employees on hand to help clients and offer guidance on various initiatives. Furthermore, before making a purchase, buyers may physically handle and inspect things in these locations, which can be quite helpful when making decisions about home improvement supplies. Hence, such factors are fuelling the growth of this segment which in turn drives the Europe DIY home improvement market growth during the forecast period.

For more insights on the market share of various regions Download PDF Sample now!

The Europe DIY home improvement market report forecasts market growth and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

|

Europe DIY Home Improvement Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

94 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.23% |

|

Market Growth 2024-2028 |

USD 48.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.47 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ace Hardware Corp., BAUHAUS AG, BAUVISTA GmbH and Co. KG, EUROBAUSTOFF Handelsgesellschaft mbH and Co. KG, Groupe Adeo, hagebau connect GmbH and Co.KG, HELLWEG Die Profi Baumarkte GmbH and Co. KG, HORNBACH Holding AG and Co. KGaA, Intergamma BV, Kesko Corp., Kingfisher Plc, Lowes Co. Inc., Maxeda DIY Group, Mr. Bricolage Group, OBI GmbH and Co. Germany KG, REWE Group, Travis Perkins Plc, and Wesfarmers Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

We can help! Our analysts can customize this market research report to meet your requirements.

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation by Distribution Channel

7 Market Segmentation by Product

8 Customer Landscape

9 Geographic Landscape

10 Drivers, Challenges, and Trends

11 Vendor Landscape

12 Vendor Analysis

13 Appendix

Get lifetime access to our

Technavio Insights

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.