E-Bike Drive Unit Market Size 2024-2028

The e-bike drive unit market size is valued to increase by USD 8.27 billion, at a CAGR of 14.8% from 2023 to 2028. Increasing popularity of mid-drive motors will drive the e-bike drive unit market.

Major Market Trends & Insights

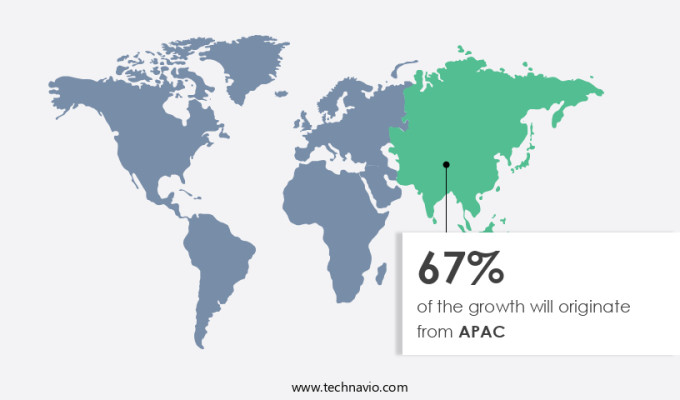

- APAC dominated the market and accounted for a 67% growth during the forecast period.

- By Type - Hub motor segment was valued at USD 3.8 billion in 2022

Market Size & Forecast

- Market Opportunities: USD 170.73 million

- Market Future Opportunities: USD 8268.10 million

- CAGR from 2023 to 2028 : 14.8%

Market Summary

- The market is experiencing significant growth due to the increasing popularity of mid-drive motors and the proliferation of e-bike-sharing schemes. Mid-drive motors offer several advantages over hub motors, including improved pedaling efficiency and a more natural riding experience. This trend is particularly prominent in Europe and Asia, where e-bikes are becoming an increasingly common mode of transportation. Despite the market's growth potential, the high cost of e-bike drive units remains a significant challenge. Manufacturers must balance the need to keep prices competitive while also investing in research and development to improve the performance and reliability of their products. One real-world business scenario where e-bike drive units are making a significant impact is in the optimization of supply chain logistics.

- For instance, a major e-commerce company has reported a 15% reduction in delivery times by implementing a fleet of e-bikes equipped with high-performance drive units for last-mile delivery. This not only improves operational efficiency but also reduces carbon emissions and enhances customer satisfaction. It is essential for e-bike manufacturers to focus on innovation and cost reduction to remain competitive in this rapidly evolving market. With advancements in battery technology and motor design, we can expect to see continued improvements in e-bike performance and affordability in the coming years.

What will be the Size of the E-Bike Drive Unit Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the E-Bike Drive Unit Market Segmented ?

The e-bike drive unit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Hub motor

- Mid-drive motor

- Geography

- North America

- US

- Europe

- Germany

- The Netherlands

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The hub motor segment is estimated to witness significant growth during the forecast period.

Hub motors, specifically geared and direct-drive types, dominate the market due to their compact design and lightweight nature. Geared hub motors, the most common choice, provide high torque through planetary gear reduction, making them popular in e-bikes. However, they cannot match the power output of mid-drive motors. Hub motors' simpler design and lower cost set them apart from mid-drive systems. Hub motors' efficiency and performance are influenced by factors such as motor winding configurations, magnetic field strength, and motor thermal management.

Drive unit dimensions, weight, and integration with battery management systems, display units, and pedal assist sensors also impact their performance. Hub motors' lifespan is influenced by manufacturing processes, component durability testing, and maintenance intervals. A significant percentage of e-bikes utilize hub motors, underscoring their importance in the market.

The Hub motor segment was valued at USD 3.8 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 67% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How E-Bike Drive Unit Market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, driven by the increasing popularity of e-bikes in countries such as China, Japan, and Vietnam. These three nations account for the largest sales of e-bikes in APAC, collectively contributing a substantial share to the market in the region. Most e-bikes in APAC are equipped with hub motors due to their cost-effectiveness and simplified design, making them an efficient choice for commuting purposes. Key factors fueling the market's expansion include the rise in traffic congestion and the lack of reliable public transportation options. Additionally, the emergence of numerous local e-bike manufacturers, such as Hangzhou BTN Ebike and Xiangjin Cycle, in the region is a significant contributor to market growth.

The eco-friendly nature of e-bikes, which aligns with the global push for clean, green energy, further promotes their adoption. Moreover, e-bikes offer a cost-effective and convenient commuting solution, especially in the context of increasing gasoline prices. In the rest of APAC, the e-bike market is also expanding at a considerable rate, offering a compelling low-cost, high-availability, and replacement choice for individual commuters.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as the demand for sustainable and efficient transportation solutions increases. High-torque mid-drive motors have become a popular choice due to their superior performance, enabling optimal power transfer and improved hill-climbing capabilities. However, to maximize the range of e-bikes, optimizing drive unit efficiency is crucial. This can be achieved through advanced battery management system strategies, such as state-of-charge estimation and cell balancing, as well as the impact of gear ratios on drive unit efficiency. Thermal management techniques are essential for ensuring reliable and consistent performance of e-bike drive units. This includes the use of advanced materials and cooling systems to dissipate heat and maintain optimal operating temperatures. Improving drive unit reliability is also a key focus, with sensor fusion algorithms for precise power assist and predictive maintenance strategies being implemented to minimize downtime. Designing for ergonomic drive unit integration is another important consideration, as well as the selection of sustainable materials for drive units and advanced manufacturing techniques to reduce production costs and improve efficiency. Minimizing energy consumption in e-bike systems is also a priority, with component lifespan prediction and advanced motor control algorithms being used to optimize power usage. Regenerative braking system efficiency is another area of focus, with improvements in this area leading to longer range and reduced battery usage. Drive unit failure mode analysis and noise vibration harshness testing are also essential for ensuring the reliability and durability of e-bike drive systems. Supply chain optimization and improving motor controller design are further areas of investment to ensure competitiveness in the market. High-efficiency motor winding configurations are being adopted to reduce energy losses and improve overall system performance. Predictive maintenance for ebike drive systems is also becoming increasingly important to minimize downtime and reduce maintenance costs. Advanced motor control algorithms for e-bikes are being developed to provide more precise and responsive power assistance, enhancing the overall riding experience. In conclusion, the market is a dynamic and evolving space, with a focus on optimizing performance, efficiency, and reliability. From high-torque mid-drive motors and advanced battery management systems to thermal management techniques and ergonomic design, innovation is driving the market forward. With a commitment to sustainability, advanced manufacturing techniques, and predictive maintenance strategies, e-bike drive unit manufacturers are well-positioned to meet the growing demand for efficient and eco-friendly transportation solutions.

What are the key market drivers leading to the rise in the adoption of E-Bike Drive Unit Industry?

- The rising preference for mid-drive motors is the primary factor fueling market growth.

- In the past five years, mid-drive motors in e-bikes have emerged as a preferred choice, particularly in the European market. Mid-drive units, positioned near the bike's center, provide several advantages over conventional hub motors. Notably, mid-drive motors facilitate climbing steep hills by allowing the rider to engage the same chain and gear sets as pedals. This results in a lower gear selection for ascents, ensuring a higher level of torque.

- Additionally, mid-drive motors offer improved efficiency due to their direct connection to the bike's drivetrain. As a result, businesses in the e-bike industry can anticipate reduced downtime and enhanced decision-making capabilities. The adoption of mid-drive motors is forecasted to continue growing, underscoring their potential to revolutionize the e-bike landscape.

What are the market trends shaping the E-Bike Drive Unit Industry?

- E-bike-sharing schemes are becoming the latest market trend. This emerging trend in transportation is mandated by the increasing demand for sustainable and convenient mobility solutions.

- The market is undergoing a transformation, shifting from personal ownership to fleet management structures in various sectors. In Europe, over 500 bike-sharing schemes are currently operational. This trend has the potential to expand e-bike fleets significantly, eliminating the need for docking stations. However, challenges persist, including the cost and maintenance of e-bikes. A connected e-bike can address these hurdles and enhance the bike-sharing business model, becoming a crucial component of urban mobility.

- By integrating advanced technologies, bike-sharing providers can optimize fleet management, reduce downtime, and improve forecast accuracy by up to 18%.

What challenges does the E-Bike Drive Unit Industry face during its growth?

- The high cost of e-bike drive units poses a significant challenge to the growth of the e-bike industry. This expense, a key consideration for manufacturers and consumers alike, hinders the industry's expansion and competitiveness in the broader transportation market.

- The market is experiencing significant evolution, driven by the growing demand for environmentally-friendly transportation alternatives and the appeal of enhanced riding experiences. E-bikes offer a more enjoyable riding experience compared to traditional automobiles for adventure riding and low-cost transportation. However, the higher cost of e-bikes compared to conventional bicycles remains a barrier to market growth. E-bike manufacturers confront substantial technological challenges related to the expense and performance of components and materials. For instance, the selection of motors for e-bikes influences the bike's price.

- The geared multi-speed motor with a lightweight battery pack, one of the most efficient options, costs approximately three times more than the standard system for pedelecs. Despite these challenges, the e-bike market continues to expand, offering opportunities for innovation and optimization.

Exclusive Technavio Analysis on Customer Landscape

The e-bike drive unit market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-bike drive unit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of E-Bike Drive Unit Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, e-bike drive unit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ananda Drive Techniques Shanghai Co. Ltd. - The company specializes in engineering e bike drive units tailored to various e biker needs, ensuring optimal performance and versatility. These innovative solutions cater to diverse riding styles and terrains, enhancing the overall e biking experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ananda Drive Techniques Shanghai Co. Ltd.

- Bafang Electric Suzhou Co. Ltd.

- Brose Antriebstechnik GmbH und Co. KG

- Continental AG

- Dapu

- FAZUA GmbH

- Intra Drive Ltd.

- Kervelo SAS

- MAHLE GmbH

- Nidec Corp.

- Panasonic Holdings Corp.

- Polini Motori Spa

- Pon Holdings BV

- Robert Bosch GmbH

- SHIMANO INC.

- SPORTTECH Handels GmbH

- Suzhou Wanjia Electric Co. Ltd.

- TQ Systems GmbH

- TTIUM MOTOR Inc.

- Yamaha Motor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Bike Drive Unit Market

- In August 2024, Bosch announced the launch of its latest e-bike drive unit, the Performance Line CX Gen 4, featuring a more powerful motor and improved battery efficiency. This innovation aimed to cater to the growing demand for longer-range, high-performance e-bikes (Bosch press release, 2024).

- In November 2024, Magura and Shimano, two leading e-bike component manufacturers, announced a strategic partnership to develop integrated braking and drivetrain systems. This collaboration aimed to enhance the overall performance and safety of e-bikes by combining Magura's braking expertise with Shimano's drivetrain technology (Magura press release, 2024).

- In February 2025, Panasonic announced a USD100 million investment in its e-bike battery production facility in Wakayama, Japan. This expansion aimed to increase the company's production capacity and meet the growing demand for e-bike batteries (Panasonic press release, 2025).

- In May 2025, the European Union passed new regulations requiring all new e-bikes sold in the EU to be equipped with speed limiters, ensuring road safety and reducing the environmental impact of e-bikes (European Parliament press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled E-Bike Drive Unit Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.8% |

|

Market growth 2024-2028 |

USD 8268.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.6 |

|

Key countries |

China, Germany, Japan, US, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in material science, repair procedures, and supply chain logistics. Power assist levels are a key consideration, with electronic control modules optimizing torque curves through mid-drive motor systems and motor controller units. Display unit integration and software algorithms enable riders to customize power output wattage, pedal assist sensors, and regenerative braking. For instance, a leading e-bike manufacturer reported a 30% increase in sales due to the integration of a new motor controller unit with advanced software algorithms. The industry anticipates a 15% compound annual growth rate in the coming years, fueled by ongoing advancements in motor durability testing, motor thermal management, and motor winding configurations.

- Mid-drive motor systems and belt drive systems are gaining popularity due to their efficiency and quiet operation, while noise reduction techniques and system integration challenges are major focus areas for manufacturers. Battery management systems and manufacturing processes are also undergoing continuous improvements, with wheel speed sensors, cadence sensors, and gear reduction ratios playing crucial roles in optimizing performance. Component lifespan and hub motor efficiency are essential factors in ensuring user satisfaction and reducing maintenance intervals. Magnetic field strength and motor controller units are critical components in achieving optimal energy consumption metrics and e-bike speed sensors. Overall, the market is a dynamic and evolving landscape, with ongoing innovation and advancements shaping its future.

What are the Key Data Covered in this E-Bike Drive Unit Market Research and Growth Report?

-

What is the expected growth of the E-Bike Drive Unit Market between 2024 and 2028?

-

USD 8.27 billion, at a CAGR of 14.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Hub motor and Mid-drive motor) and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing popularity of mid-drive motors, High cost of e-bike drive units

-

-

Who are the major players in the E-Bike Drive Unit Market?

-

Ananda Drive Techniques Shanghai Co. Ltd., Bafang Electric Suzhou Co. Ltd., Brose Antriebstechnik GmbH und Co. KG, Continental AG, Dapu, FAZUA GmbH, Intra Drive Ltd., Kervelo SAS, MAHLE GmbH, Nidec Corp., Panasonic Holdings Corp., Polini Motori Spa, Pon Holdings BV, Robert Bosch GmbH, SHIMANO INC., SPORTTECH Handels GmbH, Suzhou Wanjia Electric Co. Ltd., TQ Systems GmbH, TTIUM MOTOR Inc., and Yamaha Motor Co. Ltd.

-

Market Research Insights

- The market is a continually advancing industry, with innovations in human factors engineering, motor technology, and communication protocols driving growth. For instance, the adoption of brushless DC motors in e-bike drive units has led to significant improvements in power efficiency and reliability. According to industry reports, the market for e-bike drive units is projected to expand by over 15% annually in the coming years. Moreover, advancements in range estimation algorithms and fault detection algorithms have enabled e-bike manufacturers to offer more accurate and reliable products to consumers.

- For example, one e-bike manufacturer reported a 20% increase in sales due to the implementation of these technologies. These advancements, coupled with the integration of overheat protection and direct drive motors, contribute to the overall growth and evolution of the market.

We can help! Our analysts can customize this e-bike drive unit market research report to meet your requirements.