Electric Wheelchairs Market Size 2024-2028

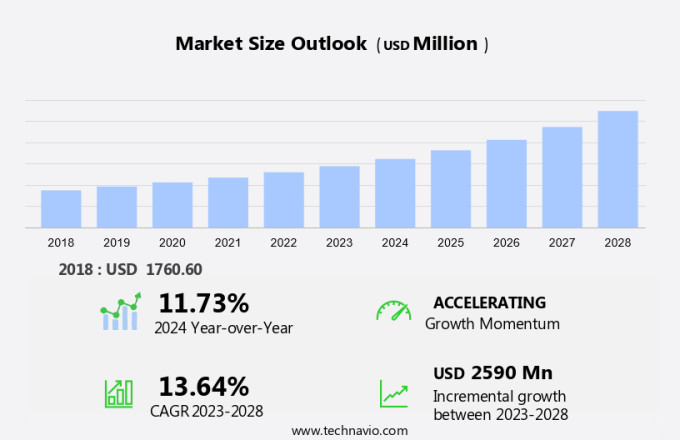

The electric wheelchairs market size is forecast to increase by USD 2.59 billion at a CAGR of 13.64% between 2023 and 2028. The Electric Wheelchairs Industry is experiencing significant growth due to the increasing prevalence of chronic diseases and disabilities among the elderly population and individuals with muscle disorders. Hospitals and health institutes are increasingly adopting electric wheelchairs as essential healthcare facilities equipment to enhance patient mobility and improve overall care. The trend towards front-wheel-electric wheelchairs is gaining popularity due to their maneuverability and ease of use. However, the high cost of electric wheelchairs remains a significant challenge for many consumers, limiting their access to this essential mobility solution. The market is expected to continue growing as the aging population and those with disabilities require more advanced and accessible mobility solutions.

The electric wheelchair industry is witnessing significant growth due to the increasing demand from hospitals, health institutes, and the elderly population. Chronic diseases, disabilities, and muscle disorders are driving the market's expansion. The market, which includes battery powered wheelchairs designed for household use, faces technological problems such as product recalls and the need for a robust manufacturing base, while e-commerce sites and online sales channels increasingly leverage pre programmed systems and open stack designs, incorporating features like LED lighting systems to enhance safety in traffic accidents. The healthcare facilities sector is a major consumer of electric wheelchairs, with patients requiring mobility assistance during treatment and rehabilitation. The aging population and younger generation with physical disabilities also contribute to the market's growth. Accidents and sports injuries can lead to temporary or permanent mobility issues, further increasing the demand for electric wheelchairs.

Furthermore, assistive technologies, pre-programmed systems, and wheelchair accessibility solutions are becoming essential in healthcare infrastructure. E-commerce sites and home delivery services have made electric wheelchairs more accessible to consumers. The market for personal mobility devices, including electric wheelchairs, is expected to grow as the younger generation seeks mobility assistance. Neuromuscular conditions and other muscle disorders are also fueling the demand for these devices. In summary, the market is poised for growth, driven by the healthcare sector, aging population, and increasing awareness of mobility assistance devices. The market's expansion is a testament to the importance of medical technology and healthcare infrastructure in addressing the mobility needs of patients and individuals with disabilities.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Personal

- Hospitals

- Sports conditioning

- Product

- Dry-battery electric wheelchairs

- Wet-battery electric wheelchairs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

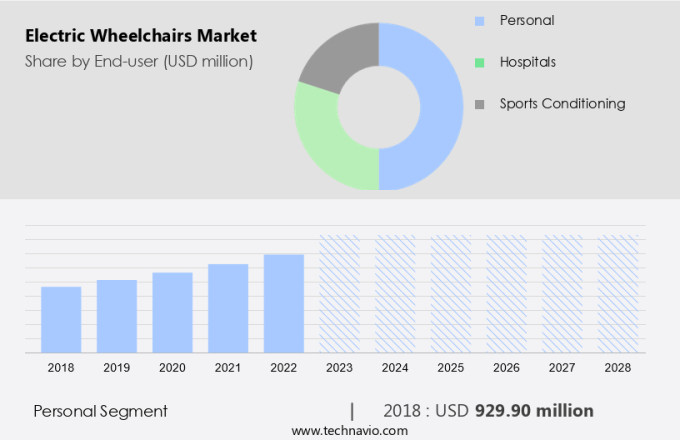

The personal segment is estimated to witness significant growth during the forecast period. Electric wheelchairs offer young age people with mobility challenges the freedom and convenience to move around with ease and independence. These personal mobility devices, also known as power wheelchairs, are particularly beneficial for individuals who have experienced accidents or have permanent disabilities. Electric wheelchairs are equipped with pre-programmed systems, allowing users to control their movement with a joystick or a push of a button, making them ideal for both indoor and outdoor use. Comfort is a crucial factor in the selection of an electric wheelchair.

Furthermore, these assistive technologies are designed with ergonomic seats and backrests, ensuring comfort during extended periods of use. With the rise of e-commerce sites and home delivery services, purchasing an electric wheelchair has become more accessible than ever before.

Get a glance at the market share of various segments Request Free Sample

The personal segment was valued at USD 929.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

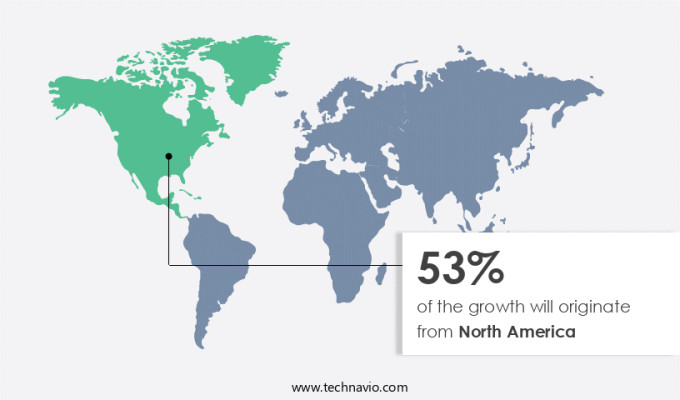

North America is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the United States, the market is experiencing significant growth due to the increasing number of young age people and accident victims requiring personal mobility devices. According to the Centers for Disease Control and Prevention (CDC), approximately 54.4 million adults in the US currently live with some form of arthritis, a condition that can limit mobility. By 2040, this number is projected to increase to 78 million. To maintain their independence, these individuals rely on electric wheelchairs. These advanced mobility aids offer pre-programmed systems for ease of use and are readily available for purchase on e-commerce sites for home delivery.

Furthermore, assistive technologies, such as electric wheelchairs, are essential for enabling individuals with mobility challenges to participate in sports and other activities. The market for electric wheelchairs in the US is expected to continue expanding to meet the growing demand for personal mobility devices.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing prevalence of orthopedic and neurologic disorders is the key driver of the market. The Electric Wheelchairs Industry is witnessing significant growth due to the increasing prevalence of orthopedic and neurological conditions among the elderly population and individuals with disabilities. These conditions, including arthritis, knee problems, hip replacements, and muscle disorders, necessitate the use of mobility devices such as electric wheelchairs.

Furthermore, hospitals and healthcare facilities are major contributors to this market growth, as patients undergoing surgeries or recovering from injuries often require the use of electric wheelchairs for mobility. Additionally, chronic diseases and health institutes catering to the elderly population are driving the demand for these mobility devices. The number of surgical procedures and medical emergencies also contributes to the increasing demand for electric wheelchairs.

Market Trends

The growing adoption of front-wheel-electric wheelchairs is the upcoming trend in the market. The Electric Wheelchairs Industry has witnessed significant growth due to the increasing demand from hospitals, health institutes, and healthcare facilities catering to the elderly population and individuals with chronic diseases or disabilities. Front-wheel-electric wheelchairs have gained popularity in the market, offering numerous advantages over rear-wheel and mid-wheel-drive models.

Furthermore, these wheelchairs provide improved maneuverability, enabling smoother navigation over rough terrain and easier obstacle negotiation. The weight distribution is optimized with the drive wheels located at the front and the batteries at the back, ensuring better stability and balance. Additionally, the distribution of force to each tire, with two smaller tires in contact with the ground, enhances the overall performance of front-wheel-electric wheelchairs. This trend is expected to continue driving the growth of the market.

Market Challenge

The high cost of electric wheelchairs is a key challenge affecting the market growth. The Electric Wheelchairs Industry has witnessed significant advancements, leading to the integration of new features and technologies. However, the elevated costs associated with electric wheelchairs pose a challenge to market expansion. For many individuals, particularly those in the elderly population and those suffering from chronic diseases or disabilities, the high price point makes electric wheelchairs an unattainable mobility solution.

Furthermore, in healthcare facilities and hospitals, the absence of reimbursement programs further restricts the adoption of electric wheelchairs. Consequently, The market growth is adversely affected by the financial barriers preventing widespread usage.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ComfyGO Inc. - The company provides a range of electric wheelchairs, including the 7000 and 8000 remote controlled recline models, and the 6011 wheelchair.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ComfyGO Inc.

- GF Health Products Inc.

- Hoveround Corp.

- Invacare Corp.

- Karma Medical Products Co. Ltd.

- Karman Healthcare Inc.

- LEVO AG

- Matsunaga Manufactory Co. Ltd.

- Medical Depot Inc.

- Medical Device Depot Inc.

- MEYRA GROUP

- Mr. Wheelchair cc

- Ottobock SE and Co. KGaA

- Permobil AB

- Pride Mobility Products Corp.

- Roma Medical

- Silverline meditech Pvt. Ltd.

- Sunrise Medical LLC

- United Seating and Mobility LLC

- WHILL Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electric wheelchairs industry caters to the growing demand for mobility assistance devices in various sectors, including hospitals and health institutes, elderly population, and individuals with chronic diseases or disabilities. The market expands further to accommodate younger age people with muscle disorders such as muscular dystrophy, multiple sclerosis, or peripheral neuropathy. Healthcare facilities and infrastructure prioritize the integration of advanced assistive technologies, like electric mobility devices, to cater to immobility patients. The industry's growth is fueled by the increasing prevalence of physical disability due to accidents, aging population, and various physical mobility illnesses. The market encompasses pre-programmed systems, mechanical wheelchairs, and smart wheelchairs, catering to diverse client requirements.

Furthermore, E-commerce sites and home delivery services facilitate the accessibility of electric wheelchairs, making them more accessible to a broader audience. Design, performance, and assistive features are crucial factors in the development of these devices. Maintenance and repair costs, weight, and technological or design problems are essential considerations for manufacturers. The market also includes standing electric wheelchairs and advanced accessibility features like LED lights, open-stack designs, leg space, and LED lighting systems, enhancing maneuverability and overall user experience. The integration of automation and robotics further revolutionizes the industry, providing innovative solutions for mobility assistance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market Growth 2024-2028 |

USD 2.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.73 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 53% |

|

Key countries |

US, Germany, Canada, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ComfyGO Inc., GF Health Products Inc., Hoveround Corp., Invacare Corp., Karma Medical Products Co. Ltd., Karman Healthcare Inc., LEVO AG, Matsunaga Manufactory Co. Ltd., Medical Depot Inc., Medical Device Depot Inc., MEYRA GROUP, Mr. Wheelchair cc, Ottobock SE and Co. KGaA, Permobil AB, Pride Mobility Products Corp., Roma Medical, Silverline meditech Pvt. Ltd., Sunrise Medical LLC, United Seating and Mobility LLC, and WHILL Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch