Electric Wire and Cable Market Size 2022-2026

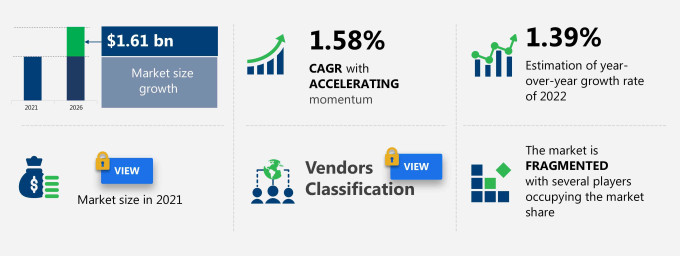

The North America electric wire and cable market size is expected to increase to USD 1.61 billion from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 1.58%.

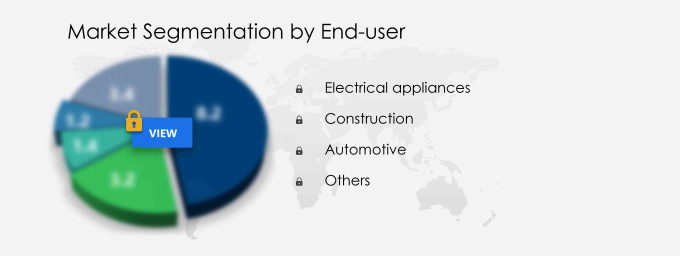

The North America electric wire and cable market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers electric wire and cable market segmentation in North America by end-user (electrical appliances, construction, automotive, and others), product (power cable, electronic wire, building cable, and others), and geography (US, Canada, and Mexico). The North America electric wire and cable market report also offers information on several market vendors, including American Wire Group, Amphenol Corp., Belden Inc., Berkshire Hathaway Inc., CommScope Holding Co. Inc., Corning Inc., EIS Wire and Cable, Encore Wire Corp., Furukawa Electric Co. Ltd., Hitachi Ltd., Lake Cable LLC, Leviton Manufacturing Co. Inc., Lexco Cable, LS Corp., Luetze International GmbH, Nexans SA, Philatron Wire and Cable, Prysmian Spa, Southwire Co. LLC, Sumitomo Electric Industries Ltd., and YFC BonEagle Electric Co. Ltd. among others.

What will the North America Electric Wire and Cable Market Size be during the Forecast Period?

Download the Free Report Sample

The Electric Wire and Cable Market is experiencing significant growth, driven by the increasing demand for sustainable energy, digital infrastructure, and the global push for energy transition. As industries embrace green energy and renewable energy integration, the need for advanced cable infrastructure and electrical engineering solutions is expanding. Key drivers of market growth include smart grid technologies, electrification of transportation, and high-voltage power lines, which are integral to grid modernization and energy security.

With the rise of electric vehicles (EVs) and the expansion of electric vehicle charging networks, there is a surge in demand for cable installation services and cable testing to ensure electrical safety and power distribution. The cable management systems are critical for handling the complex requirements of smart grid systems, power electronics, and data centers. The integration of fiber optic cables for 5G technology and IoT connectivity further boosts the need for reliable and secure cable networks that support digital transformation and remote monitoring.The growing adoption of power storage solutions and off-grid power systems for sustainable development is also a significant trend in the market. This includes the use of energy storage solutions that help optimize energy efficiency and support distributed generation. Energy efficiency solutions are being incorporated into both residential and commercial sector buildings, ensuring green building certification and sustainable construction practices.

North America Electric Wire and Cable Market Dynamics

The increasing investments in power transmission and distribution (T&D) to achieve target market demand are notably driving the electric wire and cable market growth in North America, although factors such as volatility in raw material prices may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the electric wire and cable industry in North America. The holistic analysis of the drivers will help deduce end goals and refine marketing strategies to gain a competitive edge. As cable accessories and cable insulation technologies evolve, cable certification and adherence to cable standards become essential for maintaining safety and reliability in high-demand electrical infrastructure projects. With an emphasis on predictive maintenance, infrastructure resilience, and electrical safety regulations, the industry is moving towards more sustainable building materials and low-voltage electrical systems that minimize environmental impact, reducing the carbon footprint.

Furthermore, energy auditing services and energy efficiency solutions are playing a pivotal role in helping businesses, especially in the industrial sector and commercial sector, to optimize their energy usage. This is part of the broader push toward electrification, energy auditing, and power system design for the future of energy.

Key Electric Wire and Cable Market Drivers in North America

One of the primary factors driving growth in the electric wire and cable market in North America is the increasing investments in infrastructure development, particularly in power transmission and distribution (T&D) systems. These investments are essential to meet the growing power demand and support the energy transition strategies aimed at improving energy security and sustainability. As a result, there is significant growth potential for high voltage cables and conductor materials, especially with the need to replace aging infrastructure, including transformers, across the region. In addition, the vast renewable energy resources in the US, such as wind power from the Great Plains and solar energy from the Southwest, have spurred the expansion of power networks. New projects are being developed to integrate microgrid systems and smart city infrastructure to support clean energy initiatives.

In 2019, large-scale underground high voltage transmission systems were deployed across the US, further enhancing data center infrastructure and ensuring energy security. The increasing demand for sustainable renewable energy sources such as wind and solar will drive continued growth in the electric wire and cable market in North America, particularly in countries like the US, Canada, and Mexico.

Key Electric Wire and Cable Market Trends in North America

A key trend influencing the electric wire and cable market in North America is the rising demand for renewable power generation, driven by both governmental policies and private sector investments in green energy. With a focus on climate change mitigation and sustainable energy solutions, North American countries are embracing cleaner technologies to meet renewable energy policies and achieve carbon reduction goals. The implementation of advanced building automation systems and the shift towards energy transition strategies are expected to increase the demand for wireless communication technologies, high voltage cables, and microgrid development.

For example, the US government's emphasis on energy transition strategies will lead to faster deployment of wind power and solar power, enhancing the role of renewable energy in the grid. The growing adoption of charging stations for electric vehicles (EVs) and the increased demand for data center infrastructure are also contributing to the expansion of high voltage cables and infrastructure investment in urban areas. This is in line with urban planning efforts to integrate smart infrastructure and reduce reliance on non-renewable sources of energy.

Key Electric Wire and Cable Market Challenges in North America

Despite the positive outlook, the electric wire and cable market faces challenges, especially in terms of the volatility of raw material prices, which are essential for the production of high voltage cables and conductors. Copper, known for its high electrical conductivity, durability, and tensile strength, remains the dominant material used in the industry. However, with the increasing cost of copper, manufacturers are experiencing challenges in maintaining profit margins. Although some industries are shifting toward aluminum for certain applications, copper remains irreplaceable in power transmission and distribution networks, which account for a significant portion of the market revenue.

The rise in the price of raw materials, particularly copper, negatively impacts the cost structure of electrical engineering consulting services, infrastructure investment, and smart grid initiatives. As the industry evolves to meet the needs of aging buildings, renewable energy integration, and microgrid development, cybersecurity will also play an essential role in maintaining the integrity of smart grid technologies and ensuring the safety of remote monitoring systems.

Thus, managing raw material price fluctuations, coupled with the complex demands of sustainable development and climate change mitigation, will be crucial for maintaining steady growth in the electric wire and cable market in North America.

This North America electric wire and cable market analysis report also provide detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the electric wire and cable market in North America market as a part of the global electrical components and equipment market within the global electrical equipment market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the North America electric wire and cable market during the forecast period.

Who are the Major Electric Wire and Cable Market Vendors in North America?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- American Wire Group

- Amphenol Corp.

- Belden Inc.

- Berkshire Hathaway Inc.

- CommScope Holding Co. Inc.

- Corning Inc.

- EIS Wire and Cable

- Encore Wire Corp.

- Furukawa Electric Co. Ltd.

- Hitachi Ltd.

- Lake Cable LLC

- Leviton Manufacturing Co. Inc.

- Lexco Cable

- LS Corp.

- Luetze International GmbH

- Nexans SA

- Philatron Wire and Cable

- Prysmian Spa

- Southwire Co. LLC

- Sumitomo Electric Industries Ltd.

- YFC BonEagle Electric Co. Ltd.

This statistical study of the North America electric wire and cable market encompasses successful business strategies deployed by the key vendors. The electric wire and cable market in North America is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

-

belden.com - The company offers electric wires and cables such as flat ribbon cables, and multi-pair cables.

-

belden.com - Under the enterprise solutions segment, the company provides network infrastructure solutions and cabling and connectivity solutions for broadcast, commercial audio and video, and security applications. The product lines of the segment include copper cable and connectivity solutions, fiber cable and connectivity solutions, and racks and enclosures.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The North America electric wire and cable market forecast report offer in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Electric Wire and Cable Market in North America Value Chain Analysis

Our report provides extensive information on the value chain analysis for the North America electric wire and cable market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

What are the Revenue-generating End-user Segments in the North America electric wire and cable market?

To gain further insights on the market contribution of various segments Request a FREE sample

The electric wire and cable market share growth in North America by the electrical appliances segment will be significant during the forecast period. The increase in the demand for home appliances in the region will drive the North America electric wire and cable market during the forecast period. With the rise in population, the use of lighting in activities such as interior design, photography, and other uses is growing.

This report provides an accurate prediction of the contribution of all the segments to the growth of the electric wire and cable market size in North America and actionable market insights on post COVID-19 impact on each segment.

Research Analyst Overview

As the world moves toward sustainability, renewable energy systems like hydroelectric power and geothermal energy are playing a crucial role in reducing carbon footprints. The expansion of EV infrastructure and the need for EV cables, especially for DC fast charging, reflect the growing demand for electric vehicles. Underground cables and overhead cables are integral to modern electrical systems, each offering unique benefits in terms of resilience and aesthetics. Additionally, building cabling in construction projects must comply with strict Australian standards to ensure safety and performance.

Telecommunication systems, powered by high-performance LAN cables and IoT devices, are vital in today's connected world. As urbanization accelerates, efficient energy consumption becomes a priority. The rise of smart homes and sustainable products underscores the shift toward a greener, more efficient future. Innovation in cables and specialized wires will continue to drive growth in renewable energy infrastructure and transport systems.

You may be interested in:

India Electric wire and Wable market - The market share is expected to increase by USD 1.65 billion from 2020 to 2025, and the market's growth momentum will accelerate at a CAGR of 4%.

|

Electric Wire and Cable Market Scope in North America |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.58% |

|

Market growth 2022-2026 |

USD 1.61 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

1.39 |

|

Regional analysis |

North America |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

American Wire Group, Amphenol Corp., Belden Inc., Berkshire Hathaway Inc., CommScope Holding Co. Inc., Corning Inc., EIS Wire and Cable, Encore Wire Corp., Furukawa Electric Co. Ltd., Hitachi Ltd., Lake Cable LLC, Leviton Manufacturing Co. Inc., Lexco Cable, LS Corp., Luetze International GmbH, Nexans SA, Philatron Wire and Cable, Prysmian Spa, Southwire Co. LLC, Sumitomo Electric Industries Ltd., and YFC BonEagle Electric Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Electric Wire and Cable Market in North America Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive electric wire and cable market growth in North America during the next five years

- Precise estimation of the electric wire and cable market size in North America and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the electric wire and cable industry in North America

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of electric wire and cable market vendors in North America

We can help! Our analysts can customize this report to meet your requirements. Get in touch