The electronic design automation for PCB and MCM market has the potential to grow by USD 216.97 million during 2021-2025, and the market’s growth momentum will accelerate at a CAGR of 5.38%. This electronic design automation for PCB and MCM market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The electronic design automation for PCB and MCM market report also offers information on several market vendors, including Altium Ltd., Aldec Inc., ALTAIR ENGINEERING INC., ANSYS Inc., Autodesk Inc., Boldport Ltd., Cadence Design Systems Inc., Siemens AG, Synopsis Inc., and Xilinx Inc. among others. Furthermore, this report extensively covers market segmentation by application (networking and communications, automotive, MII, cellular phone, and others) and geography (APAC, North America, Europe, South America, and MEA).

What will the Electronic Design Automation for PCB and MCM Market Size be in 2021?

Browse TOC and LoE with selected illustrations and example pages of Electronic Design Automation for PCB and MCM Market

Electronic Design Automation for PCB and MCM Market: Key Drivers and Trends

The increasing complexity in semiconductor device designs is notably driving the electronic design automation for PCB and MCM market growth, although factors such as difficulty in developing scalable design methodologies may impede market growth. To unlock information on the key market drivers and the COVID-19 pandemic impact on the electronic design automation for PCB and MCM market industry get your FREE report sample now.

|

|

This electronic design automation for PCB and MCM market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. Get detailed insights on the trends and challenges, which will help companies evaluate and develop growth strategies.

Who are the Major Electronic Design Automation for PCB and MCM Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Altium Ltd.

- Aldec Inc.

- ALTAIR ENGINEERING INC.

- ANSYS Inc.

- Autodesk Inc.

- Boldport Ltd.

- Cadence Design Systems Inc.

- Siemens AG

- Synopsis Inc.

- Xilinx Inc.

The electronic design automation for PCB and MCM market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market. Click here to uncover other successful business strategies deployed by the vendors.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Download a free sample of the electronic design automation for PCB and MCM market forecast report for insights on complete key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

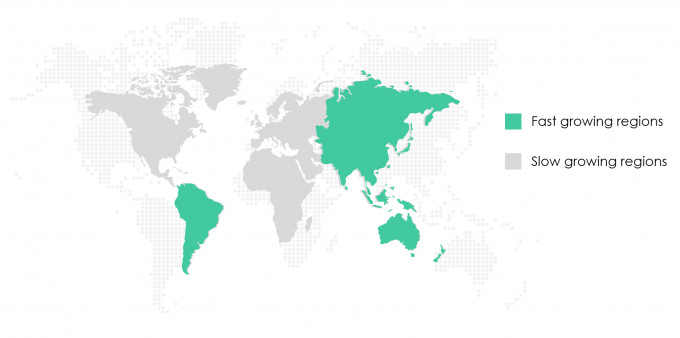

Which are the Key Regions for Electronic Design Automation for PCB and MCM Market?

For more insights on the market share of various regions Request for a FREE sample now!

46% of the market’s growth will originate from APAC during the forecast period. Japan, China, South Korea (Republic of Korea), and Taiwan are the key markets for electronic design automation for PCB and MCM market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The growing concentration of electronic manufacturers and the presence of a large number of semiconductor foundries in the region will facilitate the electronic design automation for PCB and MCM market growth in APAC over the forecast period. To garner further competitive intelligence and regional opportunities in store for vendors, view our sample report.

What are the Revenue-generating Application Segments in the Electronic Design Automation for PCB and MCM Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The electronic design automation for PCB and MCM market share growth by the networking and communications segment will be significant during the forecast period. PCBs and MCMs are mostly used in high-performance systems, including mainframe computers and telecommunications equipment. Complex parallel processing products based on neural networks are suitable contenders for PCB and MCM technology. The rising Internet penetration across the globe, especially in developing countries such as India and Brazil, is increasing the demand for base stations, backhaul, and fiber-optic networks in wireless communication infrastructure systems, wireless automation systems, and Wi-Fi connectivity products, boosting the adoption of EDA tools for PCBs and MCMs.

Fetch actionable market insights on post COVID-19 impact on each segment. This report provides an accurate prediction of the contribution of all the segments to the growth of the electronic design automation for PCB and MCM market size.

What are the Key Factors Covered in this Electronic Design Automation for PCB and MCM Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive electronic design automation for PCB and MCM market growth during the next five years

- Precise estimation of the electronic design automation for PCB and MCM market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the electronic design automation for PCB and MCM market industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of electronic design automation for PCB and MCM market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch

|

Electronic Design Automation For PCB And MCM Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.38% |

|

Market growth 2021-2025 |

$ 216.97 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.76 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 46% |

|

Key consumer countries |

US, Japan, China, South Korea (Republic of Korea), and Taiwan |

|

Competitive landscape |

Leading companies, competitive strategies, consumer engagement scope |

|

Companies profiled |

Altium Ltd., Aldec Inc., ALTAIR ENGINEERING INC., ANSYS Inc., Autodesk Inc., Boldport Ltd., Cadence Design Systems Inc., Siemens AG, Synopsis Inc., and Xilinx Inc. |

|

Market Dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for forecast period, |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |