Endoscopy Devices Market Size 2024-2028

The endoscopy devices market size is forecast to increase by USD 14.24 billion, at a CAGR of 7.17% between 2023 and 2028.

- The market is witnessing significant growth, driven by the continuous advancements in endoscopy technologies. These innovations include the development of smaller, more flexible endoscopes, the integration of imaging technologies, and the use of artificial intelligence and robotics. Furthermore, the market is experiencing a surge in new product launches, as companies seek to differentiate themselves and cater to the evolving needs of healthcare providers and patients. However, the market is not without challenges. Risks and complications associated with endoscopy procedures, such as perforations, infections, and anesthesia reactions, continue to pose significant risks.

- Ensuring patient safety and addressing these complications remains a top priority for market participants. Additionally, regulatory requirements and reimbursement policies vary significantly across regions, creating complexities for companies looking to expand their reach. Navigating these challenges while capitalizing on the opportunities presented by technological advancements and new product launches will be crucial for market success.

What will be the Size of the Endoscopy Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by continuous innovation and evolution, driven by advancements in technology and growing demand across various sectors. Flexible endoscopes, a key segment, enable minimally invasive diagnostic and therapeutic procedures, while hemostasis clips ensure effective blood vessel closure during endoscopic procedures. ERCP accessories, biopsy forceps, and capsule endoscopy expand diagnostic capabilities, offering improved accuracy and patient comfort. High definition endoscopy and advanced imaging techniques, including narrow band imaging and optical coherence tomography, enhance visualization, enabling early detection and precise diagnosis. Tissue sampling methods, such as endoscopic ultrasound and endoscopic mucosal biopsy, provide valuable information for disease staging and treatment planning.

Endoscope sterilization and infection control protocols are essential for patient safety, driving demand for advanced sterilization technologies and disposable endoscopes. Therapeutic endoscopes, including polypectomy snares, argon plasma coagulation, and endoscopic stents, offer minimally invasive treatment options for various conditions. Image guided surgery and video endoscopy further expand the applications of endoscopic technologies, while laparoscopic instruments and surgical endoscopes enable minimally invasive surgeries. Reprocessing guidelines ensure the safe and effective use of reusable endoscopes, maintaining the highest standards of patient care. The market dynamics are shaped by ongoing research and development, regulatory requirements, and changing patient needs, ensuring a vibrant and evolving landscape for endoscopy devices.

How is this Endoscopy Devices Industry segmented?

The endoscopy devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

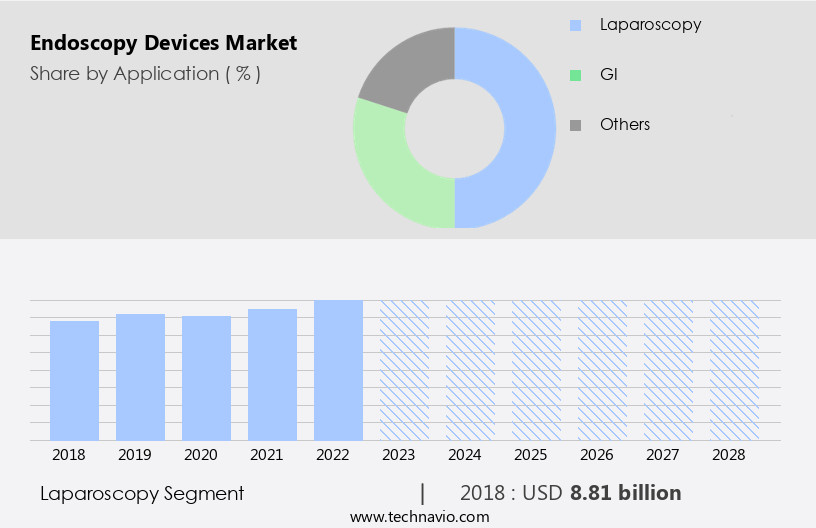

- Application

- Laparoscopy

- GI

- Others

- Product

- Accessories and others

- Endoscopes

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The laparoscopy segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of technologies and tools used in diagnostic and therapeutic procedures for examining the gastrointestinal tract and other organs. Key product categories include flexible endoscopes, hemostasis clips, ERCP accessories, biopsy forceps, capsule endoscopy, balloon dilation, argon plasma coagulation, laparoscopic instruments, image enhancement algorithms, therapeutic endoscopes, polypectomy snare, wireless endoscopes, endoscopic stents, video endoscopy, advanced imaging techniques such as optical coherence tomography and endoscopic ultrasound, high definition endoscopy, tissue sampling, endoscope sterilization, narrow band imaging, infection control protocols, and various types of endoscopes like diagnostic, single use, disposable, endoscopic retrograde cholangiopancreatography, rigid, and reprocessing guidelines. The laparoscopy segment is experiencing significant growth due to the rising incidence of liver diseases and the increasing number of morbidly obese individuals.

This segment's popularity stems from its ability to provide precise diagnoses and effective treatments when conventional methods like ultrasound, X-ray, CT, and MRI scans fail to deliver accurate results. The demand for advanced imaging techniques, such as optical coherence tomography and endoscopic ultrasound, is also increasing due to their ability to offer higher resolution images and improved diagnostic accuracy. Therapeutic endoscopes, including polypectomy snare, argon plasma coagulation, and endoscopic mucosal resection, are gaining popularity due to their minimally invasive nature and ability to treat various gastrointestinal conditions. Endoscopic stents and balloon dilation are essential tools for treating obstructive conditions in the gastrointestinal tract.

Infection control protocols and endoscope sterilization methods are crucial aspects of the market, ensuring patient safety and reducing the risk of complications. The market for disposable endoscopes is growing due to their single-use advantage, reducing the risk of cross-contamination and infection. Image-guided surgery and video endoscopy are increasingly being adopted to enhance the accuracy and precision of procedures. Overall, the market is evolving, with a focus on developing innovative technologies to improve diagnostic and therapeutic capabilities while ensuring patient safety and comfort.

The Laparoscopy segment was valued at USD 8.81 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

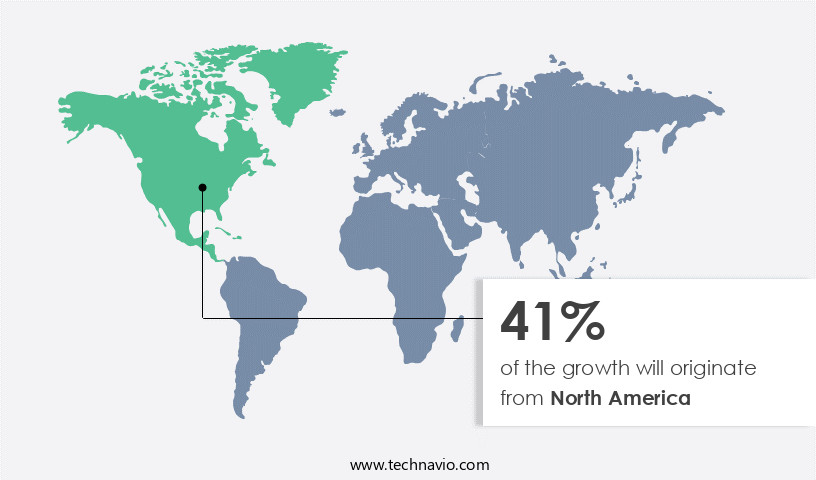

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the increasing incidence of chronic diseases necessitating diagnostic procedures. Endoscopy offers a non-invasive method for examining the interior of the body and organs, which is crucial for diagnosing conditions such as arthritis, GI diseases, and ENT disorders. In the North American region, where healthcare technology and research investments are substantial, advancements in endoscopy devices continue to drive market growth. High-definition imaging, virtual chromoendoscopy, narrow-band imaging (NBI), and robotic-assisted endoscopy are among the technological innovations enhancing diagnostic accuracy, procedural efficiency, and patient outcomes. Furthermore, image enhancement algorithms, therapeutic endoscopes, and endoscopic ultrasound contribute to the market's expansion.

Tissue sampling techniques, such as biopsy forceps and polypectomy snare, and endoscopic mucosal biopsy, confocal laser endomicroscopy, and surgical endoscopes, facilitate precise diagnosis and treatment. Endoscope sterilization, infection control protocols, and reprocessing guidelines ensure patient safety, while disposable and single-use endoscopes cater to the need for cost-effective and hygienic solutions. Endoscopic retrograde cholangiopancreatography (ERCP) accessories, laparoscopic instruments, and balloon dilation expand the market's scope. Overall, the market is thriving due to the continuous development of advanced technologies and the increasing demand for minimally invasive diagnostic and therapeutic procedures.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of technologies and applications, with continuous advancements driving innovation in this sector. These advanced tools, such as long_tail_keywords chip-on-tip sensors and high-definition imaging systems, are transforming diagnostic procedures and expanding the scope of endoscopic interventions. Focusing on minimally invasive procedures, endoscopy devices are increasingly being adopted in areas like gastroenterology and urology, enabling early detection and precise treatment of various conditions. Moreover, the integration of artificial intelligence and machine learning algorithms into endoscopic systems is revolutionizing the field, facilitating faster and more accurate diagnoses. Including advanced features like real-time image analysis and automated detection of anomalies, these intelligent endoscopy devices are poised to significantly impact clinical workflows and patient outcomes. With a growing emphasis on personalized medicine and improved patient care, the market for endoscopy devices is expected to remain a dynamic and innovative space.

What are the key market drivers leading to the rise in the adoption of Endoscopy Devices Industry?

- Advancements in endoscopy technologies serve as the primary catalyst for market growth. Incorporating this professional tone, I'll ensure all responses adhere to grammatical correctness and maintain a formal style. Endoscopy technology's continuous evolution, marked by innovative developments and improvements, significantly drives market expansion.

- Endoscopy devices have witnessed significant advancements, with high-definition (HD) imaging systems leading the way. HD cameras and video processors offer superior-quality images, resolution, and color reproduction, enhancing the visualization of anatomical structures during endoscopic examinations. This improvement in diagnostic accuracy leads to better procedural outcomes and superior patient care. An advanced optical imaging technology, Narrow Band Imaging (NBI), further enhances endoscopic visualization. By filtering light wavelengths, NBI highlights surface vascular patterns and mucosal structures, enabling specialists to detect subtle changes indicative of pathology. These changes may include dysplasia, early-stage cancer, and inflammatory conditions. Flexible endoscopes, a crucial component of endoscopy devices, continue to evolve.

- They now feature thinner, more flexible designs, allowing access to previously inaccessible areas. Hemostasis clips, ERCP accessories, biopsy forceps, capsule endoscopy, balloon dilation, argon plasma coagulation, and laparoscopic instruments are essential accessories that complement endoscopes, enhancing their functionality. Technological advancements in endoscopy devices also include the integration of artificial intelligence (AI) and machine learning algorithms, which assist in diagnosis and treatment planning. These advancements contribute to the overall growth and development of the market.

What are the market trends shaping the Endoscopy Devices Industry?

- The emergence of new products in the market is a current trend, with an increasing number of launches anticipated. As a professional assistant, I remain informed about the latest industry developments and can provide you with up-to-date information on new product releases.

- Endoscopy devices continue to evolve, with companies investing heavily in research and development to introduce advanced imaging techniques and innovative features. Image enhancement algorithms, such as optical coherence tomography, are increasingly being integrated into endoscopes to improve visualization and tissue characterization. Therapeutic endoscopes, equipped with tools like polypectomy snares and endoscopic stents, enable minimally invasive procedures. Wireless endoscopes offer greater flexibility and mobility, while video endoscopy facilitates real-time monitoring and analysis.

- New product launches, like Pristine Surgical LLC's Summit 4K single-use surgical arthroscope, address challenges in traditional visualization during procedures and enhance diagnostic accuracy, procedural efficiency, and patient outcomes. These technological advancements fuel market growth and underscore the industry's commitment to delivering cutting-edge solutions for healthcare providers.

What challenges does the Endoscopy Devices Industry face during its growth?

- The endoscopy industry faces significant growth challenges due to the risks and complications inherent in these procedures. It is crucial to mitigate these issues through rigorous training of medical personnel, continuous advancement of technology, and transparent communication with patients regarding potential risks and benefits.

- Endoscopy procedures, which include endoscopic ultrasound, high definition endoscopy, and tissue sampling, carry certain risks such as perforation, bleeding, and infections. Perforations, which can occur in organs like the stomach or esophagus, may require surgery for treatment. However, some cases may be managed with antibiotics and intravenous fluids. Bleeding, which can occur at the site of a biopsy or polyp removal, may stop on its own or be controlled through cauterization. The risk of bleeding increases with procedures that involve tissue sampling or treating digestive system disorders. To mitigate infection risks, endoscopy facilities employ strict infection control protocols, including endoscope sterilization and narrow band imaging.

- Diagnostic endoscopes are often reusable, necessitating rigorous sterilization procedures to prevent cross-contamination. Single use endoscopes have gained popularity due to their reduced infection risk. Endoscopy procedures play a crucial role in diagnosing and treating various gastrointestinal conditions, making it essential to prioritize patient safety and infection control.

Exclusive Customer Landscape

The endoscopy devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the endoscopy devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, endoscopy devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AnX Robotics - This company specializes in providing advanced endoscopy devices, including the Navicam SB with ESView, Navicam small bowel system, Proscan, Navicam Xpress stomach system, Navicam stomach system, and Navicam colon system. These innovative solutions enable healthcare professionals to diagnose and treat various gastrointestinal conditions with precision and efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AnX Robotics

- Arthrex Inc.

- asap endoscopic products GmbH

- B.Braun SE

- Boston Scientific Corp.

- Clarus Medical LLC

- Conmed Corp.

- Cook Group Inc.

- Ecleris USA

- ESC Medicams

- FUJIFILM Corp.

- Integrated Endoscopy

- Johnson and Johnson Services Inc.

- KARL STORZ SE and Co. KG

- Medtronic

- NeoScope Inc.

- Olympus Corp.

- PENTAX Medical Co.

- Pristine Surgical LLC

- SonoScape Medical Corp.

- Stryker Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Endoscopy Devices Market

- In January 2024, Medtronic plc, a leading medical technology, services, and solutions company, announced the U.S. Food and Drug Administration (FDA) approval of its new single-use, disposable gastrointestinal (GI) endoscope, the HydroMini ⢠Reusable Processing System. This approval marked a significant shift towards disposable endoscopes, addressing concerns over infection control and reprocessing in traditional reusable endoscopes (Medtronic Press Release, 2024).

- In March 2024, Boston Scientific Corporation and Fujifilm Corporation entered into a strategic collaboration to develop and commercialize a new generation of endoscopic imaging systems. This partnership aimed to combine Boston Scientific's endoscopic technology expertise and Fujifilm's imaging technology, with the goal of enhancing diagnostic capabilities and improving patient outcomes (Boston Scientific Press Release, 2024).

- In May 2024, Olympus Corporation completed the acquisition of Medi-Globe Endoskope GmbH, a leading European endoscope manufacturer. This acquisition expanded Olympus' global endoscope production capacity and strengthened its presence in the European market, contributing to its continued growth in the market (Olympus Press Release, 2024).

- In April 2025, Intuitive Surgical, Inc. Received FDA approval for its new endoscopic system, the Ion EndoWrist System. This innovative system enables surgeons to perform complex procedures using natural hand movements, enhancing precision and control. The approval marked a significant technological advancement in minimally invasive endoscopic surgery (Intuitive Surgical Press Release, 2025).

Research Analyst Overview

- The market is driven by advancements in technology, particularly in digital signal processing, which enhances surgical precision during minimally invasive procedures. Endoscope design continues to evolve, with variations in shaft diameter, working length, and insertion tube diameter catering to specific medical applications. Therapeutic efficacy is improved through tissue manipulation techniques and energy delivery systems, while image quality is paramount for accurate visualization. High-definition CMOS sensors, lens quality, and field of view are essential for clear and detailed images. Image processing technologies, such as video processing units and instrumentation channels, ensure visualization accuracy. Light source technology, including color fidelity and image distortion reduction, is critical for optimal visualization.

- Remote control systems enable greater procedural safety, while tip angulation and fiber optics facilitate access to complex anatomical structures. Data storage and image archiving are necessary for long-term record-keeping and analysis. Overall, the market is characterized by continuous innovation in technology, design, and functionality to meet the evolving needs of healthcare professionals and patients.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Endoscopy Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.17% |

|

Market growth 2024-2028 |

USD 14.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Endoscopy Devices Market Research and Growth Report?

- CAGR of the Endoscopy Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the endoscopy devices market growth of industry companies

We can help! Our analysts can customize this endoscopy devices market research report to meet your requirements.