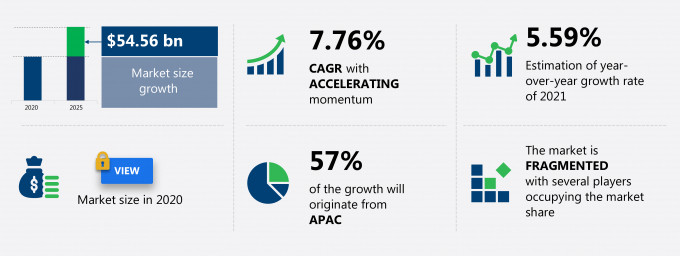

The fintech investment market share is expected to increase by USD 54.56 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 7.76%.

This fintech investment market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers fintech investment market segmentations by investment area (digital payments, insurance, and others) and geography (APAC, North America, Europe, South America, and MEA). The fintech investment market report also offers information on several market vendors, including Ant Technology Group Co. Ltd., Avant LLC, Berkshire Hathaway Inc., Facebook Inc., Funding Circle Holdings Plc, KPMG International Ltd., Oscar Insurance Corp., SoftBank Group Corp., Wealthfront Corp., and ZhongAn Online Property Insurance Co. Ltd. among others.

What will the FinTech Investment Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the FinTech Investment Market Size for the Forecast Period and Other Important Statistics

FinTech Investment Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The disintermediation of banking services is notably driving the fintech investment market growth, although factors such as privacy and security concerns may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the fintech investment industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key FinTech Investment Market Driver

One of the key factors driving the fintech investment market growth is disintermediation of banking services. It is estimated that the top banking institutions may develop a strategic approach, such as the development of smartphone payment technologies, to deal with competition from fintech platforms during the forecast period. Equity investment searches have entered the online domain where a huge number of venture capitalists are investing in the market. Angel List is operating as a main business angel network, while other providers are helping to clear investment payments (known as equity crowdfunding). Bitcoin is a virtual currency and a payment system that hinges on software and online transactions. It represents an innovative and secure cryptocurrency that can be bought with traditional money. Transactions that take place in bitcoin currency operate through peer-to-peer technology. Companies such as Microsoft are investing in virtual currencies, whereas other firms like Apple and Google are concentrating on wallets that allow online transactions. Such factors of adoption of blockchain technologies and digital wallets are expected to drive the market in focus during the forecast period.

Key FinTech Investment Market Trend

Innovation and development is the major trend influencing the fintech investment market growth. Fintech startups in New York, Silicon Valley, London, and Australia are registering steady business progress. Their customers are opting for tech-enabled payments, currency exchanges, crowdfunding, online lending, and wealth-management services. This is helping fintech startup firms to gain the upper hand over traditional banking systems and other firms in the financial system. In 2011, the fintech industry did not attract much investment, as in the wake of the 2008 global economic crisis, financial institutions focused on cost-cutting measures to maintain profit margins. There was less attention on investments or embracing new and innovative technologies. However, the current market scenario presents a better picture, with the industry launching new technological products. Major banks are helping to incubate, invest in, or partner with fintech companies. This trend indicates that financial institutions are embracing digital innovations in a bid to strengthen their brand values.

Key FinTech Investment Market Challenge

Privacy and security concerns is one of the key challenges hindering the fintech investment market growth. Payment service providers gather personal data and information about customers so that they can customize advertising messages and target key audiences. Such practices help service providers collect data on customer profiling, behavior, and data mining. However, the indiscriminate use of this data can infringe on customer privacy. Location-based services also have privacy concerns because such offerings and services operate on the basis of real-time, geo-based information. The data collected from smartphone devices is processed and stored by vendors and so remains open to abuse. As smartphones are used in monetary transactions in real-time, data theft (which is common in the virtual world) can lead to financial losses for consumers and may cause a loss of reputation for service providers. Such risks make consumers averse to online transactions and pose a potential threat to the market for fintech platforms.

This fintech investment market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global fintech investment market as a part of the global specialized consumer services market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the fintech investment market during the forecast period.

Who are the Major FinTech Investment Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Ant Technology Group Co. Ltd.

- Avant LLC

- Berkshire Hathaway Inc.

- Facebook Inc.

- Funding Circle Holdings Plc

- KPMG International Ltd.

- Oscar Insurance Corp.

- SoftBank Group Corp.

- Wealthfront Corp.

- ZhongAn Online Property Insurance Co. Ltd.

This statistical study of the fintech investment market encompasses successful business strategies deployed by the key vendors. The fintech investment market is fragmented and the vendors are deploying growth strategies such as organic and inorganic strategies to compete in the market.

Product Insights and News

- Ant Technology Group Co. Ltd. - The company creates infrastructure and platform for digital transformation of of service industry and also offers to give equal access to finacial and other services that are green and sustainable.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The fintech investment market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

FinTech Investment Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the fintech investment market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for FinTech Investment Market?

For more insights on the market share of various regions Request for a FREE sample now!

57% of the market’s growth will originate from APAC during the forecast period. Australia and Singapore are the key markets for fintech investment in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Blockchain investments in APAC will continue to grow due to its potential in the securitization of physical assets. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 slowed down the growth of the regional market in 2020. Governing bodies in several countries, including India, Australia, China, and Japan, imposed lockdowns that halted industrial operations. This hampered the growth of the overall economy and affected the purchasing power of the people in the region as many employees and workers lost their jobs in 2020. However, the regional market is expected to grow during the forecast period owing to the lifting of lockdowns, the resumption of business activities, and the initiation of vaccination drives to control the spread of COVID-19. For instance, the total fintech investment in the region saw a robust rebound in the first half of 2021. India led the market, with $2 billion in total fintech investment, followed by China ($1.3 billion) and Australia ($900 million). The top ten deals in the first half of 2021 varied across multiple countries in APAC.

What are the Revenue-generating Investment Area Segments in the FinTech Investment Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The fintech investment market share growth by the digital payments will be significant during the forecast period. The shift from traditional cash transactions to digital payments, owing to the surge in the number of smartphone users, and the growth of various fintech companies such as Paytm, Phonepe, Cred, Razorpay, Zeta, and BillDesk, in developing nations, including India, are attracting the investors, thereby driving the fintech investment market in the digital payments segment.

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the fintech investment market size and actionable market insights on post COVID-19 impact on each segment.

|

FinTech Investment Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.76% |

|

Market growth 2021-2025 |

$ 54.56 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.59 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 57% |

|

Key consumer countries |

US, Australia, Singapore, UK, and Lithuania |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Ant Technology Group Co. Ltd., Avant LLC, Berkshire Hathaway Inc., Facebook Inc., Funding Circle Holdings Plc, KPMG International Ltd., Oscar Insurance Corp., SoftBank Group Corp., Wealthfront Corp., and ZhongAn Online Property Insurance Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this FinTech Investment Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive fintech investment market growth during the next five years

- Precise estimation of the fintech investment market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the fintech investment industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of fintech investment market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch