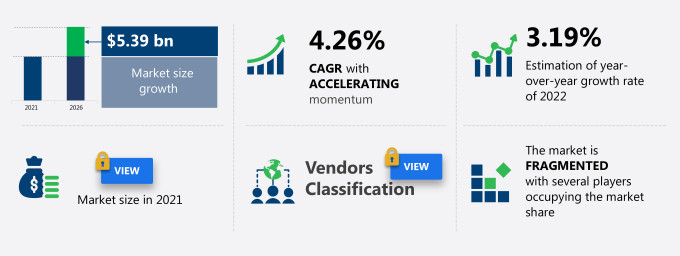

According to Technavio's analyst, the freight logistics market size in Spain is expected to be valued at USD 5.39 billion by 2026 with a progressing CAGR of 4.26%.

This freight logistics market in Spain research report extensively covers market segmentation by:

- End-user - Manufacturing, automotive, consumer goods, food and beverage, and others

- Type - Road, Maritime, Rail, and Air

The freight logistics market in Spain report also offers information on several market vendors, including Carreras Grupo Logistico Sa, CEVA Logistics AG, Compania de Distribucion Intergral Logista Holding S.A, DACHSER SE, Deutsche Bahn AG, Deutsche Post AG, DSV Panalpina AS, FedEx Corp., GEFCO Group, Hellmann Worldwide Logistics SE and Co. KG, Kerry Logistics Network Ltd., Kuehne Nagel International AG, Liberty Cargo SL, Logwin AG, Marcotran Transportes Internacionales S.L, Primafrio SL, Rhenus SE and Co. KG, TIBA SLU, Trasporti Internazionali Transmec SPA, and XPO Logistics Inc. among others.

What will the Freight Logistics Market Size in Spain be During the Forecast Period?

Download the Free Report Sample to Unlock the Freight Logistics Market Size in Spain for the Forecast Period and Other Important Statistics

Who are the Major Freight Logistics Market Vendors in Spain?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Carreras Grupo Logistico Sa

- CEVA Logistics AG

- Compania de Distribucion Intergral Logista Holding S.A

- DACHSER SE

- Deutsche Bahn AG

- Deutsche Post AG

- DSV Panalpina AS

- FedEx Corp.

- GEFCO Group

- Hellmann Worldwide Logistics SE and Co. KG

- Kerry Logistics Network Ltd.

- Kuehne Nagel International AG

- Liberty Cargo SL

- Logwin AG

- Marcotran Transportes Internacionales S.L

- Primafrio SL

- Rhenus SE and Co. KG

- TIBA SLU

- Trasporti Internazionali Transmec SPA

- XPO Logistics Inc.

This statistical study of the freight logistics market in Spain encompasses successful business strategies deployed by the key vendors. The freight logistics market in Spain is fragmented and the vendors are deploying growth strategies such as strengthening their long-term financial stability by investing in the growth markets, the expertise of people, and new businesses to compete in the market.

Product Insights and News

-

dachser.com - The company offers freight logistics solutions such as the Worldwide Gateway network with access to company-run branches around the world.

-

dachser.com - The DACHSER road logistics segment offers the transport and storage of industrial goods European Logistics and Food Logistics.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The freight logistics market in Spain forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Freight Logistics Market in Spain Value Chain Analysis

Our report provides extensive information on the value chain analysis for the freight logistics market in Spain, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

What are the Revenue-generating End-user Segments in the Freight Logistics Market in Spain?

To gain further insights on the market contribution of various segments Request for a FREE sample

The freight logistics market share growth in Spain by the manufacturing segment will be significant during the forecast period. The manufacturing sector is a crucial contributor to the GDP of the country. Electrical and electronics and pharmaceuticals are the major export commodity manufacturing industries in Spain. The automobile sector is among the primary economic drivers of Spain as it is the second-largest manufacturer of automobiles in Europe. Even though there is a slight decline in automobile production in the country, mainly owing to the introduction of new EU emissions standards, the adoption of technology and international demand is expected to boost the manufacturing sector of the Spain freight logistics market during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the freight logistics market size in Spain and actionable market insights on post COVID-19 impact on each segment.

Freight Logistics Market in Spain: Key Drivers, Trends, and Challenges

The increasing outsourcing in logistics is notably driving the freight logistics market growth in Spain, although factors such as the high infrastructure cost may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the freight logistics industry in Spain. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Freight Logistics Market Driver in Spain

- One of the key factors driving growth in the freight logistics market in Spain is the increasing outsourcing in logistics.

- Logistics companies are expected to invest more in digital and analytic technologies during the forecast period.

- It is increasingly hard to distinguish logistics companies from technology providers as they are not only providing logistics services to end-users but also using technology to provide better solutions for warehouse management, procurement, and other operational applications in the supply chain.

- Contract-based logistics is preferred over in-house logistics.

- Contract-based logistics, such as third-Party logistics (3PLs) and fourth-party logistics (4PLs), offer customized services as per the demand of the shippers to add value to their supply chain management needs. Hence, a shipper can partly manage the remaining functions in-house by outsourcing the logistics needs.

Key Freight Logistics Market Trend in Spain

- The growing popularity of multimodal transportation is a freight logistics market trend in Spain that’s is expected to have a positive impact in the coming years.

- Intermodal and multimodal transportation use multiple modes of transportation and are similar in most aspects; however, there is a difference between intermodal and multimodal transportation.

- Multimodal transportation is under a single contract, whereas intermodal transportation has multiple contracts with different carriers.

- Multimodal uses different modes of transport but under one single bill of lading. The single transport carrier is responsible for moving shipments in all different modes. This means that a single company is responsible for the movement of goods across in multimodal transportation.

- The advantages of multimodal transportation are single contract, reduction of risk or loss or damage of the goods and personnel, goods can be tracked at a single point, and the reduction in the number of documents handled.

- The increasing convenience offered to shippers while transporting goods through multimodal transportation is expected to enhance the growth of the Spain freight logistics market.

Key Freight Logistics Market Challenge in Spain

- The high infrastructure cost will be a major challenge for the freight logistics market growth in Spain during the forecast period.

- High investments in infrastructure are required to ship goods through intermodal transportation.

- Investments include the installation of gantry cranes and other heavy-duty cranes necessary to lift the containers at different ports while changing the mode of transport. For example, whenever the container arrives at a seaport, it needs to be transferred on either a flatbed, rail, or truck.

- The necessary investments for rail and road access are also required. For example, a seaport should have a rail line so that railways can transport goods to and from the seaport. Similarly, roads are necessary so that trucks can easily access these ports.

- The high investments are often delayed and time-consuming, thus having a negative impact on the demand for freight logistics. Hence, these high infrastructure cost requirements are expected to impede the growth of the Spain freight logistics market.

This freight logistics market in Spain analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the Spain freight logistics market as a part of the global air freight and logistics market within the global transportation market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the freight logistics market in Spain during the forecast period.

|

Freight Logistics Market Scope in Spain |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.26% |

|

Market growth 2022-2026 |

$ 5.39 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.19 |

|

Regional analysis |

Spain |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Carreras Grupo Logistico Sa, CEVA Logistics AG, Compania de Distribucion Intergral Logista Holding S.A, DACHSER SE, Deutsche Bahn AG, Deutsche Post AG, DSV Panalpina AS, FedEx Corp., GEFCO Group, Hellmann Worldwide Logistics SE and Co. KG, Kerry Logistics Network Ltd., Kuehne Nagel International AG, Liberty Cargo SL, Logwin AG, Marcotran Transportes Internacionales S.L, Primafrio SL, Rhenus SE and Co. KG, TIBA SLU, Trasporti Internazionali Transmec SPA, and XPO Logistics Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Freight Logistics Market in Spain Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive freight logistics market growth in Spain during the next five years

- Precise estimation of the freight logistics market size in Spain and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the freight logistics industry in Spain

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of freight logistics market vendors in Spain

We can help! Our analysts can customize this report to meet your requirements. Get in touch