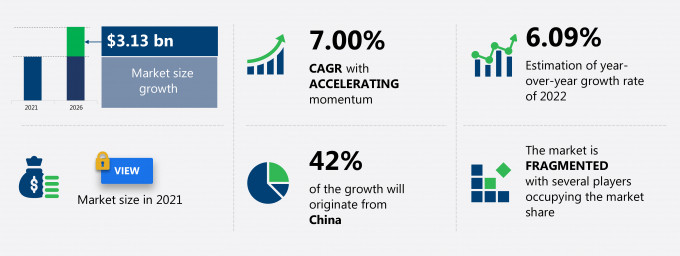

The frozen food packaging market share in APAC is expected to increase by USD 3.13 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 7.00%.

This frozen food packaging market in APAC research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers frozen food packaging market in APAC segmentation by product (ready to eat products, meat poultry and seafood, fruits and vegetables, frozen desserts, and others) and geography (China, Japan, India, South Korea (Republic of Korea), and Rest of APAC). The frozen food packaging market in APAC report also offers information on several market vendors, including Amcor Plc, Ball Corp., EasyPak LLC, Genpak LLC, Graham Packaging Co., Pactiv LLC, Placon Corp., Sonoco Products Co., Tetra Pak Group, and The West Rock group among others.

What will the Frozen Food Packaging Market Size in APAC be During the Forecast Period?

Download the Free Report Sample to Unlock the Frozen Food Packaging Market Size in APAC for the Forecast Period and Other Important Statistics

Frozen Food Packaging Market in APAC: Key Drivers, Trends, and Challenges

The rising global fresh meat consumption is notably driving the frozen food packaging market growth in APAC, although factors such as stringent regulations for sustainable packaging may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the frozen food packaging industry in APAC. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Frozen Food Packaging Market Driver in APAC

The rising global fresh meat consumption is one of the key drivers supporting the frozen food packaging market growth in APAC. Fresh meat accounts for the highest share of the total demand for meat products. APAC and Europe are projected to witness positive growth. The substitution of red meat with leaner meat in North America and Western Europe has increased the consumption rate of pork and poultry. Compared with all other types of meats, poultry is expected to witness a higher consumption rate. Growth in the global consumption of meat proteins is projected to increase by 14% by 2030 compared to the base period average of 2018-2020, driven largely by income and population growth. Rising health consciousness is a major reason that will increase poultry consumption across the world. Such concerns will drive the market growth during the forecast period.

Key Frozen Food Packaging Market Trend in APAC

The growing use of biodegradable packaging techniques is one of the key trends contributing to the frozen food packaging market growth in APAC. For instance, Amcor’s subsidiary, Bemis, has introduced an environment-sustainable packaging named Bemis EZ Peel for meat packaging. This product reduces the packaging material by 43% and provides an 83% reduction in freight volume and fuel consumption during transportation. Similarly, Clondalkin Group Holdings BV (Clondalkin Group), a Europe-based vendor that supplies packaging films across the world, has a separate product segment for biodegradable films. It offers biodegradable and compostable packaging films for various food and frozen food packaging applications, such as meat, fruits, vegetable, and poultry packaging. Such techniques are driving the market growth.

Key Frozen Food Packaging Market Challenge in APAC

Stringent regulations for sustainable packaging is one of the factors hampering the frozen food packaging market growth in APAC. Most of the frozen food packaging materials, in both flexible and rigid plastic packaging, are non-degradable. The disposal of such packaging materials leads to landfill creation. The huge labor and equipment costs, along with the stringent government regulations regarding landfill reduction, force frozen food packaging manufacturers to adopt alternatives such as investing in edible packaging. For instance, as per the National Environmental Policy Act in the US, all packaging materials used for food packaging have to be approved by Environmental Assessment with a certificate of Finding No Significant Impact, followed by the clearance from the FDA. These processes of certification check the environmental impact of each food packaging material during use and after disposal. Such imposed regulations will negatively impact the market growth during the forecast period.

This frozen food packaging market in APAC analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the frozen food packaging market in APAC as a part of the global metal and glass containers market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the frozen food packaging market in APAC during the forecast period.

Who are the Major Frozen Food Packaging Market Vendors in APAC?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Amcor Plc

- Ball Corp.

- EasyPak LLC

- Genpak LLC

- Graham Packaging Co.

- Pactiv LLC

- Placon Corp.

- Sonoco Products Co.

- Tetra Pak Group

- The West Rock group

This statistical study of the frozen food packaging market in APAC encompasses successful business strategies deployed by the key vendors. The frozen food packaging market in APAC is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Amcor Plc is a public company that is headquartered in Switzerland. It is a global company that generated a revenue of $12,861 million and had around 46,000 employees. Its revenue from the frozen food packaging market in APAC contributes to its overall revenues, along with its other offerings, but is not a key revenue stream for the company.

- Amcor Plc - The company offers frozen food packaging products such as Amcor P-Plus films for packaging fresh fruit.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The frozen food packaging market in APAC forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Frozen Food Packaging Market in APAC Value Chain Analysis

Our report provides extensive information on the value chain analysis for the frozen food packaging market in APAC, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the metal and glass containers market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Industry innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Frozen Food Packaging Market in APAC?

For more insights on the market share of various regions Request for a FREE sample now!

42% of the market’s growth will originate from China during the forecast period. China is the key market for frozen food packaging market in APAC. Market growth in this region will be slower than the growth of the market in South Korea (Republic of Korea) and India.

The large population and urbanization will facilitate the frozen food packaging market growth in China over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

For instance, international meat prices declined in 2020 due to the negative impact of COVID-19. However, the relaxation in the COVID-19 restriction from the Q3 of 2020 has further propelled the regional economic activities which has significantly accelerated the market in focus. Furthermore, the spread of African swine flu (ASF) in the country has further boosted the import of meat and meat-based product. This has significantly boosted the demand for frozen food products in China in 2021.

What are the Revenue-generating Product Segments in the Frozen Food Packaging Market in APAC?

To gain further insights on the market contribution of various segments Request for a FREE sample

The frozen food packaging market share growth in APAC by the ready-to-eat products segment will be significant during the forecast period. The ready-to-eat products segment captured the highest share of the frozen food packaging market in APAC in 2021. This is attributed to the changing consumer preferences for the consumption of healthy food coupled with the rising need for a healthy nutritional profile of the young population in the APAC country such as India. In addition, a rise in the disposable income of consumers, coupled with the increasing working population in APAC countries, is expected to drive the growth of the ready-to-eat product segment and significantly the frozen food packaging market during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the frozen food packaging market size in APAC and actionable market insights on post COVID-19 impact on each segment.

|

Frozen Food Packaging Market Scope in APAC |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.00% |

|

Market growth 2022-2026 |

$ 3.13 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

6.09 |

|

Regional analysis |

APAC |

|

Performing market contribution |

China at 42% |

|

Key consumer countries |

China, Japan, India, and Rest of APAC |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Amcor Plc, Ball Corp., EasyPak LLC, Genpak LLC, Graham Packaging Co., Pactiv LLC, Placon Corp., Sonoco Products Co., Tetra Pak Group, and The West Rock group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Frozen Food Packaging Market in APAC Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive frozen food packaging market growth in APAC during the next five years

- Precise estimation of the frozen food packaging market size in APAC and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the frozen food packaging industry across China, Japan, India, South Korea (Republic of Korea), and Rest of APAC

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of frozen food packaging market vendors in APAC

We can help! Our analysts can customize this report to meet your requirements. Get in touch