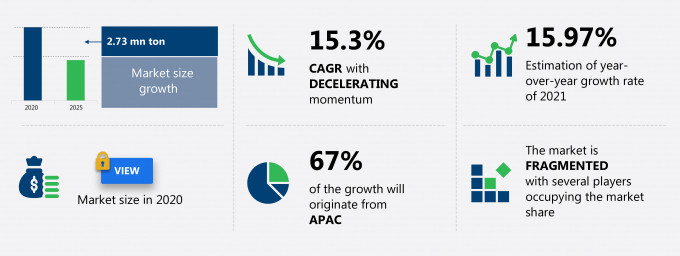

The gallium arsenide (gaas) wafers market share is expected to increase by 2.73 million ton from 2020 to 2025, and the market’s growth momentum will decelerate at a CAGR of 15.3%.

This gallium arsenide (gaas) wafers market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers gallium arsenide (gaas) wafers market segmentations by type (SC GaAs and SI GaAs), application (mobile devices, wireless communication, aerospace and defense, and others), and geography (APAC, North America, Europe, MEA, South America). The gallium arsenide (gaas) wafers market report also offers information on several market vendors, including Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Powerway Advanced Material Co. Ltd. among others.

What will the Gallium Arsenide (GaAs) Wafers Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Gallium Arsenide (GaAs) Wafers Market Size for the Forecast Period and Other Important Statistics

Gallium Arsenide (GaAs) Wafers Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The increasing adoption of smartphones is notably driving the gallium arsenide (gaas) wafers market growth, although factors such as high production cost of gaas wafers may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the gallium arsenide (gaas) wafers industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Gallium Arsenide (GaAs) Wafers Market Driver

The increasing adoption of smartphones is a major factor driving the global gallium arsenide (GaAs) wafers market share growth. The global demand for smartphones is expected to grow significantly during the forecast period, primarily owing to the growing penetration of 5G network services. Several 5G smartphones were launched in 2019, with a growing inclination of consumers toward smartphone up-gradation. The operators are expected to invest over $1 trillion in producing mobiles supporting 5G services, which, in turn, is expected to drive the demand for GaAs wafers during the forecast period. The growing data demand from consumers is insatiable as consumption is increasing drastically in many countries. Operators are developing sophisticated networks (wired and wireless), architecture, and devices to accommodate this increase in data consumption (both broadband and mobile data) and ensure the quality of service. As GaAs are suitable for such architecture and networks, the demand for GaAs wafers for the expansion of network infrastructure will increase. As a result, this will drive the market in a positive direction.

Key Gallium Arsenide (GaAs) Wafers Market Trend

The increasing GaAs content in smartphones is another factor supporting the global gallium arsenide (GaAs) wafers market share growth. Smartphones nowadays require more GaAs content as they need many frequency bands to accommodate 4G and 5G networks. Usually, each 4G LTE smartphone requires 3-4 PAs. The rapid launches of new and advanced versions of smartphones by vendors are driving the inclination of consumers to replace older versions of smartphones with newer ones to access the latest technologies and functionalities. This replacement cycle is currently 8-12 months. This replacement cycle will further decrease by 2024. The demand for GaAs wafers was lower when smartphones had longer replacement cycles. The current product replacement cycle is expected to increase the demand for GaAs wafers during the forecast period. The rising demand for advanced functionalities in smartphones from consumers is increasing the design complexity of devices. GaAs content in mobile devices such as switches is gradually being replaced by SoI technology. However, this is not expected to have a significant impact on the GaAs devices market as GaAs power amplifiers are widely adopted in mobile handsets. Therefore, the market will grow significantly during the forecast period.

Key Gallium Arsenide (GaAs) Wafers Market Challenge

The high production cost of GaAs wafers will be a major challenge for the global gallium arsenide (GaAs) wafers market share growth during the forecast period. Computer chips, solar cells, and most electronic devices have usually been based on silicon. The exclusive electronic properties of silicon can be manipulated to turn the electricity on and off the way faucets control the flow of water. GaAs is one such semiconductor material that has certain technical advantages over silicon. For example, electrons flow through its crystalline structure faster than they can move through silicon. However, the key reason for silicon still being preferred for most electronic devices is because GaAs devices are much more expensive than silicon. GaAs-based devices are only used in niche applications where their special capabilities justify their higher cost. Solar cells, which are used in specific high-end applications such as satellites, use GaAs wafers; however, their cost is significantly high as they are designed for greater photon-to-electricity conversion efficiency. Therefore, the high cost of production restricts the application of GaAs wafers in general electronic products, which, in turn, restricts the growth of the market in focus.

This gallium arsenide (gaas) wafers market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global gallium arsenide (GaAs) wafers market as a part of the global semiconductor equipment market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the gallium arsenide (gaas) wafers market during the forecast period.

Who are the Major Gallium Arsenide (GaAs) Wafers Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Advanced Wireless Semiconductor Co.

- AXT Inc.

- Freiberger Compound Materials GmbH

- GCS Holdings Inc.

- IntelliEPI Inc.

- IQE Plc

- OMMIC SAS

- Qorvo Inc.

- WIN Semiconductors Corp.

- Xiamen Powerway Advanced Material Co. Ltd.

This statistical study of the gallium arsenide (gaas) wafers market encompasses successful business strategies deployed by the key vendors. The gallium arsenide (gaas) wafers market is fragmented and the vendors are deploying growth strategies such as promoting their product offerings through a clear and unique value proposition to compete in the market.

Product Insights and News

- Advanced Wireless Semiconductor Co.- The company offers a range of gallium arsenide wafers such as Cu Pillar Bump.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The gallium arsenide (gaas) wafers market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Gallium Arsenide (GaAs) Wafers Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the gallium arsenide (gaas) wafers market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global semiconductor equipment market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Gallium Arsenide (GaAs) Wafers Market?

For more insights on the market share of various regions Request for a FREE sample now!

67% of the market’s growth will originate from APAC during the forecast period. Taiwan, China and India are the key markets for gallium arsenide (gaas) wafers market in APAC. Market growth in this region will be faster than the growth of the market in Europe, MEA and South America.

Increasing smartphone penetration in developing countries and the growth of wireless infrastructure will facilitate the gallium arsenide (gaas) wafers market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Type Segments in the Gallium Arsenide (GaAs) Wafers Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The gallium arsenide (gaas) wafers market share growth by the SC GaAs segment will be significant during the forecast period. SC GaAs substrate is a widely used semiconductor material to manufacture LEDs. The penetration rate of LEDs is rising in applications such as TVs as well as signs and displays. With rising demand for energy-efficient lighting solutions such as LEDs, the demand for SC GaAs substrates will also grow.

This report provides an accurate prediction of the contribution of all the segments to the growth of the gallium arsenide (gaas) wafers market size and actionable market insights on post COVID-19 impact on each segment.

|

Gallium Arsenide (GaAs) Wafers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 15.3% |

|

Market growth 2021-2025 |

2.73 mn ton |

|

Market structure |

Fragmented |

|

YoY growth (%) |

15.97 |

|

Regional analysis |

APAC, North America, Europe, MEA, South America |

|

Performing market contribution |

APAC at 67% |

|

Key consumer countries |

Taiwan, China, US, India, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Advanced Wireless Semiconductor Co., AXT Inc., Freiberger Compound Materials GmbH, GCS Holdings Inc., IntelliEPI Inc., IQE Plc, OMMIC SAS, Qorvo Inc., WIN Semiconductors Corp., and Xiamen Powerway Advanced Material Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Gallium Arsenide (GaAs) Wafers Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive gallium arsenide (gaas) wafers market growth during the next five years

- Precise estimation of the gallium arsenide (gaas) wafers market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the gallium arsenide (gaas) wafers industry across APAC, North America, Europe, MEA, South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of gallium arsenide (gaas) wafers market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch

Wafers Market_T.jpg?format=webp)