Head And Neck Cancer Diagnostics Market Size 2024-2028

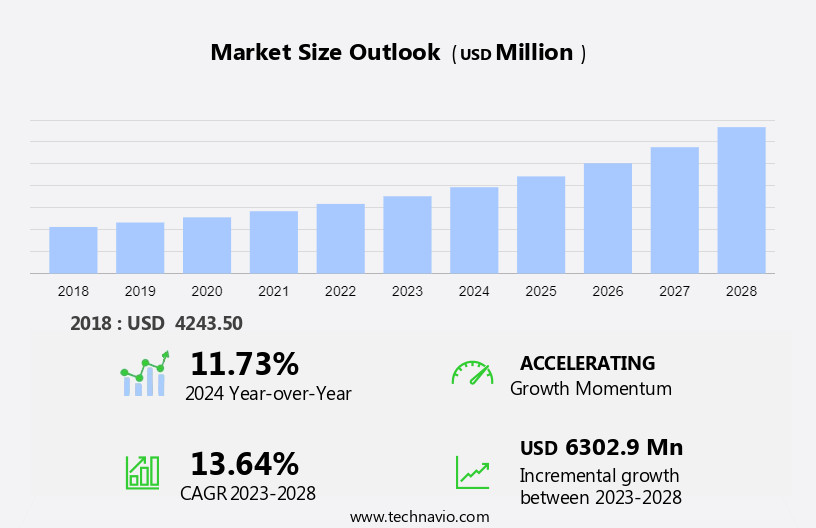

The head and neck cancer diagnostics market size is forecast to increase by USD 6.3 billion at a CAGR of 13.64% between 2023 and 2028.

What will be the Size of the Head And Neck Cancer Diagnostics Market during the Forecast Period?

How is this Head And Neck Cancer Diagnostics Industry segmented and which is the largest segment?

The head and neck cancer diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Diagnostic Methods

- Biopsy and blood tests

- Imaging

- Endoscopy

- Dental diagnostics

- End-user

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Others

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Diagnostic Methods Insights

The biopsy and blood tests segment is estimated to witness significant growth during the forecast period. The global head and neck cancer diagnostic market is primarily driven by the prevalence of oropharyngeal cancer and thyroid nodule assessment. Biopsy and blood tests are the largest diagnostic segments due to their significance in confirming cancer diagnoses. A biopsy involves the removal of tissue or cells for laboratory analysis, with incisional biopsies being commonly used for oral cancer diagnosis. Diagnostic imaging techniques, including endoscopy, MRI, CT, PET/CT, and chest imaging, complement biopsies in identifying cancerous growths. Diagnostic devices, genomic testing, tumor sequencing, molecular profiling, and genetic mutation analysis are emerging technologies in head and neck cancer diagnostics. Reimbursement issues and economic strategies pose challenges to market growth.

Early detection and advancements in targeted therapy and immunotherapy are significant trends. Key players In the market include Viome Life Science, CancerDetect, GE Healthcare, and others. Skilled physicians, software technologies, and telemedicine are transforming diagnostic practices. Healthcare expenditure, prescription drugs, dental care, sedentary lifestyle, and chronic diseases contribute to market demand.

Get a glance at the market report of various segments Request Free Sample

The Biopsy and blood tests segment was valued at USD 1.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

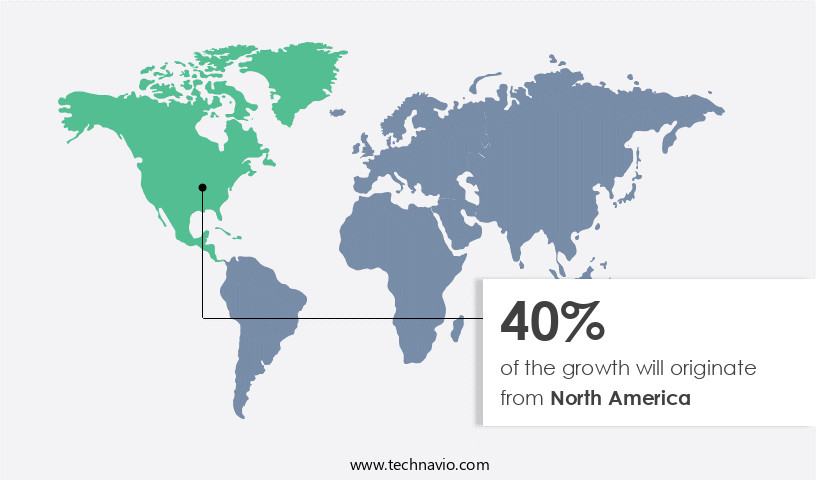

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is expected to dominate the global landscape due to the region's high incidence of head and neck cancers, particularly In the US. Notable market participants, such as GE Healthcare and Varian Medical Systems, are headquartered In the US, ensuring the availability of advanced diagnostic equipment. Oropharyngeal cancer, including squamous cells, is a significant contributor to the market. Diagnostic procedures, including endoscopy, MRI, CT, PET/CT, chest imaging, and biopsy, are commonly used for throat cancer assessment. Reimbursement issues, genomic testing, tumor sequencing, molecular profiling, and genetic mutations are crucial factors driving market growth. Novel technologies, such as clinical trials, targeted therapy, immunotherapy, and treatment modes, are also gaining traction.

Economic strategies, telemedicine, and healthcare expenditure, including prescription drugs, dental care, and hospital spending, significantly impact market dynamics. Early detection of head and neck cancers is crucial for effective treatment and reducing healthcare costs associated with chronic diseases and sedentary lifestyles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Increasing incidences of head and neck cancers is the key driver of the market.Head and neck cancers, encompassing those In the oral cavity, pharynx (nasopharynx, oropharynx, and hypopharynx), larynx, paranasal sinuses and nasal cavity, and salivary glands, account for approximately 4% of all cancers In the US. Most cases are attributed to squamous cell carcinoma (SCC), which is prevalent among men with a history of alcohol consumption and tobacco use. HNSCC, which forms around the mucosal linings of the upper aerodigestive tract, is the sixth-leading cancer globally, with about half a million new cases annually. Diagnostic procedures play a crucial role in early detection, improving treatment outcomes. These include endoscopy, magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography/computed tomography (PET/CT), chest imaging, and diagnostic devices.

Reimbursement issues, genetic mutations, and clinical trials are significant factors influencing diagnostic approaches. Novel technologies, such as genomic testing, tumor sequencing, molecular profiling, and targeted therapy, are gaining importance. Key diagnostic tools include Viome Life Science's CancerDetect, GE Healthcare's diagnostic imaging systems, and software technologies. Skilled physicians, including radiologists and pathologists, play a pivotal role in accurate diagnosis. Economic strategies, telemedicine, and personal healthcare spending are shaping the diagnostic landscape. Chronic diseases, sedentary lifestyle, and healthcare expenditure are driving the need for early detection and effective diagnostics.

What are the market trends shaping the Head And Neck Cancer Diagnostics market?

Rising use of immunotherapy in head and neck cancer treatment is the upcoming market trend.Head and neck cancer diagnostics involve various diagnostic procedures to identify and assess different types of head and neck cancers, such as oropharyngeal cancer and thyroid nodule assessment. Diagnostic imaging techniques, including endoscopy, MRI, CT, PET/CT, and chest imaging, play a crucial role in detecting and staging these cancers. Diagnostic devices, like biopsy tools, are essential for confirming a cancer diagnosis. Reimbursement issues may impact the adoption of advanced diagnostic technologies. Squamous cells, which are the most common type of cells In the head and neck region, can develop into various cancers. Companies like Viome Life Science and CancerDetect are developing novel technologies for early detection and diagnosis of head and neck cancers.

GE Healthcare, Radiologists, and Pathologists utilize diagnostic imaging and biopsy results to guide treatment decisions. Genomic testing, tumor sequencing, molecular profiling, and genetic mutation analysis are essential components of personalized treatment plans for head and neck cancer patients. Clinical trials and targeted therapies, such as immunotherapy and chemotherapy, offer new treatment modes for managing head and neck cancers. Economic strategies, software technologies, telemedicine, and the rising prevalence of chronic diseases and sedentary lifestyles contribute to the increasing demand for advanced diagnostic solutions. Cancer worldwide is a significant healthcare expenditure, with hospital spending, prescription drugs, dental care, and skilled physicians being major contributors.

The global healthcare industry continues to invest in research and development to improve cancer diagnostics and treatments. Cancer immunotherapy, a promising approach to strengthening the body's natural defenses against cancer, has shown significant progress in head and neck cancer treatment. Immune checkpoint inhibitors, a type of immunotherapy, are approved for managing metastatic or recurrent head and neck cancers, particularly those caused by HPV.

What challenges does the market face during its growth?

Frequent product recalls is a key challenge affecting the industry growth.Head and neck cancer diagnostics involve various diagnostic procedures to identify oropharyngeal and throat cancers, including physical exams, biopsies, diagnostic imaging, and genomic testing. Diagnostic devices such as endoscopy, MRI, CT, PET/CT, and chest imaging play a significant role in cancer detection. Reimbursement issues may arise due to the high cost of these procedures and advanced technologies like tumor sequencing, molecular profiling, and genomic testing. Squamous cells, a common type of cancer cell, are often assessed using these diagnostic methods. Companies like Viome Life Science and CancerDet are developing novel technologies for early detection and personalized treatment plans. Healthcare expenditure, including prescription drugs, hospital spending, and dental care, continues to rise due to the increasing prevalence of chronic diseases and sedentary lifestyles.

Skilled physicians, such as radiologists and pathologists, rely on diagnostic imaging and software technologies to accurately diagnose and treat various cancers. Economic strategies like telemedicine offer potential solutions to reduce healthcare costs and improve access to care. The global cancer market witnesses ongoing advancements in treatment modes, including targeted therapy and immunotherapy. Clinical trials and research on genetic mutations contribute to the development of new diagnostic and therapeutic approaches. Despite these advancements, ensuring the safety and functionality of diagnostic equipment is crucial to prevent potential health risks and regulatory violations. The FDA plays a vital role in monitoring and addressing medical equipment recalls to maintain patient safety and market integrity.

Exclusive Customer Landscape

The head and neck cancer diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the head and neck cancer diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, head and neck cancer diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AbbVie Inc. - The market encompasses various advanced tests and techniques for identifying malignant tumors In the head and neck region. These diagnostics include imaging modalities such as magnetic resonance imaging (MRI), computed tomography (CT) scans, and positron emission tomography (PET) scans, as well as molecular tests like next-generation sequencing (NGS) and polymerase chain reaction (PCR) assays. These tools aid In the detection, staging, and monitoring of head and neck squamous cell carcinoma, as well as other types of solid tumors like non-small cell lung cancer and triple-negative breast cancer. The diagnostic landscape is continually evolving, with ongoing research and development efforts aimed at improving accuracy, sensitivity, and specificity to enhance patient outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Accuray Inc.

- AdDent Inc.

- Bristol Myers Squibb Co.

- Canon Inc.

- Carestream Health Inc.

- Eli Lilly and Co.

- Esaote Spa

- Flexicare Group Ltd.

- General Electric Co.

- Hitachi Ltd.

- KARL STORZ SE and Co. KG

- Koninklijke Philips N.V.

- Merck KGaA

- Olympus Corp.

- Optim LLC

- Shimadzu Corp.

- Siemens AG

- Sumitomo Mitsui Financial Group

- Xoran Technologies LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The head and neck cancer diagnostic market encompasses a range of technologies and procedures used to identify and diagnose various types of malignancies affecting the head and neck region. This market is characterized by continuous advancements in diagnostic techniques and technologies, driven by the need for early and accurate detection of these cancers. Oropharyngeal cancer, one of the most common types of head and neck cancers, can be diagnosed through a combination of methods. Physical examinations, including palpation and visual inspection, are often the initial diagnostic steps. However, more advanced diagnostic procedures, such as endoscopy, MRI, CT, PET/CT, and chest imaging, are often required for a definitive diagnosis.

Diagnostic devices, including those based on software technologies, play a crucial role In the diagnosis of head and neck cancers. These devices enable healthcare professionals to analyze medical images and identify potential tumors or abnormalities. Reimbursement issues and regulatory requirements are significant factors influencing the adoption of these diagnostic devices. Squamous cells, which are the most common type of cells found In the head and neck region, can give rise to various types of cancer. Genomic testing, tumor sequencing, and molecular profiling are increasingly being used to identify genetic mutations and other biomarkers associated with these cancers. This information can help guide treatment decisions and improve patient outcomes.

Clinical trials are ongoing to evaluate the effectiveness of novel diagnostic technologies and treatment modalities for head and neck cancers. Targeted therapy and immunotherapy are two emerging treatment modes that hold promise In the fight against these cancers. Economic strategies, such as personal healthcare spending, hospital spending, prescription drugs, dental care, and sedentary lifestyle, are also being explored as potential factors influencing the incidence and progression of head and neck cancers. Skilled physicians, including radiologists and pathologists, play a critical role In the diagnosis of head and neck cancers. Diagnostic imaging, including physical exams, biopsies, and various imaging modalities, are essential tools In their diagnostic arsenal.

The use of these tools, however, requires significant expertise and experience. The global burden of cancer is a significant public health concern, with head and neck cancers accounting for a significant proportion of new cases each year. Early detection and accurate diagnosis are key to improving patient outcomes and reducing healthcare expenditure. The diagnostic market for head and neck cancers is expected to grow significantly In the coming years, driven by the increasing prevalence of these cancers and the ongoing development of new diagnostic technologies. In conclusion, the head and neck cancer diagnostic market is a dynamic and evolving field, driven by the need for early and accurate diagnosis of these cancers.

A range of diagnostic procedures and technologies, including physical exams, imaging modalities, and genomic testing, are used to diagnose these cancers. The ongoing development of new diagnostic technologies and treatment modalities, along with the increasing burden of cancer worldwide, are expected to drive significant growth in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market growth 2024-2028 |

USD 6302.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.73 |

|

Key countries |

US, Germany, France, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Head And Neck Cancer Diagnostics Market Research and Growth Report?

- CAGR of the Head And Neck Cancer Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the head and neck cancer diagnostics market growth of industry companies

We can help! Our analysts can customize this head and neck cancer diagnostics market research report to meet your requirements.