High-Pressure Processing (Hpp) Equipment Market Size 2024-2028

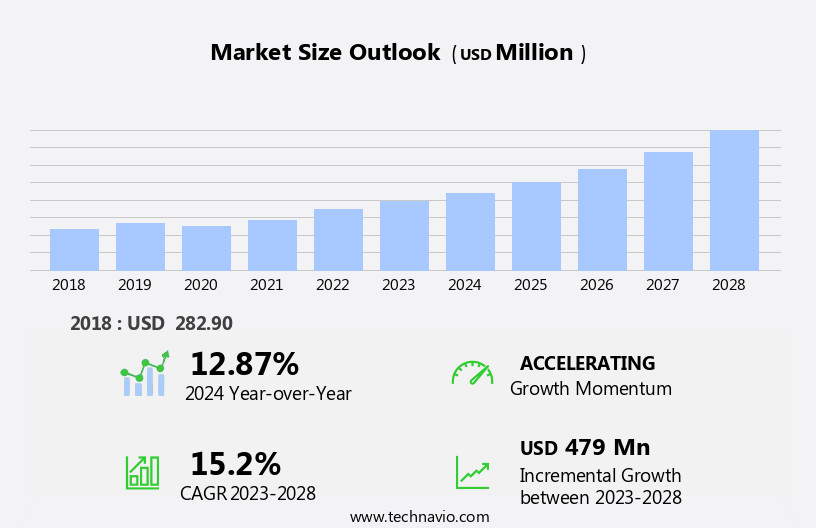

The high-pressure processing (hpp) equipment market size is forecast to increase by USD 479 million at a CAGR of 15.2% between 2023 and 2028.

What will be the Size of the High-Pressure Processing (Hpp) Equipment Market during the forecast period?

How is this High-Pressure Processing (Hpp) Equipment Industry segmented?

The high-pressure processing (hpp) equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Horizontal HPP equipment

- Vertical HPP equipment

- Application

- Fruits and vegetables

- Meat products

- Beverages

- Seafood

- Others

- Geography

- North America

- Canada

- US

- Europe

- UK

- Spain

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

The horizontal hpp equipment segment is estimated to witness significant growth during the forecast period.High-Pressure Processing (HPP) equipment refers to machinery used to preserve food products through the application of high pressure, typically between 1000 to 1500 bar. One design of HPP equipment, known as horizontal HPP equipment, positions the vessels horizontally with openings at both ends. This design offers advantages such as easier reassembly and installation and increased throughput capacity. The larger diameter vessels in horizontal HPP equipment can handle more product per cycle, increasing overall capacity. Prominent companies providing horizontal HPP equipment include John Bean Technologies Corp., MULTIVAC Sepp Haggenmuller SE and Co. KG, Kobe Steel Ltd., and Hiperbaric S.A. HPP processing is gaining popularity in various industries, including juices and beverages, fruits and vegetables, seafood, meat products, dairy, plant protein, and ready-to-eat meals.

It offers food safety benefits by eliminating pathogens like Salmonella, Escherichia coli, and Listeria monocytogenes, while maintaining fresh taste, nutritional content, and sensory qualities. Horizontal HPP equipment contributes to processing efficiency and is compatible with clean-label and minimally processed foods, making it an attractive alternative to traditional heat-based pasteurization and artificial preservatives.

Get a glance at the market report of share of various segments Request Free Sample

The Horizontal HPP equipment segment was valued at USD 256.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing growth due to the increasing adoption of this technology by food processing companies in various regions. In North America, the US market is anticipated to expand significantly, driven by the rising demand for processed food and the need to ensure food safety. High-pressure processing technology is used to eliminate pathogens and extend the shelf life of food products without the use of chemical preservatives. This technology is particularly beneficial for processing juices and beverages, fruits and vegetables, seafood, meat products, dairy, plant protein, and ready-to-eat meals. Companies are investing in HPP equipment to increase their production capacity and cater to the growing demand for clean-label and minimally processed foods.

The market is segmented into Horizontal HPP Equipment and Vertical HPP Equipment, with major players such as Hiperbaric, Cargill, and Tetra Pak offering these solutions. The HPP equipment market is expected to continue its growth trajectory due to the increasing focus on food safety regulations, consumer preferences for fresh taste and nutritional content, and the need to minimize food waste and reduce the use of artificial preservatives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of High-Pressure Processing (Hpp) Equipment Industry?

- Growing need to reduce contamination of food products is the key driver of the market.

- Food safety is a significant concern In the global food industry, with contamination posing a serious public health risk. Meat and poultry can become contaminated during slaughter, while fresh fruits and vegetables can be contaminated through contact with contaminated water. Pathogens can enter food during processing and preparation due to cross-contamination with other raw foods or improper holding temperatures. The consequences of food contamination are foodborne illnesses that impact numerous individuals annually. High-Pressure Processing (HPP) is an innovative technology that addresses these concerns by eliminating bacteria and extending the shelf life of food products. HPP uses cold water pressure to inactivate bacteria and preserve the food's nutritional value and texture.

- The market for HPP equipment is driven by the increasing demand for safe and high-quality food products. Consumers are willing to pay a premium for foods that offer extended shelf life and enhanced safety, making HPP an attractive technology for food processors. Additionally, governments worldwide are implementing stringent regulations to ensure food safety, further boosting the demand for HPP technology.

What are the market trends shaping the High-Pressure Processing (Hpp) Equipment Industry?

- Growing emphasis on new product launches is the upcoming market trend.

- The market is experiencing significant growth due to increasing product innovations in response to the rising demand across various sectors, including food and beverage, cosmetics, and pharmaceuticals. In October 2023, Hiperbaric introduced the Hiperbaric 20 HIP system, a groundbreaking hot isostatic pressing (HIP) equipment. Capable of applying pressures up to 2,000 bar and temperatures up to 2,000 degrees C, this compact and versatile system caters to small-scale production and research and development initiatives. The market's expansion is driven by the benefits of HPP technology, such as extended shelf life, improved food safety, and enhanced product quality. Companies are continually investing in research and development to introduce advanced HPP equipment, further fueling market growth.

What challenges does the High-Pressure Processing (Hpp) Equipment Industry face during its growth?

- High capital investment and operating costs is a key challenge affecting the industry growth.

- High-pressure processing (HPP) equipment is a significant investment for food processing companies, with average costs ranging from USD2-5 million. The expense is primarily attributed to the initial purchase and setup of the system, which depends on the equipment's capacity and automated features. The primary components of HPP systems include controlling and pumping systems, which incur operational or processing costs related to maintenance, labor, and energy. Consequently, the high capital investment makes HPP equipment a viable option only for large-scale food processing companies. Small- and medium-sized enterprises may find the cost prohibitive or may hesitate to invest in such expensive equipment.

Exclusive Customer Landscape

The high-pressure processing (hpp) equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high-pressure processing (hpp) equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high-pressure processing (hpp) equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Pasteurization Co. - The company specializes in supplying advanced high pressure processing equipment for various industries. This technology ensures food safety and maintains nutritional value by eliminating harmful bacteria through extreme pressure, rather than heat. Our equipment is designed to meet stringent industry standards, enhancing product quality and shelf life. By implementing high pressure processing, businesses can deliver superior, safe, and consistent products to their customers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Pasteurization Co.

- APAPROCESSING BZ SL

- Archer Daniels Midland Co.

- Bao Tou KeFa High Pressure Technology Co. Ltd.

- Cargill Inc.

- EPSI International

- EXDIN Solutions Sp. zoo

- FresherTech

- Goma Engineering Pvt. Ltd.

- Hiperbaric S.A.

- Hormel Foods Corp.

- Hydrolock

- John Bean Technologies Corp.

- Kobe Steel Ltd.

- Lineage Logistics Holdings LLC

- MULTIVAC Sepp Haggenmuller SE and Co. KG

- Shandong Pengneng Machinery Technology Co. Ltd.

- Stansted Fluid Power (Products) Ltd.

- thyssenkrupp AG

- Universal Pure LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

High-pressure processing (HPP) is an innovative food preservation technology that utilizes high-hydrostatic-pressure (HHP) or ultra-high-pressure processing (UHP) to extend the shelf life of various food products without the need for chemical preservatives. This non-thermal processing method has gained significant attention In the global food industry due to its ability to maintaIn the fresh taste, nutritional content, and sensory qualities of food while ensuring food safety. The HPP equipment market encompasses a diverse range of applications, including juices and beverages, fruits and vegetables, seafood, meat products, dairy, plant protein, and ready-to-eat meals. HPP technology is particularly beneficial for these food categories as they are susceptible to spoilage due to their perishable nature.

Tolling services have emerged as a popular business model In the HPP industry, allowing food processors to outsource HPP processing for their products. This arrangement offers several advantages, such as reduced capital investment, lower operational costs, and improved processing efficiency. The HPP market is witnessing a growing trend towards clean-label foods and minimally processed products. Consumers are increasingly demanding natural and healthy food options, leading food manufacturers to explore alternative processing methods that minimize the use of artificial preservatives and maintaIn the freshness and nutritional value of their products. Food safety regulations have become increasingly stringent, necessitating the adoption of advanced food preservation technologies such as HPP.

Pathogenic bacteria, such as Salmonella, Escherichia coli (E. Coli), and Listeria monocytogenes, pose significant risks to public health. HPP technology effectively eliminates these harmful microbes, ensuring the safety and quality of food products. The HPP equipment market comprises both horizontal and vertical HPP systems. Horizontal HPP equipment is suitable for processing larger volumes of liquid products, such as juices and beverages, while vertical HPP equipment is more suitable for processing smaller batches of solid or semi-solid food products, such as meat, poultry, fruits, and vegetables. Hiperbaric, a leading HPP equipment manufacturer, offers a range of HPP systems designed for various food applications.

Their equipment is known for its efficiency, reliability, and flexibility, making it a popular choice among food processors. Cold processing techniques are gaining popularity In the HPP industry as they help preserve the fresh taste and nutritional content of food products. Packaged beverages, in particular, benefit from cold processing as it maintains their carbonation and sensory attributes. Large production plants require vessels with significant volume capacity to process food products on a commercial scale. HPP equipment manufacturers offer vessels in various sizes to cater to the unique requirements of different food processors. The HPP equipment market is expected to continue its growth trajectory due to the increasing demand for safe, natural, and minimally processed food products.

The market dynamics are driven by factors such as consumer preferences, food safety regulations, and technological advancements in HPP processing. In conclusion, the HPP equipment market is a dynamic and evolving industry that offers numerous opportunities for food processors to extend the shelf life of their perishable products while maintaining their fresh taste, nutritional content, and sensory qualities. The adoption of HPP technology is a strategic investment for food manufacturers seeking to meet the growing demand for clean-label, minimally processed food products while ensuring food safety and reducing food waste.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2024-2028 |

USD 479 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.87 |

|

Key countries |

US, Spain, Canada, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High-Pressure Processing (Hpp) Equipment Market Research and Growth Report?

- CAGR of the High-Pressure Processing (Hpp) Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high-pressure processing (hpp) equipment market growth of industry companies

We can help! Our analysts can customize this high-pressure processing (hpp) equipment market research report to meet your requirements.