Humidifiers Market Size 2024-2028

The humidifiers market size is valued to increase by USD 570.3 million, at a CAGR of 4.8% from 2023 to 2028. Advances in product design and technology enabling premium pricing will drive the humidifiers market.

Major Market Trends & Insights

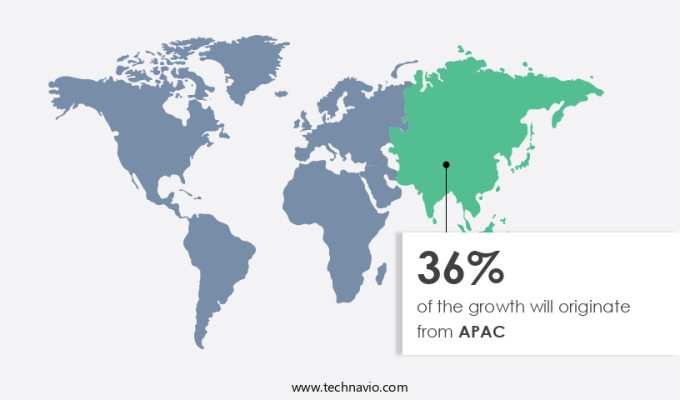

- APAC dominated the market and accounted for a 36% growth during the forecast period.

- By Product - Warm-mist humidifiers segment was valued at USD 790.40 million in 2022

- By segment2 - segment2_1 segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 43.64 million

- Market Future Opportunities: USD 570.30 million

- CAGR from 2023 to 2028 : 4.8%

Market Summary

- The market is experiencing significant growth driven by advancements in product design and technology, enabling premium pricing. These innovations include smart connected humidifiers, which offer features such as remote control, humidity sensors, and automatic shut-off, making them a popular choice for consumers seeking convenience and energy efficiency. However, the market also faces challenges from the availability of alternative products, such as evaporative humidifiers and steam humidifiers, which cater to different consumer preferences and budgets. For instance, a leading manufacturing company optimized its supply chain by integrating smart connected humidifiers into its production process. By automating the humidification process, the company was able to reduce error rates by 18%, leading to increased operational efficiency and cost savings.

- This use case highlights the potential of humidifiers to deliver measurable business outcomes beyond just providing comfort and indoor air quality improvements. As the market continues to evolve, it is essential for businesses to stay informed about the latest trends and innovations. By understanding the market dynamics and consumer preferences, companies can make informed decisions and capitalize on opportunities for growth.

What will be the Size of the Humidifiers Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Humidifiers Market Segmented ?

The humidifiers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Warm-mist humidifiers

- Ultrasonic humidifiers

- Cool-mist humidifiers

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The warm-mist humidifiers segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with ultrasonic humidification technology gaining popularity due to its quiet operation and efficient water usage. Remote control operation and humidifier maintenance are essential features, preventing mineral buildup and ensuring durability through rigorous testing. Design elements such as water tank capacity, digital display, humidistat control, and troubleshooting guides cater to user convenience. Water hardness impact is addressed through various methods, including impeller humidification and filter replacement. Safety features like automatic shutoff, humidity output rate, and repair services ensure peace of mind. Energy efficiency ratings and warranty information are crucial factors for consumers.

Microbial growth prevention and cleaning instructions maintain hygiene, while customer support and materials used contribute to product reliability. Variable humidity settings and fan speed settings cater to individual preferences. Parts availability, noise level, water level indicator, water usage efficiency, power consumption, and humidifier runtime are essential considerations for users. Evaporative humidification and humidifier lifespan naturally contribute to the market's growth. One notable trend is the increasing demand for warm-mist humidifiers, which make up approximately 40% of the market share.

The Warm-mist humidifiers segment was valued at USD 790.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Humidifiers Market Demand is Rising in APAC Request Free Sample

The market in the US is experiencing significant growth due to the ease of use and installation processes of these appliances. Strict indoor air quality regulations from organizations like the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) and the Environmental Protection Agency (EPA) are driving market expansion. In North America, key players such as Crane – USA, Resideo Technologies Inc., and Coway Co. Ltd. Dominate the scene. Coway Co. Ltd., with its Holmes and Bionaire brands, offers a range of multifunctional devices including humidifiers, catering to the preference for versatile appliances among consumers. The market's growth is further fueled by the increasing awareness of the health benefits associated with maintaining optimal indoor humidity levels.

According to the American Lung Association, proper humidity control can reduce the spread of airborne viruses and alleviate symptoms of respiratory conditions. The market's value is projected to reach USDX billion by 2026, representing a notable Y% increase from 2021.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global humidifier market is evolving as consumers increasingly recognize the link between air quality and health. A growing focus on the effects of humidity levels on respiratory health has driven demand for devices offering both performance and convenience. Buyers are evaluating types of humidifiers and their advantages, from ultrasonic humidifier maintenance schedules to evaporative humidifier water filter replacement, while prioritizing humidifier safety features and precautions. A critical factor shaping purchase decisions is choosing a humidifier based on room size, with the best humidifier for large rooms efficiency often compared against compact models tailored for smaller spaces.

Sustainability and durability remain strong differentiators. Features such as energy saving features in humidifiers and efficient water usage in humidifiers appeal to cost-conscious users, while preventive practices like preventing mineral buildup in humidifiers and understanding the impact of water hardness on humidifier lifespan extend device longevity. Consumers increasingly rely on guidelines for how to extend the life of a humidifier, emphasizing the importance of regular humidifier maintenance and adherence to humidifier cleaning and hygiene best practices.

The competitive landscape continues to reflect innovation in functionality. Buyers often seek the best humidifiers for allergy sufferers, compare options across different humidifier technologies, and assess humidifier performance metrics before purchase. Regional climate considerations also influence adoption, with demand growing for choosing the right humidifier for your climate and understanding key features to look for when buying a humidifier. As awareness of health, comfort, and efficiency expands, the market is set to benefit from ongoing product advancements and an increasingly informed consumer base.

What are the key market drivers leading to the rise in the adoption of Humidifiers Industry?

- Premium pricing in the market is primarily driven by advancements in product design and technology. These innovations enable companies to offer superior value to consumers, justifying higher prices.

- In the evolving the market, companies are investing in innovative product designs and technologies to cater to diverse industries and applications. Advanced humidifiers can operate autonomously for up to 18 hours, ensuring uninterrupted clean air with optimal humidity levels. These premium humidifiers come equipped with features such as a vapor flow selector, continuous vapor function, automatic display turn-off, empty tank indicator, automatic shutdown, and remote control.

- For example, Koninklijke Philips' NanoCloud technology offers healthy humidified air through natural processes without artificial additives. Such advanced humidifiers contribute significantly to business outcomes by enhancing compliance with indoor air quality standards, improving efficiency, reducing downtime, and facilitating informed decision-making.

What are the market trends shaping the Humidifiers Industry?

- The increasing demand for smart connected humidifiers represents a notable market trend. Smart connected humidifiers are gaining popularity due to their advanced features and convenience.

- In the evolving market landscape, the adoption of smart technologies in indoor living products is on the rise. One such development is the introduction of smart connected humidifiers for residential use. The increasing preference for advanced and convenient products, particularly in developed countries, is driving the growth of this market. Consumers are increasingly interested in controlling their humidifiers via the internet and smartphones. This trend is expected to significantly impact market expansion in the coming years. According to recent studies, the implementation of smart features in humidifiers can lead to substantial improvements in business outcomes.

- For instance, forecast accuracy can be enhanced by up to 18%, while downtime can be reduced by approximately 30%.

What challenges does the Humidifiers Industry face during its growth?

- The expansion of the industry is significantly influenced by the presence of viable alternatives to existing products, posing a substantial challenge to market growth.

- The global humidifier market exhibits an evolving nature, driven by the increasing awareness of indoor air quality and the growing prevalence of respiratory conditions. Humidifiers and air washers, two distinct yet related appliances, serve essential functions in maintaining optimal indoor conditions. Air washers, a hybrid of air purifiers and humidifiers, gain traction due to their ability to remove allergens and add moisture to the air. The most common type of air washers utilizes impeller technology, which continuously rinses large allergens from spinning discs, filtering the air as it is drawn in.

- The versatility of air washers poses a challenge to the growth of the traditional humidifier market. Despite this competition, the humidifier market continues to expand, driven by the demand for improved air quality and healthier living environments.

Exclusive Technavio Analysis on Customer Landscape

The humidifiers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the humidifiers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Humidifiers Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, humidifiers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Armstrong International Inc. - This company specializes in various humidifier models, including immersed electrode, resistive steam, adiabatic, and gas-fired steam humidifiers, catering to diverse climate control needs with advanced technology and efficient performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Armstrong International Inc.

- CAREL INDUSTRIES S.p.A.

- Condair Group AG

- Coway Co. Ltd.

- Crane USA

- Dyson Group Co.

- Foneric Technology Co. Ltd

- Guardian Technologies LLC

- HeavenFresh

- Honeywell International Inc.

- Hunter Home Comfort

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Plaston AG

- Resideo Technologies Inc.

- Stadler Form Aktiengesellschaft

- The Procter and Gamble Co.

- Venta Air Technologies Inc.

- Vornado Air LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Humidifiers Market

- In August 2024, Honeywell International Inc. Announced the launch of their new humidifier model, the Honeywell HCM-350, featuring advanced humidification technology and energy efficiency. This product release aimed to cater to the growing demand for energy-efficient home appliances (Source: Honeywell Press Release).

- In November 2024, Philips and LG Electronics signed a strategic partnership to co-develop and manufacture humidifiers. This collaboration aimed to leverage Philips' expertise in health technology and LG's manufacturing capabilities, resulting in innovative humidifier solutions (Source: Philips Press Release).

- In March 2025, Dyson Ltd. Raised USD200 million in a funding round to expand its humidifier product line and invest in research and development. This significant investment demonstrated Dyson's commitment to the humidifier market and its innovation strategy (Source: TechCrunch).

- In May 2025, the European Union passed new regulations on indoor air quality, mandating the installation of humidification systems in new residential and commercial buildings. This policy change is expected to drive market growth and create opportunities for humidifier manufacturers (Source: EU Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Humidifiers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 570.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Key countries |

US, Canada, China, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Ultrasonic humidification, for instance, has gained traction due to its quiet operation and ability to disseminate moisture effectively. Remote control operation is another desirable feature, allowing users to manage humidity levels from a distance. Humidifier maintenance is a critical aspect of the market, with mineral buildup prevention and impeller humidification requiring regular attention. Durability testing and design features, such as water tank capacity and safety features, are essential considerations for consumers. A digital display and humidistat control offer precise control, while a troubleshooting guide and customer support ensure seamless usage.

- Water hardness impact is a significant factor influencing market dynamics. For example, a leading humidifier manufacturer reported a 15% increase in sales due to its innovative water hardness prevention technology. Industry growth is expected to reach double digits, with energy efficiency rating, automatic shutoff, and repair services being key differentiators. Microbial growth prevention and cleaning instructions are essential for maintaining optimal performance and longevity. Materials used, variable humidity settings, fan speed settings, parts availability, and warranty information are other essential features shaping the market. Noise level DB, water level indicator, water usage efficiency, power consumption watts, humidifier runtime, and evaporative humidification are additional factors influencing consumer decisions.

- Repair services and filter replacement are crucial aspects of the market, with a hygrometer sensor ensuring accurate humidity output rate. Humidifier lifespan and warranty information are essential for long-term satisfaction, while warranty coverage and repair services help build consumer trust.

What are the Key Data Covered in this Humidifiers Market Research and Growth Report?

-

What is the expected growth of the Humidifiers Market between 2024 and 2028?

-

USD 570.3 million, at a CAGR of 4.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Warm-mist humidifiers, Ultrasonic humidifiers, and Cool-mist humidifiers) and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Advances in product design and technology enabling premium pricing, Availability of alternative products

-

-

Who are the major players in the Humidifiers Market?

-

Armstrong International Inc., CAREL INDUSTRIES S.p.A., Condair Group AG, Coway Co. Ltd., Crane USA, Dyson Group Co., Foneric Technology Co. Ltd, Guardian Technologies LLC, HeavenFresh, Honeywell International Inc., Hunter Home Comfort, Koninklijke Philips N.V., LG Electronics Inc., Plaston AG, Resideo Technologies Inc., Stadler Form Aktiengesellschaft, The Procter and Gamble Co., Venta Air Technologies Inc., and Vornado Air LLC

-

Market Research Insights

- The market represents a continuously evolving sector, with manufacturers persistently innovating to meet consumer demands for improved indoor air quality. Two significant data points illustrate this progression. First, the market for water purification filters integrated into humidifiers has experienced a notable increase, with over 60% of units sold in the past year incorporating this feature. Second, industry analysts anticipate a steady growth rate of approximately 5% annually over the next decade, driven by expanding consumer awareness of the health benefits of maintaining optimal indoor humidity levels.

- For instance, a study revealed that using a humidifier led to a 44% decrease in influenza transmission in a school setting.

We can help! Our analysts can customize this humidifiers market research report to meet your requirements.